Europe Automotive Composites Market Research, 2033

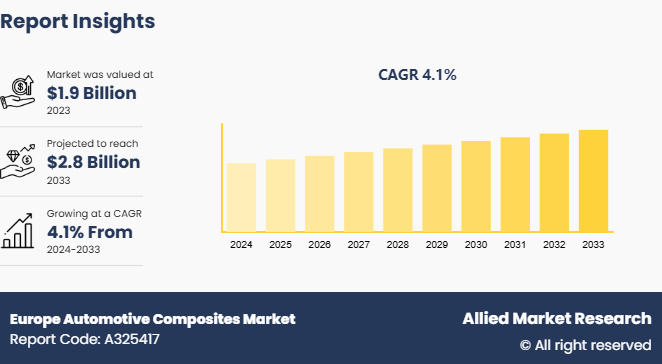

The Europe automotive composites market was valued at $1.9 billion in 2023, and is projected to reach $2.8 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

Market Introduction and Definition

Automotive composites are innovative materials composed of two or more distinct components, typically integrating high-strength fibers with a polymer matrix. These materials are engineered to provide enhanced properties, such as increased strength-to-weight ratios, improved durability, and resistance to environmental factors, compared to traditional materials such as steel and aluminum. The use of composites in the automotive industry is crucial for achieving greater fuel efficiency and reducing greenhouse gas emissions, as their lightweight nature helps decrease overall vehicle weight.

Key Takeaways

- The Europe automotive composites market study includes a segment analysis in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Europe automotive composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The demand for automotive composites in Europe is increasingly driven by sustainability and recyclability concerns, reflecting a broader shift toward environmentally friendly practices in the automotive industry. As Europe continues to set ambitious targets for reducing carbon emissions and promoting sustainable mobility, automakers prioritize materials that contribute to these goals. Automotive composites, particularly those made from renewable or recycled resources, align well with these sustainability objectives. Manufacturers enhance fuel efficiency and reduce emissions throughout the vehicle's lifecycle by incorporating lighter materials that makes composites a preferable option for meeting regulatory standards and consumer expectations. All these factors are expected to drive the growth of the Europe automotive composites market during the forecast period.

However, supply chain constraints for raw materials significantly hamper the growth of the automotive composites sector in Europe. The increase in demand for these advanced materials has put pressure on suppliers to meet production needs. Moreover, difficulties such as the geopolitical landscape and fluctuations in global trade policies have created a volatile environment for sourcing essential materials. For instance, the availability of fibers such as carbon and glass are severely impacted by production limitations, logistical challenges, and rise in transportation costs, leading to delays in manufacturing and increased production costs for automotive companies. All these factors hamper the growth of the Europe automotive composites market.

The transition to electric and hybrid vehicles involves a redesign of vehicle structures to accommodate new technologies such as battery packs and electric drivetrains. Composites provide the flexibility and strength needed for these structural components, allowing for innovative designs that enhance safety and performance. For instance, manufacturers increasingly use carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP) in critical areas such as chassis components, body panels, and interior elements. These materials offer weight savings and contribute to better crash performance and overall vehicle integrity that makes them preferable options for electric and hybrid vehicle manufacturers. All these factors are anticipated to offer new growth opportunities for the Europe automotive composites market during the forecast period.

Market Segmentation

The Europe automotive composites market is segmented into fiber type, resin type, and application. By fiber type, the market is classified into glass fiber, carbon fiber, and others. By resin type, the market is divided into thermosets and thermoplastics. By application, the market is categorized into exterior, interior, and others.

European Union Car Producers

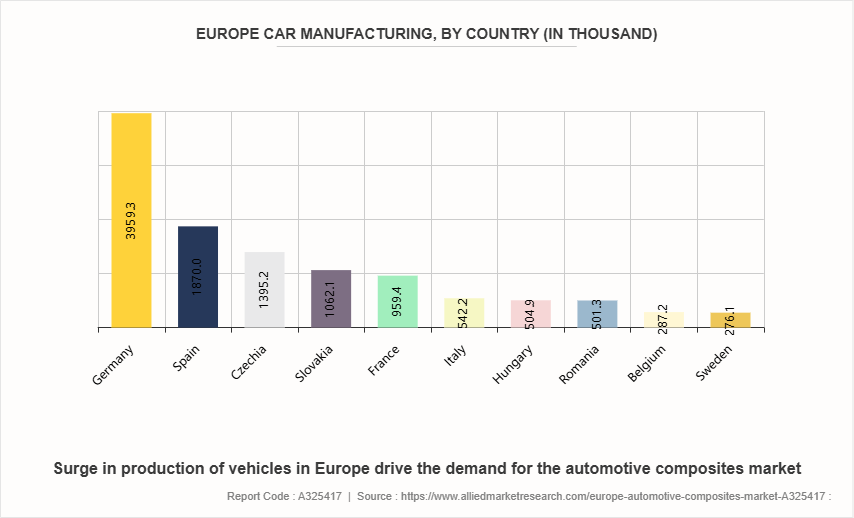

The substantial production of vehicles in Europe, led by countries such as Germany, Spain, and Czechia, significantly impacts the automotive composites market. With Germany producing approximately 3, 959.3 thousand vehicles, it remains the largest automotive hub, driving demand for advanced materials that enhance vehicle performance, safety, and sustainability. The strong output in these countries indicates a robust automotive industry that increasingly recognizes the benefits of integrating composites into vehicle design. As manufacturers seek to meet stringent environmental regulations and consumer preferences for lighter, more fuel-efficient vehicles, the reliance on automotive composites is expected to grow. Moreover, with the diverse range of vehicle production in countries such as Slovakia, France, and Italy contributing significant production numbers, the collective push towards electric and hybrid vehicles highlights the need for composite materials that support both sustainability and performance. All these factors position automotive composites as essential components in the European automotive sector.

Competitive Landscape

The major players operating in the Europe automotive composites market include SGL Carbon, TEIJIN LIMITED, BASF, Solvay, Hexcel Corporation, Zoltek Corporation, Evonik Industries AG, Mitsubishi Chemical Group Corporation, Covestro AG, and LANXESS.

Key Sources Referred

- International Trade Administration

- European Association of Automotive Suppliers

- Composites World

- European Automobile Manufacturers' Association

- International Organization of Motor Vehicle Manufacturers

- International Council on Clean Transportation

Key Benefits for Stakeholders

- The report provides a comprehensive analysis of the current market estimations through 2024-2033, which would enable the stakeholders to capitalize on prevailing market opportunities.

- Major countries are mapped according to their revenue contribution to the Europe automotive composites market.

- In-depth analysis of the Europe automotive composites market segmentation assists to determine the prevailing market opportunities.

- Identify key players and their strategic moves in Europe automotive composites market.

- Assess and rank the top factors that are expected to affect the growth of Europe automotive composites market.

- Analyze the market factors in various countries and understand business opportunities.

- Player positioning provides a clear understanding of the present position of key market players.

Europe Automotive Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.8 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Fiber Type |

|

| By Resin Type |

|

| By Application |

|

| By Country |

|

| Key Market Players | TEIJIN LIMITED, SGL Carbon, BASF SE, Evonik Industries AG, Hexcel Corporation, Solvay S.A., Covestro AG, LANXESS, Mitsubishi Chemical Group Corporation, ZOLTEK Corporation |

The Europe Automotive Composites Market is projected to grow at a CAGR of 4.1 % from 2024 to 2033.

SGL Carbon, TEIJIN LIMITED, BASF SE, Solvay S.A., Hexcel Corporation, ZOLTEK Corporation, Evonik Industries AG, Mitsubishi Chemical Group Corporation, Covestro AG, LANXESS are the leading players in Europe Automotive Composites Market.

Interior is the major application in the Europe Automotive Composites Market.

Europe Automotive Composites Market is classified as by fiber type, by resin type, by application, by country

Loading Table Of Content...