Europe Industrial Refrigeration Services Market Research - 2033

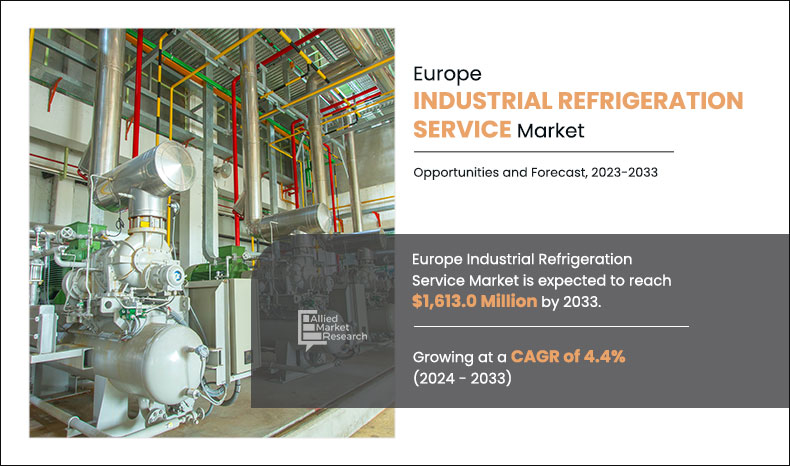

The Europe industrial refrigeration services market size was valued at $1,038.9 million in 2023 and is projected to reach $1,613.0 million by 2033, registering a CAGR of 4.4% from 2024 to 2033.

Market Introduction and Definition

Industrial refrigeration services are essential for many industries, as they offer complete solutions for removing heat to maintain specific temperatures below ambient levels. These services cover system design & engineering, including assessing cooling needs, creating custom energy-efficient solutions, and performing thermal load calculations & equipment sizing. Installation services include setting up compressors, condensers, evaporators, piping, ductwork, and electrical systems. Maintenance and Repair services focus on preventive maintenance, emergency repairs, and system upgrades to ensure efficient operation and minimize downtime.

The Europe industrial refrigeration services market is segmented on the basis of service, end user, and country. By service, the market is divided into design, installation, and maintenance & repair. By end user, the market is categorized into fresh fruits & vegetables, meat, poultry, & fish, dairy & ice cream, beverages, chemical & pharmaceutical, petrochemicals, and others. Country-wise, the Europe industrial refrigeration services market trend is analyzed across Europe (UK, Germany, France, Italy, Netherland, Switzerland, Spain, Austria, Belgium, Poland, Scandinavia, and rest of Europe)

Report Key Highlighters

- Europe industrial refrigeration services market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2023 to 2033.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the Europe industrial refrigeration services market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- Europe industrial refrigeration services market share is marginally fragmented, with players such as ACE Service, Blue Pearl Energy, Industrial Refrigeration Services Ltd., JLL Company, Maximus Chillers Ltd., NEWMAN REFRIGERATION LTD., Nimlas Group AB, Seward Refrigeration Limited, Star Refrigeration, and Stonegrove Refrigeration Services Ltd.

Importance of refrigeration in food and beverage industry

Refrigeration plays a critical role in the food and beverage industry by preserving product freshness, extending shelf life, and preventing spoilage & contamination to comply with health and safety regulations. In Europe, the growing significance of refrigeration, fueled by strict regulatory standards, consumer demand for top-notch products, the expansion of cold chain logistics, technological progress, sustainability efforts, and the rise of the processed and packaged food sector, has substantially increased the need for industrial refrigeration services. For instance, in May 2024, Lineage, a large dynamic temperature-controlled warehousing and logistics company, expanded temperature-controlled facility in Lębork in the Pomorskie region (northern Poland). Such substantial investments in expansion of warehouses in the country fuel demand for industrial refrigeration services. Maintaining high-quality warehouses and avoiding product wastage & contamination to adhere to health and safety regulations drives the need for Maintenance and Repair services.

Food safety is of the highest importance in the food and beverage industry. Without proper refrigeration, food spoils and becomes contaminated by harmful bacteria and pathogens. Consuming these contaminated products leads to health problems, which can greatly damage the reputation of the company. Maintaining optimal refrigeration is crucial for upholding food safety and quality, especially in Europe where strict regulations and consumer demand for top-notch products are major concerns. The demand for industrial refrigeration services in Europe is on the rise owing to several factors such as regulatory compliance, consumer preferences for fresh products, the expansion of cold chain logistics, technological advancements, sustainability initiatives, and the growth of the processed & packaged food sector. Technological advancements have allowed companies to implement energy-efficient refrigeration systems, meeting regulatory standards while cutting operational costs and carbon emissions. This highlights the crucial role of industrial refrigeration services in meeting the changing requirements of the food and beverage industry in Europe. Such factors are leading to a surge in Europe industrial refrigeration services market growth.

Necessity of periodic maintenance of refrigeration systems

If a refrigeration system is not periodically maintained, the probability of its breakdown during normal production work negatively impacts the output of the facility. In addition, failure of the refrigeration system responsible for maintaining cold storage leads to spoilage of the products and eventually has a negative impact on the profitability and market reputation of the company. Regular maintenance of refrigeration systems is essential for efficient operation, saving costs, and achieving overall business success, as highlighted by industry professionals. For instance, in March 2024, Industrial process engineer Doug Biedenweg's data shows that postponing $1 in maintenance results in $4 in capital renewal costs when equipment malfunctions. This figure emphasizes the financial wisdom of routine maintenance, which generates annual energy savings of 12 to 18%. Keeping coils clean and components well-lubricated enhances heat transfer efficiency, leading to a reduction in operational costs of up to 18%.

Furthermore, taking proactive measures to maintain equipment prolongs its lifespan and reduces the chances of expensive downtime, which could cost hundreds of thousands to millions of dollars per hour in extensive operations. In addition to financial benefits, routine inspections improve workplace safety by averting potential dangers linked to refrigerant leaks. By treating maintenance as a top priority, companies ensure the quality of their products, decrease the risks of downtime, and enable accurate financial planning, ultimately securing their operational efficiency & profitability.

Expansion of cold supply chains in Europe

The trend toward globalization is a key factor driving supply chain expansion in Europe. Businesses are currently exploring European markets for sourcing materials and products. This approach is designed to lower expenses, access untapped markets, and leverage specialized expertise. As a result, cold supply networks in Europe have become more extensive, reaching across multiple countries both within the continent and beyond. The rise in demand for efficient pharmaceutical distribution, and the surge in trade of perishable goods are fueling the need for industrial refrigeration services in Europe. The expansion of cold supply chains and the increasing demand for temperature-controlled warehouses present lucrative opportunities in the Europe industrial refrigeration services market. Cold chain logistics play a vital role in maintaining the quality of perishable goods, ensuring food safety, adhering to regulatory requirements, and meeting consumer expectations for fresh products. For instance, in JUNE 2024, Constellation Cold Logistics (Constellation) offers temperature-controlled storage infrastructure to various food producers through a network of 26 storage facilities in Western Europe and the Nordics, spanning seven countries. The Company provides vital food preservation services that are crucial to the contemporary food supply chain, aiding in the safe feeding of the world and minimizing food wastage.

Furthermore, Europe industrial refrigeration services industry is witnessing growth, as the market requires a range of industrial refrigeration services, such as creating and setting up tailored refrigeration systems for both new and current cold storage facilities, routine upkeep & upgrades to enhance efficiency, and overseeing the switch to eco-friendly refrigerants. Moreover, there is a strong need for energy efficiency using advanced technologies and energy assessments, as well as ensuring adherence to health, safety, and environmental regulations through regular inspections and training.

By Service

The Maintenance & Repair segment is projected to grow at a significant CAGR during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major Europe industrial refrigeration services market players that have been provided in the report include ACE Service, Blue Pearl Energy, Industrial Refrigeration Services Ltd., JLL Company, Maximus Chillers Ltd., NEWMAN REFRIGERATION LTD., Nimlas Group AB, Seward Refrigeration Limited, Star Refrigeration, and Stonegrove Refrigeration Services Ltd.

Top Impacting Factors

Industrial refrigeration services offer a wide array of solutions tailored to regulate temperatures in industrial environments, serving industries including food & beverage, pharmaceuticals, petrochemicals, logistics, and manufacturing. These services consist of personalized system design, expert installation, routine maintenance, and responsive repair services.

By End User Industry

The Meat, Poultry And Fish segment is expected to hold a majority share of the market throughout the study period

Key Benefits For Stakeholders

- This study comprises analytical depiction of the Europe industrial refrigeration services market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall Europe industrial refrigeration services market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current Europe industrial refrigeration services market forecast is quantitatively analyzed from 2024 to 2033 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the Europe industrial refrigeration services market.

- The report includes the market share of key vendors and the Europe industrial refrigeration services market.

Analyst Review

According to the insights of the top-level CXOs, the industrial refrigeration services market has witnessed significant growth in the past few years, owing to increase in the number of food & beverages processing facilities, pharmaceutical manufacturing facilities, and chemical & petrochemical facilities.

The industrial refrigeration services industry is constantly evolving. Over the last few decades, Europe has introduced multiple regulations regarding the types of refrigerants permissible in refrigeration systems. For example, several regulations regarding refrigerants have been implemented by European nations. In March 2023, the European Parliament revised its F-gas Regulation, and approved ban on HFCs and HFOs [HFC-125, HFC-134a, HFC-143a, HFO-1234yf, HFO-1234ze(E), HFO–1336mzz(Z) and HFO-1336mzz(E)] in various applications, primarily form heat pumps and stationary refrigeration, along with others. The latest rules are designed to eliminate HFCs (hydrofluorocarbons) by 2050, with a substantial decrease of 80% to 85% planned between 2036 and 2047. This gradual reduction is aimed at addressing climate change and reducing the environmental effects of these powerful greenhouse gases. These amendments are anticipated to further boost the adoption of natural refrigerants. These factors indicate a surge in demand for diverse services related to Europe industrial refrigeration.

The CXOs further added that the European industrial refrigeration services market consists of both consolidated and fragmented manufacturing. Large companies often provide advanced services such as remote monitoring and maintenance. However, small-scale companies provide generic Maintenance and Repair services often for less critical systems.

Increasing number of cold-chain logistics, rising number of food & beverages and other industries drive the growth of the global Europe industrial refrigeration service market.

The latest version of the Europe industrial refrigeration service market report can be obtained on demand from the website.

The Europe industrial refrigeration service market size was valued at $1,038.9 million in 2023.

The Europe industrial refrigeration service market size is estimated to reach $1,613.0 million by 2033, exhibiting a CAGR of 4.4% from 2024 to 2033.

The forecast period considered for the Europe industrial refrigeration service market is 2024 to 2033, wherein, 2023 is the base year, 2024 is the estimated year, and 2033 is the forecast year.

Meat, Poultry And Fish segment is the largest market for Europe industrial refrigeration service market.

Key companies profiled in the Europe industrial refrigeration service market report ACE Service, Blue Pearl Energy, Industrial Refrigeration Services Ltd., JLL Company, Maximus Chillers Ltd., NEWMAN REFRIGERATION LTD., Nimlas Group AB, Seward Refrigeration Limited, Star Refrigeration, and Stonegrove Refrigeration Services Ltd,.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...