Factoring Services Market Research, 2031

The global factoring services market size was valued at $3,271.45 billion in 2021, and is projected to reach $5,872.00 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

Factoring service is a process of collection of receivables and maintains sales ledgers, credit control and credit protection. Furthermore, services are helpful in many ways, such as the need for secure financing, which is subject to strong fluctuations due to seasonal changes in the marketplace. Moreover, businesses involved in logistic and manufacturing services make factoring as an ideal way of financing, as these firms have numerous accounts receivable from other businesses.

Rise in open account trading opportunities and need for alternate sources of financing for small & medium enterprises (SMEs) to meet immediate business goals are driving the global factoring service market. Moreover, increased awareness and understanding of supply chain financing benefits are boosting the factoring service market size. However, lack of a stringent regulatory framework for debt recovery mechanisms and foreign currency restrictions, and stamp duties are hampering the factoring service market growth. On the contrary, rise in technological advancements such as automated invoices are expected to offer remunerative opportunities for expansion of the factoring service market during the forecast period.

The factoring services market is segmented into Industry Vertical, Provider, Enterprise Size and Application.

Segment review

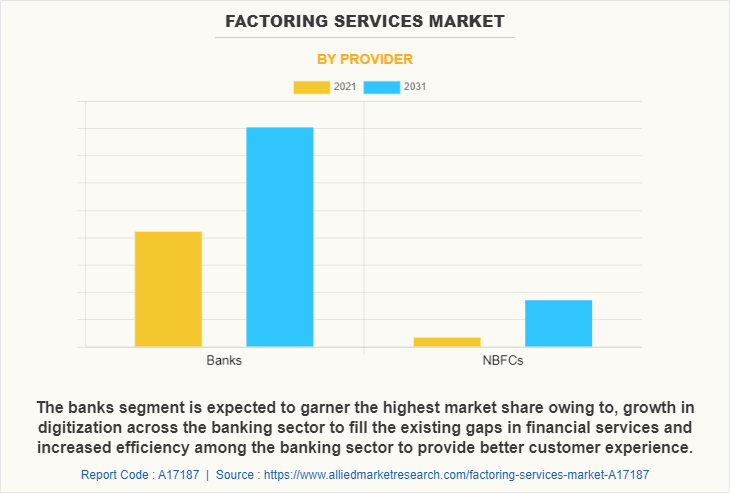

The factoring service market is segmented on the basis of by component, enterprise size, application, industrial vertical and region. On the basis of component, the market is categorized into banks and NBFCs. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. On the basis of application, the market is classified into domestic and international. On the basis of industrial vertical, it is classified into construction, manufacturing, healthcare, transportation and logistics, energy and utilities, it and telecom, staffing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the factoring service market are Advanon AG, ALAMI Technologies, Aldermore Bank PLC, AwanTunai, Barclays PLC, BNP Paribas, China Construction Bank, Deutsche Factoring Bank, Eurobank, Hitachi Capital (UK) PLC, HSBC Group, ICBC, KUKE Finance JS, Mizuho Financial Group, Inc, Riviera Finance of Texas, Inc, Societe Generale, and The Southern Bank Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the factoring services industry.

In terms of provider, the banks segment holds the largest factoring services market share as, it provides secure factoring services with minimum chances of fraud. However, the NBFCs segment is expected to grow at the highest rate during the forecast period owing to, increasing government regulations enabling them to provide factoring services to SMEs.

Region wise, the factoring service market share was dominated by Europe in 2020 and is expected to retain its position during the forecast period, owing to the presence of major players that offer factoring services. However, Asia-Pacific is expected to witness significant growth during the forecast period owing to, increasing number of SMEs in developing nations like India and large domestic trading countries like China.

COVID-19 Impact Analysis

The factoring services industry has witnessed stable growth during the COVID-19 pandemic, owing to rise in demand for anti-money laundering (AML), fraud detection solutions, and various other solutions during the pandemic situation. In addition, the COVID-19 pandemic has resulted in changes in model performance, as more continuous monitoring and validation is required to mitigate various types of risks, compared to static validation and testing methods, which, in turn, drive the development of factoring services. In addition, with rapid digital transformation, the governments of several regions become the top competitor for factoring services providers as governments implemented forgivable programs and essentially zero cost money.

For instance, on July 2022 as per IMF survey many operations have been utilizing financing solutions to ease cash flow restrictions. In addition, it has been a staple cash flow financing option across many industries for millennia. Factoring works has also rendered its solution during the pandemic. The principle of increasing cash flow based on current assets has made factoring a prime fit for pandemic-spurred business conditions. Moreover, COVID-19 has sparked a strong increase in factoring’s popularity, it hasn’t been plain sailing for open account firms.

Top Impacting Factors

Rise in open account trading opportunities

Increasing implementation of open account in small and medium enterprises (SMEs), is that propel growth of the market owing to the expansion of the manufacturing industry in Asian countries and the growing need among startups and SMEs for an alternate source of finance are further driving the market growth. In addition, BFSI companies are adopting and developing machine learning techniques to analyze large volume of data and to deliver valuable insights to customers. Moreover, increase in investments in AI and advanced machine learning by fintech & banks to enhance the automation process and to offer more streamlined and personalized customer experience propels the growth of the market. For instance, in November 2020, The International Trade Centre (ITC) and partners launched the SME Trade Finance Guide at the SME Finance Forum this aims to help SMEs exporters and importers. In addition, it is helping SMEs learn and access finance for trade, methods of payment, including cash advances, letters of credit, documentary collections and open accounts. Thus, that propel growth of the factoring service industry.

Need for alternate sources of financing for small & medium enterprises (SMEs) to meet immediate business goals

The primary factor that drives the market growth is rise in demand for alternative sources of financing for SMEs, increase in various factoring businesses delivering a combination of financing options, raised liquidity for efficient working capital management, and enhanced inventory management. In addition, improvement in the banking, financial services, and insurance (BFSI) industry is the primary factor that propels the factoring services market growth. Moreover, rise in awareness and understanding of supply chain financing benefits contribute toward the market expansion. In addition, blockchain technology and cryptocurrency in factoring services expand the market growth. Rise in advancements and unique identification for fast funding, complete transactional security, and innovative contract capabilities. For instance, on January 2022, BlueVine an SME financing company acquired by Toronto Canada based FundThrough this acquisition helps small businesses to grow and thrive, especially the one who sells to large customers with long payment terms and lack of financing options stand in the way of growing a business. Furthermore, it is changing the way exchanges such as stock market, patent awards, and factoring operate. Moreover, other factors, such as rise in use of digital platforms in trade financing and growth in cross-border trade activities drive the market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the factoring services market analysis from 2021 to 2031 to identify the prevailing factoring services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the factoring services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global factoring services market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global factoring services market trends, key players, market segments, application areas, and factoring services market opportunity.

- The study provides an in-depth analysis of the global factoring services market forecast along with current & future trends to explain the imminent investment pockets.

Factoring Services Market Report Highlights

| Aspects | Details |

| By Industry Vertical |

|

| By Provider |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Riviera Finance of Texas, Inc., Barclays, Aldermore Bank, Advanon AG, Mizuho Financial Group, Inc., ALAMI Technologies, BNP Paribas, Societe Generale, ICBC, China Construction Bank, Hitachi Capital (UK) PLC, Deutsche Factoring Bank, AwanTunai, KUKE Finance JSC, Eurobank, HSBC group, The Southern Bank Company |

Analyst Review

Factoring services reduce credit risk by completing responsibility of debt collection. In addition, new technologies help factoring companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts. Hence, it provides benefits such as cost-effectiveness, powerful insights & reporting, and credit evaluation, which are expected to increase demand for factoring services. Furthermore, Asia-Pacific exhibits high growth potential, owing to changing landscape in the financial sector with changes in customer demand and growth in digitization across various countries. Moreover, increase in manufacturing and export-oriented economies, marketplace trends in Asia-Pacific are expected to drive growth of the market.

Factoring services enable businesses to obtain working capital loans and mitigate credit risks. Moreover, rise in adoption of cryptocurrency and blockchain in the private sector non-banks propels growth of the factoring services market. With growth in requirement for factoring services, various companies have established alliances to increase their capabilities. For instance, in January 2022, TBS Factoring Service acquired Charlotte, N.C.-based financial carrier services. With the acquisition, TBS aims to grow its physical presence in key transportation markets and expands its product offerings.

In addition, with further growth in investments across the globe and rise in demand for factoring service, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in September 2021, Aldermore, a retail bank that provides financial services to small and medium-sized businesses, launched Receivables Finance, a new invoice finance product designed to support growth ambitions of the small and medium-sized enterprises (SMEs) in the UK. Receivables Finance has helped a wide range of businesses in many sectors, from entertainment and land sales to sales of licensed content. The product has helped businesses that typically sell goods or services to high quality debtors but where payment is deferred over a one-to-three-year period.

Moreover, with increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, January 2022, FundThrough, a Canadian financial technology platform acquired invoice factoring business of U.S.-based financial technology company BlueVine. The acquisition is expected be double the number of funding transactions that FundThrough makes annually and establish it as the largest AI-powered invoice funding platform in North America.

Rise in open account trading opportunities and need for alternate sources of financing for small & medium enterprises (SMEs) to meet immediate business goals are driving the global factoring service market.

Region wise, the factoring service market share was dominated by Europe in 2020 and is expected to retain its position during the forecast period, owing to the presence of major players that offer factoring services.

The global factoring service market was valued at $3,271.45 billion in 2021, and is projected to reach $5,872.0 billion by 2031, registering a CAGR of 6.1% from 2022 to 2031.

The key players that operate in the factoring service market are Advanon AG, ALAMI Technologies, Aldermore Bank PLC, AwanTunai, Barclays PLC, BNP Paribas, China Construction Bank, Deutsche Factoring Bank, Eurobank, Hitachi Capital (UK) PLC, HSBC Group, ICBC, KUKE Finance JS, Mizuho Financial Group, Inc, Riviera Finance of Texas, Inc, Societe Generale, and The Southern Bank Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...