Factory And Warehouse Insurance Market Research, 2032

The global factory and warehouse insurance market was valued at $29.7 billion in 2022, and is projected to reach $84.3 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

Factory and warehouse insurance is an insurance policy that a factory owner purchases in order to safeguard their factory against various unfavorable conditions (such as fires, thefts, acts of terror, electric fires, and others) that would result in monetary loss for the factory owner.

One of the key drivers of the factory and warehouse insurance market is the increase in property damage incidents. As industrial operations expand and become more complex, the vulnerability to various risks, such as natural disasters, fires, and accidents, amplifies significantly. This heightened exposure has propelled businesses to seek factory and warehouse insurance coverage to safeguard their assets and mitigate potential financial losses.

Furthermore, as industrial spaces become larger and more widespread, the vulnerability to theft increases substantially. Hence, the growing risk of theft and burglary is playing a key role in boosting the factory and warehouse insurance market growth. In addition, the escalating concern over business interruption risks is a significant driver behind the increasing growth of the factory and warehouse insurance market. Recognizing the critical need for financial protection in the face of business interruptions, businesses are increasingly turning to insurance solutions tailored to address the specific risks associated with factory and warehouse operations.

However, the growing factory and warehouse insurance business is facing substantial challenges to its growth due to the high cost of insurance premiums, and complex underwriting process. On the contrary, the integration of technology in risk management is expected to revolutionize the factory and warehouse insurance market, offering a spectrum of lucrative growth opportunities. Advanced technologies such as Internet of Things (IoT) devices, artificial intelligence (AI), and machine learning are becoming integral components for assessing and mitigating risks in industrial settings. IoT devices, strategically placed within factories and warehouses, provide real-time data on equipment performance, environmental conditions, and potential hazards. This increase in data enables insurers to offer more personalized and dynamic coverage, tailoring policies to specific risk profiles and enhancing overall risk management strategies for their clients.

The report focuses on growth prospects, restraints, and trends of the factory and warehouse insurance market forecast. The study provides porter‐™s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the factory and warehouse insurance market outlook.

Segment Review

The factory and warehouse insurance market is segmented into coverage type, enterprise size, industry vertical, and region. On the basis of coverage type, the market is differentiated into floating policy, valued policy, specific policy, and replacement and reinstatement policy. As per enterprise size, the factory and warehouse insurance market is categorized into large enterprises, and small and medium-sized enterprises. By industry vertical, the market is divided into manufacturing, retail and e-commerce, transportation and logistics, automotive, pharmaceuticals, and others. Region-wise, the factory and warehouse insurance market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

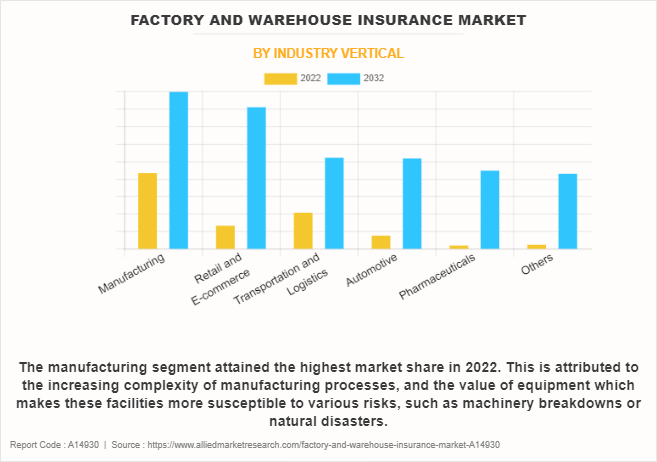

By industry vertical, the manufacturing segment acquired a major share in 2022. The growth of the manufacturing segment is propelled by the increasing complexity of manufacturing processes and the value of equipment which makes these facilities more susceptible to various risks, such as machinery breakdowns or natural disasters. Furthermore, the rise of technology in manufacturing has led to a higher reliance on specialized machinery, amplifying the financial impact of potential disruptions. However, the pharmaceuticals segment is expected to be the fastest-growing segment during the forecast period, owing to the fact that pharmaceutical manufacturing involves highly specialized equipment and delicate processes, making facilities susceptible to disruptions from equipment failures, contamination risks, and regulatory challenges.

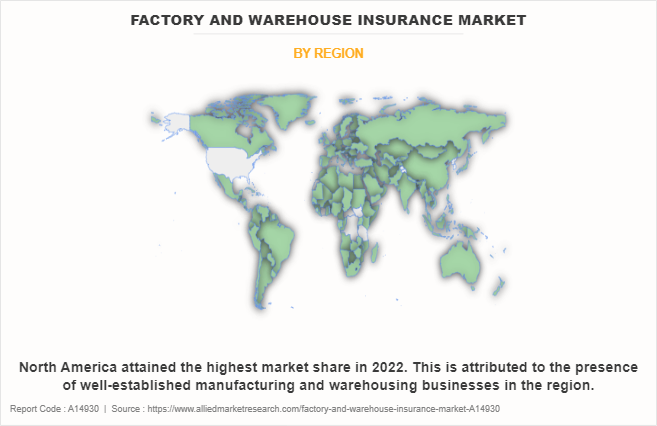

Region-wise, North America dominated the factory and warehouse insurance market share in 2022, owing to the increased awareness of potential threats, including natural disasters and supply chain disruptions. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the increase in demand for comprehensive insurance solutions among businesses. Insurance providers in the region offer policies that cover a wide array of risks, including property damage, business interruption, and liability, tailored to the unique challenges faced by factories and warehouses.

Competition Analysis

Competitive analysis and profiles of the major players in the factory and warehouse insurance market include AXA SA, Zurich Insurance Company Ltd, HII Insurance Broking Services Pvt. Ltd. (PlanCover), GeneralLiabilityInsure.com, Simply Business, The Hartford, SecureNow Insurance Broker Pvt. Ltd., GreenLife Insurance Broking Pvt. Ltd., Policywings Insurance Broker Pvt Ltd, and Insuranks.com. These players have adopted various strategies to increase their market penetration and strengthen their position in the factory and warehouse insurance industry.

Recent Partnerships in the Factory and Warehouse Insurance Market

In December 2023, HCLTech, a global technology company, and Roadzen, a leading AI-driven auto insurance technology company, formed a partnership to harness the power of AI and data engineering to deliver benefits to both auto insurance carriers as well as their customers. This partnership will help auto owners preserve the value of their assets, improve safety, and reduce insurance premiums. Furthermore, it will help carriers with better insights into driver behaviors and improve loss ratios.

In November 2022, OnTheMarket Group formed a partnership with insurance broker Simply Business to introduce four new insurance products to the portal‐™s agent customers which include professional indemnity insurance, public liability insurance, business contents insurance, and employer‐™s liability insurance.

In August 2022, Bimaplan, a Y Combinator-backed insurtech startup announced a partnership with Niyo Bharat, to provide contractual factory workers with vital microinsurance protection plans. The strategic partnership will offer essential insurance products bundled together with Niyo Bharat‐™s financial services on one platform.

Market Landscape and Trends

In 2021, in India, the government proposed a new warehousing policy that sets the roadmap for the development of exclusive warehousing zones in public-private partnership (PPP) mode to ease transportation and reduce logistics costs in India. The new policy is framed and implemented by the National Highways Authority of India (NHAI) and is aimed at improving logistics throughout the country. Modern warehouses house cold-storage chains and can store all kinds of cargo including wet and dry. Furthermore, the proposed warehousing zones are part of the initiatives taken by the government to reform the transport sector, which accounts for a majority of goods movement across India. Warehousing zones help cut India‐™s logistics cost, which is 14%-16% of gross domestic product (GDP), compared to 8%-10% of GDP in China and 12%-13% in the U.S.

Top Impacting Factors

Increase in property damage incidents

The increasing frequency of property damage incidents has become a driving force behind the rapid growth of the factory and warehouse insurance market size. As industrial operations expand and become more complex, the vulnerability to various risks, such as natural disasters, fires, and accidents, amplifies significantly. This heightened exposure has propelled businesses to seek comprehensive insurance coverage to safeguard their assets and mitigate potential financial losses. With an increasing realization of the substantial economic impact that property damage can have on manufacturing and storage facilities, businesses are turning to robust insurance solutions tailored to the unique challenges posed by the industrial landscape.

Furthermore, the evolving nature of risks in the industrial sector, coupled with the rise of global supply chains, has necessitated a nuanced approach to insurance. Factory and warehouse insurance providers are adapting to this dynamic environment by offering policies that address not only physical property protection but also business interruption, contingent business interruption, and supply chain risks. As stakeholders recognize the vital role insurance plays in ensuring business resilience, the factory and warehouse insurance market is witnessing a notable surge, reflecting a proactive response to the imperative of fortifying against the escalating threats to industrial properties. Therefore, such factors drive the growth of the factory and warehouse insurance market.

Growing risk of theft and burglary

The growing risk of theft and burglary is playing a key role in boosting the factory and warehouse insurance market. As these industrial spaces become larger and more widespread, the vulnerability to theft increases substantially. Factories and warehouses often house valuable equipment, machinery, and inventory, making them attractive targets for theft. Recognizing this heightened risk, businesses are increasingly seeking insurance solutions that can provide financial protection in the event of burglary or theft-related losses. In response to the evolving nature of security challenges in industrial settings, insurance providers are tailoring their offerings to address the specific needs of factories and warehouses. This includes coverage for stolen goods, property damage resulting from break-ins, and the associated business interruptions. The growing awareness among businesses about the potential financial impact of theft-related incidents is propelling the demand for comprehensive insurance coverage, thereby contributing to the expansion of the factory and warehouse insurance market.

Business interruption risks

The escalating concern over business interruption risks is a significant driver behind the increasing growth of the factory and warehouse insurance market. In the dynamic landscape of industrial operations, the potential for disruptions is a constant challenge. Whether due to natural disasters, equipment failures, or other unforeseen events, any pause in operations can result in substantial financial losses. Recognizing the critical need for financial protection in the face of such interruptions, businesses are increasingly turning to insurance solutions tailored to address the specific risks associated with factory and warehouse operations.

Insurance providers are responding to this demand by offering policies that go beyond traditional property coverage to include comprehensive business interruption protection. These policies aim to safeguard businesses against income loss, additional expenses incurred during downtime, and the broader impact on the supply chain. As the awareness of the far-reaching consequences of business interruptions grows, the factory and warehouse insurance market is witnessing a notable surge, with businesses seeking proactive measures to ensure continuity and resilience in the face of operational disruptions.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the factory and warehouse insurance market analysis from 2022 to 2032 to identify the prevailing factory and warehouse insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the factory and warehouse insurance market segmentation assists to determine the prevailing factory and warehouse insurance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as factory and warehouse insurance market trends, key players, market segments, application areas, and market growth strategies.

Factory and Warehouse Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 84.3 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 275 |

| By Coverage Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Simply Business, HII Insurance Broking Services Pvt. Ltd. (PlanCover), Policywings Insurance Broker Pvt Ltd, Insuranks.com, SecureNow Insurance Broker Pvt. Ltd., The Hartford, GreenLife Insurance Broking Pvt. Ltd., AXA SA, Zurich Insurance Company Ltd, GeneralLiabilityInsure.com |

Analyst Review

Factory and warehouse insurance policies are specifically designed to protect all of insurer’s belongings and inventories from a variety of hazards such as fire, implosion, explosion, natural disasters such as storm, flood, earthquake, and others. Additional factory and warehouse insurance coverage includes theft and burglary, electronic and mechanical breakdown, money insurance, and all-risk laptop insurance, all of which can be protected by factory insurance plans.

Key players in the factory and warehouse insurance market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in November 2022, OnTheMarket Group formed a partnership with insurance broker Simply Business to introduce four new insurance products to the portal’s agent customers which include professional indemnity insurance, public liability insurance, business contents insurance, and employer’s liability insurance. Therefore, such strategies adopted by key players propel the growth of the factory and warehouse insurance market.

The COVID-19 pandemic had a significant impact on the factory and warehouse insurance market size. Initially, many industries experienced disruptions in production and supply chains due to lockdowns and restrictions. This led to a higher demand for insurance coverage as businesses sought protection against unforeseen interruptions in their operations. Insurers also faced challenges in assessing and pricing risks due to the increased uncertainty and volatility in the market.

The key players in the factory and warehouse insurance market include AXA SA, Zurich Insurance Company Ltd, HII Insurance Broking Services Pvt. Ltd. (PlanCover), GeneralLiabilityInsure.com, Simply Business, The Hartford, SecureNow Insurance Broker Pvt. Ltd., GreenLife Insurance Broking Pvt. Ltd., Policywings Insurance Broker Pvt Ltd, and Insuranks.com. Major players operating in the market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With an increase in awareness and rise in demand for factory and warehouse insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The factory and warehouse insurance market is segmented into coverage type, enterprise size, industry vertical, and region. On the basis of coverage type, the market is differentiated into floating policy, valued policy, specific policy, and replacement and reinstatement policy. As per enterprise size, the market is categorized into large enterprises, and small and medium-sized enterprises. By industry vertical, the market is divided into manufacturing, retail and e-commerce, transportation and logistics, automotive, pharmaceuticals, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Factory and Warehouse Insurance.

The factory and warehouse insurance market size was valued at $29,679.24 million in 2022 and is projected to reach $84,249.38 million by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

The key players operating in the factory and warehouse insurance market include AXA SA, Zurich Insurance Company Ltd, HII Insurance Broking Services Pvt. Ltd. (PlanCover), GeneralLiabilityInsure.com, Simply Business, The Hartford, SecureNow Insurance Broker Pvt. Ltd., GreenLife Insurance Broking Pvt. Ltd., Policywings Insurance Broker Pvt. Ltd., and Insuranks.com.

Loading Table Of Content...

Loading Research Methodology...