Fasteners Market Research - 2032

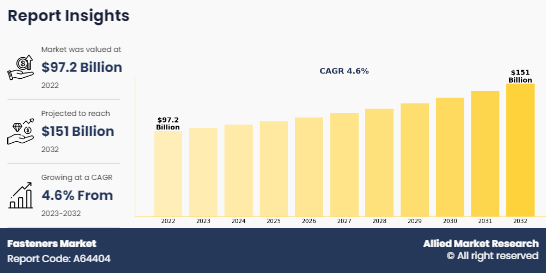

The global fasteners market was valued at $97.2 billion in 2022, and is projected to reach $151 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. Increasing investments in infrastructure projects are driven by the need to modernize aging infrastructure, accommodate growing populations, and support economic development. Governments and private sector entities are committing significant resources to these projects, which, in turn, stimulates demand for a wide range of fasteners.

Introduction

Fasteners are hardware devices designed to join or secure two or more components together. They come in various forms, including screws, bolts, nuts, washers, rivets, and anchors. Fasteners can be either temporary or permanent, depending on the nature of the connection and the requirements of the application. The choice of fastener depends on factors such as the materials being joined, the environmental conditions, and the load-bearing requirements.

In the construction industry, fasteners are fundamental for assembling structures, both temporary and permanent. Common fasteners used include bolts, nuts, screws, and anchors. Bolts and nuts are frequently used to secure steel beams and structural components, while screws are employed for securing panels, fixtures, and fittings. Anchors are essential for attaching fixtures to concrete or masonry walls. Fasteners in construction must withstand significant loads and resist environmental factors such as moisture, temperature fluctuations, and chemical exposure.

Fasteners in the aerospace industry must meet rigorous standards due to the critical nature of aircraft and spacecraft. Aerospace fasteners are typically made from high-strength materials such as titanium and high-grade stainless steel to ensure reliability under extreme conditions. Rivets, bolts, and specialty fasteners are used to assemble aircraft structures, including fuselages, wings, and landing gear. The fasteners must be capable of withstanding high-speed airflows, extreme temperatures, and varying atmospheric pressures.

Key Takeaways:

The fasteners industry market study covers data for minimum 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2023-2032).

The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global fasteners market and to assist stakeholders in making educated decisions to achieve their growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the fasteners market.

The fasteners market is highly fragmented with several players, including Stanley Black & Decker, Inc., NORMA Group, Fontana Finanziaria S.p.A., Precision Castparts Corp., LISI GROUP, ARaymond, PennEngineering, Sundram Fasteners Limited, SFS Group USA, Inc, and Trifast Plc. These players have adopted key developmental strategies such as acquisitions, product launches, mergers, and expansion to strengthen their foothold in the market.

Market Dynamics

Rapid expansion in the automotive, aerospace, and construction sectors is expected to drive the growth of the fasteners market during the forecast period. In the automotive industry, the demand for fasteners is fueled by increase in the production of vehicles and continuous advancements in automotive technologies. Modern vehicles require a wide range of fasteners for assembly, including bolts, nuts, and screws, which are essential for securing various components and systems. As automakers strive to improve vehicle performance, safety, and fuel efficiency, the need for high-quality, durable fasteners becomes even more critical. The aerospace sector also contributes to the growing demand for fasteners due to the high standards of safety and performance required in aircraft manufacturing. Aerospace fasteners must meet stringent specifications to ensure reliability and safety in flight. The growth of the aerospace industry, driven by increased air travel and advancements in aerospace technologies, continues to drive the demand for specialized fasteners that meet rigorous industry standards. In February 2022, MacLean-Fogg Component Solutions introduced the Treadstrong brand, featuring a new e-commerce website. This brand specializes in wheel fasteners designed for lightweight vehicles. Among the products offered are black wheel lug nuts specifically tailored for various Ford models, including the F-150, Explorer, and Mustang.

The construction and maintenance of railway tracks, stations, and infrastructure rely on fasteners for securing rails, sleepers, and other track components, which significantly fuel their demand. Moreover, increase in high-speed rail projects and modernization initiatives are expected to boost the demand for specialized fasteners, which are capable of withstanding the stresses and dynamic forces associated with train operations. As of May 2022, China led the world in infrastructure projects under development or execution, totaling over $5 trillion. Following China were the U.S. and India, with approximately $2 trillion worth of infrastructure projects each.

In September 2022, GAF, a subsidiary of Standard Industries and a leading manufacturer of roofing and waterproofing solutions in North America, revealed plans to construct a new manufacturing facility in Valdosta, Georgia. This facility aims to bolster the company's commercial roofing operations, particularly in the production of thermoplastic polyolefin (TPO) roofing materials. With the acquisition of 130 acres of land, GAF is poised to commence construction in the upcoming autumn season where fasteners such as bolts, nuts, and screws are gaining popularity to join structural members together, forming the framework of buildings and other structures. The anticipated completion of the plant is scheduled for the first quarter of 2024, facilitating the full-scale production of GAF's EverGuard product line.

Fluctuations in the prices of steel and aluminum have a direct impact on the production costs of fasteners, which is anticipated to restrain the growth of the fasteners market during the forecast period. Steel and aluminum are primary raw materials used in the manufacturing of fasteners, including bolts, nuts, and screws. Variations in their prices can significantly affect the overall production expenses for fastener manufacturers. When the prices of these metals rise, manufacturers face increased costs for raw materials. This, in turn, can lead to higher production costs, which may be passed on to consumers in the form of increased prices for fasteners. Rising prices may reduce demand, especially in markets or applications where cost plays a significant role in decision-making. Conversely, when metal prices fall, manufacturers might experience reduced production costs, but these fluctuations can still create uncertainty in the market. This uncertainty can affect investment decisions and financial planning for fastener manufacturers, potentially impacting their ability to scale operations or invest in new technologies.

Segments Overview

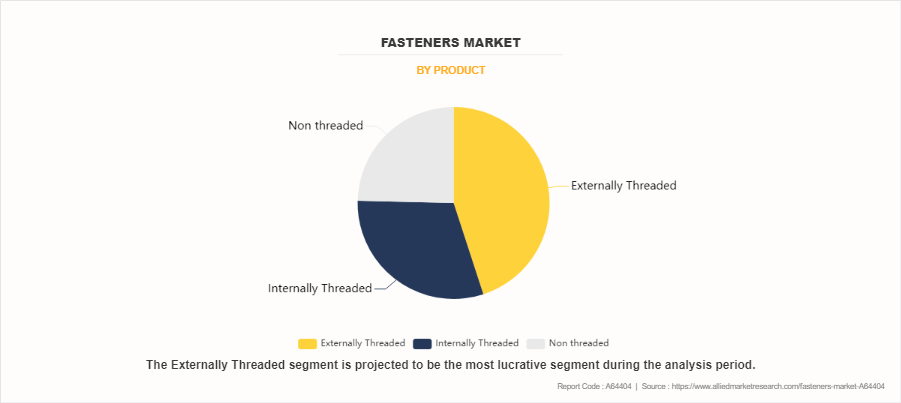

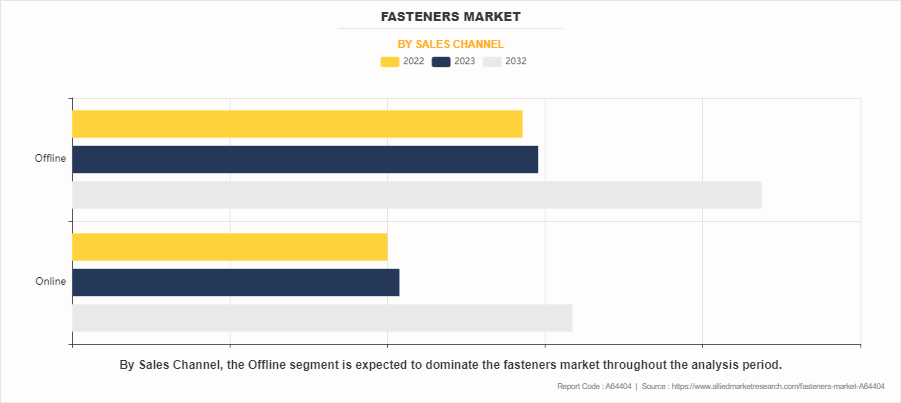

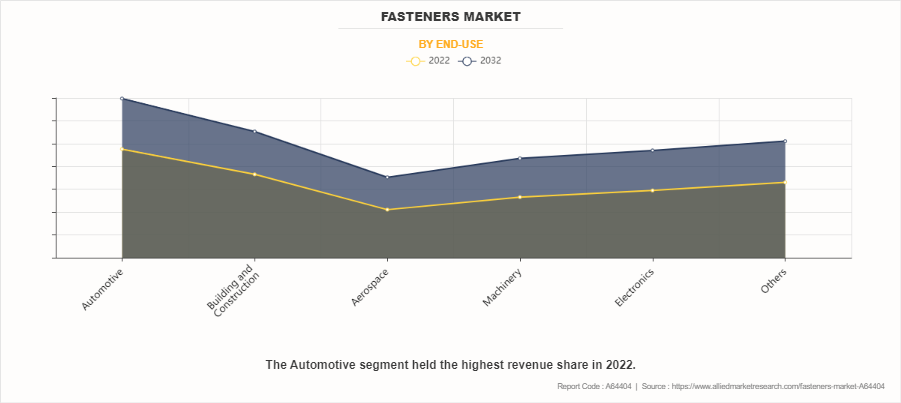

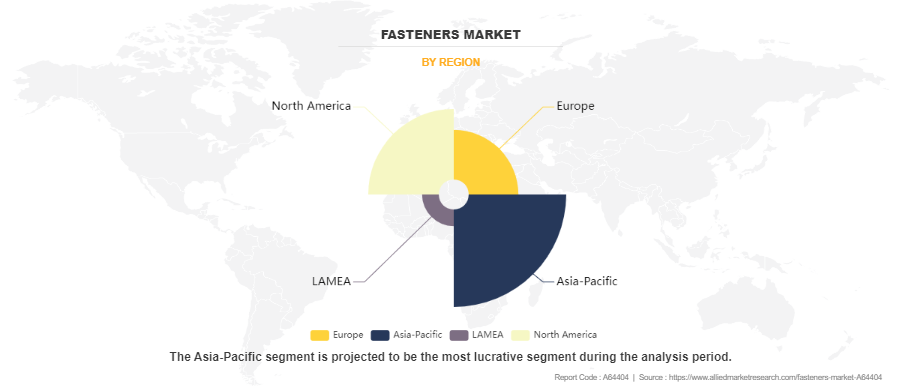

The global fasteners market is segmented into product, sales channel, end use, and region. On the basis of product, the market is classified into externally threaded, internally threaded, and non-threaded. Depending on sales channel, it is divided online and offline. By end use, it is segregated into automotive, building and construction, aerospace, machinery, electronics, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product, the externally threaded segment dominated the fasteners market, accounting for more than one-third of the market share. Screws are extensively used in externally threaded applications. They come in various types, including machine screws, wood screws, sheet metal screws, and self-tapping screws. Machine screws are commonly used with nuts or tapped holes, while wood screws are designed for use in wood or similar materials. Sheet metal screws are used to fasten metal sheets, and self-tapping screws can create their own threads in softer materials like plastic or wood.

On the basis of sales channel, the offline segment dominated the fasteners market accounting for more than half of the market share. Fasteners such as nails, screws, bolts, and nuts are extensively used in construction projects for joining structural elements, installing fixtures, and securing materials together. In-store displays showcasing various types of fasteners along with related products like tools, hardware, or construction materials. These displays serve as focal points to attract customers in the fasteners industry.

On the basis of end-use, the automotive is the most lucrative segment in the fasteners market accounting for one fifth of the market share. Fasteners secure interior trim components, such as dashboard panels, seats, consoles, and door panels, to the vehicle's interior structure. Fasteners play a crucial role in assembling the powertrain components, including the engine, transmission, and drivetrain. They secure components together, such as engine blocks, cylinder heads, transmission housings, and differential assemblies.

Region wise, Asia-Pacific dominated the fasteners market growing with a CAGR of 5.0% during the forecast period. China is a significant consumer of fasteners. The country's booming automotive industry, construction sector, and machinery manufacturing contribute to the high demand for fasteners. The construction sector, driven by infrastructure projects and urbanization, drives substantial demand for construction fasteners like anchors, screws, and bolts. Additionally, India's automotive industry, one of the largest in the world, requires a diverse range of fasteners for vehicle assembly and production.

Competitive Analysis

The major players operating in the fasteners market report include Stanley Black & Decker, Inc., NORMA Group, Fontana Finanziaria S.p.A., Precision Castparts Corp., LISI GROUP, ARaymond, PennEngineering, Sundram Fasteners Limited, SFS Group USA, Inc, and Trifast Plc.

Industry Trends of Fasteners Market

As per International Fasteners EXPO 2024, plastic fasteners are being rapidly adopted in construction and building projects. This type of fastener offers builders flexibility, low weight, and cheaper prices.

In July 2023, Triangle Fastener Corporation (TFC) revealed its acquisition of Connective Systems & Supply, Inc. (CSS). This acquisition specifically targeted CSS's division specializing in fasteners tailored for metal building, roofing, and mechanical contractors.

- April 2022, LindFast Solutions Group (LSG), a prominent distributor of specialty fasteners in North America, finalized its acquisition of Fasteners and Fittings, Inc. (F&F), headquartered in Toronto. F&F is renowned for its dominance in the imperial, metric, and stainless steel fasteners market.

- In March 2022, Birmingham Fastener revealed its acquisition of K-T Bolt Manufacturing, Inc., aiming to broaden its range of products and enhance manufacturing capabilities. K-T Bolt Manufacturing, headquartered in Katy, Texas, specializes in custom fabrication, in-house heat treating, closed-die forging, and electropolishing services.

- In January 2022, Norwegian Dokka Fasteners, an international leader in industrial fastener manufacturing, made a strategic move to enhance its presence in Europe by launching a manufacturing facility in KlaipÄ—da, Lithuania.

- According to Odebrecht, a Brazilian company, Brazil's infrastructure construction sector is projected to grow, with its GDP expected to increase from $81.3 billion in 2021 to $99.2 billion by 2025. The fasteners such as bolts, nuts, screws, and anchors are commonly used to join steel beams, concrete panels, wooden frames, and other construction materials.

Historic Trends of the Fasteners Market

- In 1798, Eli Whitney invented the first milling machine, revolutionizing the production of standardized interchangeable parts, including fasteners.

- In 1836, the first recorded U.S. patent for a machine specifically designed to make screws was granted. This patent marked a significant advancement in manufacturing technology, as it allowed for the mass production of fasteners screws with greater efficiency and precision than manual methods.

- In 2000, the fastener industry saw significant advancements with the introduction of advanced coatings and surface treatments aimed at enhancing the corrosion resistance and durability of fasteners.

- In 2010, smart fasteners were embedded with sensors for real-time monitoring of tension, stress, and other factors during installation and operation.

- In 2017, the demand for fasteners grew significantly in renewable energy infrastructure, such as wind turbines and solar panel installations, which fostered innovation in corrosion-resistant and high-strength fasteners suitable for outdoor environments.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fasteners market analysis from 2022 to 2032 to identify the prevailing fasteners market opportunities.

- The fasteners market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fasteners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global fasteners market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fasteners market trends, key players, market segments, application areas, and market growth strategies.

Fasteners Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 151 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Product |

|

| By Sales Channel |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | PennEngineering, Sundram Fasteners Limited, Araymond, Lisi Group, LLC, Fontana Finanziaria S.p.A, SFS Group USA, Inc, Stanley Black & Decker, Inc., Precision Castparts Corp, NORMA Group, Trifast plc |

Analyst Review

According to the opinions of various CXOs of leading companies, the global fasteners market was dominated by the Automotive segment. Fasteners are essential in assembling the engine and transmission components. They secure items such as cylinder heads, engine blocks, crankshafts, connecting rods, and transmission casings. High-strength fasteners are often used due to the extreme temperatures and pressures in these areas.

Fasteners are gaining ground in the emerging economies such as India, China, and Brazil, due to growing construction industry and to meet the increasing demand for reliable & efficient solutions. For instance, according to Odebrecht, a Brazilian company, Brazil's infrastructure construction sector's GDP is anticipated to reach $99.2 billion by 2025, from $81.3 billion in 2021.

In July 2023, Commercial Metals Company made a strategic move by acquiring EDSCO Fasteners LLC from MiddleGround Capital. EDSCO Fasteners is a prominent manufacturer of anchoring solutions. Its product portfolio includes a specialized range of anchor cages, fasteners, and bolts crafted mainly from rebar. These solutions are instrumental in securely fastening high-voltage electrical transmission poles to concrete foundations, catering to the growing demand for metal fasteners in fasteners industry.

The global fasteners market was valued at $97.2 billion in 2022, and is projected to reach $151.0 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032.

Asia-Pacific is the largest region in the fasteners market.

Automotive is the leading end-use of fasteners market.

An increase in construction activities and infrastructure development and automotive industries are the upcoming trends of the fasteners market in the world.

The top companies to hold the market share in Fasteners Stanley Black & Decker, Inc., NORMA Group, Fontana Finanziaria S.p.A., Precision Castparts Corp., LISI GROUP, ARaymond, PennEngineering, Sundram Fasteners Limited, SFS Group USA, Inc, and Trifast Plc.

Fluctuating raw material prices are the restraint of fasteners market.

The externally threaded segment dominated the fasteners market and accounting for more than one-third of the market share in the market.

Loading Table Of Content...

Loading Research Methodology...