Fat Filled Milk Powders (FFMP) Market Research, 2034

Market Introduction and Definition

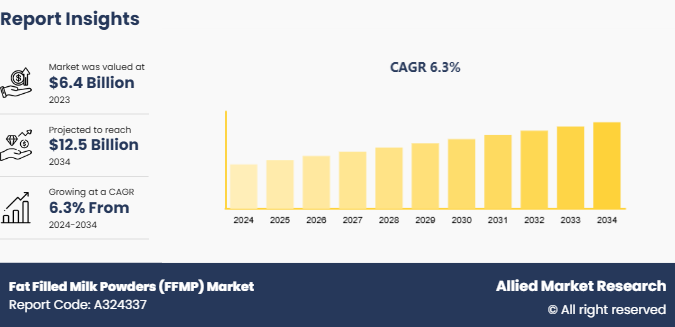

The global fat filled milk powders (FFMP) market size was valued at $6.4 billion in 2023, and is projected to reach $12.5 billion by 2034, growing at a CAGR of 6.3% from 2024 to 2034. Fat filled milk powder (FFMP) is a dairy product that combines skimmed milk powder with vegetable fats, providing a cost-effective and versatile alternative to full cream milk powder. It is commonly used in the production of baked goods, confectionery, beverages, and dairy products. FFMP is known for its functionality, extended shelf life, and affordability. Its applications span the food service industry, industrial manufacturing, and household consumption, particularly in regions where cost considerations drive demand for alternative dairy ingredients.

Key Takeaways

- The fat filled milk powders (FFMP) market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the forecast period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major paper cup industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The fat filled milk powders (FFMP) market study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

- Fat filled milk powders (FFMP) market are increasingly favored due to their cost-effectiveness, offering a more affordable alternative to whole milk powders without compromising on essential nutritional value. By blending skimmed milk powder with vegetable fats, manufacturers can significantly reduce production costs, making the product more accessible to price-sensitive markets. This affordability is particularly appealing in regions with low-income populations, where dairy consumption is vital for nutritional needs but constrained by purchasing power which is expected to boost the fat filled milk powders (FFMP) market growth.

- Rise in demand for affordable dairy products rich in essential nutrients like proteins, calcium, and fats is another key driver for the fat filled milk powders (FFMP) market demand. Consumers in emerging economies are turning to fat-filled milk powders as a solution to meet their daily nutritional requirements without straining their budgets. Furthermore, governments and non-governmental organizations (NGOs) in several countries promote FFMP as a viable source of nutrition for school meal programs and community feeding initiatives.

- Fat-filled milk powders offer an extended shelf life and ease of transportation, making them an ideal choice for regions with limited refrigeration infrastructure or remote locations. developing countries such as India, china, and Brazil held the significant fat filled milk powders (FFMP) market share. Unlike fresh milk, FFMP does not require refrigeration and remains stable under ambient storage conditions, which is crucial for distribution in regions with hot climates or inadequate cold chain facilities.

Value Chain Analysis

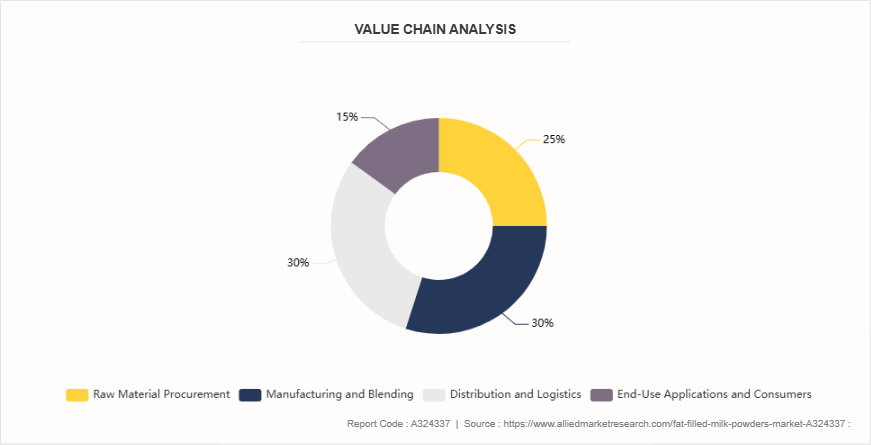

Each stage in the value chain contributes to the overall value of fat filled milk powders (FFMP) market and influences factors such as pricing, quality, and customer satisfaction. Analyzing each step helps identify areas for improvement and opportunities for innovation in the market.

Raw Material Procurement

The value chain begins with the procurement of high-quality raw materials, primarily skimmed milk powder and vegetable fats. Skimmed milk powder is sourced from dairy producers who process raw milk into powdered form through drying techniques like spray drying. Vegetable fats, often derived from palm, coconut, or soybean oil, are procured from agricultural producers or suppliers specializing in refined oils.

Manufacturing and Blending

The next stage involves blending skimmed milk powder with vegetable fats to produce fat-filled milk powder. This process requires precision and adherence to regulatory standards to achieve the desired fat content and nutritional profile. Advanced processing techniques are employed to ensure uniform mixing, consistency, and preservation of essential nutrients. Manufacturers also fortify the product with additional vitamins and minerals to enhance its nutritional value. Packaging plays a significant role at this stage to preserve product quality during storage and transportation.

Distribution and Logistics

Once manufactured, fat-filled milk powder is distributed to various end markets through an extensive network of distributors, wholesalers, and retailers. Given its powdered form and long shelf life, logistics primarily focus on efficient packaging and bulk transportation to reduce costs. Export markets require compliance with international food safety standards and certifications, adding another layer of complexity to the distribution process.

End-Use Applications and Consumers

The final stage of the value chain involves utilization of fat-filled milk powder in various applications, including direct consumer use and industrial processing. FFMP is popular among consumers for home use in beverages, baking, and cooking due to its affordability and ease of storage. On the industrial side, it serves as a key ingredient in dairy-based products like ice creams, cheeses, and yogurts, as well as in confectioneries and baked goods.

Market Segmentation

The fat filled milk powders market is segmented into fat content, application, and region. By fat content, the market is segmented into below 26% fat content, 28% fat content, and above 30%. By application, the market is classified into bakery products, confectionery, dairy products, infant nutrition, beverages, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Europe held the major fat filled milk powders (FFMP) market share in 2023. The Europe fat-filled milk powders (FFMP) market is driven by the food processing industry and rise in demand for cost-effective dairy ingredients. FFMP offers a versatile and economical alternative to traditional whole milk powder, making it a preferred choice for manufacturers of dairy-based products such as chocolates, baked goods, and confectionery. Rise in focus on cost optimization in the food industry further accelerates its adoption, as FFMP allows companies to maintain product quality while reducing production expenses which is expected to drive the fat filled milk powders (FFMP) market size.

Industry Trends

- Growing populations and increase in disposable incomes in emerging markets are driving the demand for affordable dairy substitutes. Fat filled milk powders cater to both nutritional and economic needs in these regions, particularly in Africa, Asia-Pacific, and the Middle East.

- Manufacturers are focusing on tailored FFMP solutions to meet specific industrial requirements. Products with varying fat content, enhanced solubility, and fortified nutritional profiles are being developed to cater to diverse applications of FFMP which is expected to drive market growth during Fat Filled Milk Powders (FFMP) Market Forecast.

- With rise in awareness of environmental impacts, manufacturers are adopting sustainable practices, such as sourcing responsibly produced vegetable fats and optimizing manufacturing processes to reduce emissions.

- With rise in demand for affordable dairy products in Asia-Pacific and Africa, companies such as Vreugdenhil Dairy Foods and Hoogwegt International have expanded their distribution networks, targeting regions where FFMP is a cost-effective alternative to whole milk.

Competitive Landscape

The major players operating in the fat filled milk powders (FFMP) industry include Vreugdenhil Dairy Foods, nd FrieslandCampina, Arla Foods, Fonterra, Glanbia Ingredients, Lactalis, Alpen Food Group, Armor Proteines, Saputo Dairy, and aPolindus

Recent Key Strategies and Developments

- In 2023, Arla adopted sustainability, launching initiatives aimed at reducing carbon emissions across its supply chain. It introduced eco-friendly packaging solutions and focused on enhancing production efficiency. It is also heavily investing in its premium product lines while optimizing its production and supply chains?.

- In 2023, Fonterra was focused on improving its financial stability by selling its Chilean subsidiary, Soprole, and looking to divest non-core assets. This is part of a strategy to strengthen its focus on high-value ingredients and consumer products. Fonterra has also shown a commitment to improving the sustainability of its operations

- In 2022, FrieslandCampina has undergone significant changes in its portfolio, focusing on optimizing production and expanding in Asia and Europe. This includes investments in new production facilities in Malaysia and Indonesia and adjusting its presence in Germany.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fat filled milk powders (FFMP) market analysis from 2024 to 2034 to identify the prevailing fat filled milk powders (FFMP) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fat filled milk powders (FFMP) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fat filled milk powders (FFMP) market trends, key players, market segments, application areas, and market growth strategies.

Fat Filled Milk Powders (FFMP) Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 12.5 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 305 |

| By Fat Content |

|

| By Application |

|

| By Region |

|

| Key Market Players | Glanbia Ingredients, Arla Foods, Alpen Food Group, Groupe Lactalis S.A, Armor Proteines, Vreugdenhil Dairy Foods, Fonterra, Polindus, Saputo Dairy, FrieslandCampina |

The global fat filled milk powders (FFMP) market was valued at $6.4 billion in 2023, and is projected to reach $12.5 billion by 2034, growing at a CAGR of 6.3% from 2024 to 2034.

The fat filled milk powders market is segmented into fat content, application, and region. By fat content, the market is segmented into below 26% fat content, 28% fat content, and above 30%. By application, the market is classified into bakery products, confectionery, dairy products, infant nutrition, beverages, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe is the largest regional market for fat filled milk powder

The major players operating in the fat filled milk powder market include Vreugdenhil Dairy Foods,nd FrieslandCampina, Arla Foods, Fonterra, Glanbia Ingredients, Lactalis, Alpen Food Group, Armor Proteines, Saputo Dairy, and Polindus

The global fat filled milk powder market report is available on request on the website of Allied Market Research.

Loading Table Of Content...