Feed Phosphate Market Research, 2031

The global feed phosphate market size was valued at $2.2 billion in 2021, and is projected to reach $3.3 billion by 2031, growing at a CAGR of 4% from 2022 to 2031.

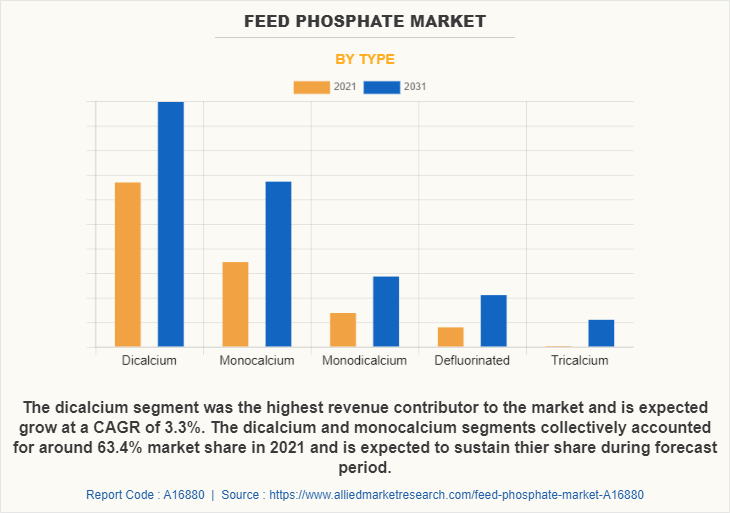

Feed phosphates are added to the diets of livestock such as chickens, pigs, cows, and aquatic creatures. They facilitate faster weight increase and other aspects of animal growth. The nutritional value of feed is maximized by feed phosphates, which also improves the quality of meat and dairy. Examples of consumer-driven favorable alterations to livestock products brought about by the addition of feed phosphates include enhanced tenderness in meat, high selenium content in eggs, and high calcium content in milk. The two feed phosphate kinds with the largest market shares are dicalcium phosphate (DCP) and monocalcium phosphate (MCP). Mono-dicalcium phosphate, tricalcium phosphate, and defluorinated phosphate are additional feed phosphate varieties.

Market Dynamics

Since the number of animals cannot be significantly increased, increased nutritional needs for animals are necessary in order to produce more meat. However, by providing superior nutrition, maximum output can be obtained. Phosphates in feed specifically assist animals in gaining the necessary body mass, bone development, fertility, and growth in a shorter amount of time. This is directly related to the rising global demand for feed phosphates. The recent trend of rising demand for premium meat products has led to an increase in the demand for feed phosphates. The maintenance of animals required to create high-quality meat products depends on their receiving the right nutrition, which will increase the need for feed phosphates. In addition to food preferences, the dairy and natural fiber business heavily depend on the healthy development of animals to produce high-quality goods. As a result, the dairy and natural fiber industries also benefit from the use of feed phosphates. The rise in demand for white meat and high-protein eggs from chicken has also contributed to an increase in the need for feed phosphates. For the best possible development of chickens, tricalcium phosphates, dicalcium phosphate, and monocalcium phosphate are especially necessary. This makes it simpler and quicker for the chickens to reach the appropriate weight and physical characteristics.

Moreover, 1.03 billion metric tons (MT) of compound feed were produced globally as of 2019. Due to the adoption of proper production techniques and eco-friendly methods, feed costs have fallen for a range of animal species. As a result, customers are currently purchasing animal nutrition products more frequently. This includes feed additives like phosphates, minerals, and vitamins. Participants in the industry are likely to have many opportunities, particularly in developing nations where the budget for the agricultural sector is constrained. The regions with the most potential for growth in the product market are thus East Asia, South Asia, and Latin America.

In addition, the raw material shortage is presumed to be an essential growth restraint for the market over the forecast period. Phosphate rocks being non-renewable in nature are anticipated to be exposed to scrutiny over their usage and demand. Once smooth phosphate rock ceases, the remaining rocks are hard to access. Such a trend is projected to impact the industry adversely over the next few years. High product cost is another major factor that is expected to affect the industry’s growth and development negatively. Growth in substitute demand for products such as phytase, which is a lower-cost alternative, is presumed to hamper the industry's growth.

Segments Overview

The feed phosphate market is segmented into type, livestock, form, and region. By type, it is classified into dicalcium, monocalcium, monodicalcium, defluorinated and tricalcium. By livestock, it is segregated into ruminants, swine, poultry, and aquaculture. By form, it is bifurcated into powder and granule. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Russia, Germany, UK, Spain, France, Italy and Rest Of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, New Zealand and Rest Of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia and Rest Of LAMEA).

By Type

By type, the dicalcium segment accounted for a major share in the feed phosphate market in 2021 and is expected to grow at a significant CAGR during the forecast period. The production of the dicalcium phosphate segment is predicted to boost due to properties such as high digestible phosphorus content and solubility as compared to other types.

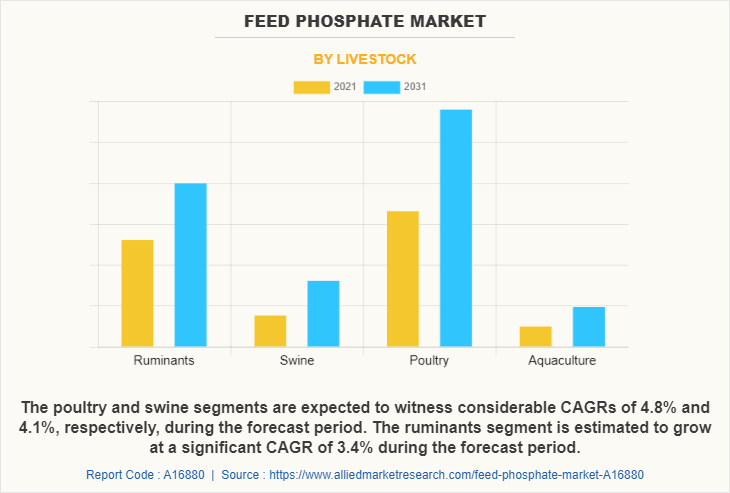

By Livestock

By livestock, the poultry segment accounted for a major share in the product market in 2021 and is expected to grow at a significant CAGR during the forecast period. It is projected that the demand for animal feed will continue to increase due to the rising demand for processed meat and protein-rich diets. This aspect will consequently result in more feed phosphates being used in diverse poultry farms. Thus, the above-mentioned factors are likely to support the feed phosphate market growth through the poultry segment during the forecast period.

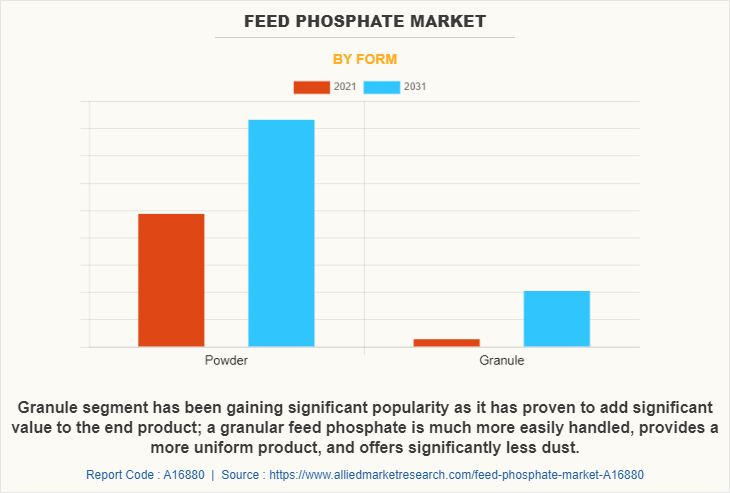

By Form

By form, the powder segment accounted for a major share of the market in 2021 and is expected to sustain its share throughout the feed phosphate market forecast period. The powder leads the market owing to its easy availability and ease of handling. The powder form of feed phosphate is significantly used in animal food as it improves the flowability and the final product. Thus, the above factors are likely to boost the growth of the market size during the forecast period.

By Region

By region, the North America feed phosphate market share is projected to dominate the market during the forecast period, Zoonotic diseases and other human infections linked to animals will have a favorable effect on the size of the local market. North America has been gaining significant traction in the product market owing to the growing production of livestock and to make livestock more palatable. Due to its capacity to improve immunity and milk production, dicalcium phosphate is in higher demand in the cattle business, which could lead to North America feed phosphate market expansion.

Competitive Analysis

The players operating in the global feed phosphate industry have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report The Mosiac Company, PhosAgro, EuroChem Group, Nutrien Ltd., Rotem, AB LIFOSA, Reanjoy Laboratories, Yara International ASA, Fosfitalia Group, and OCP Group.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the feed phosphate market analysis from 2021 to 2031 to identify the prevailing feed phosphate market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the feed phosphate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global feed phosphate market trends, key players, market segments, application areas, and market growth strategies.

Feed Phosphate Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.3 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Type |

|

| By Livestock |

|

| By Form |

|

| By Region |

|

| Key Market Players | PhosAgro, Reanjoy Laboratories, Yara International ASA, Rotem, EuroChem Group, OCP Group, Nutrien Ltd., Fosfitalia Group, AB LIFOSA, The Mosiac Company |

Analyst Review

According to the insights of the CXOs, the feed phosphate market is expected to witness robust growth during the forecast period. The feed phosphate market is expanding as a result of the growth in consumption of the meat and meat products. Feed phosphate is significantly used in the animal food owing to its benefits such as it enhances bone density, fertility, gastrointestinal functionality, and a number of other things. These elements support the normal growth of animals. As a result, there is now a higher need for feed phosphate in animal feed. By offering benefits such as premium, soft meat, higher selenium levels in eggs, and high calcium levels in milk, feed phosphates benefit animal health. The feed phosphate market is anticipated to develop as people become more concerned about animal health.

CXOs further added the high threat of diseases in livestock. The improvement of animal health, the provision of essential nutrients, and the use of feed phosphates in such situations have proven to be successful methods of reducing such outbreaks. However, Various factors restrain the growth of the global feed phosphate market such as high cost of phosphate salts, such as monocalcium and dicalcium phosphates, replacements for feed phosphate such as phytase, which are less expensive and may be used to reduce the overall feed cost, have become more popular.

The global feed phosphate market size was valued at $2,226.6 million in 2021, and is estimated to reach $3,270.3 million by 2031.

4.0% is the CAGR of feed phosphate market.

You can request sample from the website (www.alliedmarketresearch.com) or you can call our sales representative on U.S. - Canada toll free - +1-800-792-5285, Int'l : +1-503-894-6022 and for Europe region + 44-845-528-1300.

2021 is the base year calculated in the feed phosphate market report.

The Mosiac Company, PhosAgro, EuroChem Group, Nutrien Ltd., Rotem, are some of the top companies in the feed phosphate market report.

The feed phosphate market is segmented into type, livestock, form and region.

Growing demand for poultry and cattle meat demand and rapid expansions local animal feed production units are some of the key factors shaping the growth of the feed phosphate market.

Asia-Pacific region holds the maximum market share of the feed phosphate market.

Outbreak of COVID-19 was negatively impacted the growth of the feed phosphate market.

Loading Table Of Content...