Fertility and Pregnancy Rapid Test Kits Market Research, 2033

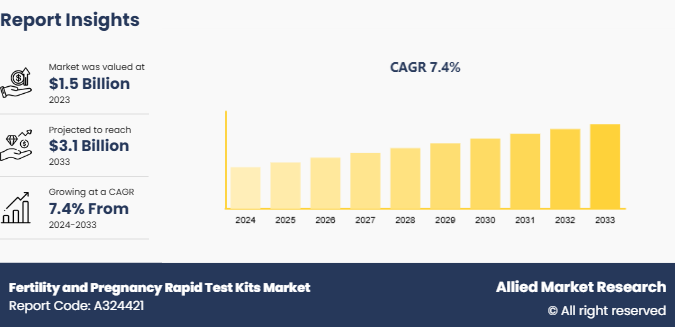

The global fertility and pregnancy rapid test kits market size was valued at $1.5 billion in 2023, and is projected to reach $3.1 billion by 2033, growing at a CAGR of 7.4% from 2024 to 2033. Increasing awareness of reproductive health, a rise in first-time pregnancies at older ages, and a growing demand for at-home testing solutions for convenience and privacy are teh factors which drives the market growth.

Market Introduction and Definition

Fertility and pregnancy rapid test kits are diagnostic tools designed for home or clinical use to detect pregnancy or evaluate fertility status quickly and conveniently. Pregnancy test kits work by detecting the presence of human chorionic gonadotropin (hCG) , a hormone produced during pregnancy, in urine or blood. Fertility test kits assess hormone levels, such as luteinizing hormone (LH) , to identify ovulation periods, aiding in conception planning. These kits offer rapid, reliable results, enabling users to monitor their reproductive health without the need for laboratory testing, providing privacy and ease of use.

Key Takeaways

- The fertility and pregnancy rapid test kits market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Fertility and pregnancy rapid test kits industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The fertility and pregnancy rapid test kits market growth driven by increase in awareness of reproductive health. More individuals are becoming conscious of the importance of understanding fertility cycles and confirming pregnancies early, owing to awareness campaigns and education on family planning. This trend is encouraging proactive reproductive health management, boosting the demand for home testing kits thereby drives the fertility and pregnancy rapid test kits market size.

In addition, rise in technological advancements also played a crucial role in driving the market growth. Innovations in testing technology led to more reliable, sensitive, and easy-to-use kits. The improvements in accuracy and the speed of results have made these products more appealing to consumers who seek quick, private, and reliable health assessments at home thereby drives the growth during fertility and pregnancy rapid test kits market forecast period. Furthermore, rise in incidence of infertility, often linked to lifestyle factors, delayed childbearing, and health conditions. This led more couples to explore fertility tracking and testing options, thereby increasing the demand for these kits. Furthermore, these kits offer convenience and privacy, which makes them a preferable choice for users over traditional lab-based testing.

Moreover, government initiatives and policies promoting reproductive health services and family planning indirectly bolster the market by creating a supportive environment for fertility and pregnancy awareness. The growth of e-commerce has made these test kits more accessible. Consumers can easily purchase them online, which enhances distribution reach and offers the privacy many users desire. However, stringent regulations and varying approval requirements across different regions can delay product launches and complicate market entry for manufacturers. In addition, limited consumer awareness in some regions restricts market expansion, particularly in rural areas where access to information on reproductive health is still lacking thereby limits the fertility and pregnancy rapid test kits market growth.

On the other hand, rise in awareness of reproductive health and the growing emphasis on proactive health management provide fertility and pregnancy rapid test kits fertility and pregnancy rapid test kits market opportunity. As individuals become more informed about fertility issues and the importance of family planning, the demand for home test kits is expected to rise. Moreover, the growing acceptance of digital health solutions opens up opportunities for manufacturers to innovate and integrate mobile apps or digital platforms with their kits, offering users enhanced data tracking and personalized insights thereby supports the growth during fertility and pregnancy Rapid test kits market forecast period.

Parent Market Overview

The fertility and pregnancy rapid test kits market is a part of the rapid tests market, which has shown substantial growth potential in recent years. According to Allied Market Research, the global rapid tests market generated revenues of $33.3 billion in 2020, and is expected to reach $97.6 billion by 2030, reflecting a significant compound annual growth rate (CAGR) . This growth can be attributed to increasing awareness of personal health, the convenience offered by home-based testing solutions, and technological advancements leading to more accurate, user-friendly tests.

Within this expanding landscape, fertility and pregnancy rapid test kits are gaining traction due to rising consumer demand for privacy and convenience in monitoring reproductive health. The market benefits from the broader trends of increased healthcare spending and a shift towards point-of-care diagnostics. As the rapid tests market grows, fertility and pregnancy rapid test kits are expected to see a parallel rise in adoption, driven by technological innovations, heightened awareness of reproductive health, and expanding access to self-testing solutions globally.

Rapid Tests Market Revenue ($Billion)

Year | Rapid Tests Market Revenue ($Billion) |

2020 | 33.3 |

2030 | 97.6 |

Market Segmentation

The fertility and pregnancy rapid test kits market is segmented into product, test type, end user, and region. On the basis of the product, the market is segmented into pregnancy rapid tests and fertility rapid tests. By test type, the market is classified into urine-based test kits and blood-based test kits. By end user, the market is divided into hospitals, homecare settings, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has significant fertility and pregnancy rapid test kits market share owing to high awareness of reproductive health and family planning among the population plays a crucial role, with many individuals proactively seeking to monitor their fertility and pregnancy status. The region also benefits from well-established healthcare infrastructure and easy accessibility of rapid test kits through pharmacies, retail stores, and online platforms, making these products readily available to consumers. Moreover, ability to spend on healthcare products, coupled with a high rate of infertility treatments and delayed pregnancies, contribute to the growing demand for these test kits.

- According to a report from the Centers for Disease Control and Prevention (CDC) , the U.S. fertility rate dropped by 3% in 2023, marking a historic low and the second consecutive year of declining birth rates. This trend indicates a growing focus on reproductive health and family planning, driving the demand for fertility and pregnancy rapid test kits. As couples become more cautious about family planning and seek to understand their fertility status, the adoption of at-home testing solutions is likely to increase.

However, the Asia-Pacific, particularly India and China, represents the fastest-growing market. Rise in population and increase in awareness of reproductive health drive the demand for these products as more individuals prioritize family planning and early pregnancy detection. Urbanization and changing lifestyles led to delayed pregnancies and a growing prevalence of infertility, further boosting the need for fertility monitoring solutions.

- In India, the government's Mission Parivar Vikas (MPV) , launched in 2016, aims to significantly increase access to family planning services in high-fertility districts. This initiative, extended in 2021, targets regions with low contraceptive usage and a high unmet need for family planning, which increases the demand for fertility and pregnancy rapid test kits. As awareness of reproductive health grows in these areas, couples are likely to turn to these kits for early fertility assessment and pregnancy detection.

Industry Trends

- In April 2023, RESOLVE, The National Infertility Association organized National Infertility Awareness Week to raise awareness about infertility and the barriers many individuals face in accessing family-building options. The campaign emphasized the need for improved access to care, including insurance coverage for treatments like IVF. Advocates engaged with Congress to address these issues, highlighting the importance of legislative support for reproductive health services. By engaging with Congress for legislative support, advocates amplified the visibility of reproductive health issues, encouraging individuals to use test kits as a first step toward understanding and addressing their fertility status.

- In May 2024, according to the Centers for Disease Control and Prevention (CDC) , approximately 19% of married women aged 15 to 49 faced challenges in conceiving after one year of trying. This statistic emphaiszed the importance of public health initiatives aimed at educating couples about fertility issues and encouraging timely consultations with healthcare providers. The prevalence of infertility challenges also emphasizes the importance of public health initiatives focused on educating couples about reproductive health, thereby boosting adoption of fertility and pregnancy test kits as part of early intervention strategies.

Competitive Landscape

The major players operating in the market are Atlas Medical GmbH, Church & Dwight Co., Inc., ?Everlywell, Inc., Geratherm Medical AG, QuidelOrtho Corporation, Mylab Discovery Solutions Pvt. Ltd., Salignostics, Abbott, SPD Swiss Precision Diagnostics GmbH, and AdvaCare Pharma.

Recent Key Strategies and Developments in Fertility and Pregnancy Rapid Test Kits Industry

- In June 2022, Mylab launched home pregnancy test kit. This at-home rapid test kit, priced at Rs 55, provided results with 99.99% accuracy.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

- National Health Service (NHS)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fertility and pregnancy rapid test kits market analysis from 2024 to 2033 to identify the prevailing fertility and pregnancy rapid test kits market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fertility and pregnancy rapid test kits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fertility and pregnancy rapid test kits market trends, key players, market segments, application areas, and market growth strategies.

Fertility and Pregnancy Rapid Test Kits Market , by Product Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.1 Billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 240 |

| By Product |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Abbott, AdvaCare Pharma, SPD Swiss Precision Diagnostics GmbH, Atlas Medical GmbH, Everlywell, Inc., Salignostics , Geratherm Medical AG, QuidelOrtho Corporation, Mylab Discovery Solutions Pvt. Ltd., Church & Dwight Co., Inc. |

The total market value of fertility and pregnancy rapid test kits market was $1.5 billion in 2023.

The market value of fertility and pregnancy rapid test kits market is projected to reach $3.1 billion by 2033.

The forecast period for fertility and pregnancy rapid test kits market is 2024 to 2033.

The base year is 2023 in fertility and pregnancy rapid test kits market.

The market is driven by factors such as rising awareness of reproductive health, an increase in first-time pregnancies at older ages, and growing demand for at-home, convenient, and private testing solutions.

Fertility and pregnancy rapid test kits are diagnostic tools used at home or in clinical settings to detect pregnancy and fertility-related hormones quickly. They are commonly available as urine or blood tests and provide fast, easy-to-read results for users.

Loading Table Of Content...