Fluid Shortening Market Research, 2034

Market Introduction and Definition

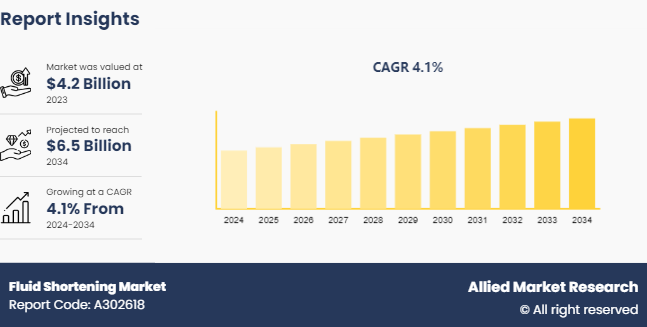

The global fluid shortening market was valued at $4.2 billion in 2023, and is projected to reach $6.5 billion by 2034, growing at a CAGR of 4.1% from 2024 to 2034. Fluid shortening is a type of edible oil or fat used in baking and food processing. It is typically made from vegetable oils such as soybean, canola, palm, or cottonseed oil, which have been hydrogenated to increase their melting point and improve stability. This process makes the oils semi-solid at room temperature and provides a longer shelf life. Fluid shortening finds extensive application across various food industries due to its versatile properties. It is widely used in the baking industry for producing bread, cakes, cookies, pastries, and pie crusts, providing a tender texture, improved moisture retention, and extended shelf life. The confectionery and snack food sectors rely on fluid shortening to create desirable textures and mouthfeel in products like chocolates, candies, chips, and crackers. Additionally, it serves as a key ingredient in processed foods, such as frozen meals and convenience foods, contributing to their overall quality and shelf life.

Key Takeaways

The fluid shortening market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major fluid shortening industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The increasing demand for baked goods and confectionery products is a significant driver for the fluid shortening market size. As consumer preferences shift towards convenient and indulgent food options, the consumption of items like bread, cakes, pastries, cookies, and chocolates continues to rise. Fluid shortening plays a crucial role in the production of these products, contributing to their desirable texture, moisture retention, and extended shelf life. Bakeries and confectionery manufacturers rely heavily on fluid shortening as a key ingredient, as it imparts tenderness, improves mouthfeel, and enhances the overall quality of their offerings. With the growth of the baking and confectionery industries, driven by factors such as urbanization, changing lifestyles, and the popularity of on-the-go snacking, the demand for fluid shortening is expected to increase correspondingly.

Health concerns and regulations related to trans fats and saturated fats pose significant restraints for the fluid shortening market share. As awareness about the negative health impacts of these fats grows, consumers are becoming more conscious of their consumption. Governments and regulatory bodies have implemented strict guidelines and labeling requirements to limit the presence of trans fats and excessive saturated fats in food products. This has prompted manufacturers to reformulate their fluid shortening offerings, moving away from partially hydrogenated oils and exploring healthier alternatives. However, this transition presents challenges in maintaining the desired functional properties and taste profiles, potentially hindering the growth of traditional fluid shortening products in the market.

The growth of the clean label and natural food products market presents significant opportunities for fluid shortening manufacturers. As consumer demand for transparent, recognizable, and minimally processed ingredients increases, companies can develop clean label fluid shortening formulations free from artificial additives, preservatives, and hydrogenated oils. By utilizing non-hydrogenated vegetable oils, plant-based ingredients, and exploring organic options, fluid shortening suppliers can cater to the growing health-conscious consumer segment seeking natural and clean label products. Partnerships with food manufacturers emphasizing clean labels can open new avenues and potentially command premium pricing in this expanding market.

Value chain

A value chain for fluid shortening, which is a type of edible oil or fat used in baking and food processing, would typically involve the following stages:

Raw Material Sourcing: Procuring suitable vegetable oils or animal fats as raw materials, adhering to quality standards through rigorous testing and inspections to ensure consistent product quality.

Refining: A multi-step process involving degumming to remove impurities, neutralization to reduce free fatty acids, bleaching to eliminate color pigments, and deodorization to remove undesirable odors and flavors.

Hydrogenation: An optional step where the oil undergoes partial or full hydrogenation by introducing hydrogen under controlled conditions, often catalyzed, to increase melting point and improve stability.

Packaging and Storage: Filling the refined and optionally hydrogenated oil into appropriate containers, labeling for identification, and storing under controlled conditions to maintain quality until distribution.

Distribution and Transportation: Efficient logistics network to transport the packaged fluid shortening to food manufacturers, bakeries, and other customers while ensuring proper handling and temperature control.

Market Segmentation

The fluid shortening market is segmented into type, application, and region. On the basis of type, the market is divided into normal type, stable type and high emulsification. As per application, the market is segregated into baked food and fried food. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America is a major market for fluid shortening owing to the region's strong food industry and consumer preferences. The baking, confectionery, and processed food sectors heavily depend on fluid shortening as a crucial ingredient, driving substantial fluid shortening market forecast.

The well-developed distribution channels for food ingredients in North America facilitate the efficient supply and availability of fluid shortening to various food processing facilities and bakeries. Moreover, the functional properties of fluid shortening, such as improved texture, moisture retention, and extended shelf life, make it a preferred choice for many food manufacturers. Despite health concerns about trans fats leading to formulation changes, the traditional dietary preferences of North American consumers still include products that incorporate fluid shortening. Additionally, the region's stringent regulatory environment has driven innovation in developing improved fluid shortening formulations tailored to meet evolving fluid shortening market growth.

Industry Trends:

Here are some key industry trends related to the consumption of fluid shortening in various applications.

Bakery Products: The bakery industry remains a significant consumer of fluid shortening, with a shift towards healthier options like non-hydrogenated and low-saturated fat varieties for products like cakes, cookies, and pastries.

Confectionery and Snacks: The confectionery and snack food sectors continue to rely on fluid shortening for its functional properties, such as improving texture and shelf life, while also embracing clean label and plant-based formulations.

Convenience Foods: The growing demand for convenience and ready-to-eat foods has driven the use of fluid shortening in frozen foods, ready-meals, and other processed products for its ability to enhance taste and mouthfeel.

Plant-Based Formulations: With the rising popularity of plant-based diets, there is an increasing demand for fluid shortenings derived from plant sources, like palm, coconut, or high-oleic oils, as alternatives to animal-based fats.

Clean Label and Natural Ingredients: Consumers are seeking clean label and natural ingredient formulations, prompting manufacturers to develop fluid shortenings without artificial additives, preservatives, or hydrogenated oils, aligning with clean label trends.

Functional and Fortified Products: Some manufacturers are exploring the development of functional and fortified fluid shortenings, incorporating nutrients, vitamins, or other beneficial compounds to cater to health-conscious consumers seeking added nutritional value.

Competitive Landscape

The major players operating in the fluid shortening market include ADM, Cargill, Olenex, Walter Rau, Y?ld?z Holding, VFI GmbH, AAK, Zeelandia, Puratos, Princes Group, HAS Group and so on.

Recent Key Strategies and Developments

In 2021, Cargill invested USD 15 million in a high-pressure hydrogenation plant in Kurkumbh, Maharashtra, to manufacture superior bypass fat, a health and nutrition supplement for dairy cattle.

In 2020, Archer Daniels Midland Company and Wilmar International Limited upgraded their partnership into a full-function joint venture- Olenex. As a part of the agreement, ADM announced to transfer a specialty oils and fats facility and a palm refining plant in Hamburg, Germany, to the new joint venture.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluid shortening market analysis from 2024 to 2034 to identify the prevailing fluid shortening market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the fluid shortening market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global fluid shortening market trends, key players, market segments, application areas, and market growth strategies.

Fluid Shortening Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 6.5 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 200 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | AAK, Olenex, VFI GmbH, Walter Rau, Puratos, Archer Daniels Midland Company, Yildiz Holding, HAS Group, Zeelandia, Princes Group |

The global Fluid Shortening Market is trending towards healthier formulations with reduced trans fats and improved nutritional profiles. There's growing demand for plant-based and clean-label fluid shortenings to meet consumer preferences for natural ingredients. Manufacturers are focusing on developing specialty shortenings for specific applications and improving functionality. The market is also seeing increased adoption of palm oil alternatives and sustainable sourcing practices. Additionally

The leading application of Fluid Shortening is in the commercial baking industry. It is widely used in the production of various baked goods such as cakes, cookies, pastries, and breads. Fluid shortening offers advantages like easy handling, consistent performance, and improved texture in baked products. It's particularly valued for its ability to create tender, flaky pastries and cakes with a fine crumb structure. Additionally, it's used in frying applications and as a release agent in food pro

North America is the largest regional market for fluid shortening.

The global fluid shortening market was valued at $4.2 billion in 2023, and is projected to reach $6.5 Billion by 2034, growing at a CAGR of 4.1% from 2024 to 2034.

The top companies to hold the market share in fluid shortening are ADM, Cargill, Olenex, Walter Rau and Y?ld?z Holding.

Loading Table Of Content...