Fluidized Bed Concentrator (FBC) Market Research, 2032

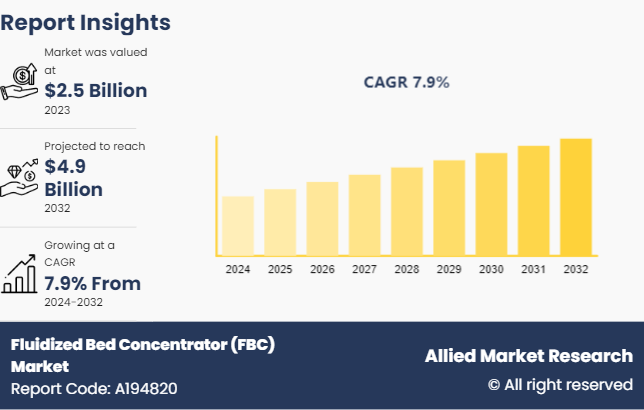

The Global Fluidized Bed Concentrator (FBC) Market was valued at $2.5 billion in 2023, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Market Introduction and Definition

A Fluidized Bed Concentrator (FBC) is an environmental technology used primarily for air pollution control in industrial settings. It operates by passing contaminated air through a bed of small particles, usually activated carbon or alumina, which are suspended and fluidized by a controlled upward flow of air. This fluidization creates a turbulent and highly reactive environment where volatile organic compounds (VOCs) and other pollutants adhere to the surface of the particles through adsorption.

The pollutants are then concentrated onto the surface of these particles, achieving high removal efficiencies. FBCs are known for their effectiveness in capturing and concentrating emissions from various industrial processes, contributing to compliance with stringent air quality regulations and reducing harmful emissions released into the atmosphere.

Key Takeaways

The fluidized bed concentrator (FBC) market growth study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major fluidized bed concentrator (FBC) e industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The Fluidized Bed Concentrator (FBC) market is growing due to increasing environmental regulations and the demand for efficient air pollution control systems. Factors driving growth include its ability to handle diverse pollutants and its cost-effectiveness in industrial applications. However, challenges such as high initial costs and technical complexities hinder widespread adoption. Technological advancements enhance efficiency and versatility, thereby expanding its applicability across industries. Regulatory support for emission reduction continues to be a significant growth factor, particularly in regions tightening environmental standards. Overall, the FBC market faces a competitive landscape with opportunities for innovation and market expansion driven by the need for sustainable industrial practices.

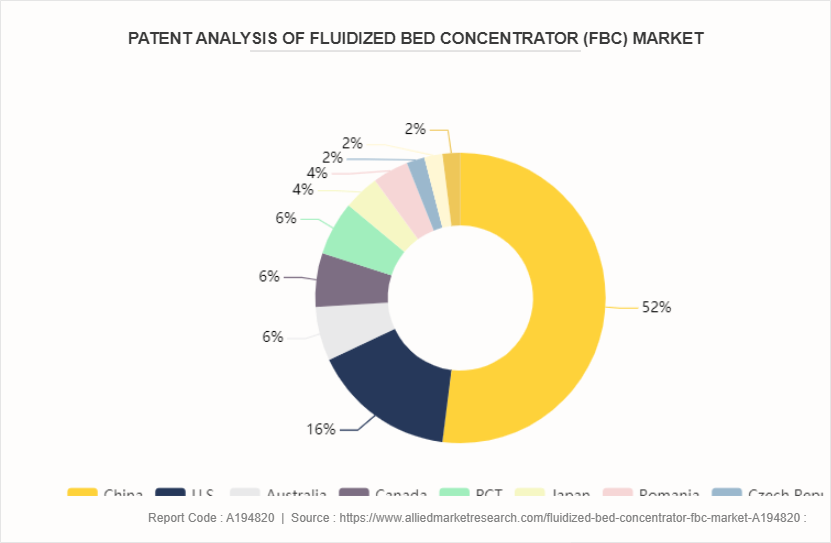

Patent Analysis of Global Fluidized Bed Concentrator (FBC) Market

The fluidized bed concentrator market is segmented according to the patents filed by China, U.S., Australia, Canada, PCT, Japan, Romania, Czech Republic, European Patent Office and UK which have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these patent holder countries are followed by high adoption of fluidized bed concentrator and initiatives associated with enhancing air purity at regional and global level. Therefore, these countries have the maximum number of patent filings.

Market Segmentation

The global fluidized bed concentrator (FBC) market overview is segmented into flow rate and application. On the basis of flow rate, the market is divided into below 10000 CFM, 10000-50000 CFM, and above 50000 CFM. As per application, the market is segregated into paint finishing, semiconductor, printing, chemical production, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

Market Segment Outlook

Based on flow rate, the 10, 000 and 50, 000 CFM segment held the highest market share in 2023, accounting for nearly half of the fluidized bed concentrator (FBC) market size. This is due to its optimal balance of cost-effectiveness and efficiency in treating industrial emissions. This range caters well to medium-sized industrial facilities across various sectors, addressing regulatory compliance needs for pollutants like particulate matter and VOCs. The demand is driven by this segment’s versatility and effectiveness in managing emissions while minimizing operational costs.

Based on application, the paint finishing segment held the highest fluidized bed concentrator (FBC) market share in 2023, accounting for more than one-third of the fluidized bed concentrator (FBC) market. Paint finishing operations require effective VOC control, making FBC systems crucial for meeting environmental regulations.

Regional/Country Market Outlook

The North American Fluidized Bed Concentrator (FBC) industry is driving demand for efficient air pollution control solutions across various industries. For instance, in the United States, the Environmental Protection Agency's (EPA) Clean Air Act mandates have spurred adoption in sectors like manufacturing, chemical production, and power generation.

Leading players in the north american fluidized bed concentrator (FBC) market forecast include companies like CECO Environmental, DuPont Clean Technologies, and Babcock & Wilcox. These companies are focusing on enhancing FBC technology to meet stricter emission limits and improve operational efficiency. For example, DuPont Clean Technologies has been developing advanced FBC systems capable of handling a wide range of pollutants effectively. Babcock & Wilcox has been investing in research and development to improve the reliability and performance of their FBC solutions.

Moreover, partnerships and strategic collaborations are becoming common to leverage expertise and expand market presence. These initiatives aim to address specific regulatory challenges and optimize solutions tailored to the North American market's unique environmental requirements.

DEC IMPIANTI S.p.A. has highlighted their DEC.FBC™ system, which is an industrial process for the treatment of exhaust air. This system uses a bed of adsorbent beads to adsorb volatile organic compounds (VOCs) from the exhaust gas. The fluidized bed increases the surface area of the adsorbent-gas interaction, making it more effective at capturing VOCs.

Circulating Fluidized Bed (CFB) technology plays a crucial role in utilizing low-grade coal in China. A novel CFB boiler design theory has been developed, leading to the domestic manufacturing of CFB boilers with various capacities.

Competitive Landscape

The major players operating in the fluidized bed concentrator (FBC) market include CECO Environmental, DuPont Clean Technologies, Babcock & Wilcox, Dürr AG, FLSmidth & Co. A/S, Eisenmann SE, CTP Chemisch Thermische Prozesstechnik GmbH, Anguil Environmental Systems, Inc., Advanced Cyclone Systems, and Gulf Coast Environmental Systems.

Other players in the fluidized bed concentrator (FBC) e market include Catalytic Combustion Corporation, Munters Corporation, AirClean Energy, Pollution Systems and others.

Industry Trends:

In April 2022, the 24th International Conference on Fluidized Bed Conversion (FBC24) took place in Gothenburg, Sweden, with significant participation from German experts. The conference discussed advancements in FBC technology, including design and experimental results of micro-CHP systems based on Stirling engines and fluidized bed combustion.

Germany is part of the International Energy Agency (IEA) Technology Collaboration Programme (TCP) in the field of FBC, which aims to provide a framework for international collaboration on clean energy production. The TCP focuses on various FBC techniques and their applications, including combustion and gasification of solid fuels.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluidized bed concentrator (FBC) market analysis from 2024 to 2032 to identify the prevailing fluidized bed concentrator (FBC) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fluidized bed concentrator (FBC) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fluidized bed concentrator (FBC) market trends, key players, market segments, application areas, and market growth strategies.

Fluidized Bed Concentrator (FBC) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.9 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Flow Rate |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gulf Coast Environmental Systems, Eisenmann SE, DuPont Clean Technologies, CECO Environmental Corp., FLSmidth & Co. A/S, Advanced Cyclone Systems, CTP Chemisch Thermische Prozesstechnik GmbH, Durr AG, Babcock & Wilcox Enterprises, Inc., Anguil Environmental Systems, Inc. |

Increasingly adoption of FBC systems for effective Volatile Organic Compounds (VOC) abatement, innovations in FBC technology, such as improved thermal efficiency, enhanced operational flexibility, and lower energy consumption and expanding chemical, automotive, and semiconductor industries are the upcoming trends of Fluidized Bed Concentrator (FBC) Market in the globe.

Paint finishing is the leading application of Fluidized Bed Concentrator.

North America is the largest regional market for Fluidized Bed Concentrator.

The fluidized bed concentrator (FBC) market was valued at $2.5 billion in 2023.

CECO Environmental, DuPont Clean Technologies, Babcock & Wilcox, Dürr AG, FLSmidth & Co. A/S, Eisenmann SE, CTP Chemisch Thermische Prozesstechnik GmbH, Anguil Environmental Systems, Inc., Advanced Cyclone Systems, and Gulf Coast Environmental Systems are the top companies to hold the market share in Fluidized Bed Concentrator (FBC)

Loading Table Of Content...