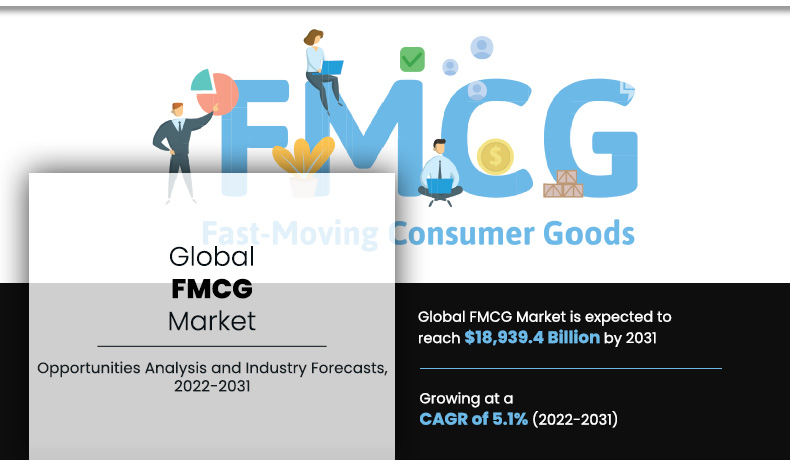

The global FMCG market size was valued at $11,490.9 billion in 2021 and is projected to reach $18,939.4 billion by 2031, registering a CAGR of 5.1% from 2022 to 2031.

Fast-moving consumer goods (FMCG), also called consumer packaged goods (CPG) is the largest group of consumer products. It includes durable and non-durable goods such as food & drinks, personal health, and home care products. FMCG products are required every day in human life. All sections of society consume these products frequently and spend a considerable portion of their income on these goods. The FMCG product group is an important contributor to the economy. The products included in the FMCG group have a quick turnover. The global FMCG market includes a wide range of durable and non-durable consumer products, which are frequently purchased. These include soap, toiletries, cosmetics, shaving products, tooth cleaning products, detergents, and the non-durable consumer products such as glassware, paper products, and others. The food & beverages segment was the leading segment that generated highest revenue in the overall market.

Increase in global population is directly proportional to the rise in consumption of the consumer goods. This is one of the major factors responsible to drive the global FMCG market growth. Moreover, growth in awareness in the consumers about FMCG products, increase in the disposable income of middle-class population, frequent launch of new products by the manufacturers, effective advertisement of the brands, and strong distribution channel system of the market boost the growth. Rise in income increases the purchases of FMCG products.

Thus, easier access of the consumer goods for common people also contributes toward the growth of the market. Changes in the lifestyle of consumers in developed and the developing countries is also predicted to drive the growth of the market. However, the growth of the FMCG market affected by increase in competition among major market players. Moreover, retail execution is another factor that restricts the growth of the market. The growth in trend of online shopping, R&D for the new brands and products, and expansion of FMCG network in rural areas of developing countries are the factors anticipated to provide growth opportunity for the global FMCG market.

Furthermore, the growth in urbanization and premiumization of FMCG products have significant contributions in the overall growth of the market. According to data published by un.org in 2018, about 55% of the world's population currently resides in urban areas, and that number is projected to rise to 68% by 2050. As per projections, there might be an additional 2.5 billion people living in urban areas by 2050, with about 90% of this expansion occurring in Asia and Africa. Urbanization is the steady transition of the human population from rural to urban settings. Urbanization is a global trend that has significant effects on a variety of concerns, including food, water, healthcare, home care, and others. Players in the market must raise their output to meet the demands of the expanding urban population.

In addition, the rise in income of customers accelerates the trend toward the premiumization of products. The trend can be observed significantly in the mid-high income groups. Consumers belonging to high-income groups satisfy their exclusive feel and emotional value with premium products and their behavior. For instance consumers of developed economies spend a considerable amount on premium products, such as skincare and beauty products. They are well-informed about various products and are willing to purchase products that suit their style.

On the other hand, the consumers belonging to the mid-income group mostly spend their income on products offered for mass consumption and less on lavish products, which offer better functional benefits. Over the last 5 years, significant premiumization is observed across personal care, consumer electronics, and other premium categories. The high adoption of premium products by consumers is fueling the growth of the FMCG market.

In the twenty-first century, everything is available online, and clients are aware of the benefits of digitalization. In large metropolitan regions, the majority of consumer purchases are conducted online or through e-commerce, and this trend is quickly extending to non-metropolitan areas as well. Shopping online via apps is becoming a current trend in the FMCG business as a consequence of the massive increase in internet access across metros and non-metros. Over the next 10 years, consumers will continue to acquire power via the use of new communication technologies. In 2015, India gained 260 million new internet users, and by 2025, the country is expected to have 900 million internet users. It is expected that by 2020, that around 75-90 million customers would have purchased FMCG goods online and that 55-60 million consumers will be digitally touched by FMCG, with 12-20 million doing so. The generation of wireless features and device integration, such as wallet phones, are expected to stimulate mobile commerce, supporting the rise of the FMCG industry.

The FMCG market has grown significantly due to developed markets such as the U.S., China, and others. These are expected to account for over 70% of the global increase in consumer expenditure. According to projections from the World Bank, India would have surpassed Japan and Germany to become the world's third-largest market in terms of total consumer expenditure by 2030.

As economic capacity shifts to developing nations such as China and India, new business industries will emerge, as will a new generation of internationally-minded firms from these emerging markets. New economic giants such as China and India are likely to rise in the coming decade. In terms of purchasing power, India's economy is one of the largest on the globe. As a result of this power shift, an unstable global economy will be the norm for the next decade. Emerging trade sectors will advance, and a new generation of globally aggressive organizations from emerging countries will emerge, further solidifying their position in the global commercial center and assisting the FMCG industry to flourish at a healthy rate.

As per the FMCG market analysis, the market is segmented on the basis of product type, production type, distribution channel, and region. By product type, it is classified as food & beverages (juice and drinks, tea and coffee, fresh food, frozen food, processed and packaged food, and others), personal care and cosmetics (body care, hair care, oral care, skin care, and baby care), healthcare (over the counter, vitamin & dietary supplements, feminine care, and others), home care (cleaning products, fragrances, and others), footwear (formal footwear, athletic footwear, casual footwear), footwear accessories, and others. By production type, it is classified as inhouse and contract based. The distribution channel segment comprises of supermarkets & hypermarkets, grocery stores, specialty stores, e-commerce, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Food and Beverage segment held the major share of 84.8% in 2021. Rising disposable income, multicultural engagement, and population expansion are driving the food and beverage business.

According to the FMCG market forecast, on the basis of product type, the food and beverages segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. Rising disposable income, multicultural engagement, and population expansion are driving the food and beverage business. The shift toward healthier eating has had a substantial influence on the growth of the food and beverage business. As consumers' health awareness has grown, more individuals have begun to stick to "special" diets and want to enjoy these better alternatives both at home and when dining out. Quality and health are becoming more linked in people's purchase decisions. Consumers nowadays are more aware and open to the meals and beverages enjoyed by individuals from various cultures. All of the above factors contribute to the growth of the food and beverages market.

According to the FMCG market trends, on the basis of production type, the inhouse segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. Inhouse manufacturing is the most popular way of manufacturing goods in the FMCG sector. Major FMCG companies from all around the globe are carrying out in-house manufacturing processes. The companies are investing a large sum of money in opening new facilities in different regions to open their businesses in a new region. The high investment by the FMCG companies is fueling the growth of in-house manufacturing processes in the FMCG market.

By Production Type

Inhouse segment held the major share of 96.4% in 2021. The companies are investing a large sum of money in opening new facilities in different regions to open their businesses in a new region.

On the basis of distribution channel, the supermarkets and hypermarkets segment accounted for around 53% of the global market share in 2021 and is expected to sustain its share during the forecast period. Supermarkets and Hypermarkets offer a convenient experience of diverse shopping under a single roof to consumers. Supermarkets and Hypermarkets provide consumers a premium advantage, i.e., higher availability of chocolate confectionery products at discounts, the assistance of sales representatives, and easy checkouts. These advantages are expected to drive the growth of Supermarkets and Hypermarkets during the forecast period.

By Distribution Channel

Supermarkets and Hypermarkets segment held the major share of 53.9% in 2021. Supermarkets and Hypermarkets provide consumers a premium advantage, i.e., higher availability of chocolate confectionery products at discounts, the assistance of sales representatives, and easy checkouts.

Based on region, Asia-Pacific dominated the fast-moving consumer goods market in 2021 and is expected to remain dominant during the fast-moving consumer goods market forecast period. Asia-Pacific is a growing region in which nations such as India and China have experienced significant economic expansion in recent decades. This region's countries have a vast population, and consumer products are in great demand. Asia-Pacific consumers are price sensitive and want the most value for their money. Lifestyle changes are being driven by globalization and an increase in the working population. Consumption of processed and packaged goods has increased as the affluent population has expanded, along with the growth internet and social media usage. This paves the path for the region's FMCG market demand to expand. Furthermore, innovations in current products and the introduction of new products with attractive pricing are the factors expected to provide growth opportunities for the FMCG market in the future.

By Region

Asia-Pacific segment held the major share of 35.1% in 2021. Asia-Pacific is a growing region in which nations such as India and China have experienced significant economic expansion in recent decades.

The leading players in the FMCG market focus on providing customized solution to consumers as their key strategies to gain a significant share in the market. Strategies such as product launch and acquisition have also helped the key players to gain a significant global FMCG market share and exploit prevailing FMCG market opportunities. The key players profiled in the report include Procter & Gamble, Unilever Group, The Coca Cola Company, Pepsico Co. Inc, Kimberly-Clark Corporation, Patanjali Ayurved Ltd., Dr Pepper Snapple Group, Inc., Revlon, Inc, Johnson & Johnson, and Nestle.

Key Benefits for the stakeholders:

- The report provides an in-depth analysis of the current trends, drivers, and dynamics of the FMCG market to elucidate the prevailing opportunities and tap into the investment pockets.

- It offers qualitative trends and quantitative analysis of the global FMCG market from 2000 to 2031 to assist stakeholders to understand the market scenario.

- In-depth analysis of the key segments demonstrates the types of fast-moving consumer goods available.

- Competitive intelligence of the industry highlights the business practices followed by key players across geographies and the prevailing market opportunities.

- Key players and their strategies and developments are profiled to understand the competitive outlook of the market.

FMCG Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Production Type |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

FMCG is an essential part of the day-to-day life and accounts for more than half of all consumer spending. It comprises products such as food & beverages, over-the-counter drugs, health care products, and other products such as personal care, toiletries, and home care products. The global FMCG market has witnessed significant growth, owing to changes in lifestyles, variations in demographics, an upsurge in organized retail, a rise in disposable income, and an increase in urbanization.

Indian FMCG industries have higher growth potential as compared to the world, due to an increase in the purchasing power of the Indian population and its sizeable youth population coupled with the growth stage of the industries. There has been an increase in disposable incomes in both urban cities and rural India. The share of spending on necessities, leisure & recreation, and miscellaneous goods & services witnesses an increase with the rise in household incomes and disposable incomes. This in turn boosts the growth of the Indian FMCG market.

In addition, growth in the young population of India is the major consumer segment for FMCG products. Changes in the needs and preferences of this segment have enforced domestic players to create products specifically compatible with the lifestyle of the young population. International players are also trying to mold their products and offerings according to Indian consumer needs to enter and succeed in a diverse market like India. Further, a strong distribution channel network makes the desired product accessible to the customers, which contributes to the growth of the Indian FMCG market. The emergence and growth of e-commerce also fuel the market growth. This is expected to make way for established FMCG firms to develop their existing brands to gain higher margins.

The global fast-moving consumer goods market size was valued at $11,490.9 billion in 2021 and is projected to reach $18,939.4 billion by 2031, registering a CAGR of 5.1% from 2022 to 2031. Growth in awareness in consumers about FMCG products, increase in the disposable income of middle-class population, frequent launch of new products by the manufacturers, effective advertisement of the brands, and strong distribution channel system of the FMCG industry boost the market growth. Rise in income increases the purchases of FMCG products.

The global FMCG market is estimated to register a CAGR of 5.1% from 2022 to 2031. The market growth is attributable to rise in disposable income coupled with growing penetration of e-commerce across the developed and developing economies.

The global FMCG Market report is available on request on the website of Allied Market Research.

The base year calculated in the FMCG market report is 2021. Furthermore, the year 2020 was an exceptional year characterized by the outbreak of the COVID-19 disease and its rapid spread across the globe. The report provides a detailed analysis of the COVID-19 impact on the global FMCG market.

The key players profiled in the report include Procter And Gamble, Unilever Group, The Coca Cola Company, Pepsico Co. Inc, Kimberly-Clark Corporation, Patanjali Ayurved Ltd., Dr Pepper Snapple Group, Inc., Revlon, Inc, Johnson & Johnson, and Nestle.

The FMCG market is segmented on the basis of product type, production type, distribution channel, and region. By product type, it is classified as food & beverages (juice and drinks, tea and coffee, fresh food, frozen food, processed and packaged food, and others), personal care and cosmetics (body care, hair care, oral care, skin care, and baby care), healthcare (over the counter, vitamin & dietary supplements, feminine care, and others), home care (cleaning products, fragrances, and others), footwear (formal footwear, athletic footwear, casual footwear), footwear accessories, and others. By production type, it is classified as inhouse and contract based. The distribution channel segment comprises of supermarkets & hypermarkets, grocery stores, specialty stores, e-commerce, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The FMCG market has grown significantly due to developed markets such as the U.S., China, and others. These are expected to account for over 70% of the global increase in consumer expenditure. According to projections from the World Bank, India would have surpassed Japan and Germany to become the world's third-largest market in terms of total consumer expenditure by 2030.

Based on region, Asia-Pacific dominated the fast moving consumer goods market in 2021 and is expected to remain dominant during the fast moving consumer goods market forecast period. Asia-Pacific is a growing region in which nations such as India and China have experienced a significant economic expansion in recent decades. This region's countries have a vast population, and consumer products are in great demand.

A: The outbreak of COVID-19 pandemic resulted in a worldwide lockdown; thereby, halting the production and disrupting the supply chain. However, the pandemic did not had severe effects on the FMCG market, as people become more conscious about cleanliness and hygiene due to the rapid spread of the COVID-19 virus. Further, the panic buying of food products had boosted the market growth to an extent during the pandemic.

Loading Table Of Content...