FMCG Packaging Market Research, 2033

The global FMCG packaging market size was valued at $0.9 trillion in 2023, and is projected to reach $1.4 trillion by 2033, growing at a CAGR of 4.6% from 2024 to 2033. FMCG packaging refers to the packaging used for Fast-Moving Consumer Goods (FMCG), which are everyday products like food, beverages, toiletries, and household items. This packaging plays a vital role in protecting these goods, preserving their quality, and attracting consumers' attention on store shelves. It includes various types of packaging such as bottles, cans, boxes, pouches, and wrappers, designed for convenience, durability, and aesthetic appeal to enhance the consumer experience. Additionally, FMCG packaging often incorporates branding, nutritional information, and regulatory labeling to inform consumers and comply with industry standards.

Report Key Highlighters

The FMCG packaging market studies more than 23 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2023 to 2033.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

The FMCG packaging market share is marginally fragmented, with players such as Amcor plc, Tetra Pak, Ball Corporation, Sealed Air Corporation, Huhtamaki, Berry Global Group, Inc., DS Smith plc, Mondi Group, RPC Group, and WestRock Company. Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market dynamics

Industrialization in sectors consisting of food and liquids, homecare, and personal care products is using the growth of the FMCG Packaging Market, each in terms of production volume and product diversity. Countries consisting of India, China, Vietnam, Indonesia, Brazil and others have diverse applications and tasks to aid the development of the home industries. For instance, Indian authorities has introduced diverse schemes, including Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Pradhan Mantri Mudra Yojna‐™ and others to aid small-scale industries. Such packages have been a success in driving the boom of the small- and medium-scale business zone in the last decade; thereby boosting the manufacturing quarter within the us of a. In addition to this, in 2020, authorities of India unveiled Production Linked Incentive (PLI) scheme, to inspire home manufacturing of goods. As manufacturing facilities scale up manufacturing to meet growing demand, there's a corresponding want for green packaging answers which could accommodate excessive-velocity production traces, ensure product protection and hygiene, and beautify emblem visibility on save cabinets. Packaging organizations play a essential position in helping the boom of these industries by way of providing customized packaging answers that cope with particular requirements and demanding situations. This may additionally contain growing packaging codecs optimized for automatic filling and sealing approaches, incorporating tamper-evident features to enhance product protection, or enforcing sustainable packaging initiatives to align with company social responsibility goals.

Furthermore, economic growth in developing countries has led to a significant increase in disposable income among consumers which led to growth in FMCG sector eventually having a positive impact on the FMCG Packaging Market. For example, between 2019 and 2030, there is projected growth in the number of households across developing countries with an annual disposable income of $45,000-100,000 (PPP) by an average of 5.6% per year. This increase in disposable income of people in China, Russia, as well as South Africa, and India is expected to drive demand for various products that require FMCG packaging. This includes looking for well-packaged items that ensure product freshness, safety, and ease of use. Manufacturers and packaging companies respond to this demand by developing innovative packaging solutions that cater to the preferences and purchasing behaviours of consumers in emerging markets. This may involve introducing smaller pack sizes for affordability, implementing attractive designs to appeal to local tastes, or using sustainable materials to align with growing environmental awareness.

However, fluctuating prices of raw materials negatively effect the profitability of the manufacturers. Thus, this fluctuation of raw materials is expected to restrain the FMCG packaging market growth. For instance, the price of metal reduced by $79.8/metric tonne or about 14.51% in China in the start of 2024. Similarly, in April 2024, the futures of metal fell to about $466.2/metric tonne. In addition, aluminum prices surged to $2,450 per tonne in April 2024, the highest in 14 months. This was due to a rally for other base metals, pressure on the dollar, supply concerns, and some traction in demand from China. Moreover, food packaging costs, such as clamshells, may experience a rise of 6% to 10%. This percentage increase also appears in other product packaging costs, including corrugated cartons and labels. Despite the plastic pollution crisis and poor recycling rates, 72% of global consumers still believe plastic has average or above recyclability relative to other materials. The use of flexible LDPE packaging for F&B products has grown 8.6% on average between 2018-2022.

Moreover, growing demand for sustainable development is driving the demand for various types of eco-friendly packaging materials which includes paper & board, metal, glass and similar types of packaging. This is a major FMCG Packaging Market opportunity for growth of the key players in the market.

Segmental Overview

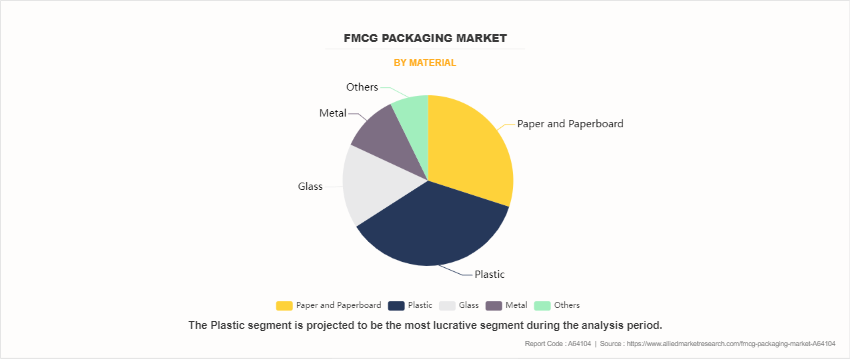

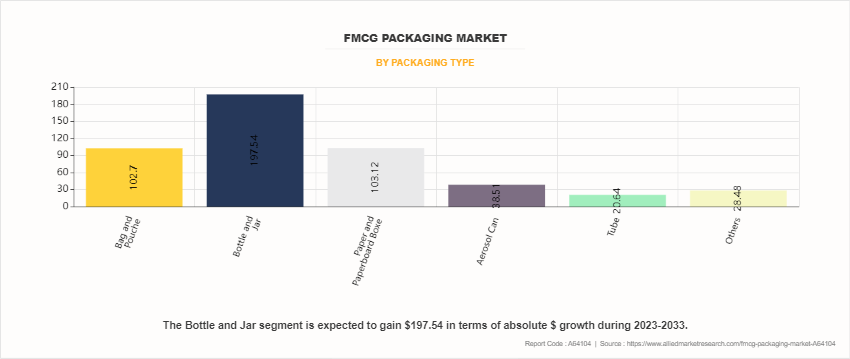

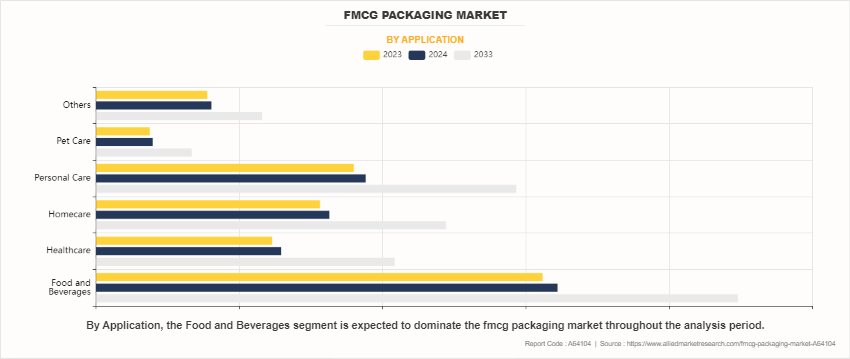

The FMCG packaging market is segmented on the basis of material, packaging type, application, and region. By material, it is divided paper and paperboard, plastic, glass, metal, and others. By packaging type, it is categorized into bags and pouches, bottles and jars, paper and paperboard boxes, aerosol cans, tubes, and others. By application, it is divided into food and beverages, healthcare, homecare, personal care, pet care, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By material, it is divided into paper and paperboard, plastic, glass, metal, and others. In 2023, plastic segment held the most dominant market share in terms of sales. However, the due to various environmental benefits, the paper and paperboard segment is anticipated to grow with a higher CAGR. Paper and paperboard are desired for versatility and eco-friendliness, whilst plastic gives sturdiness and versatility. Glass as a packaging material offers a highly aesthetic appeal. Whereas the metal ensures robust protection. Furthermore, different materials like composites and biodegradable plastics are desired by common population for their sustainability. Each of these materials serves specific product needs and consumer preferences in the fast-moving consumer goods industry.

By packaging type, the market is categorized into bags and pouches, bottles and jars, paper and paperboard boxes, aerosol cans, tubes, and others. The bottles and jars segment held the largest market share in 2023, in terms of revenue, attributed to growing demand for products from food and beverages, and cosmetics sector. Bottles and jars are popular for beverages, sauces, and cosmetics, providing durability and product visibility. Bags and pouches are flexible and offer a greater convenience in storage and transportation. Bags and pouches commonly used for packaging snacks, grains, and personal care products. Furthermore, Paper and paperboard boxes are getting rapid popularity amongst a larger population owing to their eco-friendliness. They are versatile and suitable for packaging dry goods and cereals. Aerosol cans, however, are utilized for products like deodorants, hairsprays, and air fresheners, offering ease of use and precise dispensing. Moreover, tubes are common in cosmetics and pharmaceuticals as well as food products, where it provides higher portability and controlled dispensing of the products.

By region, the FMCG packaging market is analyzed throughout North America, and Europe, and also including Asia-Pacific, and LAMEA. Asia-Pacific had the largest market share in 2023, and is projected to secure the leading position through the forecast duration that is 2024-2033. The Asia-Pacific region presents many growth opportunities to the major players in the FMCG packaging market, owing to rapid industrialization in the countries such as India, and China. Moreover, the population of Asia-Pacific is rising at a higher rate and the same is expected to register a larger per capita income in the coming decade which is anticipated to have a greater impact on the market. On the other hand, the market for food and beverages, and cosmetics is matured in North America and Europe, and the probability for further expansion of the market are relatively limited. However, Latin America, and Middle East & Africa encompasses various countries that are having a lower per capita income. The low per-capita income indicates a potential for market expansion if the government releases industry favorable policies.

Competition Analysis

Competitive analysis and profiles of the major players in the FMCG Packaging Market include Amcor plc, Tetra Pak, Ball Corporation, Sealed Air Corporation, Huhtamaki, Berry Global Group, Inc., DS Smith plc, Mondi Group, RPC Group, and WestRock Company, are provided in the report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the FMCG packaging market.

Recent Development in the FMCG packaging Market

- In April 2024, GEKA has launched a novel recycled polypropylene (PP) material tailored for cosmetics packaging. This groundbreaking material, the first-ever bulk and formulation-compliant post-consumer-recycled (PCR) polypropylene (PP) suitable for primary cosmetic packaging, offers remarkable color brilliance and ensures no loss of visual effects. Additionally, it substantially reduces CO2 emissions by 75% compared to virgin materials.

- In October 2020, Amcor unveiled HeatReadyâ„¢ AmLite HeatFlexâ„¢ Recycle-Ready, the world's first recycle-ready flexible retort pouch. This innovative packaging solution addresses the challenge of recycling flexible packaging used for heat-processed food and beverages, contributing to a circular economy and reducing plastic waste.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging FMCG packaging market trends and dynamics.

- In-depth market analysis is conducted to attain insightful FMCG Packaging Market statistics by constructing market estimations for the key market segments between 2023 and 2033.

- Extensive FMCG packaging market analysis is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The FMCG packaging market forecast analysis from 2024 to 2033 is included in the report.

- The key market players within FMCG packaging market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the FMCG packaging industry.

FMCG Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.4 trillion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 245 |

| By Material |

|

| By Application |

|

| By Packaging Type |

|

| By Region |

|

| Key Market Players | WestRock Company, Berry Global Group, Inc., Sealed Air Corporation, RPC Group Plc, Tetra Pak, Amcor PLC, Huhtamaki, Ball Corporation, DS Smith Plc, Mondi Group |

Analyst Review

The FMCG packaging market, vital for everyday products like food, beverages, toiletries, and household items, is driven by factors like industrialization, global trade, and rising disposable incomes. With over 23 countries studied, the analysis provides a comprehensive breakdown from 2023 to 2033, combining data, professional opinion, and research. Major players in the market include Amcor plc, Tetra Pak, and Ball Corporation, employing strategies like product launches and partnerships to maintain market share. Industrialization in sectors like food and beverages spurs FMCG market expansion, with countries like India and China supporting domestic industries through various initiatives. This growth necessitates efficient packaging solutions that ensure product safety, hygiene, and brand visibility. Additionally, rising disposable incomes in developing countries drive FMCG consumption, prompting demand for convenient, quality products. However, fluctuating raw material prices, especially in metals like aluminum, pose a challenge to market profitability. Nonetheless, the growing demand for eco-friendly packaging materials presents an opportunity for sustainable development and growth in the industry.

A significant rise in global trade, and rising industrialization in many developing countries drive the growth of the global FMCG packaging market.

The latest version of the FMCG packaging market report can be obtained on demand from the website.

The FMCG packaging market size was valued at $886.0 billion in 2023.

The FMCG packaging market size is estimated to reach $1.4 trillion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

The forecast period considered for the FMCG packaging market is 2024 to 2033, wherein, 2023 is the base year, 2024 is the estimated year, and 2033 is the forecast year.

Food and beverages segment is the largest market for FMCG packaging market.

Key companies profiled in the FMCG packaging market report include Amcor plc, Tetra Pak, Ball Corporation, Sealed Air Corporation, Huhtamaki, Berry Global Group, Inc., DS Smith plc, Mondi Group, RPC Group, and WestRock Company.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...