Food Safety Monitoring System Market Insight: 2032

The global food safety monitoring system market was valued at USD 36.1 million in 2022, and is projected to reach USD 63.5 million by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

A food safety monitoring device is a comprehensive framework of practices, technologies, and protocols designed to ensure the security and quality of food products throughout the entire supply chain. It includes the systematic monitoring, analysis, and control of various factors, such as hygiene, infection risks, storage conditions, and transportation. Leveraging technologies such as sensors, data analytics, and traceability tools, the system aims to realize and mitigate potential hazards, comply with regulatory standards, and furnish customers with assurance regarding the safety, integrity, and quality of the food they consume.

The demand for nutritious and beneficial food components is rising, and several factors are driving the growth of the global food safety monitoring system market. These include rising concerns about food safety, aging populations, rising healthcare costs, shifting lifestyles, and the ease of access to different food safety testing techniques. With the growing awareness regarding the advantages that digestive healthcare products offer, food safety testing is becoming more and extra significant in the healthcare sector. Testing for food security includes looking for infections, chemicals, and other potentially dangerous materials in food products. An increase in chemical infection conditions and an increase in adulteration ranges are important factors driving the global food safety monitoring system market growth.

The growing focus on health advantages, as well as an increase in food-related issues such as food poisoning, nausea, and diarrhea, have propelled the international market development. Food protection testing also helps prevent oxidative stress-related problems such as cancer. Contaminant levels are rising as a result of increased imports and exports, necessitating more food safety monitoring systems. In addition, an increase in demand for pesticide residue and other contaminants testing for fruits and vegetables, as well as a rise in the global fruits and vegetables trade, are likely to food safety monitoring system market forecast.

The small enterprises and manufacturers of food products do not have enough information regarding the new and high-tech food safety methods, services, and programs. They are thus unable to meet the specific requirements for food safety. Therefore, a lack of skills and knowledge, especially in developing countries, is expected to affect the effective evaluation and inspection of food operations. Technical expertise and knowledge are essential to implement any such procedures. Thus, the government should conduct specific programs to educate workers, ensuring maximum food safety testing and, consequently, enhancing overall safety standards.

Lack of experience and technical knowledge, especially in small enterprises, leads to some serious contamination of food & beverage products which results in food-borne disease and can cause severe problems. The lack of expertise and technical knowledge harms the food safety testing industry. Due to the increasing automation in the industry, there is a demand for skilled and technically proficient individuals to operate the machinery. However, small-scale enterprises often face challenges in finding qualified professionals for these roles.

Food safety is becoming more digitalized in the food sector as companies use digital solutions to record food safety data more accurately, reduce human error, and make compliance simpler. It is anticipated that this trend will continue as automated apps and new technologies assist food businesses in optimizing their operations. For example, software and apps are now connected to devices and sensors, making it possible to capture data quickly and automatically without the need for human involvement. These digital solutions speed up and reduce error rates in food safety recording, which helps the food safety testing market expand by providing creative and useful digital solutions to food safety enterprises.

However, they are not intended to replace human labor. Future developments in the industry are being determined by several key trends driving the food safety monitoring system market. The FDA's ‘New Era of Smarter Food Safety’ initiative is one of these trends; it aims to provide more contemporary methods of food safety, such as innovative tools for controlling outbreaks and a technology-driven traceability system. This program aims to enhance predictive assessments for food safety purposes and improve responses to issues and outbreaks.

The key players profiled in food safety monitoring system market report include SGS SA, RJ Hill Laboratories Ltd., DuPont, Intertek Group PLC, Danaher Corporation, SAP, AsureQuality Ltd., SecureMetric Technology, IBM, and Bureau Veritas SA. Investment and agreement are common strategies followed by major market players. For instance, in February 2022, Thermo Fisher Scientific, a U.S.-based provider of reagents, software services, consumables, and scientific apparatus, introduced QuEChERS product solutions for food safety analysis. 48 new goods are available in the product range for use with Original, AOAC (Association of Official Analytical Chemists), and European techniques. To satisfy the highest demands for sample preparation solutions, they come in a variety of options.

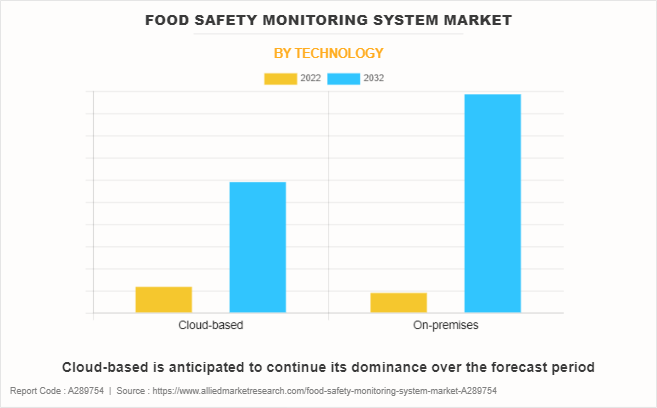

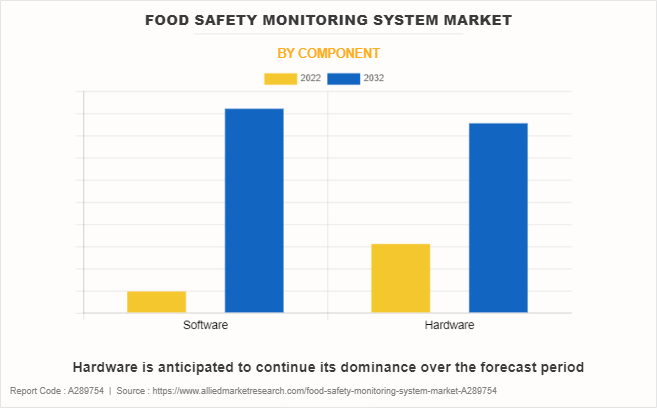

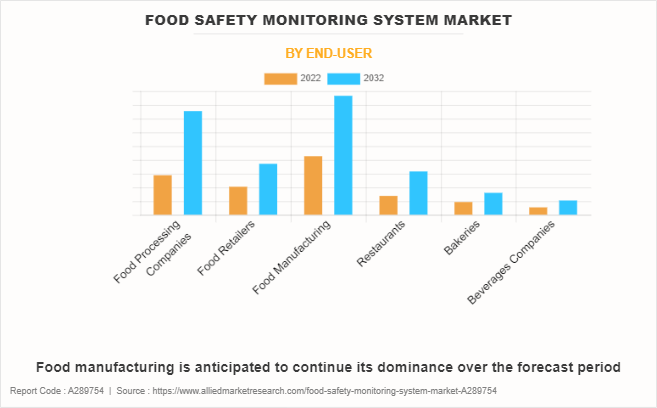

The food safety monitoring system market is segmented on the basis of technology, component, end-user, and region. By technology, the market is divided into cloud and on-premises. By component, the market is classified into software and hardware. By end-user, the market is classified into food processing companies, food retailers, food manufacturing, restaurants, bakeries, and beverages companies. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By technology, the cloud-based sub-segment dominated the market in 2022. The cloud-based technology is a driving force in the food safety monitoring system market, providing unparalleled efficiency and accessibility. Cloud-based solutions provide real-time data management, enhancing traceability and transparency throughout the food supply chain. The scalability, cost-effectiveness, and ease of integration with current structures make cloud-based platforms increasingly attractive for businesses.

In addition, the flexibility to access critical data remotely fosters quick decision-making. With an increased emphasis on regulatory compliance and the want for streamlined operations, the cloud-based segment addresses these challenges, serving as a key component in propelling the growth of the food safety monitoring system market. These are predicted to be the major factors driving the food safety monitoring system market size during the forecast period.

By component, the hardware sub-segment dominated the global food safety monitoring system market share in 2022, owing to increasing demand for robust and automated solutions. As food safety regulations become more stringent, companies are embracing advanced hardware for real-time monitoring and data analysis. The hardware segment provides comprehensive tools for risk assessment, traceability, and compliance management, streamlining processes for food safety and quality assurance.

Furthermore, the integration of artificial intelligence and machine learning enhances predictive analytics, enabling proactive identification of potential hazards. The growing necessity for precision, speed, and accuracy in monitoring practices positions hardware solutions as essential driving forces within the food safety monitoring system market.

By end-user, the food manufacturing sub-segment dominated the global food safety monitoring system market share in 2022. Food safety monitoring systems are increasingly being used in the food manufacturing sector, due to the industry's commitment toward ensuring product security and compliance.. Stringent regulations, such as Hazard Analysis Critical Control Point (HACCP) requirements, compel food producers to invest in advanced monitoring systems. The growing demand for processed foods increases the need for strong safety measures during the manufacturing process. Adoption of modern technologies, like real-time monitoring and analytics, enhances traceability and quality control. As buyers prioritize safe and high-quality food, the integration of innovative monitoring options becomes a pivotal driving force for the increase in the food safety monitoring system market within the food manufacturing sector.

By region, North America dominated the global food safety monitoring system market in 2022. Stringent regulatory standards, growing awareness, and technological developments contribute to the regional market expansion. Adoption of superior monitoring solutions, such as real-time monitoring and traceability, is on the rise. As consumers prioritize secure and amazing food, North America continues to be a key driver in shaping the trajectory of the food safety monitoring system market. For instance, the U.S. Department of Agriculture's Food Safety and Inspection Service monitors the safety of exported and imported food. It is additionally responsible for border and port inspections, as well as food labeling regulations.

Impact of COVID-19 on the Industry

- The COVID-19 pandemic had a significant impact on the food safety monitoring system market. The industry responded by adopting innovative technologies, accelerating the integration of digital solutions to ensure robust food safety practices in the post-pandemic landscape.

- The global food safety monitoring system industry faced substantial impacts due to the COVID-19 pandemic. The pandemic highlighted the importance of stringent food safety measures. Disruptions in supply chains, increased awareness of hygiene, and evolving regulations prompted a surge in demand for advanced monitoring solutions.

- Post-COVID-19, the global food safety monitoring system industry is experiencing a transformative shift. The pandemic has intensified the focus on food safety, prompting increased adoption of advanced monitoring technologies. Stringent regulations and an increased awareness regarding health and safety have become paramount, driving the industry to embrace innovative solutions.

- The post-pandemic landscape sees a resilient food safety monitoring system industry, adapting to new norms and prioritizing robust measures for the well-being of consumers.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food safety monitoring system market analysis from 2022 to 2032 to identify the prevailing food safety monitoring system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food safety monitoring system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global food safety monitoring system market trends, key players, market segments, application areas, and market growth strategies.

Food Safety Monitoring System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 63.5 million |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Technology |

|

| By Component |

|

| By End-user |

|

| By Region |

|

| Key Market Players | SAP, IBM, AsureQuality Ltd., Intertek Group plc, RJ Hill Laboratories Ltd., DuPont (US), Bureau Veritas SA, SecureMetric Technology, SGS SA (Société Générale de Surveillance SA), Danaher Corporation |

The food safety monitoring system market is projected to grow at a compound annual growth rate of 6.1% from 2023-2032

The global food safety monitoring system market was valued at USD 36.1 million in 2022, and is projected to reach USD 63.5 million by 2032

SGS SA, RJ Hill Laboratories Ltd., DuPont, Intertek Group PLC, Danaher Corporation, SAP, AsureQuality Ltd., SecureMetric Technology, IBM, and Bureau Veritas SA are the major players in the food safety monitoring system market.

Asia-Pacific is projected to provide more business opportunities for the global food safety monitoring system market in the future.

The global food safety monitoring system market is driven by increasing awareness regarding foodborne illnesses, stringent regulations, and a growing demand for transparent supply chains. Technological advancements, including IoT and data analytics, create opportunities for real-time monitoring and traceability. The rising focus on health & wellness also contributes to market growth. Opportunities lie in the adoption of innovative solutions, government initiatives, and the need for comprehensive food safety measures, fostering a dynamic landscape for the continuous development of the food safety monitoring system market.

Loading Table Of Content...

Loading Research Methodology...