Foreign Exchange Services Market Research, 2031

The global foreign exchange services market was valued at $8.5 billion in 2021, and is projected to reach $18.2 billion by 2031, growing at a CAGR of 8.3% from 2022 to 2031.

Foreign exchange refers to the conversion of currency into another currency. It is the global market where different currencies are traded. It is used for conducting business transactions, investing, and hedging against currency fluctuations. In the foreign exchange services market, currency exchange rates are determined by supply and demand dynamics.

Moreover, there are providers of the foreign exchange services, and this service offers financial products and services that allow individuals, businesses, and financial institutions to convert one currency into another. In addition, these services can include buying and selling currency in the spot market, transferring funds between international accounts, offering currency options & hedging tools, as well as providing market analysis and research. Thus, the goal of foreign exchange services market is to help clients to manage currency risk and take advantage of market opportunities arising from fluctuations in exchange rates.

The rise in usage of digital technologies has transformed the way foreign exchange services are delivered and consumed, making them faster, more convenient, and more accessible to a wider range of customers, which has helped to drive growth in the market. Moreover, international trade has led to increased trade and investment flows between countries, which has driven the demand for foreign exchange services. Furthermore, due to cross border investments and e-commerce, companies need to convert one currency into another in order to conduct cross-border transactions, and foreign exchange service providers offer the tools and services needed to do so. Thus, this is expected to lead to the growth of the foreign exchange services market in upcoming years.

However, the fluctuations in the economic stability of a country have a significant impact on the foreign exchange services market as the unstable economy results in lower volumes of currency transactions, reduced profitability for foreign exchange service providers, and increased volatility in exchange rates. In addition, political and economic events that impact a country's stability can also lead to fluctuations in the foreign exchange services market, making it more challenging for businesses, individuals, and organizations to engage in cross-border transactions.

Therefore, instability and fluctuation in the economy act as restraint for the growth of the market. On the contrary, the growth of global trade and investment has a positive impact on the foreign exchange services market. As countries engage in more international trade, the demand for foreign exchange services increase. Therefore, this increase in cross-border e-commerce has led to an increase in demand for foreign exchange services industry in upcoming years.

The report focuses on growth prospects, restraints, and trends of the foreign exchange services market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the foreign exchange services market size.

Segment Review

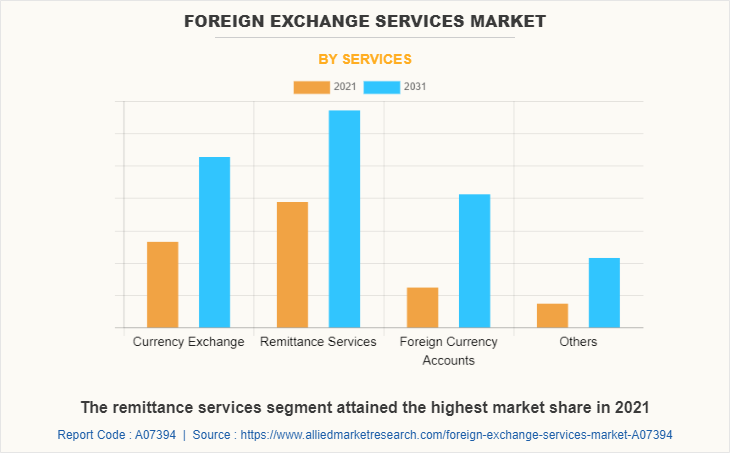

The foreign exchange services market is segmented based on services, providers and application. By services, it is segmented into currency exchange, remittance services, foreign currency accounts, and others. By providers, it is segmented into banks, money transfer operators, and others. By application, it is segmented into businesses and individuals. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By services, the remittance services segment attained the highest growth in 2021. This is attributed to the fact that due to the increasing number of migrant workers and their need to send money back to their home countries has led to a rise in demand for remittance services. In addition, the growth of digital technologies has also made it easier and more convenient for individuals to send money across borders through online and mobile platforms.

However, the foreign currency accounts segment is considered to be the fastest growing segment during the forecast period. This is attributed to the fact that the increasing number of international travelers and the growth of the travel & tourism industry have created a need for convenient foreign currency management solutions. Moreover, foreign currency accounts also offer benefits such as reduced currency conversion costs and improved exchange rates. Therefore, these factors lead to the foreign exchange services market growth.

By region, North America attained the highest growth in 2021 as North American foreign exchange services market is a vital part of the financial services sector, providing currency exchange and risk management solutions to businesses and individuals. Furthermore, the market in North America is dominated by large banks and financial institutions, and also includes specialized foreign exchange service providers.

However, Asia-Pacific is expected to be the fastest growing region during the forecast period. This is attributed to the fact that, the increasing use of digital technologies is driving the shift toward electronic and online foreign exchange services, making it more convenient and accessible for individuals and businesses to participate in the market. In addition, there has been a growing demand for risk management and hedging services, as businesses seek to protect themselves against fluctuations in currency exchange rates. Thus, these are the major trends for the growth of the foreign exchange services market in Asia-Pacific.

The report analyzes the profiles of key players operating in the foreign exchange services market such as American Express Company, Barclays, Citigroup Inc., Deutsche Bank AG, JPMorgan Chase & Co., Goldman Sachs, HSBC Group, Standard Chartered, Wells Fargo, and Western Union Holdings. These players have adopted various strategies to increase their market penetration and strengthen their position in the foreign exchange services market share.

Market Landscape and Trends

The foreign exchange services market is a rapidly growing and highly competitive market. The market is characterized by the presence of many players, including banks, non-bank financial institutions, and online foreign exchange brokers. Furthermore, market is influenced by several factors, including global economic conditions, geopolitical events, and advancements in technology. But on the other hand, the rise of fintech has transformed the foreign exchange services market, making it easier and more convenient for traders to access the market.

Moreover, online foreign exchange brokers have capitalized on this trend by offering sophisticated trading platforms and mobile apps that allow traders to trade from anywhere and at any time. These brokers offer a range of services, including currency trading, money transfer, and other financial services, and are able to offer at a lower costs and higher levels of convenience compared to traditional banks and financial institutions. Thus, these leads to the growth of the market. Additionally, now-a-days foreign exchange service providers are focusing on improving their customer experience by offering personalized services, educational resources, and high-quality support. And this trend is driven by the growing importance of customer satisfaction and loyalty in the foreign exchange services market. Overall, the foreign exchange services market is expected to continue its growth trajectory as global economic conditions improve and technology continues to advance.

Top Impacting Factors

Growing Foreign Trade between Countries

The growth of globalization and international trade is a key driver of the foreign exchange services market. International trade and the foreign exchange services market are intricately linked. The growth of globalization has created new opportunities for foreign exchange service providers, as companies conducting more business across borders need efficient solutions for managing international transactions. Moreover, globalization has led to increased trade and investment flows between countries, which has driven demand for foreign exchange services. In addition, due to cross border investments, e-commerce companies are required to convert one currency into another in order to conduct cross-border transactions, and foreign exchange service providers offer the tools and services which is needed for cross border transactions.

Furthermore, globalization has been a major driver of growth in the foreign exchange services market, and these two trends of globalization and cross border investments are likely to continue to be closely linked in the future. As globalization continues to expand, demand for foreign exchange services is expected to grow, creating new opportunities for service providers. Therefore, this leads to the growth of the foreign exchange services market in upcoming years.

Ease of doing Business with other Countries

The rise in usage of digital technologies has transformed the way that foreign exchange services are delivered and consumed, making them faster, more convenient, and more accessible to a wider range of customers, which has helped to drive growth in the market. Moreover, now-a-days online platforms have made it easier for businesses to access foreign exchange services, allowing them to compare exchange rates, initiate transactions, and track the status of the payments in real-time. In addition, technology has developed so much that there has been launch of mobile apps for the use currency exchange services.

For instance, mobile app for foreign exchange services is TransferWise. TransferWise is a fintech company that offers a mobile app that allows users to send money abroad quickly and easily. The app provides real-time exchange rates and low fees, making it a cost-effective solution for managing international payments. Therefore, this has increased the convenience and accessibility of foreign exchange services, allowing businesses to manage international payments from anywhere, at any time.

Furthermore, with use of blockchain and artificial intelligence technology has a potential to transform the foreign exchange services market by improving the efficiency and transparency of cross-border transactions. In addition, use of such technology helps to automate processes, improve risk management, and provide more personalized services to customers and businesses. Therefore, such trends towards greater digitalization is simplifying the foreign exchange business with other countries, further, this is expected to continue, creating new opportunities for innovation and growth in the market.

Regulatory Barriers in doing Foreign Trade

The foreign exchange services market is highly regulated, and these regulatory barriers make it difficult for service providers to enter new markets or expand their operations. Moreover, obtaining the necessary licenses and authorizations from regulatory bodies is a time-consuming and expensive process, and failure to comply with regulatory requirements leads to penalties or fines.

Furthermore, these regulatory barriers act as a limitation for innovation in the foreign exchange services market as service providers must adhere to strict rules and guidelines for their operations. Thus, making it difficult for new entrants to compete with established players, limiting the growth of the market. Therefore, regulatory barriers act as a limitation for the growth of the foreign exchange services market.

Fluctuation in the Economic Stability of a Country

The fluctuations in the economic stability of a country have a significant impact on the foreign exchange services market. A stable economy usually leads to a strong currency, which attracts investment and creates demand for foreign exchange services. Whereas, an unstable economy can cause currency depreciation, inflation, and a lack of investor confidence, which decrease demand for foreign exchange services and result in higher volatility in currency exchange rates. Therefore, fluctuation in economy or unstable economy result in lower volumes of currency transactions, reduced profitability for foreign exchange service providers, and increased volatility in exchange rates.

Moreover, political and economic events that impact a country's stability can also lead to fluctuations in the foreign exchange services market, making it more challenging for businesses, individuals, and organizations to engage in cross-border transactions. Therefore, fluctuation in economic stability of a country act as restraining factor for the growth of the foreign exchange services market.

Growing Global Trade and Investment

The growth of global trade and investment has a positive impact on the foreign exchange services market. As countries engage in more international trade, the demand for foreign exchange services increases. In addition, these services allow businesses and individuals to convert one currency into another in order to facilitate cross-border transactions. Therefore, the growth of global trade and investment creates new opportunities for foreign exchange services providers to offer their services to a wider range of customers.

For instance, a recent example of growing global trade and investment is the increase in cross-border e-commerce between the United States and Europe. With the growth of online shopping and advancements in logistics and delivery systems, many businesses are now able to sell their products and services to customers across the globe. Therefore, the increase in cross-border e-commerce has led to an increase in demand for foreign exchange services, as businesses need to convert payments and transactions into different currencies. Therefore, these factors lead to the growth of the market in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the foreign exchange services market forecast from 2022 to 2031 to identify the prevailing foreign exchange services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the foreign exchange services market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global foreign exchange services market trends, key players, market segments, application areas, and market growth strategies.

Foreign Exchange Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.2 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 389 |

| By Services |

|

| By Providers |

|

| By Application |

|

| By Region |

|

| Key Market Players | JPMorgan Chase & Co., Citigroup Inc., Western Union Holdings, Barclays, American Express Company, Deutsche Bank AG, Goldman Sachs, HSBC Group, Standard Chartered, Wells Fargo |

Analyst Review

Foreign exchange (forex or FX) services refer to the exchange of one currency for another, or the conversion of one currency into another currency. This is done for a variety of reasons, such as for facilitating international trade & investment or for facilitating travel. Moreover, foreign exchange services are typically offered by financial institutions such as banks, currency exchange bureaus, and online providers. These services allow individuals and organizations to buy, sell, and transfer different currencies at current exchange rates.

Furthermore, market players are adopting strategies such as business expansion for enhancing their services in the market and improving customer satisfaction. For instance, in September 2020, Barclays expanded its business by deploying its latest FX trading and pricing engine in Singapore, under the monetary authority of Singapore’s (MAS) FX Trading Hub strategy. This marked Barclays’ latest milestone as it continues to strengthen its FX presence in Asia-Pacific. Therefore, such strategy is anticipated to boost the foreign exchange services market in upcoming years.

Moreover, some of the key players profiled in the report are American Express Company, Barclays, Citigroup Inc., Deutsche Bank AG, JPMorgan Chase & Co., Goldman Sachs, HSBC Group, Standard Chartered, Wells Fargo, and Western Union Holdings. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Foreign Exchange Services Market will expand at a CAGR of 8.3% from 2021 - 2031

The market value of Foreign Exchange Services Market by the end of 2031 will be 18.21 billion

Growing foreign trade between countries Ease of doing business with other countries Regulatory barriers in doing foreign trade

American Express Company, Barclays, Citigroup Inc., Deutsche Bank AG, JPMorgan Chase & Co., Goldman Sachs, HSBC Group, Standard Chartered, Wells Fargo, and Western Union Holdings

By application, the Foreign Exchange Services Market is segmented into businesses and individuals

Loading Table Of Content...