Fractional Flow Reserve Market Research, 2035

The global fractional flow reserve market was valued at $901.3 million in 2023, and is projected to reach $2,558.34 million by 2035, growing at a CAGR of 9.1% from 2024 to 2035. The fractional flow reserve market growth is driven by the rise in prevalence of cardiovascular diseases, particularly coronary artery disease, which increases the demand for accurate diagnostic tools. For instance, according to a 2021 report by the National Library of Medicine, the incidence of coronary artery disease increased annually by 2.7% and 1.2% in men and women, respectively. As coronary artery disease becomes more prevalent, there is a growing demand for precise diagnostic tools such as FFR to assess the severity of arterial blockages.

Fractional Flow Reserve (FFR) is a diagnostic technique used to measure the pressure differences across a coronary artery narrowing to assess its impact on blood flow to the heart. By calculating the ratio of blood pressure before and after the narrowing, FFR helps determine whether stenosis is expected to cause ischemia (reduced blood flow). FFR is primarily used during coronary angiography to guide treatment decisions, ensuring that only clinically significant blockages are treated with interventions such as stenting or bypass surgery.

Key Takeaways

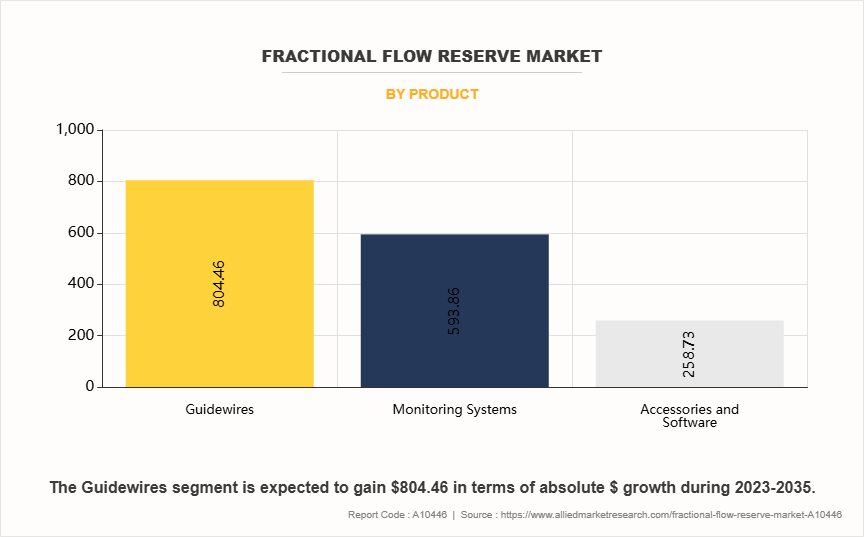

- By product, the guidewires segment dominated the global fractional flow reserve market size in 2023. However, the monitoring systems segment is expected to register the highest CAGR during the forecast period.

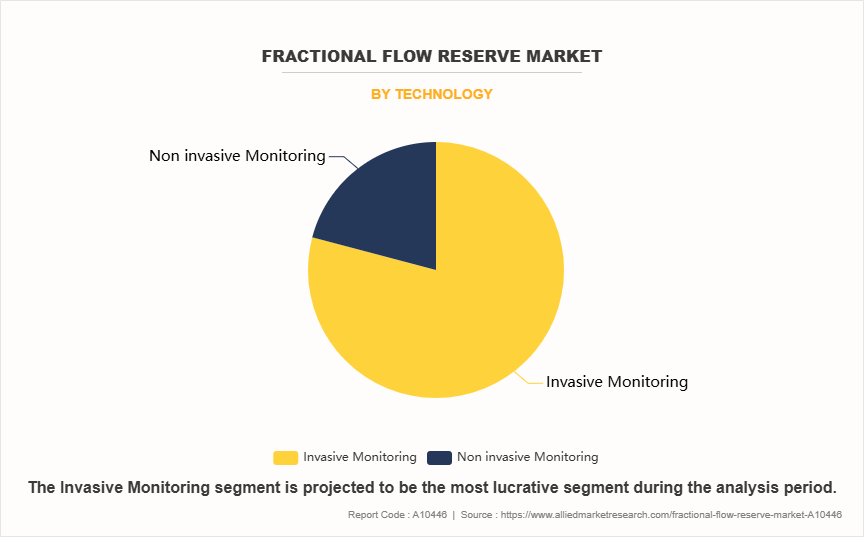

- By technology, the invasive monitoring segment dominated the global market in terms of revenue in 2023. However, the non-invasive monitoring segment is expected to register the highest CAGR during the forecast period.

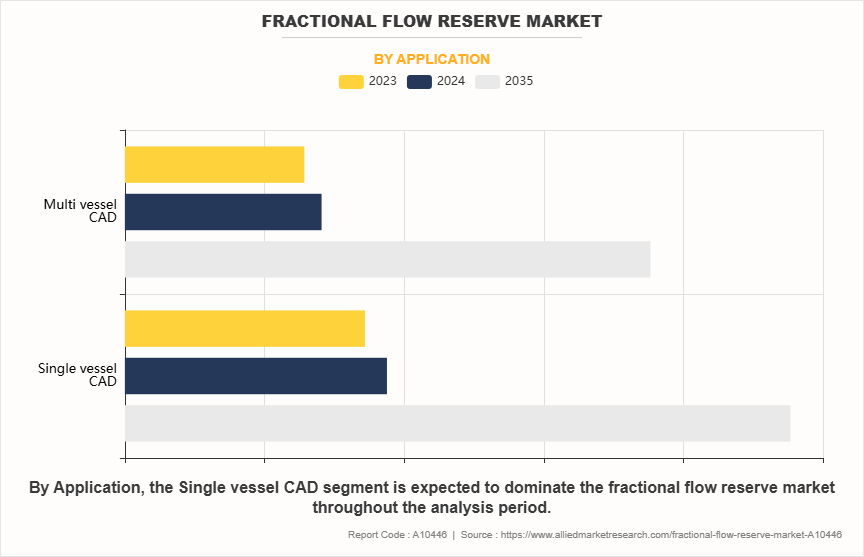

- By application, the single vessel CAD segment dominated the global market in terms of revenue in 2023. However, the multi vessel CAD segment is expected to register the highest CAGR during the forecast period.

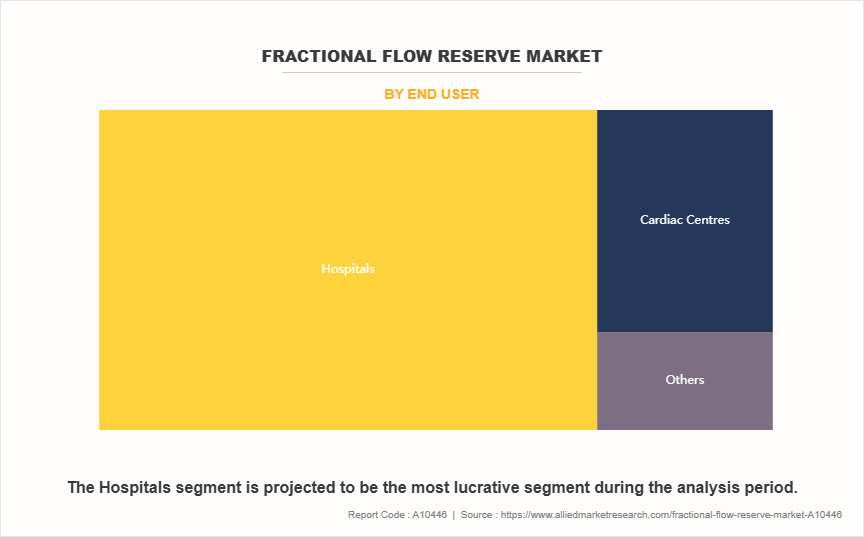

- By end user, the hospitals segment dominated the global market in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

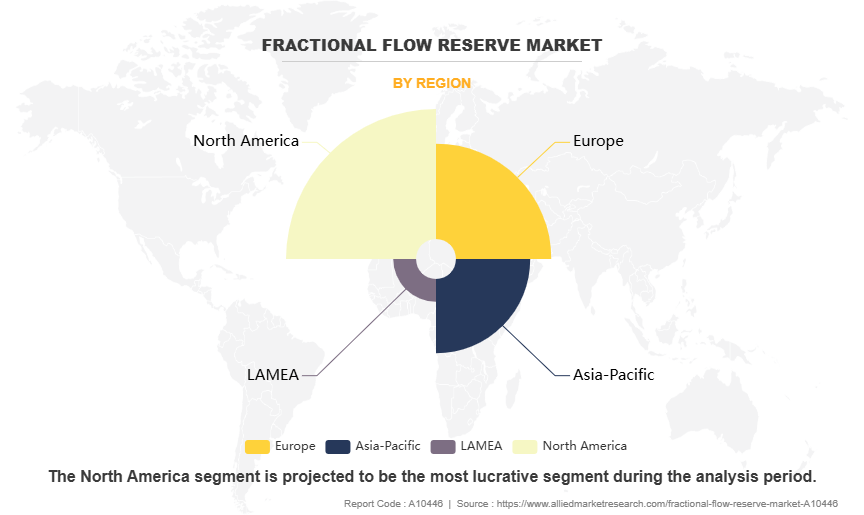

- By region, North America dominated the fractional flow reserve market share in terms of revenue in 2023. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Market Dynamics

The fractional flow reserve market growth is driven by the rising prevalence of cardiovascular diseases, particularly coronary artery disease (CAD), which significantly increases the demand for accurate diagnostic tools. According to the Center for Disease Control and Prevention, Coronary artery disease (CAD) was the most common type of heart disease in the U.S. in 2022. In addition, advancements in FFR technology, including non-invasive methods such as FFR-CT, offer safer alternatives to traditional invasive procedures, attracting healthcare providers and patients alike which is expected to drive the market growth. These innovations improve diagnostic accuracy and reduce patient risk, thereby encouraging greater utilization.

Furthermore, increasing awareness among healthcare professionals about the benefits of FFR in guiding treatment decisions is fostering its acceptance in clinical practice and thereby supporting market growth. The shift towards minimally invasive procedures aligns with the capabilities of FFR, making it a preferred choice for many clinicians. Moreover, supportive government policies and reimbursement schemes for FFR procedures are facilitating access and encouraging healthcare institutions to adopt this technology, which further fuels the fractional flow reserve market forecast.

However, the high costs associated with FFR procedures and devices can restrict accessibility, particularly in developing regions, thereby hindering market growth. In addition, the need for specialized training for healthcare professionals may further impede market growth. On the other hand, the growing demand for minimally invasive diagnostic procedures, which can enhance patient comfort and recovery times, provides an opportunity for the market growth. Advancements in technology, such as non-invasive FFR methods and integration of artificial intelligence, are expected to improve diagnostic accuracy and efficiency, which further creates fractional flow reserve market opportunity.

Segments Overview

The fractional flow reserve market is segmented into product, technology, application, end user, and region. By product, it is classified into guidewires, monitoring systems, and accessories and software. On the basis of technology, the market is categorized into invasive monitoring and non-invasive monitoring. On the basis of application, the market is bifurcated into single-vessel CAD and multi-vessel CAD. On the basis of end user, the market is classified into hospitals, cardiac centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Product

By product, the guidewires segment dominated the market share in 2023. This is attributed to their critical role in facilitating accurate measurements during fractional flow reserve (FFR) assessments. As essential components for invasive procedures, guidewires enable the delivery of pressure sensors to assess blood flow in coronary arteries effectively. However, the monitoring systems segment is expected to register the highest CAGR during the forecast period. This is attributed to the increasing integration of advanced technologies, such as artificial intelligence and machine learning, into monitoring systems. These innovations enhance the accuracy and efficiency of fractional flow reserve (FFR) assessments, allowing for real-time data analysis and improved clinical decision making.

By Technology

By technology, the invasive monitoring segment dominated the fractional flow reserve market size in 2023. This is attributed to its ability to provide real-time, accurate measurements of blood flow and pressure within coronary arteries. Invasive FFR techniques are considered the gold standard for diagnosing coronary artery disease, as they allow for precise assessment during coronary angiography. Furthermore, the growing number of interventional procedures and the preference for detailed diagnostic information in complex cases contribute to the increasing adoption of invasive monitoring methods.

However, the non-invasive monitoring segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in demand for safer and more comfortable diagnostic options for patients. Non-invasive methods, such as CT-based FFR, eliminate the need for catheterization, reducing procedural risks and recovery time. In addition, advancements in imaging technology and growth in awareness of the benefits of non-invasive assessments in diagnosing coronary artery disease are driving adoption of non-invasive procedures.

By Application

By application, the single vessel CAD segment held the largest fractional flow reserve market share in 2023, owing to the rise in prevalence of patients with isolated coronary artery blockages that require precise diagnosis. In addition, growth in preference for minimally invasive procedures and the effectiveness of FFR in single vessel cases further support the dominance of this segment. However, the multi vessel CAD segment is expected to register the highest CAGR during the forecast period, owing to an increase in complexity of cases requiring precise diagnosis across multiple arteries. Advances in FFR technology and growth in awareness of its benefits in assessing multiple blockages are driving the adoption of FFR.

By End User

By end user, the hospitals segment held the largest fractional flow reserve market share in 2023 and is expected to register the highest CAR during the forecast period. This is attributed to the increase in number of cardiovascular procedures performed in hospitals, the availability of advanced diagnostic equipment, and the preference for FFR-guided interventions in clinical settings. Additionally, hospitals benefit from favorable reimbursement policies and skilled medical professionals, further driving the segment's growth.

By Region

The fractional flow reserve industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market share in 2023. This dominance is attributed to its advanced healthcare infrastructure, rise in prevalence of cardiovascular diseases, and early adoption of cutting-edge medical technologies. The region's strong presence of leading medical device manufacturers, along with well-established reimbursement policies for advanced diagnostic procedures, further supports market growth.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to increase in prevalence of cardiovascular diseases, particularly in densely populated countries such as China and India, which is driving demand for advanced diagnostic tools such as fractional flow reserve (FFR). In addition, improving healthcare infrastructure, and growing awareness of minimally invasive procedures are contributing to market growth. Government initiatives supporting better cardiovascular care and the expansion of medical device companies into the region further bolster the FFR market’s potential in Asia-Pacific.

Competitive Analysis

Key players such as Esoate Group and Siemens have adopted expansion and product launch as key developmental strategies to improve the product portfolio of the fractional flow reserve market. For instance, in April 2022, Siemens Healthineers announced the expansion of its manufacturing facility in India. In its aim to accelerate the growth of medical devices space in the country, the company has launched its new production line (plant) for Computed Tomography Scanners at its Bengaluru facility.

Recent Development in the Fractional Flow Reserve Industry

- In May 2024, CathWorks announced that the CathWorks FFRangio System now approved under the European Union (EU) Medical Device Regulation 2017/745, commonly referred to as EU MDR, and fulfilled the requirements for CE marking (0344).

- In September 2024, GE HealthCare announced the launch of enhanced Venue ultrasound systems and a new solution setting the pace of point-of-care ultrasound (POCUS): Venue Sprint.Venue family ultrasound systems have access to Caption Guidance, which provides turn-by-turn, on-screen guidance to help capture diagnostic-quality cardiac ultrasound images.

- In June 2024, Pie Medical Imaging, a global leader in cardiac imaging, announced the completion of enrollment in FASTIII, a multi-center randomized clinical trial, which investigates the use of angiography-based vessel fractional flow reserve in patients undergoing coronary revascularization procedures. The FASTIII trial aims to establish the role of vFFR in guiding coronary revascularization for patients with intermediate coronary artery lesions

- In December 2023, Haemonetics Corporation completed its previously announced acquisition of OpSens Inc., a medical device cardiology-focused company delivering innovative solutions based on its proprietary optical technology. OpSens offers the OptoWire, a pressure guidewire that aims to improve clinical outcomes by accurately and consistently measuring Fractional Flow Reserve (FFR).

- In May 2023, Esaote, a leading manufacturer of medical diagnostic systems introduced the MyLab Omega eXP, a portable ultrasound system with advanced cardiac tools and AI-powered automation. Additionally, Esaote showcased Suitestensa CVIS, a comprehensive cardiovascular management solution, and Caas Qardia, a state-of-the-art echocardiography software platform developed by its subsidiaries Ebit and Pie Medical Imaging.

- In July 2022, Medtronic, a global leader in healthcare technology announced it has entered into a strategic partnership agreement with CathWorks. As part of the agreement, Medtronic will invest up to $75 million and immediately begin co-promotion of CathWorks' FFRangio System in the U.S., Europe, and Japan, where it is commercially available.

- In April 2021, Abbott announced that its new imaging platform powered by Ultreon 1.0 Software, is now CE Marked in Europe. This first-of-its-kind imaging software merges optical coherence tomography (OCT) an imaging tool that provides physicians a comprehensive view inside an artery or blood vessel with the power of artificial intelligence (AI) for enhanced visualization. The new Ultreon Software can automatically detect the severity of calcium-based blockages and measure vessel diameter to enhance the precision of physicians’ decision-making during coronary stenting procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fractional flow reserve market analysis from 2023 to 2035 to identify the prevailing fractional flow reserve market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fractional flow reserve market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fractional flow reserve market trends, key players, market segments, application areas, and market growth strategies.

Fractional Flow Reserve Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 2.6 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2023 - 2035 |

| Report Pages | 350 |

| By Application |

|

| By Product |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V., Esaote Group, Boston Scientific Corporation, Abbott Laboratories, Haemonetics Corporation, HeartFlow, Inc., CathWorks, Bracco, GE HealthCare, Siemens |

Analyst Review

This section provides various opinions of top-level CXOs in the fractional flow reserve market. According to the insights of CXOs, the fractional flow reserve market expansion is driven by rise in prevalence of coronary artery diseases, advancements in FFR technology, and increase in awareness among healthcare professionals regarding the benefits of precise cardiovascular diagnostics. However, challenges such as the high cost of FFR procedures, the need for specialized training for healthcare professionals, and potential complications associated with invasive techniques restrain market growth.

CXOs further added that favorable reimbursement policies and guidelines supporting FFR use play a significant role in driving market growth, as they enhance accessibility and encourage adoption of FFR technologies in clinical practice. In addition, growing investment in healthcare infrastructure, particularly in emerging markets, further fuels the demand for FFR technologies.

North America generated the highest revenue in 2023, owing to its advanced healthcare infrastructure, rise in prevalence of coronary artery diseases, and significant investments in medical technology. The region's strong support for innovative diagnostic tools, along with favorable reimbursement policies and guidelines promoting the use of fractional flow reserve (FFR), further contribute to its market leadership. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to surge in prevalence of cardiovascular diseases, rise in healthcare expenditures, and improved access to advanced medical technologies.

North America is the largest regional market for fractional flow reserve

Single Vessel is the leading application of fractional flow reserve market.

The global fractional flow reserve market was valued at $901.3 million in 2023, and is projected to reach $2,558.34 million by 2035, growing at a CAGR of 9.1% from 2024 to 2035.

The major companies are Haemonetics Corporation, Abbott Laboratories, Boston Scientific Corporation, Bracco, Koninklijke Philips N.V., HeartFlow, Inc., CathWorks, Siemens, GE HealthCare, and Esaote Group.

2023 is the base year of fractional flow reserve market.

2024 to 2035 is the forecasted year of fractional flow reserve market.

Loading Table Of Content...

Loading Research Methodology...