Fuze And Guidance Kits Market Research, 2033

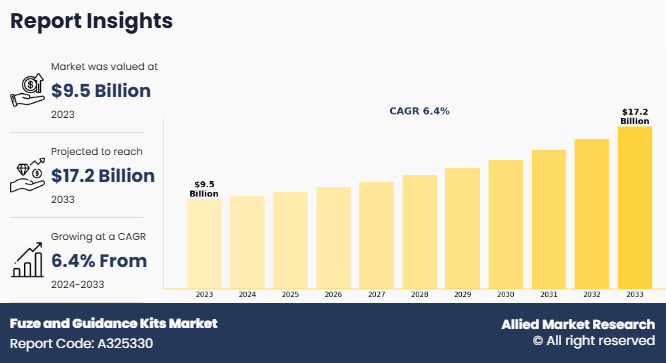

The global fuze and guidance kits market was valued at $9.5 billion in 2023, and is projected to reach $17.2 billion by 2033, growing at a CAGR of 6.4% from 2024 to 2033.

Market Definition and Introduction

Fuze and guidance kits are essential components in modern munitions, designed to enhance their precision, effectiveness, and reliability. A fuze is a device that detonates a munition's explosive material under specified conditions. Some types of fuzes include impact fuze, time fuze, proximity fuze, and multifunction fuze. In addition, guidance kits are systems added to munitions such as bombs and missiles to improve their targeting accuracy. These kits utilize technologies such as GPS, lasers, and dual mode to guide the munition along a precise trajectory toward the intended target, minimizing collateral damage and maximizing strike efficiency. Collectively, fuze and guidance kits significantly enhance control, accuracy, and safety in military operations.

The demand for advanced artillery systems capable of launching accurate, targeted strikes in military operations boosts the fuze and guidance kits market growth. These kits, which improve the accuracy of artillery projectiles, are increasingly needed to reduce civilian casualties, minimize unintended damage, and improve mission success rates. Moreover, the strict export controls and regulations associated with guidance kits restrain the growth of fuze and guidance kits market.

Furthermore, factors such as a rise in defense budgets, geopolitical tensions, and the need to modernize military capabilities are key factors driving market growth. In addition, defense modernization efforts across various countries have increased demand for advanced missile guidance systems. Governments invest in technological developments to improve missile accuracy, extend range, and enhance target acquisition capabilities.

Key Developments/Strategies in fuze and guidance kits

- In March 2023, BAE Systems expanded by successfully testing its Advanced Precision Kill Weapon System (APKWS) laser guidance kits in a counter-unmanned aircraft system (C-UAS) mission, coordinated by the U.S. Joint Counter-Small Unmanned Aircraft Systems Office. This test demonstrated APKWS’s capability to transform unguided rockets into precision munitions for engaging and neutralizing drone threats effectively. By equipping rockets with laser guidance for precise targeting, APKWS offers a cost-efficient solution for countering small unmanned aerial threats, enhancing flexibility and mission adaptability in the field. revenue.

- In August 2024, Elbit Systems Ltd. announced a $190 million contract with the Israeli Ministry of Defense to supply its Iron Sting laser and GPS-guided mortar munition, with completion expected within two years. This contract enhances the effectiveness and survivability of mobile mortar capabilities through precision-guided munitions, enabling accurate targeting with the first round and offering cost-saving advantages. To address varied operational needs, Elbit Systems provides both the Iron Sting guided mortar round and the LG2MK Laser/GPS-Guided Mortar Kit, which upgrades legacy mortars with advanced precision guidance experience on board planes through better Internet connection speeds.

- In October 2023, Arabsat and Telesat signed a contract of Understanding (MoU) to form The U.S. Navy awarded Northrop Grumman Corporation a development contract to advance its newly designed 57mm guided high explosive ammunition, specifically intended for the Mk110 Naval Gun Mount. This contract involves carefully testing and maturation of the munition to ensure it meets the Navy's qualification standards. By enhancing the capabilities of the Mk110 system with precision-guided munitions, the U.S. Navy aims to improve the effectiveness and accuracy of its naval gunfire, thereby enhancing operational readiness and lethality in various maritime scenarios. issues and orbital resources.

Market Dynamics

Growing demand for proximity fuzes in modern warfare and defense systems

The demand for proximity fuzes has increased as modern defense systems prioritize precision and effectiveness in munitions. Proximity fuzes, which detonate upon nearing a target rather than requiring direct contact, increase hit accuracy and are especially valuable in air defense and anti-missile applications. Their integration is driven by advancements in proximity sensing technology, such as radar and radio frequency capabilities, which enhance the ability to respond swiftly to dynamic battlefield conditions. The militaries need these fuzes to minimize collateral damage and improve response times, proximity fuzes are becoming an essential component in both new and upgraded munitions systems. Some proximity fuzes within guidance kits are M1156 Precision Guidance Kit (PGK), developed for artillery applications. This GPS-guided kit enhances accuracy by modifying projectile trajectories to minimize targeting errors. Integrated with fuzing functionality, the PGK helps convert standard artillery munitions into precision-guided weapons, especially valuable for 155mm projectiles such as M795 and M549A1. For instance, in October 2021, BAE Systems successfully demonstrated the use of its Hydra APKWS rockets with a new proximity fuze to intercept and neutralize small unmanned aerial vehicles (UAVs). The test involved APKWS rockets outfitted with Mk66 motors, M151 warheads, and the newly integrated proximity fuze. Such developments are driving the need for proximity fuze in guidance kits.

Stringent exports regulation

The government-owned defense organizations must follow federal and legislative rules and regulations, including import-export control, exchange restrictions, the Foreign Corrupt Practices Act, and the Export Administration Act. Many governments prevent defense manufacturers from exporting their products, limiting their ability to serve overseas clients. This hampers radar producers' access to international markets. Defense manufacturers must comply with various laws and regulations governing the sale of their products and services, as imposed by relevant authorities. Failure to comply results in significant consequences, such as fines, penalties, contract termination, or public and criminal investigations. Geopolitical instability further strains international relations, complicating trade. Trade restrictions in some countries limit the export of fuze and guidance kits to developing regions, impacting the global market growth for these critical defense components. For instance, South Korea has strict regulations that restrict domestic companies from selling advanced weapon systems, including precision-guided munitions and associated guidance systems, to certain countries. These policies are aimed at controlling the proliferation of advanced military technology. In 2021, South Korea approved exports of specific guided munitions to the UAE, indicating a controlled relaxation of restrictions. Such policies generally constrain market expansion, especially in regions with high demand for defense modernization.

Rise in integration of advanced navigation technologies will create lucrative opportunities

There is a notable movement in the precision guidance kit (PGK) toward integrating advanced navigation systems. This fuze and guidance kits market trends includes the combination of Inertial Navigation Systems (INS) with millimeter wave radar or laser guiding for improved target acquisition and tracking. These enhancements are crucial for modern warfare, where precision is vital. In addition, there is ongoing research on Global Navigation Satellite System (GNSS) technology to enhance accuracy and reliability, especially in environments where GPS signals are weak or jammed. For instance, in June 2024, Northrop Grumman announced its plan to develop precision guidance kits that are expected to convert standard 155 mm artillery rounds into smart munitions. This initiative aims to enhance the accuracy and effectiveness of conventional artillery, allowing for more precise targeting and reduced collateral damage in military compared to other regions, which is expected to increase in the fuze and guidance kits market forecast.

Top Impacting Factors

The fuze and guidance kits market is expected to witness notable growth owing to growing demand for proximity fuzes in modern warfare and defense systems, surge in contracts and investments to strengthen the capabilities of fuze and guidance kits and rise in territorial conflicts. Moreover, the rise in integration of advanced navigation technologies will create lucrative opportunities and rise in adoption of precision-guided weapons systems are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, stringent exports regulation and single-use limitations of guidance kits limit the growth of the fuze and guidance kits industry.

Historical Data & Information

The market is competitive, owing to the strong presence of existing vendors. Vendors in the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

The fuze and guidance kits market is segmented into Product Type, End Use and Platform.

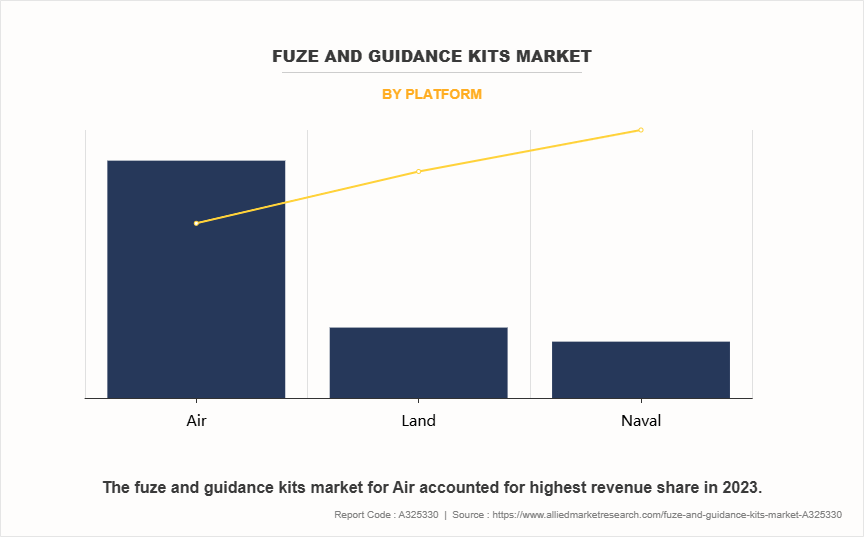

On the basis of platform, the market is divided into land, air, and navy. The air segment dominated the market.The surge in integration of guidance kits with rockets, general purpose bombs, artillery, and mortars fuels the expansion of the global fuze and technologies has played a key role in significantly boosting market growth.

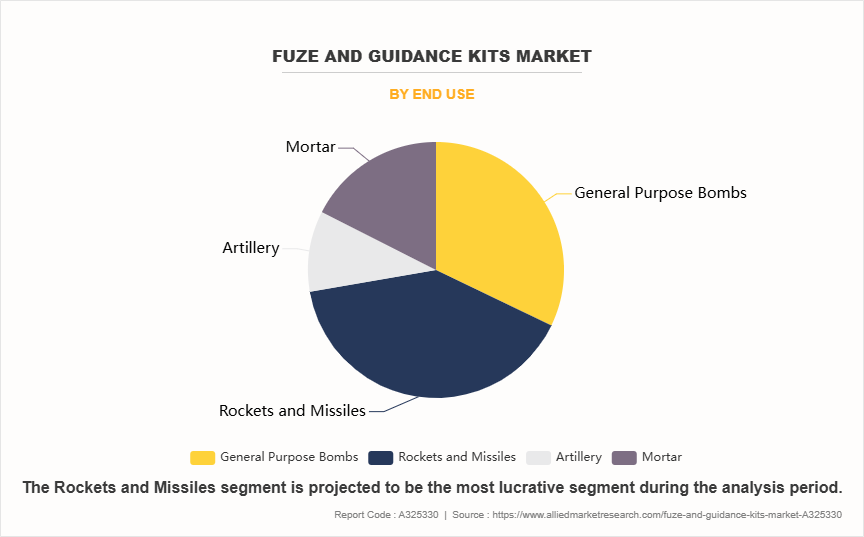

On the basis of end use, the market is categorized into general purpose bombs, rockets & missiles, artillery, and mortar. The rockets and missiles accounted for the largest fuze and guidance kits market share in 2023.Growing global security concerns and rising defense budgets significantly drove the demand for advanced rocket and missile systems. Technological advancements, such as precision guidance systems and enhanced propulsion mechanisms, have also contributed to the increased adoption of these systems across various military forces.

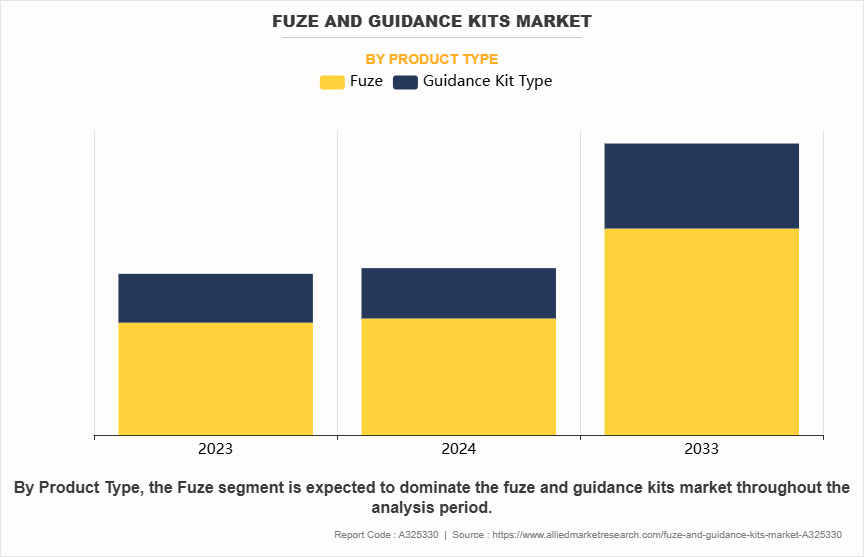

On the basis of product type, the market is classified into fuze type and guidance kits. The fuze type segment is further divided into impact, proximity, time, multi-function and others. In addition, the guidance kits segment is further classified into laser guidance kits, GPS/INS guidance kits, and dual mode guidance kits.

Competitive Analysis

Competitive analysis and profiles of the major global fuze and guidance kits market players that have been provided in the report include BAE Systems, Boeing, North Grumman Corporation, IAI (Israel Aerospace Industries), Elbit Systems Ltd., ASELSAN, Kaman Corporation, Bharat Electronics Limited (BEL), Roketsan, EDGE group, AERTEC, Lockhead Martin Corporation, Safran, Raytheon Technologies Corporation, and SDT Space & Defence Technologies Inc. The key strategies adopted by the major players of the global market are product launch, mergers, and acquisitions.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global fuze and guidance kits market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global fuze and guidance kits market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2023 to 2033 benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in satellite services.

- The report includes the market share of key vendors and the global market.

Fuze and Guidance Kits Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.2 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 369 |

| By Product Type |

|

| By End Use |

|

| By Platform |

|

| By Region |

|

| Key Market Players | AERTEC, Lockhead Martin Corporation, Elbit Systems Ltd., IAI (Israel Aerospace Industries), Boeing, North Grumman Corporation, BAE Systems, SDT Space & Defence Technologies Inc., ASELSAN, Roketsan, Kaman Corporation., EDGE Group, Bharat Electronics Limited (BEL), Raytheon Technologies Corporation., Safran |

The upcoming trends of fuze and guidance kits market include growing demand for proximity fuzes in modern warfare and defense systems, surge in contracts and investments to strengthen the capabilities of fuze and guidance kits and rise in territorial conflicts.

BAE Systems, Boeing, North Grumman Corporation are some of the top companies to hold the market share in fuze and guidance kits.

The rockets and missiles is the leading end use of fuze and guidance kits market.

North America is the largest regional market for fuze and guidance kits.

The fuze and guidance kits market were valued at $9,511.0 million in 2023.

Loading Table Of Content...

Loading Research Methodology...