Gallium-Oxide Power Devices Market Overview, 2033

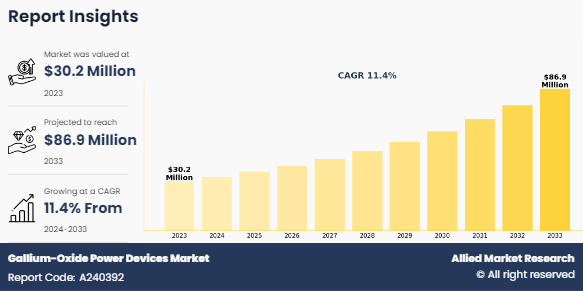

The Global Gallium-Oxide Power Devices Market was valued at $30.2 million in 2023, and is projected to reach $86.9 million by 2033, growing at a CAGR of 11.4% from 2024 to 2033. Gallium oxide power devices are advanced semiconductor components made from gallium oxide, a wide bandgap material known for its high breakdown voltage and thermal stability. These devices are designed to efficiently handle high voltages and power levels, making them ideal for applications in power electronics, such as power converters, inverters, and electric vehicles. Unlike traditional silicon-based devices, gallium oxide power devices offer superior performance, including lower energy losses, faster switching speeds, and higher temperature resistance. This positions them as a promising solution for next-generation power systems, particularly in renewable energy, industrial automation, and electric mobility.

Market Dynamics

Continuous advancements in research and development (R&D)

Continuous advancements in research and development (R&D) are a significant driving factor for the Gallium Oxide (Ga2O3) power device market. As researchers explore innovative methods to enhance the performance of Ga2O3-based devices, breakthroughs in material science and semiconductor technology are emerging, leading to improved efficiency, thermal stability, and breakdown voltage. These advancements enable the development of high-performance power devices capable of handling higher voltages and temperatures, which are crucial for applications in electric vehicles, renewable energy systems, and industrial automation. Moreover, increased funding and collaboration between academic institutions and industry players foster a vibrant ecosystem for innovation, accelerating the commercialization of Ga2O3 technology. This dynamic environment not only enhances product offerings but also attracts investment, further propelling market growth and adoption across various sectors.

Competition from established technologies, such as silicon carbide (SiC) and gallium nitride (GaN)

Competition from established technologies like silicon carbide semiconductor(SiC) and gallium nitride (GaN) poses a significant restraint for the Gallium-Oxide Power Devices Industry. SiC and GaN have already established their presence in high-power and high-frequency applications due to their proven reliability and superior performance characteristics, such as high thermal conductivity and low switching losses. This established foothold presents challenges for Ga2O3, which, despite its promising attributes like higher breakdown voltage and lower manufacturing costs, is still in the developmental phase compared to SiC and GaN. The extensive customer base and existing supply chains of SiC and GaN manufacturers further complicate market entry for Ga2O3 devices. Consequently, overcoming this competition requires significant advancements in Ga2O3 technology, along with effective marketing strategies to demonstrate its unique benefits to potential customers.

Expanding electric vehicle (EV)

The expanding electric vehicle (EV) market presents a significant opportunity for the Gallium Oxide (Ga2O3) power device market. As EVs require efficient power conversion systems for improved performance and longer ranges, Ga2O3 devices, with their high breakdown voltage and thermal stability, are well-suited for applications such as onboard chargers and inverters. The increasing push for sustainable transportation and government incentives are driving the adoption of EVs, thereby creating a demand for advanced power electronics. By leveraging Ga2O3 technology, manufacturers can enhance energy efficiency, reduce weight, and improve the overall performance of EV systems, positioning themselves favorably in a rapidly growing sector.

Segment Overview

The gallium-oxide power devices market is segmented on the basis of type, end use, and region.

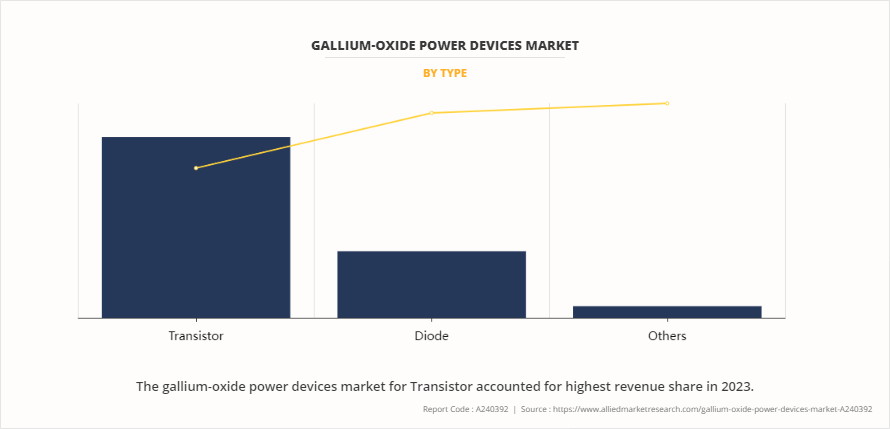

By type, the Gallium-Oxide Power Devices Market Growth is divided into transistor, diode, and others.

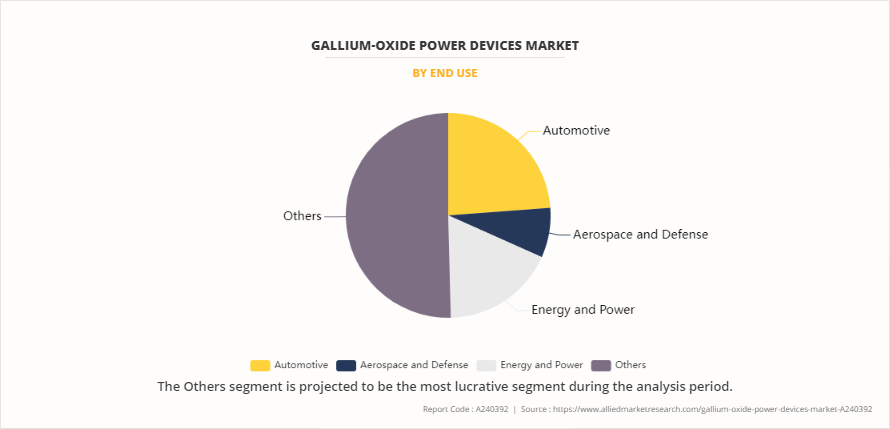

By end use, the market is segmented into automotive, aerospace and defense, energy & power, and others.

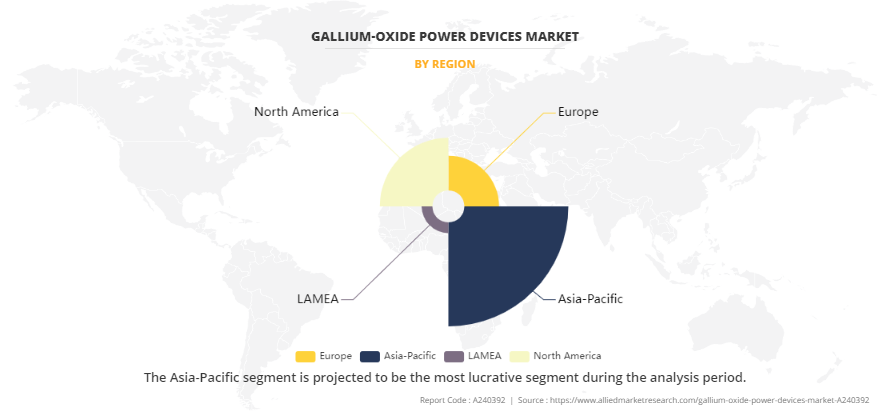

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competitive Analysis

Gallium-oxide power devices market share by company and profiles includes Novel Crystal Technology, Inc., Kyma technologies, ON Semiconductor Corporation, NXP Semiconductors, FLOSFIA, and Atecom Technology Co., Ltd. are new product development and collaboration. Market players have adopted various strategies such as product launch, investment, and acquisition to expand their foothold in the gallium oxide power device market.

Recent Developments in Gallium oxide power Industry.

- In March 2024, Novel Crystal Technology (NCT) successfully developed a 6-inch gallium oxide (GaO) single crystal using the Vertical Bridgman (VB) technique. This advancement enhances the production of larger, higher-quality semiconductor wafers, crucial for power devices. The VB method outperforms the previous Edge-defined Film-fed Growth (EFG) technique, offering improved crystal quality and reduced costs. This innovation supports NCT's goal of broadening GaO applications in power electronics, particularly in high-voltage sectors such as electric vehicles and renewable energy systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gallium-oxide power devices market analysis from 2023 to 2033 to identify the prevailing gallium-oxide power devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities of Gallium-Oxide Power Devices Market Size, Gallium-Oxide Power Devices Market Forecast, and Gallium-Oxide Power Devices Market Insights .

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gallium-oxide power devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global siemens surge protector market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gallium-oxide power devices market trends, key players, market segments, application areas, and Gallium-Oxide Power Devices Industry growth strategies.

Gallium-Oxide Power Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 86.9 million |

| Growth Rate | CAGR of 11.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 219 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Kyma Technologies, Atecom Technology Co., Ltd., NXP Semiconductors, Novel Crystal Technology, Inc., FLOSFIA, ON Semiconductor Corporation |

Adoption in Electric Vehicles (EVs), and Increased Research and Development (R&D) are the upcoming trends of Gallium-Oxide Power Devices Market in the globe.

Automotive is the leading application of Gallium-Oxide Power Devices Market

Asia-Pacific is the largest regional market for Gallium-Oxide Power Devices

In 2023, $30.18 million was the estimated industry size of Gallium-Oxide Power Device

Novel Crystal Technology, Inc., Kyma technologies, ON Semiconductor Corporation, NXP Semiconductors, FLOSFIA, and Atecom Technology Co., Ltd are the the top companies to hold the market share in Gallium-Oxide Power Devices

Loading Table Of Content...

Loading Research Methodology...