The gaming gadgets market size was valued at $52.6 billion in 2021, and is estimated to reach $166.9 billion by 2031, registering a CAGR of 12.7% from 2022 to 2031. A gaming gadget is an electronic device, which is paired with PC or a console. Many gaming accessories exist in the market that support the gaming gadgets such as keyboards, mice, and headsets, which improve the overall gaming experience and performance. In addition, gaming keyboard and mice are diverse from standard ones as they prioritize things such as agility, speed, and responsiveness.

Technological advancements boost the market growth. For instance, as of March 2021, the latest home video game console1 devices in the market are Microsoft's Xbox Series X/S and Sony's PlayStation 5 (PS5), both of which were introduced in November 2020. Each has a keen edition for downloading online games, as well as an edition with a traditional disk drive. This reflects the changes in lifestyles accompanying such factors as the improved speed of home internet connections. Meanwhile, Nintendo has seen a steady increase in sales of the Nintendo Switch since its 2017 launch, and has launched the Nintendo Switch Lite in 2019, which is an inexpensive model that only supports handheld play mode and is not compatible with the Nintendo Switch dock for enabling TV output.With the advent of cloud gaming, which allows users to play games on any device, console manufacturers is anticipated to be required to find ways to emphasize the value and appeal of consoles' unique qualities.

Consoles are devices that are fundamentally optimized for playing games, and console manufacturers may need to pursue directions that leverage this characteristic by creating "experiences that amaze users". View exists that states that the "experiences" here are not necessarily limited to high-end technology. The creation of new experiences through the combination of peripheral devices could be said to represent new value. Gaming gadgets are specialized equipment that require advanced technologies and compatible hardware and software in order to function properly. Many players in the gaming gadgets market are trying to deliver top of the line, premium products and hardware components for gaming as they provide the best experience and functionality while gaming. However, the integration of newer technologies into these gadgets substantially raise the price of the devices, which may hamper customer purchasing decisions. For example, a gaming laptop fitted with a graphics card that supports ray tracing technology costs more than a gaming laptop without ray

tracing. Similarly, consoles with higher storage capacities and faster storage units such as solid state drives cost significantly higher. These high prices of gaming devices make it difficult for consumers to purchase these devices, which negatively impacts the market.

In recent years, a sharp growth in the purchasing of gaming equipment has been noted. Also, the creation of hardware that can handle immersive and hyper-realistic games has resulted in an increase in the sales of gaming devices intended for both consumer and business use. Customers are becoming more interested in gaming, which is good for the market thanks to the development of ultra-realistic-looking games by several gaming companies and the rise in customer awareness of contemporary innovations in gaming devices like faster processors and more effective cooling systems. Also, the expansion of gaming device types—particularly laptops and portable consoles that are very user-friendly—is grabbing consumers' interest and driving up market sales.

In recent years, video games have become increasingly popular as media and content. Several YouTubers, streamers, and let players are actively involved in producing video about games and gaming equipment. Also, a lot of these businesspeople and content producers have teamed up to create e-sports orgs, which are institutions entirely devoted to the game industry. As a result, there has been a sharp rise in the number of people creating gaming content and participating in e-sports. This has increased demand for gaming devices, which are necessary to create this kind of material. The production of various kinds of gaming-related material, some of which may only be available on specific platforms, requires a large number of gaming PCs and consoles, which is driving up the price of gaming hardware.

Gaming equipment is customised hardware designed with the intent to run demanding, high-performance software. The availability of gaming hardware and devices was previously limited to relatively specialised retail locations, but in recent years, the availability of these products has dramatically risen. Gaming consoles, gaming desktops, and gaming laptops are now widely available in conventional computer hardware and electronics stores, making them more convenient for customers. Additionally, it has become very simple for customers to browse and order gaming devices thanks to the availability of these devices across a number of websites, both on the website of the company that makes these devices and on third-party websites. This has had a positive impact on the gaming devices market.

Users can enter a 3D representation of a world or scenario to experience it as if it were a real-world setting thanks to virtual reality, more usually abbreviated as VR. Through the use of Chroma key technology or AR headsets and glasses, augmented reality, or AR, projects digital information into the physical world. In the past, high-end hardware and equipment were needed for VR and AR to work. However, recent advancements in VR and AR technology have made it possible to run these devices on medium-tier hardware by utilising a combination of hardware and software features. Additionally, the use of contemporary technology is assisting in lowering the cost of VR and AR equipment, as well as adding features like cross-platform compatibility and native VR support, which removes the need for third party VR software, is driving customers to such types of gaming equipment, which is assisting in boosting the market for gaming devices.

The demand for gaming accessories suddenly increased after the COVID-19 epidemic broke out, despite the sector having had tremendous expansion in recent years. The COVID-19 outbreak caused the demand for mobile gaming software and apps to skyrocket. Also, the epidemic has perfectly matched consumer demand for gaming devices, especially given the chance to increase involvement during lockdown.

The market for gaming and gaming equipment is heavily reliant on technology. Little, pixelated, and boxy games have been transformed into ones that are smooth, feel hyper-realistic, and appear hyper-realistic. The gaming and gaming device industries are seeing a lot of innovation, which is always improving them. The incorporation of cross platform and cloud gaming into devices that allow players to pause a game on a console and pick it up again on a PC, and vice versa, is encouraging the purchase of both types of gaming equipment.

Segmental Overview

The gaming gadgets market is segmented into gadget type, end user, age group, distribution channel, and region. By gadget type, the gaming gadgets market is classified into consoles and personal computers. Depending on age group, the market is categorized into below 20, 21-35, and 35 & above. By end user, the gaming gadgets market is classified into commercial and residential users. According to distribution channel, the market is segmented into specialty stores, multi-brand stores, independent small stores, online retailers, and others. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia and rest of Europe), Asia-Pacific (China, India, Japan, Australia, Singapore, New Zealand, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE and rest of LAMEA).

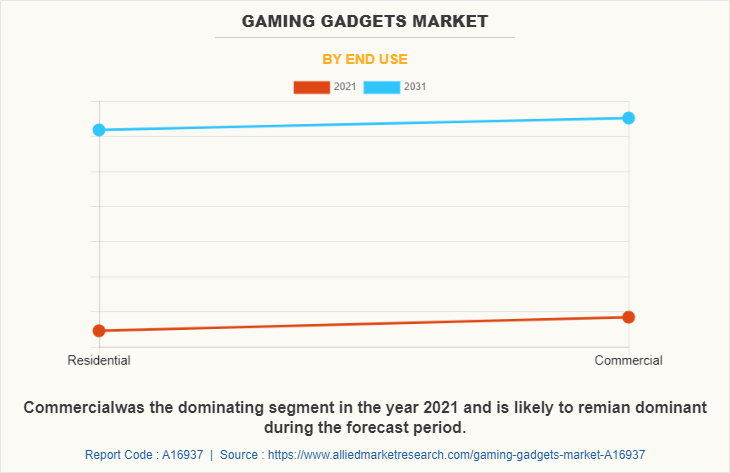

By End Use

Depending on the end use, the commercial segment dominated the market in 2021, garnering around half of the market share; however, the residential is expected to grow at the highest CAGR of 13.3% from 2022 to 2031. In addition, In recent years, video games have become increasingly popular as media and content. Several YouTubers, streamers, and let players are actively involved in producing video about games and gaming equipment. Also, a lot of these businesspeople and content producers have teamed up to create e-sports orgs, which are institutions entirely devoted to the game industry. As a result, there has been a sharp rise in the number of people creating gaming content and participating in e-sports. This has increased demand for gaming devices, which are necessary to create this kind of material.

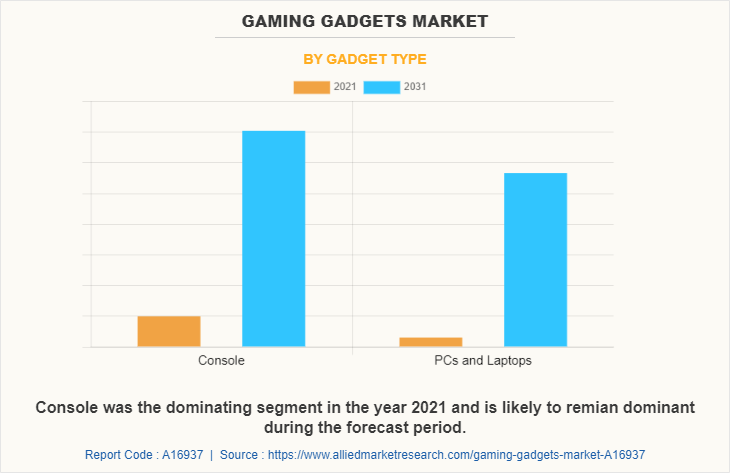

By Gadget Type

Depending on the gadget type, the console segment dominated the market in 2021; however, the personal computers is expected to grow at the highest CAGR of 13.3% from 2022 to 2031. In addition, In order to satisfy the technological and financial needs of the clients, consoles are produced to a variety of standards using non-replaceable, non-upgradable hardware components. Nintendo, Sony, and other major competitors in the industry have a strong hold on the console business. Also, the incorporation of solid state drives (SSDs) and more powerful graphics cards greatly improves game loading times and quality, which helps to increase sales of contemporary gaming consoles. It is projected that continued console technology advancements, particularly in hand-held consoles, will contribute to a rise in the popularity of consoles.

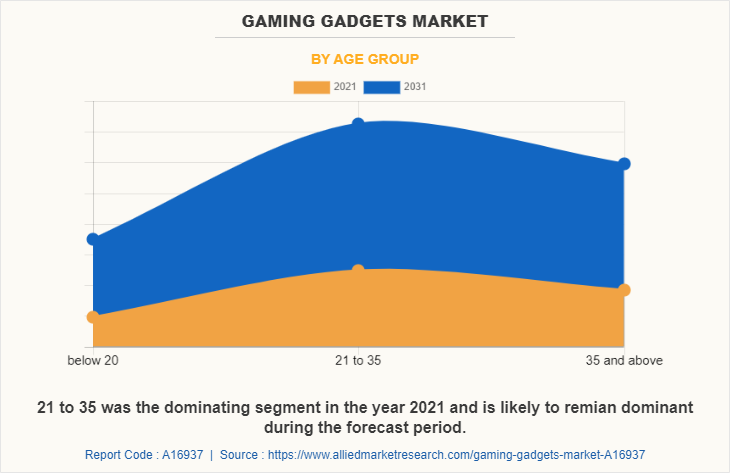

By Age Group

Depending on the age group, the 21 to 35 segment dominated the market in 2021, garnering majority of the market share; however, the below 20 is expected to grow at the highest CAGR of 14.2% from 2022 to 2031. In addition, The majority of customers in the 21 to 35 age range played video games growing up, and they now equate gaming with ease and comfort, which helps drive sales of games and gaming accessories. Also, more money is spent on consoles, PCs, or both due to consumers above the age of 25 to 27 having better spending power. Gaming commentary and lets plays have become increasingly popular forms of media, which is encouraging more people to enter into such content creation, which is helping to increase the sales of gaming gadgets. Professional video game players, streamers, and other content creators have emerged in recent years due to a widespread interest in gaming, stories, and animations.

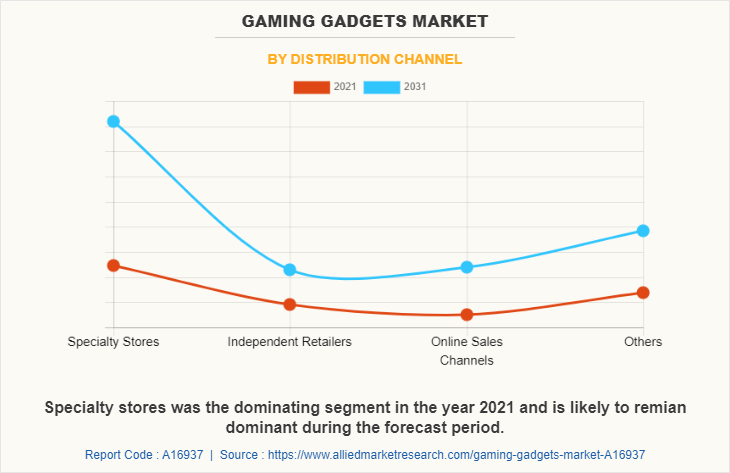

By Distribution Channel

Depending on the distribution channel, the specialty stores segment dominated the market in 2021, garnering the majority of the market share; however, the online sales channel is expected to grow at the highest CAGR of 16.8% from 2022 to 2031. In addition, the top list of considerations for the growth of eyelash serum includes specialty shops. The traits of specialty stores are well known. In their specialist stores, any product is easily accessible. So, it is possible to assume that specialty shops will have a significant impact on the market for gaming devices. Manufacturers are primarily focusing on specialty stores since they are always making attempts to boost the visibility of their items on the shelf. As a result, specialty shops carry a wider selection of gaming equipment. Also, specialist shops provide choices like discounts and the advantage of instant gratification, which promotes the expansion of the gaming devices market.

By Region

Region wise, Asia-Pacific dominated the market in 2021, garnering a market share of around one-third market share. Leading game marketplaces in Asia-Pacific have established the international benchmark for social gaming elements like in-game chat, friendship or mentorship networks, leaderboards, and player versus player (PvP) types. Publishers have the chance to further sculpt the creative and social experience in virtual gaming worlds for an already receptive audience with the emergence of the metaverse. Some of the major players analyzed in this report are Dell, Asus, HP, Acer, msi, Lenovo, Gigabyte, Razer, Corsair, origin, Sony, Microsoft, Nintendo, steam, Sega, and Atari

Some Examples of Product Launch In the global gaming gadgets Market

- In May 2022, Acer Launched Predator 300 Helios with spatial labs which offer a 3D gaming experience. Acer added a new laptop to their laptop portfolio.

- In May 2022, Acer Expands its 3D stereoscopic lineup with new portable displays for gamers and content creators.

- In May 2022, Acer expands its Vero Product portfolio by upgrading the product with 12th gen Intel Processors.

- In May 2022, Acer Launched Acer Chromebook spin 514 with AMD Ryzen 5000 C- Series Processors and expand their product portfolio with AMD’s processors.

- In February 2022, Acer Launched the Swift 5 ultraportable laptop and expanded its product portfolio.

- In January 2022, Acer Launched the new Predator Desktop and Monitor and expand its product portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of current trends, estimations, and dynamics of the global gaming gadgets market from 2021 to 2031 to identify the prevailing market opportunities.

- The Porter’s five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry.

- The market player positioning segment facilitates benchmarking while providing a clear understanding of the present position of the key market players.

- The report includes analyses of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Gaming Gadgets Market Report Highlights

| Aspects | Details |

| By Gadget Type |

|

| By End Use |

|

| By Age Group |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | HP Inc., Micro-Star INT'L CO., LTD, LENOVO, valve corporation, RAZER, Sega, MICROSOFT, Acer Inc, Nintendo, ASUSTeK Computers Inc., SONY CORPORATION, Dell Technologies Inc., GIGA-BYTE Technology Co., Ltd, Corsair, Atari,Inc |

Analyst Review

The popularity of gaming consoles, especially hand held gaming consoles, has gone up severely in the recent years due to the ease of use and convenience associated with consoles. However, the sales of gaming PCs have also gone up considerably as consumers are preferring gaming PCs instead of regular PCs as they offer more flexibility and greater performance in terms of gaming experiences as well as other tasks that can be performed on computers. The inclusion of aesthetic features such as red, green, and blue lighting scheme in gaming PCs, also sometimes known as towers, is also attracting many customers towards gaming PCs as it also helps in providing an aesthetic feel to the area where the PCs are placed.

Increase in the number of scalpers, people who purchase hardware components for gaming devices in bulk and sell them at higher prices, had led to a sharp increase in the prices of these components, which in turn increased the prizes of gaming devices. However, efforts taken by the manufacturers of such components to reduce incidences of scalping and their efforts to produce devices that cost less and are affordable while giving high performance output is resulting in a gradual lowering of prices of such devices, which will prove to be a major factor that helps in the growth of the gaming devices market. Newer generation of gaming devices, consoles and PCs alike, will further enhance gaming experiences, which will further promote the sales of such gaming devices.

The gaming gadgets market size was valued at $52.6 billion in 2021, and is estimated to reach $166.9 billion by 2031, registering a CAGR of 12.7% from 2022 to 2031.

From 2022-2031 would be forecast period in the market report

$52.6 billion is the market value of gaming gadgets market in 2021.

2021 is base year calculated in the gaming gadgets market report

The key players analyzed in the report are Acer Inc, ASUSTeK Computers Inc, Atari Inc, Dell, HP, Lenovo, Gigabyte, Razer, Corsair, Origin, Sony, Microsoft, Nintendo, Steam, Sega, and Atari are the top companies hold the market share in gaming gadgets market.

Gaming consoles is the most influencing segment growing in the gaming gadgets market report during the forecast period.

Availability of alternatives, innovation in products offerings, regulatory compliances, technological advancements and high prices of gadgets are some of the key trends in gaming gadgets market report.

14.6% and 14.0% are the growth rate of the emerging countries.

Loading Table Of Content...