General Aviation Market Research, 2033

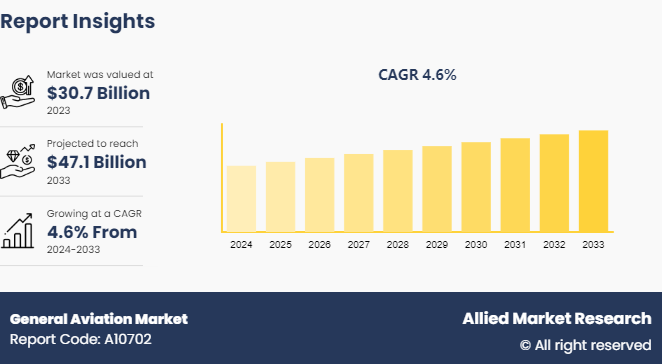

The global general aviation market size was valued at $30.7 billion in 2023, and is projected to reach $47.1 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Market Introduction and Definition

The general aviation market includes a broad spectrum of aircraft operations and services outside of commercial and military aviation. It includes privately owned and operated aircraft, as well as those used for business, leisure, training, and other non-commercial purposes. General aviation aircraft range from small single-engine planes to larger, multi-engine turboprops and jets. This market serves various purposes, including personal transportation, aerial photography, agricultural spraying, medical evacuation, law enforcement, and flight training.

In addition, it includes the manufacturing, sales, and maintenance of these aircraft, as well as related services such as flight instruction, aircraft rental, and charter operations. The general aviation industry plays a crucial role in connecting communities, supporting economic development, and providing flexibility and accessibility in air transportation.

Key Takeaways

The general aviation market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive switches industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In February 2024, Leonardo received helicopter orders from the Middle East and India during Heli-Expo 2023. These orders, totaling 'almost' 40 helicopters, contribute to the company's sales contracts for more than 50 AW09 next-generation single-engine helicopters for customers globally.

In June 2023, State Grid Space Technology Co., Ltd (SGST) achieved a significant milestone in Chinese aviation by conducting the first helicopter flight using sustainable aviation fuel (SAF) in China. The demonstration, carried out at Hefei Shiwan Airport, utilized an Airbus H125 helicopter powered by a Safran ARRIEL 2D engine. Approximately 40% of the fuel used during the flight was sourced from sustainable aviation fuel provided by China National Aviation Fuel (CNAF) . This development marks a major step forward in the pursuit of low-carbon aviation in China.

Key Market Dynamics

Demand for efficient and flexible air transportation, growth of industries requiring remote access, and advancements in aircraft technology are expected to drive the global general aviation market growth during the forecast period. However, high costs of aircraft ownership & operation and stringent regulations & certification requirements are anticipated to hamper the growth of the market during the forecast period. Moreover, expansion of air taxi & charter services and development of electric & hybrid-electric aircraft are projected to offer lucrative opportunities for market expansion in the future. The general aviation market size is experiencing steady growth due to increasing personal and business travel.

General aviation offers a convenient alternative to commercial air travel, providing businesses and individuals with the ability to optimize their travel schedules and reach remote or underserved locations with ease.

As businesses continue to expand their operations globally and seek to streamline logistical processes, the need for efficient transportation solutions has become paramount. General aviation offers a level of flexibility and accessibility that commercial airlines are unable to match. Private aircraft allow executives, entrepreneurs, and other professionals to travel on their own schedules, minimizing layovers and delays, and enabling them to conduct business more efficiently.

Moreover, the demand for general aviation services has been fueled by the growth of industries such as energy, mining, and agriculture, which often require access to remote locations where traditional transportation infrastructure may be limited. General aviation aircraft can land on smaller airstrips or unpaved runways, enabling the transportation of personnel, equipment, and supplies to these remote sites, facilitating exploration, extraction, and production activities.

In addition, There is a substantial general aviation market opportunity in the development of electric and hybrid aircraft. The rise of urban air mobility and the development of advanced air mobility solutions, such as electric vertical takeoff and landing (eVTOL) aircraft, have the potential to further drive the growth of the general aviation market. These innovative technologies promise to revolutionize urban transportation, reducing congestion and enabling faster and more efficient travel within cities and metropolitan areas. The general aviation market forecast suggests that technological innovations will enhance safety and efficiency.

Overall, the primary driver of the general aviation market is the increasing demand for efficient and flexible air transportation solutions that can cater to the diverse needs of businesses, industries, and individuals. As the global economy continues to evolve and the need for rapid and convenient travel grows, the general aviation market is well-positioned to meet these demands, offering a range of aircraft and services that can optimize transportation logistics and enhance operational efficiency.

Market Segmentation

The general aviation market is segmented into product, application, and region. By product, it is divided into helicopters, piston fixed-wing aircraft, turboprop aircraft, and business jets. By application, the market is categorized into commercial and non-commercial segments. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

North America stands as the largest region in the general aviation market due to several factors. A notable trend is the rising demand for personal and business aviation services, buoyed by the region's robust economy and corporate expansion. This demand surge is particularly pronounced for travel to remote destinations inaccessible by commercial airlines.

Technological advancements also play a pivotal role, with North America serving as a hub for aviation innovation. From cutting-edge avionics systems to more fuel-efficient engines, technological developments are enhancing safety, efficiency, and passenger comfort in general aviation aircraft.

Regulatory policies are another key factor shaping market dynamics in North America. While stringent regulations are in place to ensure safety and security, efforts are ongoing to streamline procedures and reduce bureaucratic obstacles, facilitating smoother operations for individuals and businesses within the aviation sector.

Furthermore, North America benefits from an extensive network of airports and Fixed-Base Operators (FBOs) , providing essential infrastructure support for general aviation operations. This robust infrastructure, coupled with favorable geographic conditions, contributes significantly to market growth in the region.

In addition, evolving consumer preferences are driving changes in the market landscape, with a growing emphasis on sustainability and environmentally friendly aviation practices. This trend is prompting manufacturers and operators in North America to invest in cleaner technologies and explore alternative fuels, aligning with global initiatives to reduce carbon emissions in the aviation sector.

In March 2024, Yingling Aviation, a prominent provider of maintenance, repair, and overhaul (MRO) services, as well as fixed-base operation (FBO) services in the U.S., announced its acquisition of Mid-Continent Aviation Services (MCAS) . MCAS is also a full-service MRO located at Wichita’s Dwight D. Eisenhower National Airport (ICT) . The financial details of the transaction were not disclosed.

Competitive Landscape

The key players operating in the global general aviation market include Bombardier Inc., Dassault Aviation, Embraer, General Dynamics Corporation, Textron Inc., Airbus SE, Cirrus Design Corporation, Honda Motor Co., Ltd., and Leonardo S.p.A. Major manufacturers are striving to increase their general aviation market share through innovative aircraft designs.

Industry Trends

The surge in interest in on-demand air charter services and fractional aircraft ownership models is fueling the expansion of air charter companies and fractional ownership programs, providing greater flexibility and accessibility for travelers.

The increase in demand for pilots, particularly in the commercial and business aviation sectors, drives expansion of pilot training programs, flight schools, and aviation academies to address the growing talent shortage.

Regulatory developments, including changes in airspace management, drone integration, and certification standards, are influencing the development and adoption of new technologies and operational practices in the general aviation industry.

Adoption of digital technologies such as artificial intelligence, data analytics, and predictive maintenance is improving operational efficiency, reducing downtime, and enhancing safety in general aviation operations.

Key Sources Referred

- National Business Aviation Association (NBAA)

- Aircraft Owners and Pilots Association (AOPA)

- General Aviation Manufacturers Association (GAMA)

- Experimental Aircraft Association (EAA)

- Helicopter Association International (HAI)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the general aviation market analysis from 2024 to 2033 to identify the prevailing general aviation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the general aviation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global general aviation market trends, key players, market segments, application areas, and market growth strategies.

General Aviation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 47.1 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Airbus SE, Dassault Aviation, Bombardier Inc., General Dynamics Corporation, Textron Inc., Honda Motor Co., Ltd., Pilatus Aircraft Ltd, Embraer, Leonardo S.p.A, Robinson Helicopter Company Inc, Cirrus Design Corporation |

The key players operating in the global general aviation market include Bombardier Inc., Dassault Aviation, Embraer, General Dynamics Corporation, Textron Inc., Airbus SE, Cirrus Design Corporation, Honda Motor Co., Ltd., and Leonardo S.p.A.

The global general aviation market was valued at $30.7 billion in 2023, and is projected to reach $47.1 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

North America is the largest regional market for General Aviation

Commercial is the leading application of General Aviation Market

Expansion of air taxi and charter services and development of electric and hybrid-electric aircraft are the upcoming trends of General Aviation Market in the globe

Loading Table Of Content...