Glass Mat Market Research, 2032

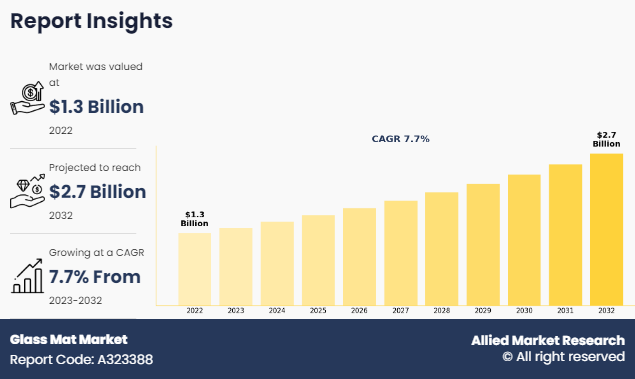

The global glass mat market was valued at $1.3 billion in 2022, and is projected to reach $2.7 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. The global glass mat market is poised for significant growth, primarily driven by its growing usage in the construction sector and increasing adoption of lightweight and fuel-efficient vehicles. Glass mat, also known as fiberglass mat, is a non-woven material made from glass fibers bonded together with a resin binder. It is commonly used in various industries, including construction, automotive, and aerospace, for its strength, durability, and thermal resistance. Glass mat is produced by randomly arranging fine glass fibers into a mat-like structure, then saturating it with a resin to hold the fibers together. This results in a lightweight yet durable material that is ideal for applications requiring high strength-to-weight ratios, such as reinforcing composites, insulation, and soundproofing materials.

Introduction

Glass mat is a non-woven material made from glass fibers, typically used as a reinforcement in various industrial applications. It is produced by bonding glass fibers together with a resin or adhesive, forming a mat-like structure. Glass mats offer excellent mechanical properties, such as high tensile strength, durability, and resistance to heat, moisture, and chemicals. They are commonly used in the manufacturing of composite materials, like fiberglass-reinforced plastics (FRP), roofing materials, and insulation products. In construction, glass mats are used to enhance the strength and durability of wallboards, roof shingles, and other building materials. Their lightweight, flexible, and corrosion-resistant nature makes them an essential component in automotive, marine, and aerospace industries as well.

Key Takeaways:

Quantitative information mentioned in the global glass mat market includes the market numbers in terms of value ($Million) concerning different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

The analysis in the report is provided on the basis of mat type, binder type, manufacturing process, application, End-Use , and region. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

A few companies, including 3B - the fibreglass company, Johns Manville, Owens Corning, PPG Industries Inc., and ÅžiÅŸecam hold a large proportion of the glass mat market.

This report makes it easier for existing market players and new entrants to the glass mat industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics:

Surge in the construction activities drives the glass mat market growth. Glass mat is extensively used in construction for reinforcing purposes, particularly in the production of gypsum wallboards and cement boards. Glass mats give these materials the support they require to increase their durability and structural integrity. According to the World Bank Group, the entire amount of investment commitments, which was $36.4 billion in 2022 across 44 nations, decreased by 7% as compared to the same period in 2022. However, the total count of projects increased from 121 to 161. This increase illustrates a move toward a wider range of infrastructure projects globally.

Furthermore, the expanding infrastructure projects, including roads, bridges, and tunnels, also contribute to the increased demand for glass mat. India's Union Budget 2023–2024 emphasizes the importance of the construction industry and includes substantial funding for its expansion. It generates an increased capital expenditure budget of approximately USD 133 billion, with significant allotments for transportation infrastructure projects, regional airports, and railroads. Infrastructure development often involves the use of composite materials such as glass mat to reinforce concrete structures, providing them with enhanced load-bearing capacity and longevity. Thus, increase in construction activities is expected to boost glass mat market size during the forecast period.

The increase in demand for vehicles that are lightweight and fuel-efficient is expected to drive the glass mat market. In the U.S., regulations mandate that by 2025, the average fuel economy standard must meet 54.5 miles per gallon. Reducing vehicle weight by 10% may yield a 6-8% rise in fuel economy. Lightweight materials that contribute to achieve these objectives without reducing performance or safety have become necessary as manufacturers focus on the development of more ecologically and fuel-efficient automobiles. Glass mat offers excellent strength-to-weight ratio properties, making it an ideal choice for various automotive applications. Glass mats are frequently incorporated into body panels, interior trim, and underbody shields to help automakers reduce the overall weight of their vehicles, that improve fuel efficiency and lower emissions.

Moreover, glass mat provides enhanced structural integrity and durability, contributing to the safety and longevity of vehicles. Governments across the globe have imposed strict rules on vehicle emissions and fuel economy standards, and automakers are under pressure to provide innovative methods to comply with these demands. The use of glass mat in the production of automobiles complies with these regulations as it makes vehicles lighter and increases fuel economy, which in turn reduces carbon emissions and their negative effects on the environment. Thus, surge in demand for lightweight and fuel-efficient vehicles is expected to boost glass mat market share during the forecast period.

However, availability of substitutes restrains the growth of the glass mat industry. One key substitute for glass mats is carbon fiber. The global carbon fiber demand is expected to grow to 150,000 tons and 200,000 tons by 2023 and 2025, respectively, with the wind power blade sector being the primary driver of this expansion. Similar to glass mats, carbon fiber is‐¯used in many similar applications due to its high strength and lightweight nature., particularly in industries where weight reduction is critical, such as aerospace and automotive manufacturing. In addition, carbon fiber possesses excellent corrosion resistance and fatigue properties, further enhancing its appeal as a substitute for certain glass mat applications.

Also, natural fiber composites, such as hemp and flax, have gained traction as environmentally friendly alternatives to traditional glass mats. These natural fibers satisfy the increasing need for sustainable materials across a range of industries by offering comparable strength and stiffness characteristics collectively with the further advantage of being renewable and biodegradable. Thus, the presence of substitutes hinders the growth of the glass mat market.

Rise in the use of filtration systems offers a significant growth opportunity for the glass mat market due to its suitability for filtration applications. This demand is driven by increase in environmental concerns, strict regulations on pollutant discharge, and the growing demand for clean water and air across various industries and households globally. The glass mat market trends show inherent properties such as high porosity, uniformity, and chemical resistance, that makes them ideal for use in filtration systems for air, water, and liquid filtration processes. Strict‐¯restrictions on the discharge of pollutants and rise in‐¯concerns about environmental pollution are driving the need for effective filtration solutions, which is expected to cause an increase in the market for glass mats as filtering media. Thus, rise in usage of filtration systems presents lucrative growth opportunity for the glass mat industry.

Segments Overview:

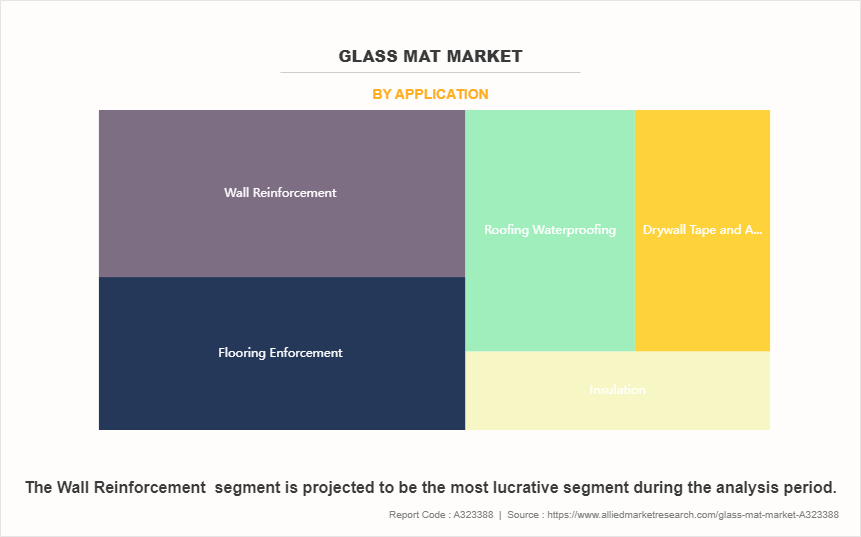

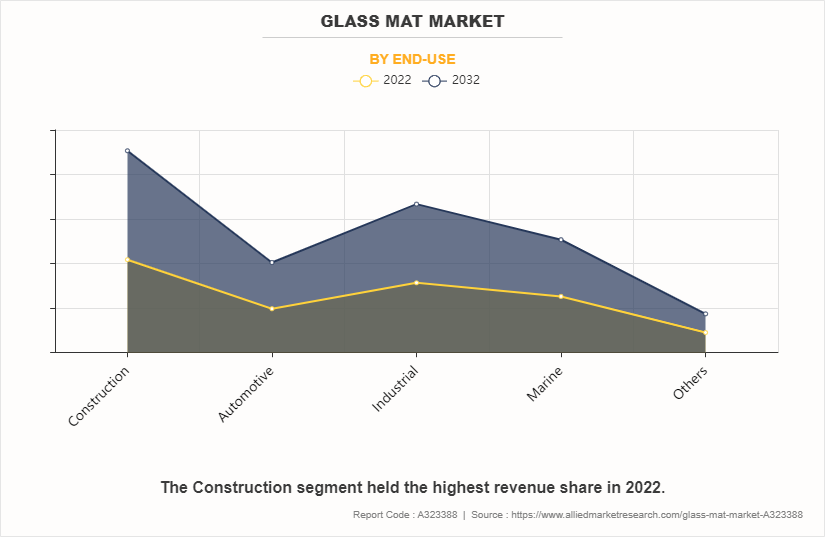

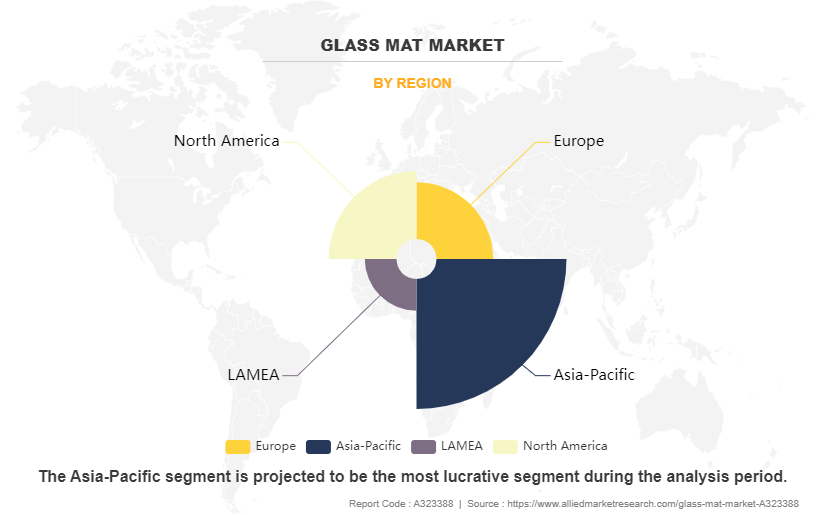

The glass mat market is segmented on the basis of mat type, binder type, manufacturing process, application, End-Use , and region. On the basis of mat type, the market is bifurcated into chopped strand glass mat and continuous filament glass mat. By binder type, the market is divided into powder bonded glass mat and emulsion bonded glass mat. Depending on manufacturing process, the market is classified into wet-laid, dry-laid, and others. On the basis of application, the market is segregated into drywall tape and accessories, flooring enforcement, wall reinforcement, roofing waterproofing, and insulation. By End-Use , the market is classified into construction, automotive, industrial, marine, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

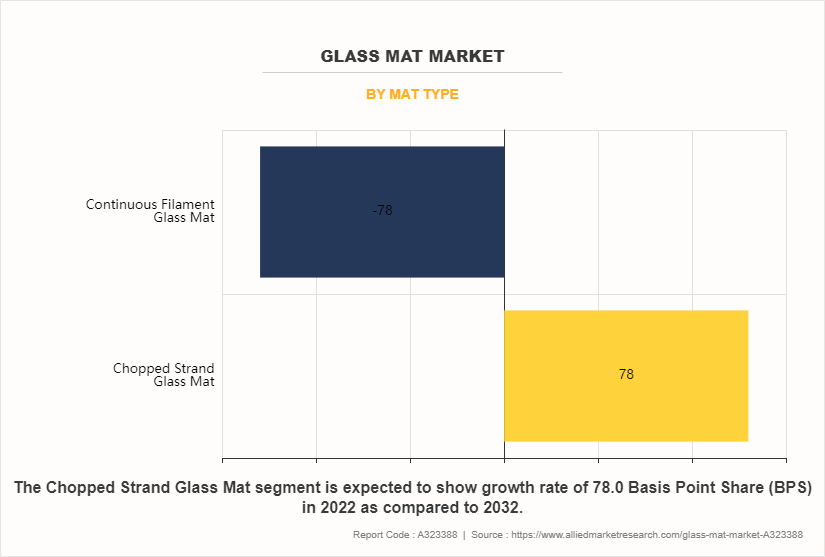

The chopped strand glass mat segment accounted for the largest share in 2022. chopped strand glass mat (CSM) is widely used in the construction industry for reinforcing plastics, composites, and other materials. With the global construction sector experiencing steady growth, especially in emerging economies, the demand for CSM has increased significantly. Furthermore, the automotive industry is increasingly adopting lightweight materials to improve fuel efficiency and reduce emissions. CSM, being lightweight and strong, is utilized in manufacturing components for vehicles, such as bumpers, body panels, and interior parts. The growing automotive market, coupled with the emphasis on lightweighting, has fueled the demand for CSM.

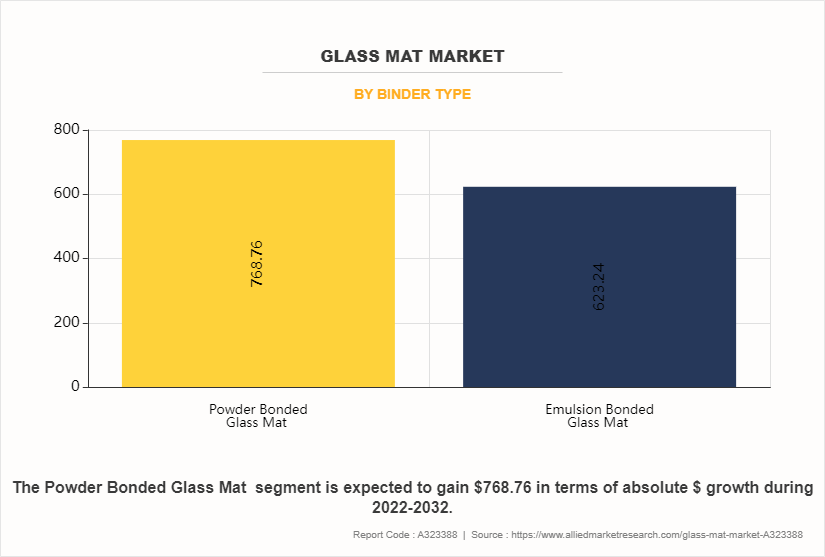

The powder bonded glass mat segment accounted for the largest share in 2022. Powder bonding offers advantages in terms of processing efficiency. Compared to other bonding methods like emulsion or chopped strand mat (CSM) bonding, powder bonding can be faster and more cost-effective, reducing production time and costs. Moreover, powder bonding can result in composites with superior mechanical properties. The powder binder distributes more evenly throughout the glass fibers, leading to better bonding and higher strength in the final composite material. This makes PBM particularly desirable for applications where strength and durability are critical, such as in automotive and aerospace industries.

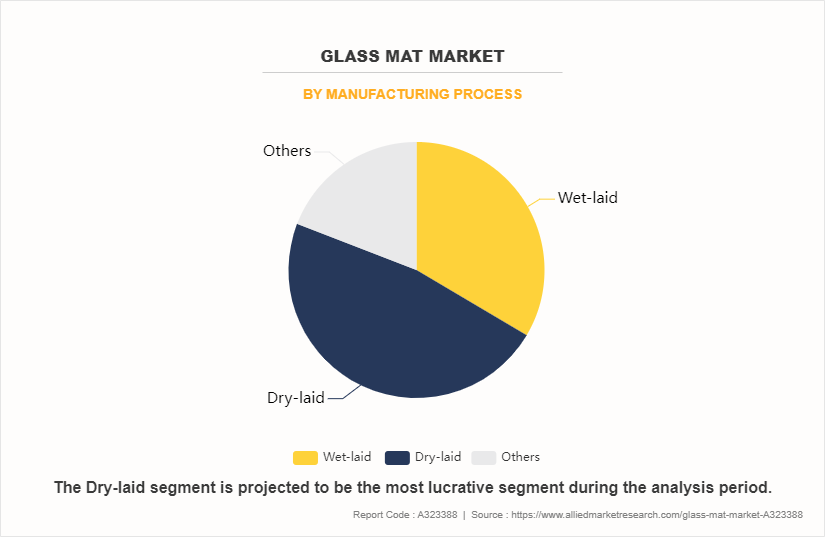

The dry-laid segment accounted for the largest share in 2022. Dry-laid processes typically require fewer resources and lower energy consumption compared to wet-laid processes. This can result in cost savings for manufacturers, making it a more economically viable option. Furthermore, in dry-laid processes, glass fibers are randomly oriented or laid in a specific direction depending on the desired properties of the final product. This allows manufacturers to have greater control over the fiber orientation, which can be critical for achieving the desired strength, stiffness, and other mechanical properties in the finished glass mat.

The wall reinforcement segment accounted for the largest share in 2022. Glass mat offers excellent strength and durability, making it an ideal material for reinforcing walls. It helps prevent cracking, sagging, and other forms of structural damage, thereby extending the lifespan of walls and reducing maintenance costs. Moreover, glass mat is resistant to moisture, mold, mildew, and insects, making it suitable for use in areas prone to water damage, such as bathrooms, kitchens, and basements. It helps protect walls from moisture-related issues and enhances their resilience against environmental factors.

The construction segment accounted for the largest share in 2022. Glass mat offers excellent strength and durability, making it suitable for a wide range of construction applications. It enhances the structural integrity of buildings, bridges, roads, and other infrastructure projects, leading to increased demand from construction companies and contractors. Additionally, glass mat is lightweight yet strong, offering a high strength-to-weight ratio. This makes it particularly desirable for applications where weight reduction is critical, such as in aerospace, automotive, and marine industries, as well as in construction projects where load-bearing capacity is a consideration.

Asia-Pacific garnered the largest share in 2022. The Asia-Pacific region is experiencing rapid urbanization, with a growing population moving to cities. This trend has led to increased demand for residential, commercial, and infrastructure construction, driving the need for materials like glass mat for reinforcement, insulation, and other construction applications. Furthermore, countries in the Asia-Pacific region, such as China, India, and Southeast Asian nations, are undergoing significant construction booms to accommodate urban growth and modernize infrastructure. This includes the construction of residential buildings, commercial complexes, transportation networks, energy facilities, and industrial infrastructure, all of which require materials like glass mat for various construction purposes.

Competitive Analysis:

The major players operating in the global glass mat market are 3B - the fibreglass company, ADFORS, China Jushi Co., Ltd., ENTEK, Gridtential Energy, Inc., Johns Manville, Owens Corning, PPG Industries Inc., ÅžiÅŸecam, and TAIWAN GLASS IND. CORP.

Other players include China Beihai Fiberglass Co., Ltd., Hitech Fibre Glass Mattings (P) Ltd., Jiangsu Changhai Composite Materials Co., Ltd., Jiangsu Jiuding New Materials Co., Ltd, Johns Manville, KROSGLASS S.A., Nippon Electric Glass Co.,Ltd., Nitto Boseki Co., Ltd., RUBY MICA CO. LTD., Superior Huntingdon Composites, LLC, and Total Security Solutions.

Recent Developments in Glass Mat Industry

On February 08, 2023, China Jushi Co., Ltd. invested approximately $820 million to build three glass fiber production lines in stages, including 2 lines each having an annual output of 100,000 tons and 1 line outputting 200,000 tons annually. The new lines will be fully powered by green energy, produced by an additional wind power plant. This expansion is expected to increase the demand for glass mat products, leading to the market growth.

- On December 05, 2022, Owens Corning completed the sale of its operations in the country to Umatex, a Russian manufacturer of carbon fiber and fiber-based products. The transaction includes two manufacturing plants: one in Gous-Khroustalny for composites and another in Tver/Izoplit for insulation. This development is expected to increase the demand for glass mat products, leading to the market growth.

- On April 21, 2022, ENTEK made an investment to increase the manufacturing of absorbent glass mat (AGM) battery separators in India and the U.S. owing to rise in need for energy storage solutions for inverters, industrial uses, and electric vehicles. This expansion is expected to boost the growth of the glass mat market.

Industry Trends:

- The glass mat market is growing steadily due to increasing demand from various sectors like construction, automotive, and aerospace. Governments worldwide are focusing on infrastructure development, which has directly influenced the rise in the use of glass mat-reinforced materials. For instance, the U.S. Census Bureau recorded a 5% increase in construction spending in 2023, boosting demand for durable and lightweight materials like glass mat in roofing, wallboards, and insulation. These materials provide structural reinforcement, making them critical in both new builds and renovation projects.

- The glass Sustainability trends are also playing a pivotal role in shaping the glass mat market. European Union regulations, such as the Energy Performance of Buildings Directive (EPBD), emphasize the use of energy-efficient and environmentally friendly construction materials. This has led to increased demand for glass mat products, which offer superior insulation properties. According to the European Commission, the adoption of eco-friendly building practices grew by 6% in 2022, with glass mat products playing a key role in improving energy efficiency and reducing carbon footprints in buildings.

- In the automotive and aerospace sectors, the use of glass mat is expanding due to its lightweight yet strong characteristics. Governments in regions like China and India are investing heavily in electric vehicle (EV) infrastructure, which is boosting demand for composite materials that enhance fuel efficiency. China's National Bureau of Statistics reported a 7% increase in demand for glass mat in automotive applications in 2023, driven by the shift toward EVs and lightweight materials. These trends are expected to continue fueling market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the glass mat market analysis from 2022 to 2032 to identify the prevailing glass mat market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the glass mat market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global glass mat market trends, key players, market segments, application areas, and market growth strategies.

Glass Mat Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.7 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Mat Type |

|

| By Binder Type |

|

| By Manufacturing Process |

|

| By Application |

|

| By End-use |

|

| By Region |

|

| Key Market Players | China Jushi Co., Ltd., 3B - the fibreglass company, Johns Manville, ADFORS, Entek, TAIWAN GLASS IND. CORP, PPG Industries Inc., Gridtential Energy, Inc., TAIWAN GLASS IND. CORP., Owens Corning |

Analyst Review

According to the insights of the CXOs of leading companies, the global glass mat market is anticipated to experience substantial growth during the forecast period. This growth is attributed to rise in usage of glass mat in the construction sector owing to its excellent strength-to-weight ratio and resistance to moisture, mold, and fire, that makes it an ideal material for reinforcing gypsum boards and insulation panels. In addition, its durability and dimensional stability contribute to its widespread use in applications such as roofing, wallboard, and flooring systems. Furthermore, the increased adoption of lightweight and fuel-efficient vehicles is a significant driver for the market expansion. Glass mat is used in the automobile sector due to its lightweight, high strength, and resistance to corrosion, making it an ideal material for reinforcing plastic composites used in automotive components such as bumpers, interior panels, and underbody shields. Its acoustic insulation properties contribute to reducing noise and vibration within vehicles, enhancing overall comfort and performance.

However, availability of alternative solutions including carbon fibers, synthetic fibers, and natural fibers is restraining the market growth. The CXOs further added that surge in the use of filtration system offers lucrative opportunities for the market growth. Glass mat is used in filtration systems due to its high porosity, uniformity, and chemical resistance, making it an effective filtration media for air, water, and liquid filtration processes.

Currently, polyurethane joint sealants are the most used joint sealants; however, silicone joint sealants are expected to grow in terms of revenue. Similarly, the Asia-Pacific region is expected to grow at a significant rate during the forecast period.

Rapid growth in demand from construction sector, Rise in demand form automotive sector, and renewable energy expansion are the upcoming trends of Glass Mat Market in the world.

Wall reinforcement is the leading application of Glass Mat Market

Asia-Pacific is the largest regional market for Glass Mat

The global glass mat market was valued at $1.3 billion in 2022 and is projected to reach $2.7 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

ADFORS, China Jushi Co., Ltd., ENTEK, Gridtential Energy, Inc., Johns Manville, Owens Corning, PPG Industries Inc., ?i?ecam, and TAIWAN GLASS IND. CORP. Other players include China Beihai Fiberglass Co., Ltd., Hitech Fibre Glass Mattings (P) Ltd., Jiangsu Changhai Composite Materials Co., Ltd., Jiangsu Jiuding New Materials Co., Ltd, Johns Manville, KROSGLASS S.A., Nippon Electric Glass Co.,Ltd., Nitto Boseki Co., Ltd., RUBY MICA CO. LTD., Superior Huntingdon Composites, LLC, and Total Security Solutions.

Loading Table Of Content...

Loading Research Methodology...