Glassware Market Research, 2035

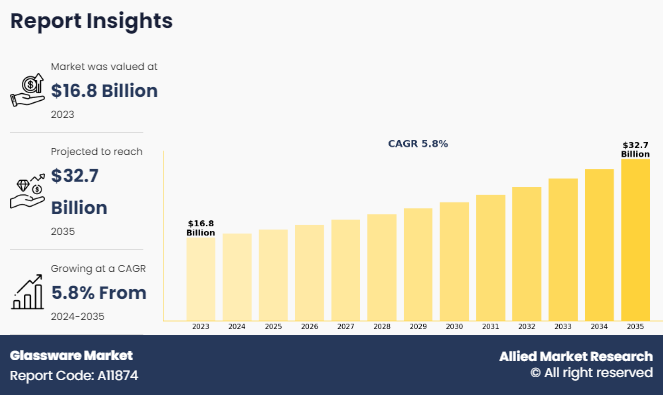

The global glassware market was valued at $16,831.7 million in 2023 and is projected to reach $32,703.9 million by 2035, registering a CAGR of 5.8% from 2024 to 2035. The demand for glassware is driven by several key factors, including lifestyle trends, consumer preferences, and industrial applications. In the consumer sector, the popularity of home entertainment, dining out experiences, and the increasing emphasis on aesthetics in table settings contribute significantly to the demand for glassware.

In addition, the growing awareness of health and environmental concerns favors glassware due to its non-reactive and recyclable nature compared to alternative materials. In the hospitality industry, the rise of fine dining establishments and the expansion of the tourism sector worldwide fuel demand for premium glassware to enhance guest experiences. Moreover, technological advancements in glass manufacturing processes, such as automation and precision engineering, help to produce higher-quality glassware at competitive prices, further stimulating glassware market demand.

Glassware refers to any type of vessel, container, or object made from glass. It includes a wide range of items, including drinking glasses, stemware, vases, bowls, jars, bottles, and laboratory glassware. Glassware is manufactured using various types of glasses, such as soda-lime glass, borosilicate glass, or lead-free crystal, depending on the intended use and desired characteristics. Glassware serves diverse purposes across different industries and settings, including household kitchens, restaurants, bars, laboratories, and manufacturing facilities. It is valued for its transparency, durability, versatility, and aesthetic appeal, making it a popular choice for a multitude of applications in glassware industry.

Key Takeaways of the Glassware Market Report

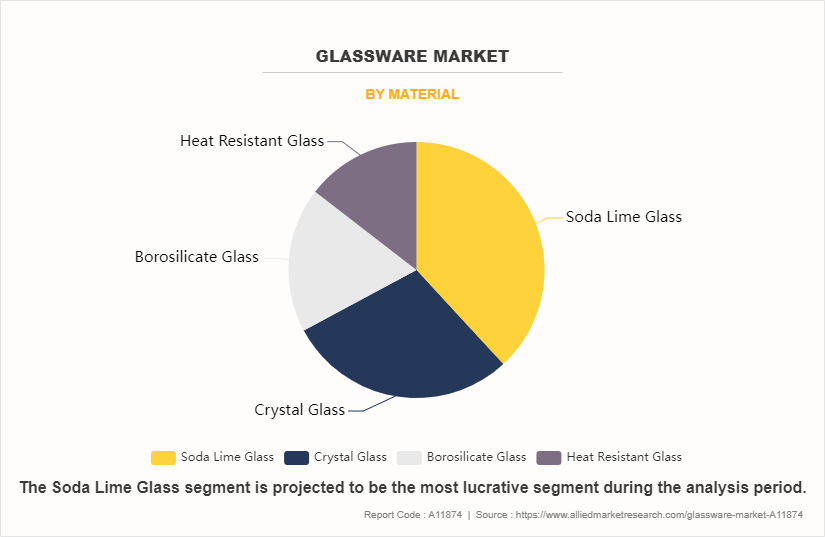

- By material type, the soda lime glass segment was the highest revenue contributor to the market in 2023.

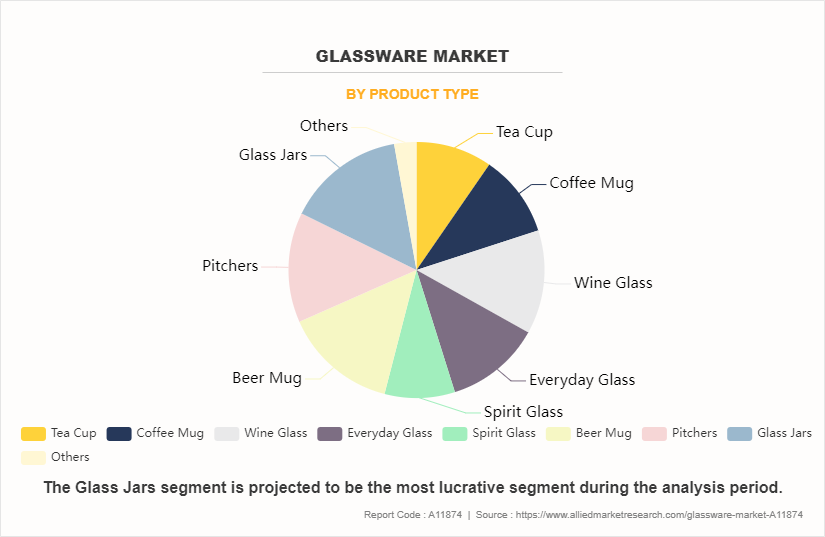

- By product type, the glass jar segment was the highest revenue contributor to the market in 2023.

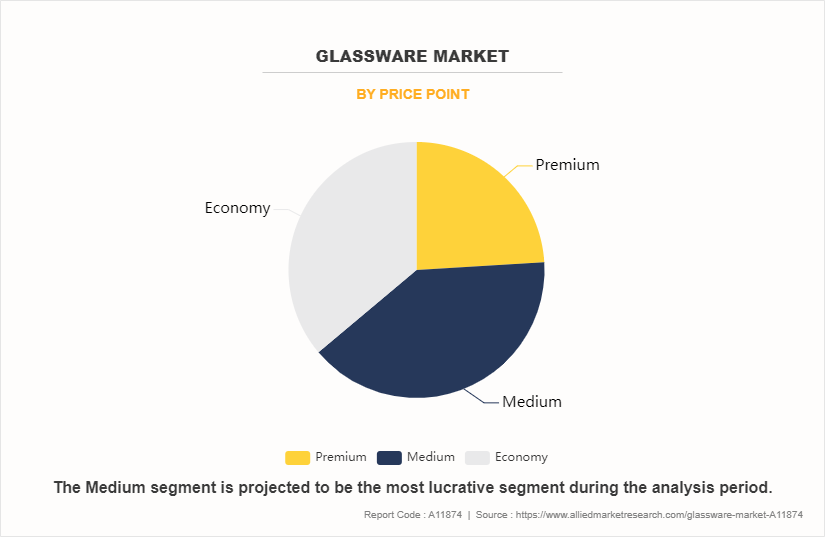

- By price point, the medium segment was the largest segment in the global market during the forecast period.

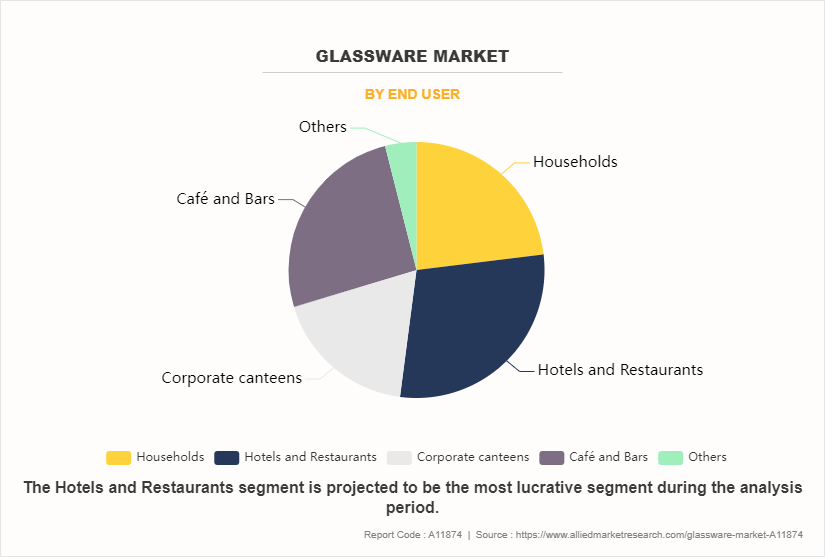

- By end user, the hotels and restaurants segment was the highest revenue contributor in 2023 owing to the desire for new taste experiences.

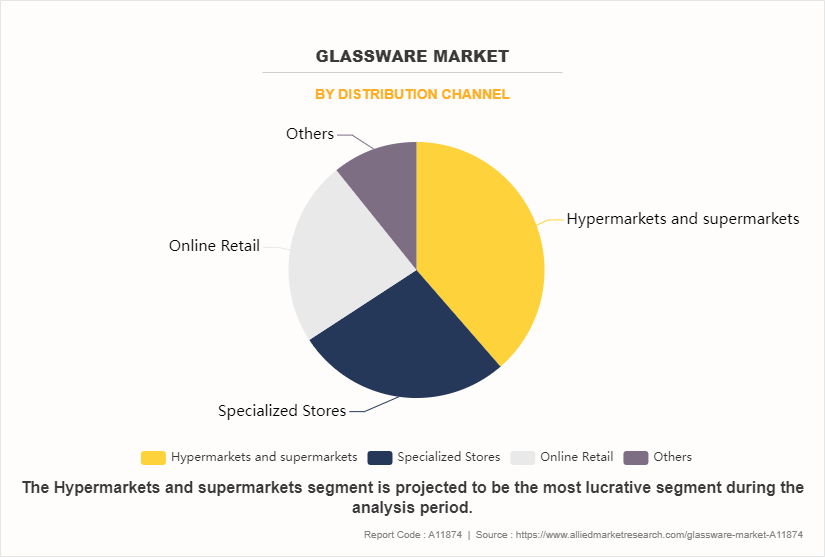

- As per distribution channel, the hypermarkets and supermarkets segment was the largest segment in the global glassware market during the forecast period.

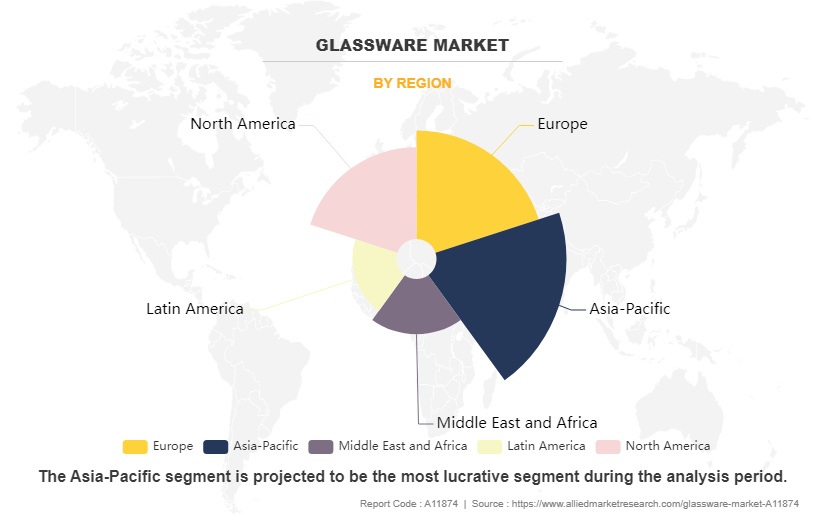

- Region-wise, Asia-Pacific was the highest revenue contributor in 2023 owing to high levels of disposable income and tourism industry.

Market Dynamics

The expansion and investment in the hospitality sector have been instrumental in driving the demand for glassware in recent years. With the global tourism industry experiencing steady growth and the rise of emerging markets, there has been a corresponding increase in the number of hotels, resorts, restaurants, and bars worldwide. As these establishments seek to attract and retain customers in a competitive market, they recognize the importance of offering a superior dining and drinking experience. Glassware plays a crucial role in this endeavor, as it enhances the visual appeal of beverages and contributes to the overall ambiance & presentation of the dining experience.

Furthermore, the rise in the trend of experiential dining has led to a heightened emphasis on aesthetics and attention to detail. Consumers today expect more than just a meal or a drink; they seek immersive experiences that engage all their senses. Premium glassware adds a touch of elegance and sophistication to these experiences, elevating them from ordinary to extraordinary. Consequently, the hospitality industry has been investing in high-quality glassware to meet the evolving demands of their clientele and stay ahead of the competition. This surge in market demand for glassware is expected to continue as the hospitality sector expands further and continues to prioritize the enhancement of customer experiences.

However, the rise in demand for steel and paper-based drinkware restrains the market demand for traditional glassware. As environmental concerns and sustainability considerations gain traction globally, consumers are increasingly seeking alternatives to glass that are perceived as more eco-friendly. Steel and paper-based drinkware offer advantages such as reusability, durability, and biodegradability, aligning with the preferences of environmentally conscious consumers. This shift toward alternative materials has led to a diversion of market demand away from traditional glassware, particularly in sectors where sustainability is a primary concern, such as hospitality and food service industries.

Furthermore, advancements in manufacturing technologies have led to the development of innovative steel and paper-based drinkware that rivals the aesthetic appeal and functionality of glassware. Steel tumblers and insulated cups, for instance, offer superior durability and thermal insulation properties compared to traditional glassware, making them popular choices for both indoor and outdoor use. Similarly, paper-based cups and containers have gained traction in the beverage industry due to their lightweight, recyclable nature, and customizable designs. As these alternative materials continue to gain market share, the demand for glassware faces surge in competition, posing challenges for glassware manufacturers to differentiate their products and adapt to evolving consumer preferences and market dynamics for glassware market forecast.

In addition, technical innovation in the glass industry has generated significant opportunities in the glassware market growth. Advancements in glass manufacturing processes, such as automation and precision engineering, have led to improvements in quality, efficiency, and cost-effectiveness. These innovations enable glassware manufacturers to produce a wider range of products with enhanced durability, clarity, and design flexibility, catering to diverse consumer preferences and market segments. In addition, innovations in glass composition and treatment techniques have resulted in the development of specialized glassware for various applications, such as tempered glassware for increased resistance to thermal shock and impact, or lead-free crystal glassware for superior clarity and brilliance.

Moreover, technological advancements have opened up new avenues for creativity and product differentiation in the market. Customization options, such as personalized engravings or unique shapes and textures, allow manufacturers to offer bespoke solutions tailored to the specific needs and preferences of their customers with glassware market statistics. In addition, advancements in digital printing and decoration techniques enable intricate design and branding opportunities, enhancing the aesthetic appeal of glassware market share. As consumer demand for premium and customizable products continues to grow, technical innovation in the glass industry provides glassware manufacturers with the tools and capabilities to capitalize on these trends and drive market expansion with glassware market size.

Segmental Overview

The glassware market is segmented on the basis of material, product type, price point, end user, distribution channel, and region. By material, the market is categorized into soda lime glass, crystal glass, borosilicate glass, and heat resistant glass. By product type, the market is classified into teacup, coffee mug, wine glass, everyday glass, spirit glass, beer mug, pitchers, glass jars, and others. By price point, the market is divided into premium, medium, and economy. By end user, the market is segregated into households, hotels & restaurants, corporate canteens, café & bars, and others. By distribution channel, the market is fragmented into hypermarkets and supermarkets, specialized stores, online retail, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Material

By material, the soda lime glass segment dominated the global market in 2023 and is expected to register the highest CAGR of 5.5% during the forecast period, owing to its widespread use and versatility. Soda lime glass, composed of silica, soda ash, and lime, is the most common type of glass used in glassware production due to its cost-effectiveness and ease of manufacturing. This type of glass is suitable for a wide range of applications, including drinking glasses, tableware, kitchenware, and decorative items, making it highly sought after by consumers and industries alike.

By Product type

By product type, the glass jar segment dominated the global market in 2023 and is expected to register the highest CAGR of 5.9% during the forecast period, owing to several advantages including transparency, which allows consumers to easily view the contents, as well as impermeability to moisture and gases, ensuring product freshness and longevity. Glass jars are favored for their eco-friendliness, being reusable, recyclable, and inert, making them a preferred choice for consumers seeking sustainable packaging solutions.

By Price Point

By Price point, the medium segment dominated the global market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 6.0% during the forecast period. This segment includes products such as everyday drinking glasses, basic kitchenware, and standard storage containers, which are priced competitively while still maintaining decent quality and functionality. Consumers often gravitate toward medium-priced glassware as it offers good value for money, meeting their basic needs without breaking the bank. In addition, the medium segment benefits from its versatility, appealing to a broad spectrum of consumers across various demographics and geographic regions, thereby solidifying its dominance in the global market by price point.

By End User

By end user, the hotels and restaurants segment dominated the global glassware market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 5.6% during the forecast period. The hospitality industry has a constant demand for glassware to serve beverages and food in hotels, restaurants, bars, and catering establishments. These businesses require a large volume of glassware to accommodate their daily operations and serve their customers effectively. In addition, hotels and restaurants often prioritize quality and presentation, opting for premium glassware to enhance the dining experience and elevate their brand image.

By Distribution Channel

By distribution channel, the hypermarkets and supermarkets segment dominated the global glassware market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 5.7% during the forecast period. Hypermarkets and supermarkets offer a wide variety of glassware options under one roof, making it convenient for consumers to browse and compare different products before making a purchase. In addition, these retail outlets often leverage their purchasing power to negotiate favorable deals with glassware manufacturers, allowing them to offer competitive prices to consumers. Furthermore, hypermarkets and supermarkets invest in marketing and promotional activities to showcase glassware products, driving consumer awareness and demand.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest glassware market share during the forecast period. The region's rapidly growing population and urbanization have led to an increase in consumer spending on household items, including glassware. Rise in disposable incomes in countries such as China, India, and Southeast Asian nations have fueled demand for premium and luxury glassware products, driving market growth. In addition, the flourishing hospitality industry in Asia-Pacific, with surge in number of hotels, restaurants, and catering services, further contributes to the demand for glassware for dining and entertaining purposes.

Competitive Analysis

Several well-known and upcoming brands are competing for market dominance in the expanding glassware industry. Smaller, niche firms have become more well-known for catering to consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Companies that influence the preferences of their considered audience and coordinate with their ethical and environmental principles hold a competitive edge against competitors.

Recent Developments in Glassware Market

In August 2023, Borosil Limited announced the setting up of Borosilicate 3.3 expansion tubing furnace at the Company's plant in Bharuch, Gujarat.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the glassware market analysis from 2023 to 2035 to identify the prevailing glassware market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the glassware market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global glassware market trends, key players, market segments, application areas, and market growth strategies.

Glassware Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 295 |

| By Material |

|

| By Product Type |

|

| By Price Point |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Zrike Brands, Sisecam, Lenox Corporation, Shandong Huapeng Glass Co., Ltd., Garbo Glassware, Lifetime Brands, Inc, Glass Tech Life, Guangzhou Jing Huang Glassware Co,Ltd, Borosil Limited, Anchor Hocking Group, Inc, Arc Online, Ocean Glass Public Company Limited, Anhui Deli daily Glass Co., Ltd, Degrenne, Taiwan Glass Industry Corporation, Villeroy & Boch AG, Libbey Glass LLC, Steelite International |

Analyst Review

According to insights from CXOs of leading companies, the glassware market presents significant opportunities for growth, with its contribution to the global market projected to notably increase during the forecast period. Glassware exhibits versatility, finding applications in various sectors such as hotels, restaurants, corporate canteens, cafes, and bars. Recent advancements and developments in glassware production are anticipated to unlock new opportunities in this rapidly growing industry. However, multiple competitors are present in the market, launching innovative designs, cost-effective solutions, and durable products.

Moreover, the rise in investment in the food service industry and its expansion further support the prospects for glassware manufacturers in the coming years. These investments are expected to stimulate demand for glassware products, driven by the need for high-quality and aesthetically pleasing tableware in food establishments. As the market continues to evolve and consumer preferences shift toward premium and sustainable options, glassware manufacturers have an opportunity to capitalize on these trends and solidify their position in the market through innovation and strategic partnerships.

The global glassware market was valued at $16,831.7 million in 2023 and is projected to reach $32,703.9million by 2035, registering a CAGR of 5.8% from 2023 to 2035.

The forecast period in the glassware market report is 2024 to 2035.

The base year calculated in the glassware market report is 2023.

The top companies analyzed for global glassware market report are Anchor Hocking Group, Inc, Anhui Deli daily Glass Co., Ltd, Arc Online, Borosil Limited, Degrenne, Garbo Glassware, Glass Tech Life, Guangzhou Jing Huang Glassware Co,Ltd, Lenox Corporation, Libbey Glass LLC, Lifetime Brands, Inc, Ocean Glass Public Company Limited, Shandong Huapeng Glass Co., Ltd., Sisecam, Steelite International, Taiwan Glass Industry Corporation, Villeroy & Boch AG, and Zrike Brands.

Glass Jar segment is the most influential segment in the glassware market report.

Asia-Pacific holds the maximum market share of the glassware market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the glassware market in 2023 was $16,831.7 million.

Loading Table Of Content...

Loading Research Methodology...