Glutamic Acid Market Research – 2030

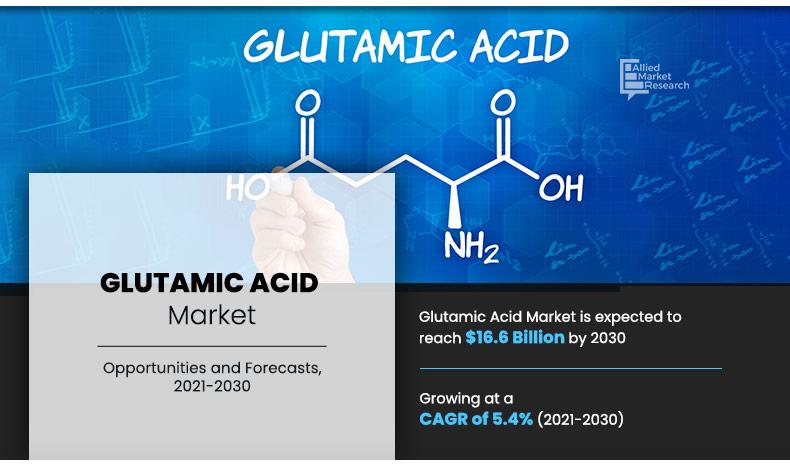

The global glutamic acid market size was valued at $9.9 billion in 2020, and is projected to reach $16.6 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030. Glutamic acid is widely used as a flavor enhancer, especially in the form of monosodium glutamate (MSG), in the food industry. The growing processed food sector and rise in demand for savory foods increase the need for glutamic acid, thus driving the market growth.

Introduction

Glutamic acid is one of the most important amino acids for the synthesis of proteins. The key raw materials used to produce glutamic acid include sugarcane molasses, coryneform bacteria and glucose. Glutamic acid is produced by fermentation process using this raw material. The fermentation process involves various stages that include fermentation, centrifugation, carbon adsorption, evaporation, crystallization, and ion exchange. The manufacturing process is very popular among manufacturers owing to the high quality and purity of glutamic acid obtained through the process. However, the fermentation process requires high capital investment and requires high amounts of water and energy.

Glutamic acid is present in the highest concentrations in muscle, spinal fluid, brain and blood plasma as well as in all protein-rich foods such as meats, soy proteins, eggs, and cereals. It is essential for the digestive system, immunological system, neurological system, and the synthesis of energy in the body. In addition, glutamic acid aids muscular growth and is hence commonly found in supplements used by sportsmen and bodybuilders. Furthermore, it also helps with detoxifying and controlling acid balance. Moreover, it is necessary for skin tightening and the production of new skin cells.

Glutamic acid is also used as a flavor enhancer in the food industry. Increased demand for packaged food as well as increased use of food additives and enhancers in the food and beverage industry, are raising glutamic acid demand. The demand for glutamic acid in the food sector has increased as people become more aware of the importance of eating healthy foods. Furthermore, glutamic acid consumption will be boosted by rising demand from the pharmaceutical industry. Glutamic acid is commonly used to treat disorders such as muscular dystrophy, epilepsy, neurotransmission abnormalities, and cognitive and behavioral issues in people. Favorable government policies to assist the pharmaceutical business, together with increased government investment in the industry, are expected to propel the pharmaceutical industry, which in turn is expected to boost the glutamic acid demand in coming years.

Key Takeaways

The glutamic acid market study covers 20 countries. The research includes a segment analysis of each country in terms of both value and volume (kilotons) for the projected period.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global glutamic acid markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the glutamic acid market.

The glutamic acid market is highly fragmented, with several players including Amino GmbH, Ajinomoto co, Evonik industries, Fufeng group, Haihang industry, Hefei TNJ chemicals, Kyowa hakko, Medinex, Sichuan Tongsheng amino acid, and Wuhan amino acid. Key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the glutamic acid market are also included in the report.

Market Dynamics

Rise in focus on health and wellness has increased the demand for glutamic acid-based supplements, which is expected to drive the growth of glutamic acid market during the forecast period. The growing nutraceutical industry has significantly influenced the demand for glutamic acid-based supplements. As consumers become more health-conscious and prioritize wellness, the focus on products that support bodily functions, including amino acids, has intensified. Glutamic acid, recognized as a key amino acid involved in protein synthesis and various metabolic processes, has gained prominence. It plays a crucial role in the formation of proteins and serves as a building block for other amino acids, making it essential for muscle growth, tissue repair, and overall cellular function.

The nutraceutical industry's growth is further propelled by a shift toward preventive healthcare. Consumers are increasingly opting for natural and bio-based supplements, which include amino acids like glutamic acid, to maintain health and prevent chronic conditions. This has opened new opportunities for manufacturers to develop innovative, glutamic acid-infused products, ranging from dietary supplements to functional foods, thus meeting the rising demand for health-enhancing ingredients. In September 2022, Abbott introduced a new Ensure formulation featuring HMB (hydroxy-methyl butyrate). This science-backed nutritional supplement is designed to enhance muscle and bone strength. The updated Ensure formula includes 32 essential nutrients, such as protein, calcium, and vitamin D, and incorporates HMB, a key ingredient that helps combat muscle loss while boosting strength and power.

However, availability of alternative flavor enhancers and amino acids is expected to restrain the growth of the glutamic acid market during the forecast period. Availability of alternative ingredients, particularly flavor enhancers and amino acids, has created challenges for the widespread use of glutamic acid in certain industrial applications. In the food and beverage industry, where glutamic acid is most commonly used as a flavor enhancer, several alternatives have emerged that can mimic its umami taste. Substitutes such as yeast extracts, hydrolyzed vegetable proteins, and artificial flavor enhancers often provide similar flavor profiles while being perceived as more natural or less controversial than monosodium glutamate (MSG), the sodium salt of glutamic acid. These alternatives appeal to health-conscious consumers and industries looking to avoid the negative perceptions associated with MSG, which has faced scrutiny over potential health impacts. In addition to flavor enhancers, other amino acids are being used in various industrial applications where glutamic acid was once dominant. For instance, amino acids such as lysine, methionine, and tryptophan, which are vital in animal feed and supplements, can compete with glutamic acid depending on the specific nutritional needs of livestock or humans. The presence of these alternatives can limit the growth of glutamic acid in certain sectors, especially where cost-effectiveness, specialized nutritional needs, or alternative functionality is prioritized.

Segments Overview

The glutamic acid market is segmented on the basis of end-use industry and region. By end-use industry, the market is categorized into pharmaceutical, cosmetics & personal care, food industry, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Glutamic Acid Market, by End Use Industry

By End Use Industry

Food Industry holds a dominant position in 2020 and pharmaceutical industry is projected as the most lucrative segment.

The food industry accounted for the largest share in 2020 and the pharmaceutical industry is expected to be the fastest growing segment at 5.8% CAGR during the forecast period, in terms of revenue. This is attributed to increase in use of glutamic acids as food additives in the food industry. In addition, the rise in pharmaceutical industry and increased demand for glutamic acid for the treatment of epilepsy, ulcers, mental retardation, and muscular dystrophy. In processed foods, glutamic acid is frequently used in products such as soups, snacks, sauces, frozen meals, and instant noodles. It plays a vital role in balancing and boosting the taste profile of these items without overpowering the natural flavors. In addition, glutamic acid helps reduce the need for excessive salt in recipes, making it popular in health-conscious food formulations. Because of its widespread use, MSG is subject to regulatory oversight in many countries, and while it has been declared safe by food authorities, its usage must be clearly labeled in food products.

Glutamic Acid Market, by Region

By Region

Asia-Pacific holds a dominant position in 2020 and is expected to grow at fastest growth rate during the forecast period.

Region-wise, North America dominated the glutamic acid market in 2020 representing the CAGR of 4.9% during the forecast period. The Asia-Pacific is the fastest growing region expected to grow at the highest CAGR of 5.9%, in terms of both volume and value. The Asia-Pacific region is home to several of the world’s largest food manufacturing hubs, and glutamic acid is primarily recognized for its use in the production of monosodium glutamate (MSG). MSG is a popular food additive, especially in East Asian cuisines, where it enhances the umami flavor. Countries such as China, Japan, and South Korea are significant consumers of MSG, and by extension, glutamic acid, due to its role as a key ingredient in various seasonings, processed foods, and snack items.

Competitive Analysis

The major players operating in the global glutamic acid market include Amino GmbH, Ajinomoto co, Evonik industries, Fufeng group, Haihang industry, Hefei TNJ chemicals, Kyowa hakko, Medinex, Sichuan Tongsheng amino acid, and Wuhan amino acid.

Other players operating in the glutamic acid market are Avenit AG, Suzhou Yuanfang Chemical Co. Ltd., Luojiang Chenming Biological Products Co., Ajinomoto Health & Nutrition North America, Inc., IRIS BIOTECH GMBH, Global Bio-chem Technology Group Company Limited, and Akzo Nobel N.V.

Historic Trends of Glutamic Acid Market

In 1908, Japanese chemist Kikunae Ikeda discovered that glutamic acid is responsible for the "umami" taste, which he identified as the fifth basic taste (alongside sweet, sour, salty, and bitter). He extracted monosodium glutamate (MSG) from seaweed, which enhances savory flavors in food.

In 1920, the production of monosodium glutamate (MSG), derived from glutamic acid, began to evolve significantly. The growing demand for flavor enhancers in food led to efforts to refine and scale up the production process. Initially, MSG was produced by hydrolyzing proteins such as wheat gluten or casein (from milk), which are rich in glutamic acid. However, this method was costly and inefficient.

In 1992, monosodium glutamate (MSG) was reaffirmed by the U.S. Food and Drug Administration (FDA) as being "Generally Recognized as Safe" (GRAS). This status means that MSG, like many other common food additives, is considered safe for use in food products under conditions that are generally recognized by experts as safe, based on a long history of common use in food or on scientific evidence.

Key Benefits For Stakeholders

- The report provides in-depth analysis of the market along with the current glutamic acid market trends and future estimations.

- The glutamic acid market size is provided in terms of volume and revenue.

- This report highlights the key drivers, market opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the glutamic acid market forecast.

- The qualitative data about market dynamics, market trends, and developments is provided in the glutamic acid marketreport.

Glutamic Acid Market Report Highlights

| Aspects | Details |

| By END-USE INDUSTRY |

|

| By Region |

|

| Key Market Players | Haihang Industry, Evonik Industries AG, Hefei TNJ Chemical Industry Co., Ltd, Medinex, KYOWA HAKKO BIO CO.,LTD ., Wuhan Amino Acid Bio-Chemical Co., Ltd, Sichuan Tongsheng Amino acid Co., Ltd, AMINO GmbH, Ajinomoto Co., Inc., FUFENG GROUP |

Analyst Review

According to the perspective of the CXOs of leading companies, increased demand from end-use industries, continuous growth in demand for healthy and nutritional food, and extensive investments in R&D in the pharmaceutical industry leads to the development of new pharmaceutical products, which are expected to propel the glutamic acid market forward during the forecast period. Glutamic acid is primarily utilized as a flavor enhancer and food additive in the food industry. Over the forecast period, the total demand for glutamic acid is expected to be driven by a shift in the use of processed food and a growing customer desire for healthier food products. Glutamic acid is also employed in a variety of end-use industries, including pharmaceuticals, cosmetics, agriculture, and chemicals. The glutamic acid market is being driven by increased demand from these above mentioned end-use industries.

However, harmful effect associated with the usage of glutamic acid can have a restraining effect on the growth of the market. Furthermore, the growth of the worldwide glutamic acid market may be impeded by fluctuating raw material prices and the government's harsh laws against chemical firms. Furthermore, during the forecast period from 2021 to 2030, shifting consumer preferences for natural food additives, as well as rising health concerns, are projected to create new opportunities for the glutamic acid market

Increased demand from pharmaceutical and cosmetic industry in the primary factor boosting the glutamic acid market growth.

The glutamic acid market was valued at $9.8 billion in 2020, and is projected to reach $16.6 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030.

AMINO GmbH Ajinomoto Co., Inc. Evonik industries Fufeng group

Pharmaceutical industry is projected to increased demand for glutamic acid market owing to high government spending on pharmaceutical industry and increased demand during COVID-19 pandemic.

By end-use industry Pharmaceutical Cosmetic and Personal Care Food industry Other

Increasing usage of natural food additives in the food industry is the main driver of glutamic acid market.

Application of glutamic acid like food additive and flavor enhancer is expected to drive the adoption of glutamic acid.

COVID-19 pandemic is going to positively impact glutamic acid market in 2021 owing to the increased demand for pharmaceuticals and packaged food due to COVID-19 pandemic.

Loading Table Of Content...