The global government and education logistics market size was valued at $406.2 billion in 2021, and is projected to reach $917.4 billion by 2031, growing at a CAGR of 8.3% from 2022 to 2031.

Logistics is defined as the process to control, execute, and plan the movement of material, capital, and service. These services consist of activities such as material handling, packaging, transportation, inventory, security, and warehousing, which can be scaled according to customer needs and market conditions. Logistics service providers are responsible for the delivery of materials or goods from manufacturers to consumers. The government logistics industry market comprises military logistics, aid & relief logistics, public utilities logistics, and government inbound logistics, outbound logistics, and other logistics services. Education logistics refers to the movement, provision, and delivery of the supplies required by educational institutions to provide students with more effective learning opportunities. The distribution of educational resources in a secure environment without compromising their integrity is one of the logistics services provided.

There is a need for logistics in education to transport educational resources from urban centers to isolated farms and village schools in rural locations. This covers the province-wide dissemination of learner-teacher support materials (LTSM). This includes everything from textbooks and stationery to whiteboards. Additionally, it aids in the distribution of exam papers to the Free State and basic education departments. It collects exam papers from highly secure printers and delivers them in the proper order as needed to education authorities, who then see to it that the exam papers are delivered to the schools in the end. These needs for transportation and logistics for the management of educational materials are expected to drive the growth of the market during the forecast period.

In addition, transport companies operating in the market are incorporating new warehousing services in various countries which are propelling the market growth for the storage & warehousing segment. Penetration of fully automated warehousing distribution systems is extremely less, which is expected to provide a remarkable growth opportunity for the key players operating in the government and education logistics market.

The demand for logistic distribution is mainly driven by the higher demand for materials and services across government sectors such as military, healthcare, and public utilities. Increasing emergency pharmaceutical services is expected to drive the growth of the government and education logistics market in the healthcare sector. Also, the demand for procuring military materials and transporting them over to military bases for installation is a growth factor for the logistics market in the military industry. Moreover, to remain competitive, aerospace companies are choosing to work with logistics providers to provide them with a more agile supply chain to quickly adapt to the demand of the market and seamlessly move government cargo across borders. In addition, the continuous growth in the public utility sectors, such as telephone services, electricity services, and other public services, is expected to surge the demand for logistics services, thereby propelling the growth of the government and education logistics distribution sector.

Surging demand for a rise in free trade agreements between nations, growth in international trade, a rise of tech-driven logistics services and the growing adoption of IoT-enabled connected devices, and an increase in the demand for logistics services in public utilities are the major factors that propel the government and education logistics market growth. However, poor infrastructure and higher logistics costs, and the growing number of cargo thefts are the major factors that hamper the growth of the market. Furthermore, cost cutting and lead time reduced by adopting multimodal systems, and new government policies are the factors expected to offer growth opportunities during the forecast period.

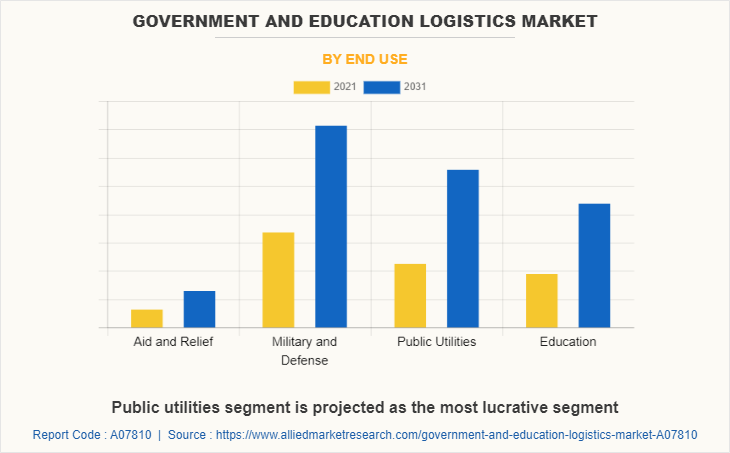

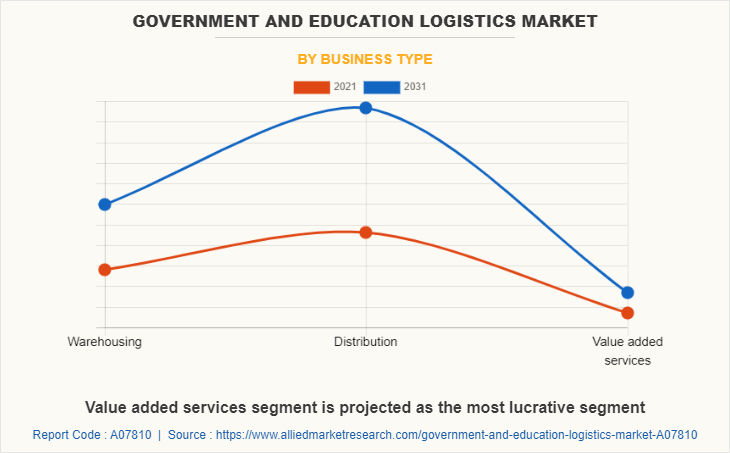

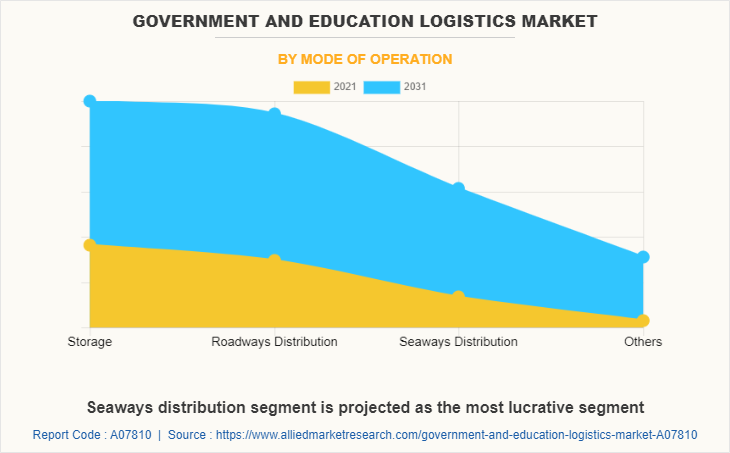

The government and education logistics market segmentation is based on end use, business type, mode of operation, and region. By end use, it is divided into aid and relief, military and defense, public utilities, education, and others. By business type, it is classified into warehousing, distribution, and value-added services. By mode of operation, it is categorized into storage, roadways distribution, seaways distribution, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Investments by governments in the logistics and transportation sector, advanced transportation infrastructure in Europe, strong demand for healthcare logistics, and new logistics start-ups with innovative solutions are factors that are expected to drive the growth of the government and education logistics market during the forecast period across Europe. In addition, Strong demand for healthcare logistics, new logistics start-ups with innovative solutions, and advanced transportation infrastructure are factors that are expected to propel the market growth across the region. For instance, in January 2020, Germany’s Federal Government and Deutsche Bahn (DB), a German railway company, signed an agreement of approximately $105 (€86) billion for the maintenance and modernization of the existing rail network in Germany to strengthen transportation infrastructure.

Some leading companies profiled in the government and education logistics market report comprise Agility, AIT Worldwide Logistics, Inc., ARC Worldwide Limited, Atlantic Logistics, DB Schenker, Deutsche Post DHL Group, DSV, PLS Logistics, Scan Global Logistics A/S, SEKO Logistics, and Vetcom Logistics.

The leading companies are adopting strategies such as product launch and contract to strengthen their market position. In March 2020, Agility Defense & Government Services (DGS) signed a contract with the U.S. Army to manage the movement of troops, equipment, and related material throughout Europe. The contract is intended to help meet the requirements of the growing presence of the North Atlantic Treaty Organization (NATO) forces in Europe. Agility DGS is one of six companies positioned to provide transportation services for U.S. Army.

A rise in free trade agreements between nations

A free trade agreement (FTA) is an agreement between two or more countries under which countries agree on certain terms & conditions that affect trade in goods and services. The signing of free trade agreements facilitates better trade between two parties and results in a rise in import–export activities, which boosts the development of the entire logistics ecosystem. Reduction or elimination of tariffs, intellectual property protection, and fair treatment of investors are some of the important advantages of free trade agreements. In addition, the U.S. currently has 14 free trade agreements with 20 countries in force. For the U.S., the main aim of the trade agreement is to reduce barriers to the U.S. exports, protect U.S. interests from competing abroad, and enhance rule of law in the FTA partner country or countries.

Similarly, in Asia-Pacific, China, Singapore, and India have 47, 44, and 44 FTAs, respectively, which offer lucrative opportunities for logistics to thrive and support the economy of the nations. Moreover, in January 2022, The Regional Comprehensive Economic Partnership (RCEP) Agreement enters into force for Australia, Brunei Darussalam, Cambodia, China, Japan, Lao PDR, New Zealand, Singapore, Thailand and Viet Nam, paving the way for the creation of the world’s largest free trade area.

The Regional Comprehensive Economic Partnership (RCEP) includes 15 East Asian and Pacific nations of different economic sizes. The RCEP will become the largest trade agreement in the world as measured by the GDP of its members; will eliminate 90% of tariffs among 15 East Asian and Pacific countries; and is expected to boost intraregional exports by $42 billion. Thus, such types of free trade agreements are expected to increase the import and export activities, which in turn will drive the growth of the market during the forecast period.

Rise of tech-driven logistics services and the growing adoption of IoT-enabled connected devices

Increasing penetration of the internet of things (IoT) in the logistics sector enables freight companies and consumers to have direct access to the company network via the internet. The logistics infrastructure is constantly upgraded to meet the need. Increasing use of artificial intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth coupled with other newly introduced technologies, such as drone delivery and driverless vehicles, is being witnessed in logistics services. These growing technological advancements act as the catalyst to the growth of the government and education logistics market size. In addition, some logistics companies across the world are increasing their spending and using technologically advanced systems for logistics enhancement, which are further expected to propel the growth of the market. For instance, SimpliRoute, an urban logistics solution, raised $3 million in funding to improve its AI-powered logistics platform. The new funding will help the startup to grow its logistics intelligence platform and expand to other countries besides Mexico, Chile, Peru, and Uruguay. In addition, AT&T provides Internet of Things (IoT) solutions for Honeywell’s transport and logistics offerings internationally in countries across Europe, North America, Latin America, Asia, Africa, and Australia.

Poor infrastructure and higher logistics costs

Logistics demands good infrastructure, supply chain, and trade facilitation. Without these, firms must build more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, the lack of infrastructure hinders the government and education logistics market as it increases costs and reduces supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the region’s roads are unpaved. Further, inconsistency in the address and postal system is the other challenge for parcel delivery in Latin American countries. As many countries lack postal codes and rely on local landmarks for addresses, shipping companies often have trouble delivering parcels successfully. Moreover, logistics costs are heavily determined by the availability and quality of infrastructure. Infrastructure directly influences transport costs and indirectly affects the level of inventories, and consequently financial costs.

Thus, owing to poor transport infrastructure, firms need to have high levels of inventories to account for contingencies, which can result in higher overall logistics costs. Therefore, poor infrastructure along with high inventory prices and insufficient warehousing space is expected to hamper the government and education logistics market growth.

Cost cutting and lead time reduced by adopting multimodal systems

Reduction in the cost of transportation and timely delivery of goods poses a challenge to logistics service providers to increase profitability. The number of orders to be delivered in a limited time is rising, as a result of which logistics companies have the opportunity to use multi-modal transportation systems to increase the efficiency of the supply chain. The advantage of multimodal transport is that it uses the most efficient combination of transport modes, keeping transportation costs down. For instance, APL Logistics provides ShipMax solutions to its customers. It includes pairing with compatible trucking partners as well as allowing customers to take advantage of better load utilization and delivery optimization, thus enabling customers to maximize their transportation budget. Therefore, cost-cutting and lead time reduction by adopting a multi-modal system pose exponential growth opportunities for the key players operating in the logistics market. For instance, in December 2020, the Union Cabinet of the Indian Government launched the Multi-Modal Logistics Hub & Multi-Modal Transport Hub (MMTH) at Greater Noida to focus on the MMT infrastructure in the country.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the government and education logistics market analysis from 2021 to 2031 to identify the prevailing government and education logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the government and education logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global government and education logistics market trends, key players, market segments, application areas, and market growth strategies.

Government and Education Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 917.4 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By End Use |

|

| By Business Type |

|

| By Mode of Operation |

|

| By Region |

|

| Key Market Players | Deutsche Post DHL Group, PLS Logistics, SEKO Logistics, Arc Worldwide Limited, AIT Worldwide Logistics, Inc, Atlantic Logistics, VETCOM LOGISTICS, db schenker, Scan Global Logistics A/S, Agility, DSV |

Analyst Review

The government and education logistics market is expected to witness remarkable growth in the future, owing to a rise in free trade agreements between nations. The key factor that drives the growth of the market is the rise of tech-driven logistics services and the growth in adoption of IoT-enabled connected devices, an increase in demand for logistics services in public utilities, and growth in international trade. However, the poor infrastructure and higher logistics costs are anticipated to hinder the growth of the market. Furthermore, cost cutting, and lead time reduced by adopting multimodal systems and new government policies are expected to provide remarkable growth opportunities for players operating in the government and education logistics market.

Furthermore, government utilities, such as military and relief organizations, adopt commercial logistics for their own needs. A major problem for relief organizations was maintaining their own logistics equipment. Therefore, government relief organizations collaborate with private players for effective management and improved performance, which is one of the major factors for boosting the government and education logistics market growth. In addition, the continuous growth in the public utility sectors, such as telephone services, electricity services, and other public services, is expected to surge the demand for logistics services, thereby propelling the government logistics market. Moreover, the increasing demand for daily public necessities, such as water & gas supply, telecom, and postal services, further increases the demand for logistics services in public utilities, thereby driving the growth of the government and education logistics market during the forecast period

The government and education logistics market valued for $406.19 billion in 2021 and is estimated to reach $917.36 billion by 2031, exhibiting a CAGR of 8.3% from 2022 to 2031.

Some leading companies profiled in the report comprise Agility, AIT Worldwide Logistics, Inc., ARC Worldwide Limited, Atlantic Logistics, DB Schenker, Deutsche Post DHL Group, DSV, PLS Logistics, Scan Global Logistics A/S, SEKO Logistics, and Vetcom Logistics.

Military and Defense is the leading application of Government and Education Logistics Market

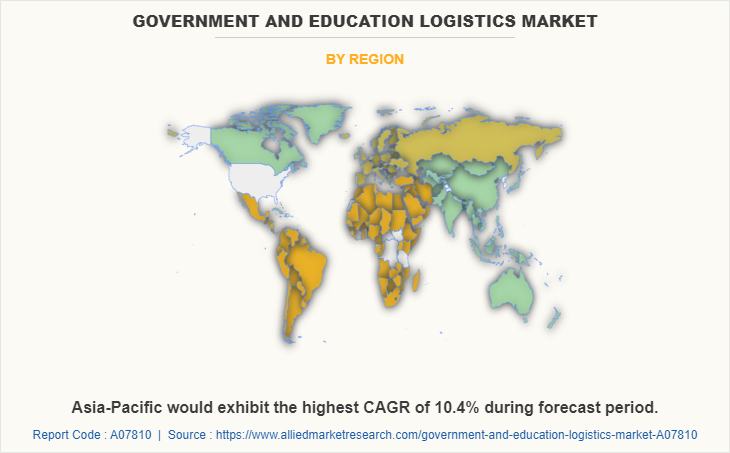

Asia-Pacific is the largest regional market for Government and Education Logistics

Cost-cutting and lead time reduced by adopting multimodal systems and new government policies are the upcoming trends of Government and Education Logistics Market

Loading Table Of Content...