Grease Market Outlook - 2031

The global grease market size was valued at $4.2 billion in 2021 and is projected to reach $5.7 billion by 2031, growing at a CAGR of 3.2% from 2022 to 2031. The growth of the grease market is driven by increasing automotive production and maintenance, along with rising usage in the aerospace and defense sectors. As the automotive industry expands, the need for high-performance greases to ensure vehicle efficiency and longevity grows. Similarly, in aerospace and defense, grease is essential for maintaining complex machinery and equipment, further boosting demand for specialized grease formulations in these high-demand industries.

A semi-solid lubricant called grease is used to shield equipment, machinery, vehicles, and their parts from rust, wear, and tear. It includes thickeners, lubricants, and additives that help improve performance. It is produced using rendered fat from animal waste, inedible lard, synthetic oil, or petroleum-derived products that contain thickeners. Grease works as a sealant to reduce water loss and helps guard against pollutants. It helps to retain flexibility, safeguard bearing surfaces, improve stop-start functionality, and lower friction. It offers improved rust-proofing performance, high viscosity index, high thermal stability, and corrosion protection. Therefore, grease finds extensive application across various industries, such as automotive, chemical manufacturing, power generation, metallurgy, and food & beverage.

A positive outlook for the market is being produced by the global automobile industry's significant growth. Ball joints, tie-rod ends, suspension, chassis, control arm-shafts, and U-joints are frequently lubricated with grease. ccording to Invest India, India's automotive industry is worth around $222 billion, while the EV market in India was valued at $2 billion inby 2023 and is expected to reach $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global research and development spending. Thus, the rise in demand for high-performance vehicles is promoting market expansion.

Grease also prevents wear and tear on a number of auto parts, including switches, connections, wheel bearings, and gears, due to its stability and temperature tolerance. The development of bio-based and environment-friendly grease made from renewable, non-toxic ingredients with low sulphur levels is just one example of the many product advancements that are significantly boosting the expansion of the market. In addition, the widespread adoption of high-performance grease in wind power plants to remove residue and ensure cleaner operations is positively impacting the market growth. Apart from this, the implementation of various government initiatives to encourage the utilization of bio-based grease and the increase in product demand in the manufacturing sector are anticipated to drive the grease market growth.

The growth of the grease market is being restrained by increasing competition from alternative lubricants, such as synthetic oils and bio-based lubricants. These alternatives offer advantages such as longer service life, better performance in extreme temperatures, and improved environmental friendliness. As industries prioritize sustainability and efficiency, many are shifting towards these modern lubricants, which are often more versatile and meet stringent regulatory standards. This shift reduces the demand for traditional grease products, thus limiting market growth. Additionally, ongoing advancements in alternative lubricants further intensify competition, making it challenging for the grease market to maintain its position in various sectors.

The increasing use of grease in the renewable energy sector presents a significant opportunity for the grease market. Renewable energy technologies, such as wind turbines and solar panels, require specialized greases for lubrication and protection against harsh environmental conditions. These greases enhance the performance and longevity of critical components, reducing maintenance costs and downtime. As the global focus shifts toward clean energy, the demand for reliable, high-performance lubricants is witnessing a rise. This trend creates a growing market for advanced greases tailored as per the unique needs of renewable energy systems, thus driving expansion in the grease industry.

Segment Overview:

The market is segmented on the basis of base oil, thickener type, end-use industry, and region. On the basis of base oil, the market is classified into mineral oil, synthetic oil, and bio-based oil. On the basis of thickener type, the market is classified into metallic soap, non-soap, and inorganic. On the basis of end-use industry, the market is classified into power generation, automotive, heavy equipment, food & beverage, chemical manufacturing, and others. Region wise, the grease market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

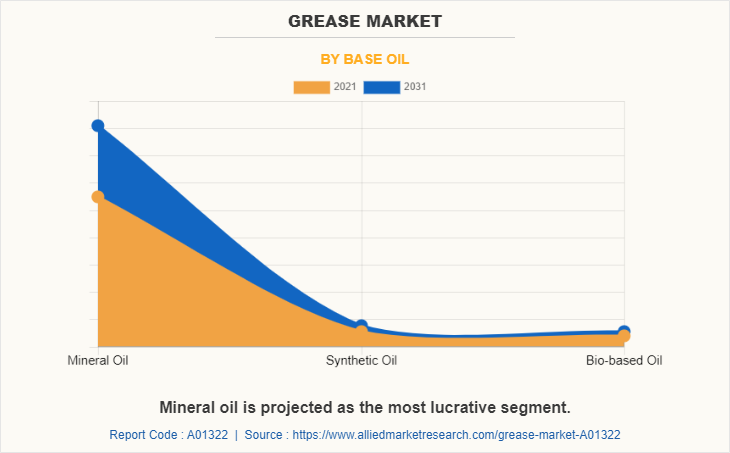

Grease Market, By Base Oil

On the basis of base oil, the mineral oil segment dominated the global grease market in terms of revenue, in 2021, and is expected to maintain its dominance during the forecast period. Mineral oil is frequently a liquid by-product of refining crude oil. Crude oil is produced from crude petroleum through distillation procedures that involve many refining steps, including extraction, crystallization, and purification by acid treatment, and hydrogenation. Due to its superior lubricating qualities, mineral oil is currently the most popular base oil in the manufacturing of grease. Mineral oils have the major benefit of being soluble with a variety of additives, which can enhance the general performance of grease.

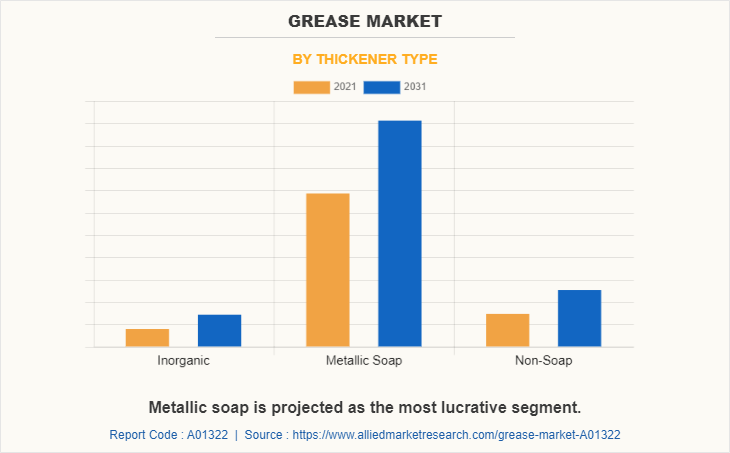

Grease Market, By Thickener Type

On the basis of thickener type, the metallic soap segment dominated the global grease market in terms of revenue in 2021. This is because of its versatility, which enables it to be used in the off-highway industrial, construction, and automotive sectors. Metal soap thickener has a superior ability to retain superb consistency at higher temperatures, in addition to other desirable features such as load-bearing, shear strength, water resistance, and corrosion safety.

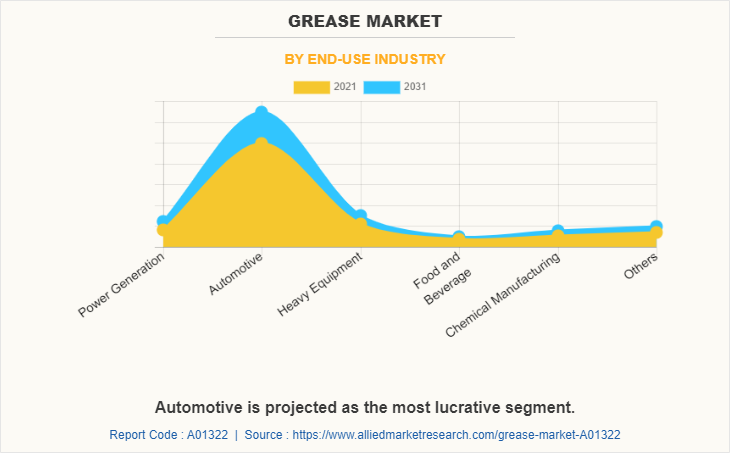

Grease Market, By End-Use Industry

On the basis of end-use industry, the automotive segment dominated the global market in terms of revenue, in 2021. The passenger cars offer maximum market potential in the automotive grease market, owing to increase in demand for these cars and general utility vehicles globally, with rise in public transportation expenditure. For instance, according to the Association des Constructeurs Européens d'Automobiles (ACEA) in 2021, a total of 79.1 million motor vehicles were produced around the world; an increase of 1.3% compared to 2020.

Grease Market, By Region

On the basis of region, Asia-Pacific dominated the market in terms of revenue, in 2021, owing to increase in urbanization in emerging countries. China is the largest consumer of grease in the current scenario. The vast manufacturing activities pertaining to different sectors and the rapid growth in the industrial and automotive sectors have pushed the country to stand among the major consumers and grease producers in the global landscape.

Competitive Analysis:

The major players operating in the grease industry include Axel Christiernsson, ENEOS Holdings, Inc., Exxon Mobil Corporation, FUCHS, Idemitsu Kosan Co., Ltd., Petroliam Nasional Berhad (PETRONAS), PKN ORLEN, Sinopec Corporation, The Chevron Corporation, TOTAL energies. These players have adopted product launch, acquisition, and business expansion as their key strategies to increase the grease market shares.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the grease market analysis from 2021 to 2031 to identify the prevailing grease market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the grease market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global grease market trends, key players, market segments, application areas, and market growth strategies.

Grease Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.7 billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 354 |

| By Base Oil |

|

| By Thickener Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Exxon Mobil Corporation, Petronas, Idemitsu Kosan Co. Ltd., Sinopec Corporation, FUCHS, BP plc, TOTAL SA, ENEOS Holdings Inc, Axel Christiernsson, The Chevron Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the grease market is driven by the growth in the industrial sector coupled with the improved quality of grease. The rise of automation in various industries is driving the growth of the global grease market. Improving grease quality is a key driver of the market. Consumers prefer better quality products, primarily due to longer shelf life and improved durability, resulting in better performance of machinery and equipment. High quality grease also saves money by reducing the frequency of grease changes. There is an increase in the demand for high quality grease in Europe and North America.

Significant growth in the automotive industry across the globe is creating a positive outlook for the market.

power generation, automotive, heavy equipment, food & beverage, chemical manufacturing application are the potential customers of grease industry

Asia-Pacific region will provide more business opportunities for grease market in coming years.

The grease market is projected to reach $5.7 billion by 2031, registering a CAGR of 3.2% from 2022 to 2031.

Axel Christiernsson, ENEOS Holdings, Inc., Exxon Mobil Corporation, FUCHS, Idemitsu Kosan Co., Ltd., Petroliam Nasional Berhad (PETRONAS), PKN ORLEN, Sinopec Corporation, The Chevron Corporation, TOTAL energies are the top players in grease market.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Loading Table Of Content...