HDPE Conduits Market Research, 2033

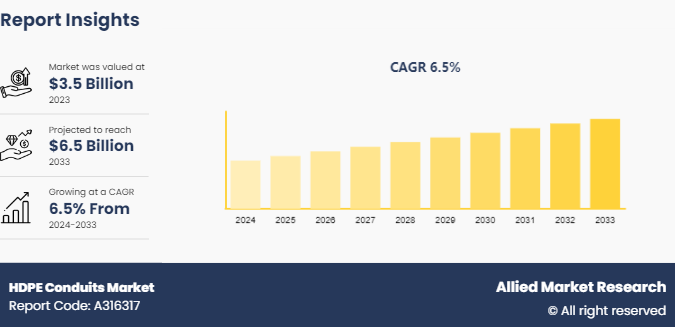

The global HDPE conduits market was valued at $3.5 billion in 2023, and is projected to reach $6.5 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Market Introduction and Definition

HDPE conduit is made from high-density polyethylene, a thermoplastic polymer that offers a unique combination of strength, flexibility, and chemical resistance. It is characterized by its excellent durability, which allows it to endure harsh environmental conditions, including extreme temperatures and corrosive substances. The material's flexibility is another significant advantage, enabling it to be easily bent and installed in a variety of configurations without breaking or cracking. This makes HDPE conduit a preferred choice for applications that require complex routing and installation.

One of the defining features of HDPE is its resistance to chemical and biological degradation. It is not affected by most chemicals, which means it can be used in environments where exposure to aggressive substances is a concern. Furthermore, HDPE does not support the growth of bacteria or fungi, making it suitable for applications in the food and pharmaceutical industries. Its non-toxic nature also ensures that it does not contaminate the contents it carries, whether they are liquids, gases, or other materials.

In the telecommunications and electrical industries, HDPE conduit is widely used for protecting and routing cables. Its flexibility and ease of installation make it ideal for laying underground cables in urban and rural areas. The conduit provides a protective barrier that shields cables from physical damage and environmental hazards such as moisture, chemicals, and rodents. This protection is crucial for maintaining the integrity and performance of telecommunications and electrical systems.

Key Takeaways

- The HDPE Conduits industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the HDPE conduits market forecast period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global HDPE conduit market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the HDPE conduits market size.

- The HDPE conduits market share is highly fragmented, with several players including JM EAGLE, INC., Dura-Line, Blue Diamond Industries, WL Plastics, Creek Plastics LLC., Atkore, IPEX Electrical Inc, EMTELLE, Bulldog Pipe, and Metoree. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the HDPE conduits market growth.

Market Segmentation

The HDPE conduit market is segmented into type, application, and region. On the basis of type, the market is divided into smoothwall conduits, corrugated conduits, and microducts. On the basis of application, the market is classified into telecommunications, electric cable, utility, renewables, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Surge in renewable energy projects is expected to drive the growth of HDPE conduit market during the forecast period. The expansion of renewable energy sources, particularly solar and wind farms, is driving significant demand for durable conduit systems in the U.S. These projects need robust infrastructure to protect electrical cables that transmit power to distribution networks. HDPE conduit is becoming a preferred choice due to its resilience against environmental factors such as moisture, soil chemicals, and UV radiation, making it ideal for challenging conditions.

For instance, in January 2023, BP PLC began construction on the Arche solar project in Fulton County, Ohio, with a capacity of 134 megawatts DC (107 MW AC) . This project, which has a Power Purchase Agreement with Meta, aims to prevent over 155,900 metric tons of carbon emissions annually. Solar farms, covering large areas, use underground electrical distribution systems to connect photovoltaic panels to inverters and the grid. HDPE conduits ensure reliable protection against physical damage and maintain the integrity of electrical pathways, crucial for the efficiency and longevity of solar installations. According to the Solar Energy Industries Association (SEIA) , utility-scale solar installations increased by 66% from the first quarter of 2022. Despite ongoing supply constraints, the situation is improving as module shipments arrive at ports. In the first quarter of 2022, photovoltaic solar (PV) accounted for 54% of all new electricity-generating capacity additions.

However, the temperature sensitivity of HDPE conduit is expected to restrain the growth of HDPE conduit market. The temperature sensitivity of high-density polyethylene (HDPE) conduits is a significant consideration during their installation and handling. HDPE's relatively low melting point means that exposure to high temperatures, typically above 60-70 degrees Celsius (140-158 degrees Fahrenheit) , can cause the material to soften and deform. This requires installers to follow strict temperature guidelines, use shade tents, cooling techniques, or schedule installations during cooler times to prevent thermal deformation. In addition, the thermal expansion of HDPE conduits, especially in above-ground installations or under direct sunlight, can cause the conduits to expand and contract. This necessitates careful planning, including the use of expansion joints and thoughtful installation layouts, to maintain the alignment and stability of the conduit system. These temperature-related challenges are expected to limit the growth of the HDPE conduit market in the U.S.

Furthermore, expansion of broadband and fiber optic networks is expected to offer lucrative opportunities for market expansion. The expansion of broadband and fiber optic networks in the U.S. is creating significant opportunities for HDPE conduits in infrastructure development. As demand for high-speed internet and advanced telecommunications grows, HDPE conduits are becoming a preferred solution for protecting and housing fiber optic cables. This need is evident in both urban areas undergoing rapid digital transformation and rural regions striving to close the digital divide. In urban settings, HDPE conduits are ideal due to their durability, flexibility, and resistance to corrosion and weathering, which is essential in high-density and high-data-consumption areas. Their lightweight nature makes them easy to handle and install, reducing labor costs and minimizing disruption to existing infrastructure during upgrades or expansions. In March 2023, CommScope, a leading network connectivity solutions provider, announced plans to expand its fiber-optic cable production in the U.S. This expansion aims to accelerate broadband rollout, especially in underserved communities, and is expected to significantly increase fiber-optic cable output, enabling faster deployment of high-speed internet. CommScope's HeliARC lines are projected to connect around 500, 000 households annually through Fiber-to-the-Home (FTTH) rollouts. Consequently, the rising popularity of fiber-optic cables is expected to create lucrative opportunities in the U.S. conduit market during the forecast period.

Competitive Analysis

Key market players in the HDPE conduit market include JM EAGLE, INC., Dura-Line, Blue Diamond Industries, WL Plastics, Creek Plastics LLC., Atkore, IPEX Electrical Inc, EMTELLE, Bulldog Pipe, and Metoree.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, HDPE (High-Density Polyethylene) conduit is widely used due to its durability, flexibility, and resistance to environmental stressors. It is primarily used in the telecommunications and power utility sectors for protecting fiber optic cables and electrical lines. The growing demand for broadband services and the expansion of power infrastructure have significantly boosted the adoption of HDPE conduit. In addition, stringent regulations regarding the use of sustainable and environmentally friendly materials have encouraged the use of HDPE conduits, which are known for their recyclability and low environmental impact. The U.S. and Canada are the primary markets in this region, with ongoing infrastructure projects further driving the demand.

The Asia-Pacific region is experiencing rapid growth in the use of HDPE conduit, driven by the region's ongoing urbanization and infrastructure development. Countries like China, India, and Japan are at the forefront of adopting HDPE conduits for their telecom and power sectors. The need for robust and reliable infrastructure to support the region's economic growth has led to the widespread use of HDPE conduits, which offer excellent protection and longevity. In addition, government initiatives aimed at improving digital connectivity and expanding power distribution networks are significant factors contributing to the increased usage of HDPE conduit in this region.

Impact of Renewable Sector on HDPE Conduit

Total renewable energy capacity is expected to nearly double from 3, 655.2 GW in 2022 to 6, 599.6 GW in 2027, the infrastructure supporting these installations also needs to scale up. The increase in renewable energy projects means more extensive cabling systems to connect various components such as solar panels, wind turbines, hydropower generators, and bioenergy plants. HDPE conduits offer the flexibility, durability, and environmental resistance required to protect these cables over long distances and in challenging conditions. This surge in renewable energy projects directly translates to a rising demand for HDPE conduits, driving market growth and encouraging further innovation and production in this sector.

Industry Trends

- As per Steve Evans Ltd, in February 2024, Bermuda-based reinsurer Conduit Re saw significant growth in 2023, with gross premiums written (GPW) rising to $931.4 million. Reinsurance revenue surged by 61% year-on-year, reaching $633 million, while the company's combined ratio improved significantly to 72.1%. The estimated ultimate premiums written for 2023 increased by 50% to $966.6 million, up from $644.8 million in the previous year. This included a 58% rise in property premiums, a 20% increase in casualty premiums, and a substantial 95% growth in specialty premiums. Overall, GPW grew by 50% year-on-year to over $931 million, compared to $623 million in 2022. This growth comprised a 63% increase in property, a 17% rise in casualty, and an impressive 91% growth in specialty.

- In July 2022, ExxonMobil introduced a new HDPE product range called EXXONMOBIL HMA706. This product is noted for its high dimensional stability and excellent impact strength. Approved for food contact, HMA706 is designed for fast cycling and boasts a high gloss finish, making it ideal for food packaging and other consumer goods.

- In June 2022, Formosa Plastics Corporation announced its plan to invest $207 million in constructing a new production facility in Texas. The project is slated for completion by October 2025, and upon completion, the plant is expected to have an annual production capacity of 100, 000 tons of alpha olefins. These alpha olefins are utilized in the manufacturing of high-density polyethylene (HDPE) and various other products.

Historic Trends of HDPE Conduit Market

- In 1953, Karl Ziegler and his team at the Max Planck Institute for Coal Research achieved a significant milestone by synthesizing High-Density Polyethylene (HDPE) . This breakthrough involved the polymerization of ethylene using a new catalyst, which resulted in HDPE—a material characterized by its high strength and density compared to other forms of polyethylene.

- In the 1970s, the use of HDPE conduit in telecommunications and electrical applications started to gain traction. The material's durability and ease of installation made it ideal for protecting electrical and communication cables underground.

- The 1980s witnessed a rapid expansion in telecommunications networks due to the increasing demand for faster and more reliable communication systems. This period saw significant advancements in technology, including the development and deployment of fiber optic cables, which offered higher bandwidth and better performance compared to traditional copper cables.

- In 2020s, the focus on smart infrastructure and the deployment of 5G networks increased the demand for HDPE conduit. Its role in protecting the vast amounts of fiber optic cables required for these networks underscored its importance in modern telecommunications infrastructure.

Key Sources Referred

- The International Trade Administration

- U.S. Department of Commerce

- International Energy Agency

- KM Business Information US, Inc

- SAE International

- National Conduit Supply Inc

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hdpe conduits market analysis from 2024 to 2033 to identify the prevailing HDPE conduits market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the High-density polyethylene (HDPE) conduits market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global HDPE conduits market trends, key players, market segments, application areas, and market growth strategies.

HDPE Conduits Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.5 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Types |

|

| By Application |

|

| By Region |

|

| Key Market Players | Metoree, IPEX Electrical Inc, EMTELLE, WL Plastics, Creek Plastics LLC, Bulldog Pipe, Dura-Line, JM EAGLE, INC., Atkore, Blue Diamond Industries |

The global HDPE conduits market was valued at $3.5 billion in 2023, and is projected to reach $6.5 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Key market players in the HDPE conduit market include JM EAGLE, INC., Dura-Line, Blue Diamond Industries, WL Plastics, Creek Plastics LLC., Atkore, IPEX Electrical Inc, EMTELLE, Bulldog Pipe, and Metoree.

Asia-Pacific is the largest regional market for HDPE conduits.

Surge in renewable energy projects is the main drivers of HDPE conduits market.

Expansion of broadband and fiber optic networks are the upcoming trends of HDPE conduits market.

Loading Table Of Content...