Heavy Duty Truck Market Research, 2031

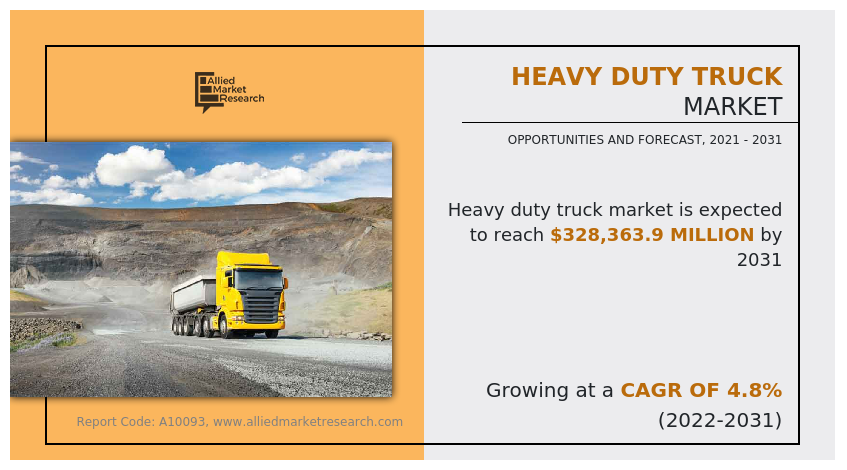

The global Heavy Duty Truck Market size was valued at $209,973.7 million in 2021, and is projected to reach $328363.9 million by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

A heavy-duty truck is classified as a vehicle that has or exceeds a Gross Vehicle Weight Rating (GVWR) of more than 26,001 pounds. It comprises of steel for strength & durability, aluminum for lightweight & corrosion resistance, polished stainless steel for bright finishes, and molded plastics for complex shapes. Several heavy duty trucks are built with powerful engines and sturdy transmissions, and are frequently used in the business sector, particularly on construction sites to transport bulky building materials or lift enormous loads. Furthermore, heavy-duty trucks offer convenient and secure transportation since they include a trailer or a space for carrying items. Logistics, construction, and dump trucks are just a few of the industries that use heavy-duty trucks. Moreover, the popularity of heavy-duty trucks with multi-car trailers, such as single-decker and double-decker trailers, is gradually growing in the automotive industry, owing to the advantages of transporting multiple vehicles from one location to another. For instance, in February 2022, the Union Ministry of Road Transport and Highway (India) allowed rigid vehicles as well as trailers to have a maximum of three decks to transport two-wheelers.

Currently, the demand for heavy-duty trucks in rural and semi-rural areas of Asian and African countries is gaining for a purpose of transportation. Truck manufactures are in product launch with advancement in many areas of African countries providing the growth opportunity to market during projected year. For instance, in August 2022, SMT Ghana, the official distributor of Volvo Construction Equipment, Volvo Trucks and Volvo Penta in Ghana, has held a grand ceremony in Accra to launch four new Volvo heavy-duty truck ranges.

In addition increase in demand for goods along with an increase in construction and development of infrastructure is a major factor driving the demand for heavy duty trucks. The governments in developed and developing economies across the world are investing significantly in improving and upgrading their road network facilities which require dumping trucks for carrying the load. For instance, the Government of India has given a massive push to infrastructure by allocating around $1.4 trillion for infrastructure to be invested until 2025. Furthermore, governments across the globe are taking initiatives to educate people about waste management and recycling. This, in turn, is expected to drive the global heavy-duty truck market of waste and, subsequently, heavy-duty trucks.

The factors such as high payload capacity, greater availability of credit and financing options, and improvement of road infrastructure supplement the growth of the heavy duty truck market. However, rising fuel prices & high maintenance cost of trucks and growing carbon emission from the burning of diesel fuel are the factors expected to hamper the growth of the market. In addition, increasing need for transportation mediums for rural and semi-urban areas and technology advancement in heavy duty trucks creates numerous opportunities for the key players operating in the market.

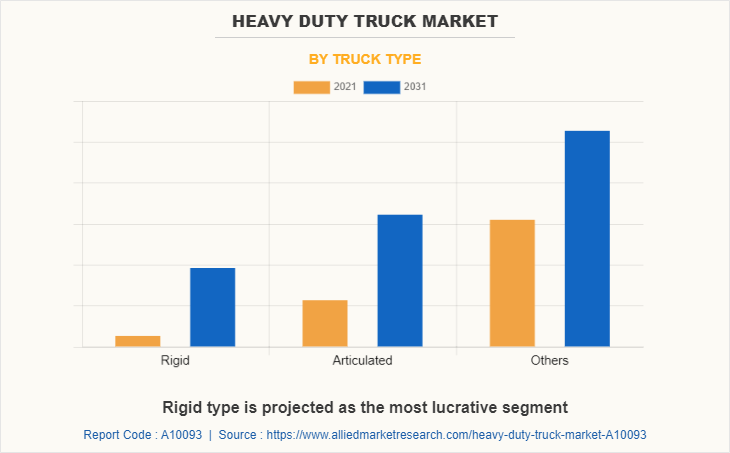

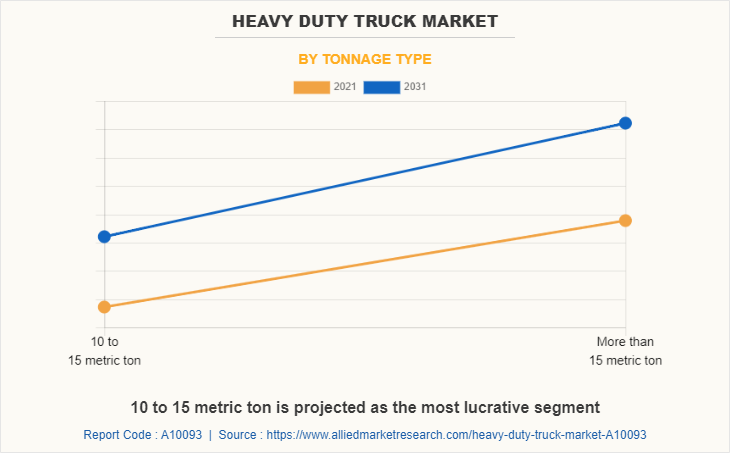

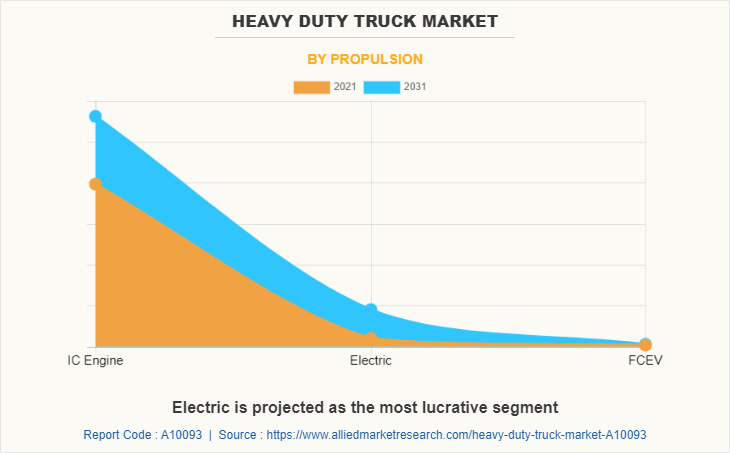

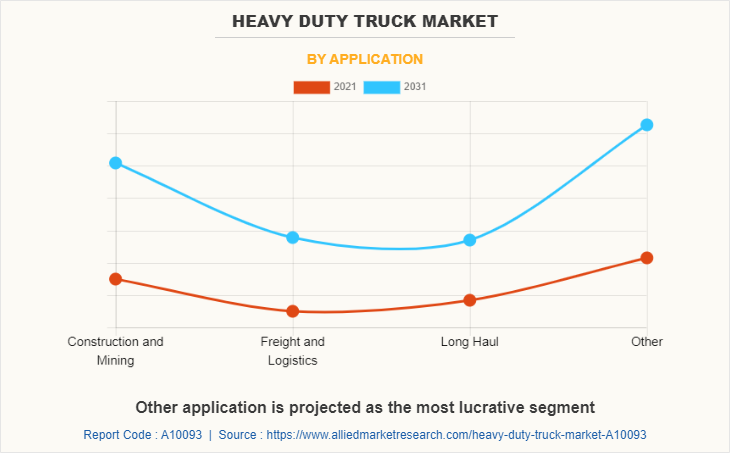

The heavy duty truck market is segmented into Truck Type, Tonnage type, Propulsion, Application, Axle Type and region. By tonnage type, the market is divided into 10 to 15 metric ton and more than 15 metric ton. By propulsion, it is fragmented into internal combustion engine (ICE), electric, and fuel cell electric vehicle (FCEV). By application, it is categorized into construction and mining, freight and logistics, long haul, and other. By truck type, it is categorized into rigid, articulated, and others. By axle type, it is fragmented into 4X2, 6X4, 6X2, 6X6, 8X6, 8X8, and Others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the heavy duty truck market are Ashok Leylands, Isuzu Motors Limited, TATA Motors, Scania, AB Volvo, Freightliner, MAN, PACCAR Inc., Eicher Motors Ltd, NAVISTAR, INC., China National Heavy Duty Truck Group Co., Ltd, and Dongfeng Commercial Vehicle Company Limited.

High payload capacity

Heavy-duty trucks have a large cargo-carrying capacity. Regardless of the size of the trailer, it increases carrying capacity as every inch of space from floor to ceiling can be brought to utilization. Thus, transporting goods and commodities such as perishable foods, construction materials, heavy loads, and loose materials through heavy-duty trucks is an affordable option. Furthermore, the popularity of heavy-duty trucks with multi-car trailers, such as single-decker and double-decker trailers, is gradually growing in the automotive industry, owing to the advantages of transporting multiple vehicles from one location to another. For instance, in February 2022, the Union Ministry of Road Transport and Highway (India) allowed rigid vehicles as well as trailers to have a maximum of three decks to transport two-wheelers.

Similarly, the Indian government also raised load carrying capacity of commercial vehicles by 20-25%. The move will help reduce logistic costs by 2% and attempts to bring norms at par with international standards. Hence, such factors are expected to propel the growth of the heavy-duty truck market during the forecast period.

Greater availability of credit and financing options

The government of developed and developing countries supports adopting heavy-duty electric trucks as commercial vehicles by introducing various subsidiary plans in terms of tax credits and incentives that propel market demand. For instance, in June 2019, the Indian Government announced a plan to lower the goods & service tax (GST) on electric vehicles. The subsidies further bring down the overall cost of ownership, which allows the owner to save a significant amount of capital annually. In addition, in August 2022, Ashok Leyland’s authorized distributors, Deluxe Trucks categories ranging from 2.55 Ton GVW to 55 Ton GVW and Bus in Kenya signed a partnership with Kenya Commercial Bank to jointly promote the Ashok Leyland brand of vehicles.

Growing carbon emission from the burning of diesel fuel

Vehicles on roads are vital contributors to a nation facilitating the timely movement of goods and other consumer-related activities. According to the International Air Agency, around 6.5 million deaths are recognized each year due to air quality. Meanwhile, diesel is the predominant fuel used for shipping goods and moving freight across the country and around the world. Diesel fuel (refined from crude oil) produces many harmful emissions when it is burned, and diesel-fueled vehicles are major sources of harmful pollutants, such as ground-level ozone and particulate matter. For instance, the U.S. Energy Information Administration (EIA) estimates that in 2020, diesel (distillate) fuel consumption in the U.S. transportation sector resulted in the emission of about 432 million metric tons of carbon dioxide (CO2), a greenhouse gas. This amount was equal to about 26% of total U.S. transportation sector CO2 emissions and equal to about 9% of total U.S. energy-related CO2 emissions in 2020. Thus, the growing carbon emission from the burning of diesel fuel is expected to hamper the market growth.

Technology advancement in heavy duty trucks

Trucks are fundamental for businesses, including mining, construction, infrastructure development, and energy plants, creating a favorable market environment. Several countries, including China, India, UK, and U.S. are passing regulations to curb emissions and increase the productivity of trucks, expanding the market expansion. The European Commission (EC) is also developing new software solutions to determine fuel consumption and CO2 emissions. In response to these policy changes across North America and Europe, the market players are introducing new hybrid and fully electric heavy-duty truck models. For instance, in January 2022, Volvo Trucks launched Volvo VNR electric trucks with a more extended range. Volvo VNR Electric had an operating range of up to 240 km (150 miles). Recently, an enhanced version of class 8* electric truck is launched, with an operational range of up to 440 km (275 miles) and increased energy storage of up to 565kWh. Such initiatives lead to customers' shifting preferences, development of charging infrastructure, availability of fast-charging stations, and the subsidiary benefits of electric vehicles over conventional internal combustion engine trucks, which in turn is expected to create lucrative opportunities for the market during the forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global heavy duty truck market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall heavy duty truck market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global heavy duty truck market with a detailed impact analysis.

- The current heavy duty truck market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Heavy Duty Truck Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 328363.9 million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 335 |

| By Truck Type |

|

| By Tonnage type |

|

| By Propulsion |

|

| By Application |

|

| By Axle Type |

|

| By Region |

|

| Key Market Players | Scania, NAVISTAR, INC., AB Volvo, China National Heavy Duty Truck Group Co., Ltd, freightliner, PACCAR Inc., Tata Motors, Eicher Motors Ltd, Ashok Leyland, Isuzu Motors Limited, Dongfeng Commercial Vehicle Company Limited, MAN |

Analyst Review

This section provides the opinions of various top-level CXOs in the global heavy duty truck market. Hence, based on the interviews of various top-level CXOs of leading companies, the rapidly growing logistics, retail, and e-commerce sectors, expected to drive demand for the new advanced trucks across the globe. In addition, government of developing countries also promoting heavy-duty truck with higher payload capacity by implementing new norms in their countries which further boosts the heavy-duty truck market globally. For instance, in India, The Ministry of Road Transport and Highways has increased load carrying capacity of heavy trucks to be increased by 20-25%. Thus, two-axle truck to be increased from 16.2 to 18.5 tonnes. It will also be beneficial for the logistics industry and the transport industry as they’ll be able to carry more freight legally which propels the market demand.

Moreover, increasing globalization and trade activities across the globe are fueling growth to the market. For instance, in October 2022, according to the American Trucking Association (ATA), the trucking industry moved 10.93 billion tons of freight in 2021, generating $875.5 billion in revenue. In addition, increased international trade with the U.S., Canada, and other countries around the globe has led to the adoption of heavy-duty vehicles for freight transport in the region. For instance, trucks moved 66.1% of the value of surface trade between the U.S. and Canada and 82.7% of cross-border trade with Mexico, for a total of $828 billion worth of good in FY’ 2021.

In addition, leading market players of heavy-duty truck are introducing new range of trucks series, which in turn is anticipated to propel the growth of heavy-duty truck market. Similarly, several countries, including China, India, UK, and U.S. are passing regulations to curb emissions and increase the productivity of trucks, expanding the market expansion. The European Commission (EC) is also developing new software solutions to determine fuel consumption and CO2 emissions. In response to these policy changes across North America and Europe, the market players are introducing new hybrid and fully electric heavy-duty truck models. For instance, in January 2022, Volvo Trucks launched Volvo VNR electric trucks with a more extended range. Volvo VNR Electric had an operating range of up to 240 km (150 miles). Recently, an enhanced version of class 8* electric truck is launched, with an operational range of up to 440 km (275 miles) and increased energy storage of up to 565kWh.

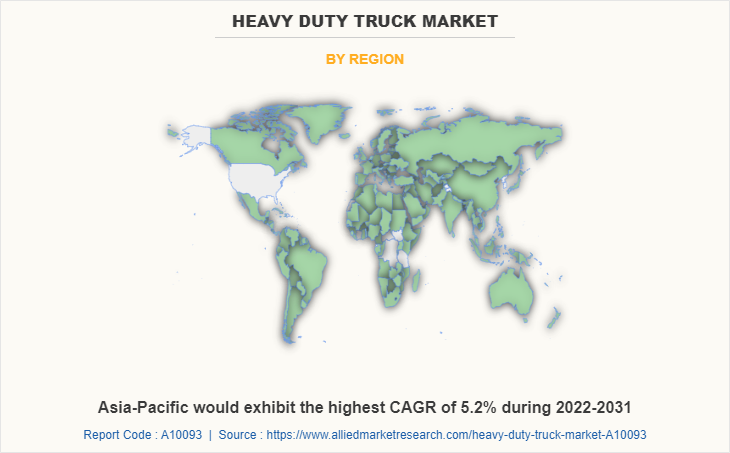

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period, due to rising demand for high-performance mobility solutions for all terrains and rising investments in infrastructure development activities in the region.

the global heavy duty truck market was valued at $209.97 billion in 2021, and is projected to reach $328.36 billion by 2031, registering a CAGR of 4.8% from 2022 to 2031.

The leading players operating in the heavy duty truck market are Ashok Leylands, Isuzu Motors Limited, TATA Motors, Scania, AB Volvo, Freightliner, MAN, PACCAR Inc., Eicher Motors Ltd, NAVISTAR, INC., China National Heavy Duty Truck Group Co., Ltd, and Dongfeng Commercial Vehicle Company Limited.

Asia-Pacific is the largest regional market for Heavy Duty Truck

Construction And Mining is the leading application of Heavy Duty Truck Market

Introduction of electric propelled trucks are the upcoming trends of Heavy Duty Truck Market in the world

Loading Table Of Content...