Hemodialysis Market Research, 2032

The global hemodialysis market size was valued at $76.9 billion in 2022, and is projected to reach $111.8 billion by 2032, growing at a CAGR of 3.8% from 2023 to 2032. The growth of the hemodialysis market size is driven by a rise in awareness regarding hemodialysis, rise in prevalence of chronic cardiac diseases (CKD) and end-stage renal disease (ESRD), which further increases the demand for hemodialysis products and services. For instance, according to “Prevalence of chronic kidney disease in Asia” article of National Library of Medicine published in 2022, an estimated 434.3 million (95% CI 350.2 to 519.7) adults have chronic kidney disease (CKD) in Asia, including up to 65.6 million (95% CI 42.2 to 94.9) who have advanced CKD. The 159.8 million of adults living with CKD were in China (95% CI 146.6 to 174.1) and up to 140.2 million of adults living with CKD were in India (95% CI 110.7 to 169.7), collectively having 69.1% of the total number of adults with CKD in the Asia-Pacific region.

Key Takeaways:

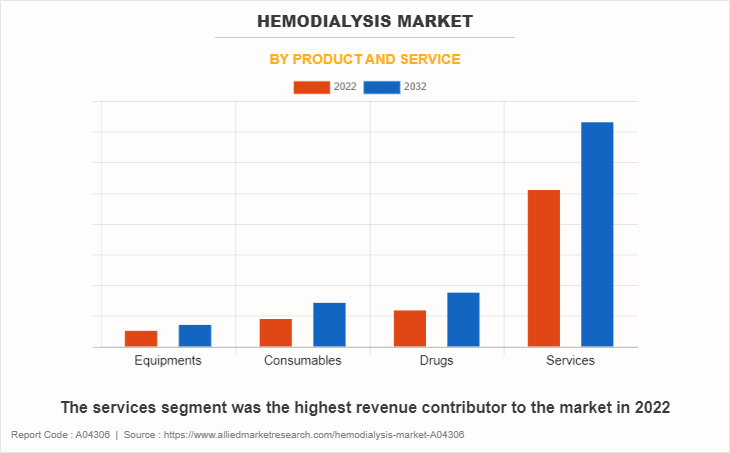

- On the basis of product and service, the services segment held the largest share in the hemodialysis market in 2022.

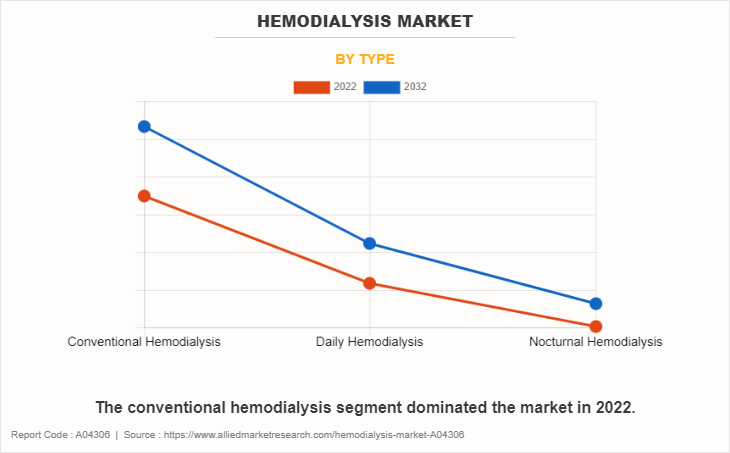

- On the basis of type, the conventional hemodialysis segment dominated the hemodialysis market in 2022.

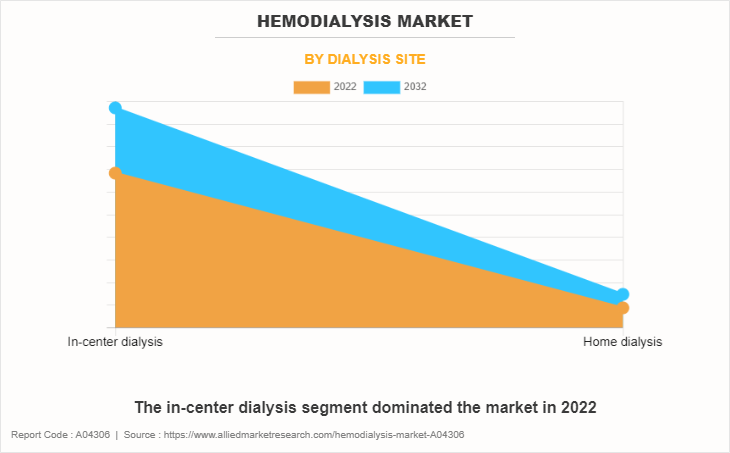

- On the basis of dialysis site, the in-center dialysis segment dominated the hemodialysis market in 2022.

- On the basis of region, Asia-Pacific is expected to witness the highest CAGR during the hemodialysis market forecast period.

Hemodialysis is a procedure in which machine filter waste products, excess salts, and other toxins from the blood. The process of filtration and removal is performed by the hemodialyzer. For patients suffering from kidney failure and other renal impairments, hemodialysis functions similar to an artificial kidney.

Market Dynamics

In addition, patients suffering from kidney failure require either dialysis or kidney transplant for their survival. Therefore, the shortage of kidneys for transplantation is expected to boost the growth of the hemodialysis market share. For instance, according to Penn Medicine News December 2020, the shortage of kidneys for transplantation continues to be a public health crisis in the U.S. More than 90,000 patients are waiting for kidney transplants, yet only about 20,000 transplants are performed each year. Annually, nearly 5,000 people on the transplant waiting list die without getting a transplant.

Furthermore, the rise in geriatric population suffering from chronic kidney disease (CKD) drives the hemodialysis market growth. For instance, according to the Centers for Disease Control and Prevention’s (CDC) Chronic Kidney Disease in the U.S., 2021 report, 38% of people ages 65 or older suffering from CKD, followed by 12% of people ages 45 to 64, and 6% of people ages 18 to 44 suffering from chronic kidney disease (CKD). According to the United Nations Report on “World Population Ageing,” published in December 2020, globally, there were 727 million people aged 65 years or above in 2020.

In addition, the rise in the ageing population suffering from diabetes & hypertension which further contributing to kidney failure, drives the growth of hemodialysis market share. According to International Diabetes Federation (IDF) Diabetes Atlas, 9th edition 2020, the prevalence of diabetes among the global elderly population aged above 65 years was about 135.6 million. Thus, a rise in geriatric population is expected to drive the growth of the hemodialysis market during the forecast period.

Moreover, the increase in utilization of advanced healthcare devices and technologies, growth opportunities in emerging economies and rise in adoption of strategies by key players to expand their market share are the major factors that creating significant growth opportunities for the hemodialysis market.

Recession 2023 impact analysis on Hemodialysis Market

Economic recessions often strain healthcare systems as government budgets may be cut, and public spending on healthcare could decrease. This can lead to reduced funding for dialysis centers, hospitals, and healthcare programs, potentially impacting the availability and quality of hemodialysis services. Recessions can lead to higher unemployment rates, which, in turn, can result in more people losing their health insurance. This can make it financially challenging for individuals to access hemodialysis treatment, which is a long-term and expensive therapy.

However, hemodialysis is critically important for patients with kidney failure (end-stage renal disease) because it serves as a life-saving treatment that replicates the vital functions of the kidneys when they are no longer able to perform adequately. Thus, the bad economy did not stop chronic kidney disease patients from taking their hemodialysis as they are necessary for living to kidney failure patients. In addition, during a recession, people may delay seeking medical care due to financial constraints, leading to later diagnoses of kidney disease. Delayed diagnoses can result in more individuals reaching ESRD and requiring hemodialysis, potentially increasing the patient pool. Therefore, the demand for hemodialysis products & services and pharmaceuticals remains relatively stable even during economic downturns as they are necessary for chronic kidney disease and end-stage renal disease patients.

Furthermore, the rise in prevalence of chronic kidney disease, rise in incidence of diabetes and hypertension, shortage of kidneys for transplantation and high growth potential in developing countries are expected to bring a high growth rate during the forecast period.

Segmental Overview

The hemodialysis market is segmented on the basis of product and service, type, and region. On the basis of product and service, the market is classified into equipment, consumables, drug and services. The equipment segment, the hemodialysis market is further bifurcated into dialysis machines, hemodialysis water treatment systems, and others hemodialysis equipment (hemodialysis chairs, body composition monitors, and various analysis systems). The consumables segment is bifurcated into dialyzers, catheters and needles, other hemodialysis consumables (concentrates & solutions, dialysates, catheter end caps, cleaners). On the basis of type, the hemodialysis market is segregated into conventional hemodialysis, daily hemodialysis, nocturnal hemodialysis. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product and Service

The services segment generated maximum revenue in 2022, owing to a higher number of people using hemodialysis services and the high number of hemodialysis service providers. The consumables segment is expected to witness the highest CAGR during the forecast period, owing to surge in usage of hemodialysis consumables by hemodialysis patients and rise in demand of hemodialysis consumables in developing countries.

By Type

The conventional hemodialysis segment dominated the market in 2022, owing to high adoption of conventional hemodialysis and performed only three days a week, so there is no more risk of other complications. However, the nocturnal hemodialysis segment is expected to witness the highest CAGR during the forecast period, owing to its various advantages such as it is done at night, so patients are free in the day to pursue other activities and improves the health of the patient.

By Dialysis Site

The in-center dialysis segment dominated the market in 2022, owing to patient does not requiring any medical training and the majority of hemodialysis devices manufacturing companies are engaged in developing dialysis centers in various regions. However, the home dialysis segment is expected to witness the highest CAGR during the forecast period, owing to its various advantages such as patient can adjust session schedules in the day or at night by letting the treatment fit around the patient timetables and rise in number of people choice for home dialysis options for dialysis treatment.

By Region

North America accounted for a major share of the hemodialysis market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Baxter International Inc., DaVita Inc., and Rockwell Medical Technologies Inc, and high healthcare expenditure from government organizations in the region drive the growth of the market. Moreover, the high adoption rate of hemodialysis products & services, and the significant increase in capital income in developed countries boost the growth of the hemodialysis market in North America.

Furthermore, the availability of advanced healthcare system, increase in cases of end-stage renal disease (ESRD), and availability of newly launched products in the region fosters the growth of the market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the hemodialysis market during the forecast period. The presence of key players, high number of geriatric population suffering from kidney failure, high medical tourism and high purchasing power propels the growth of market.

Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to rise in the number of people suffering from chronic kidney disease (end-stage renal disease), increase in awareness regarding the use of hemodialysis products & services, and increase in purchasing power of populated countries, such as China and India.

Furthermore, the market growth in the region is attributable to factors such as high number of patient suffering from diabetes & hypertension which further contributing to kidney failure, increase in per capita spending, and increase in government initiatives for improving healthcare infrastructure. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India as the second most populated country having 1,380,004,385 population in 2020. Therefore, a rise in population along with longer life expectancy is expected to drive the growth of the market in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the hemodialysis market, such as Asahi Kasei Corporation, B. Braun Melsungen AG, Baxter International Inc., DaVita Inc., Diaverum, Fresenius Medical Care AG & Co. KGaA, Nikkiso Co., Ltd, Nipro Corporation, Rockwell Medical Technologies Inc., TORAY INDUSTRIES, INC. (TORAY MEDICAL CO., LTD.) are provided in the report. These major players have adopted acquisition, agreement, expansion, merger, partnership, product launch, product approval as key developmental strategies to improve their product portfolio.

Recent Acquisition in the Hemodialysis Market

In April 2023, Diaverum, a leading global renal care service provider, announced that it has been acquired by M42, an Abu Dhabi-based tech-enabled healthcare company, from Bridgepoint Group, making M42 the largest healthcare company in the Middle East.

In July 2023, Rockwell Medical, Inc., a healthcare company that develops, manufactures, and distributes a hemodialysis product announced that the Company acquired the hemodialysis concentrates business from Evoqua Water Technologies.

Recent Agreement in the Hemodialysis Market

In June 2023, B. Braun Medical Inc. ("B. Braun"), a one of the leading company in renal therapies including innovative, high-quality products for hemodialysis, announced that it has entered into a three-year co-promotion services agreement with Rockwell Medical, Inc., a healthcare company that develops, manufactures, and distributes a hemodialysis product. As part of the agreement, Rockwell Medical designates B. Braun as an independent, non-exclusive representative to promote the Company's hemodialysis concentrates products to dialysis providers in the U.S., All orders will be directed to, and processed by, Rockwell Medical. B. Braun will receive a fee for any sales generated by its promotional efforts.

In February 2023, Rockwell Medical, Inc., a commercial healthcare company announced that it has signed a three-year product purchase agreement with Concerto Renal Services ("Concerto"), the largest provider of dialysis in skilled nursing facilities in the U.S. Under the terms of the agreement, Rockwell Medical will be the primary supplier of liquid and dry acid and bicarbonate concentrates to Concerto through a three-year commitment that includes supply and purchasing minimums.

In March 2021, Fresenius Medical Care North America (FMCNA) and DaVita Kidney Care announced an expanded agreement to provide home dialysis technology including NxStage home hemodialysis (HHD) machines, dialysis supplies, and a connected health platform to DaVita patients across the U.S. The agreement supports both companies' goals to empower more patients to choose home dialysis, which can provide a higher quality of life for people living with chronic kidney failure.

In January 2021, B. Braun Melsungen AG, Physidia and B. Braun signed an agreement covering 3 European countries. In France, the Physidia and B. Braun partnership focuses on developing home therapy in private B. Braun Avitum clinics. In Czech Republic, B. Braun becomes the exclusive distributor of the S system, whereas in the UK, B. Braun will be the logistics partner of Physidia UK.

Recent Expansion in the Hemodialysis Market

In January 2023, Baxter International Inc., a leading global medtech company, announced a comprehensive strategic roadmap to meaningfully enhance its operational effectiveness, drive toward improved long-term performance, accelerate innovation and create additional value for all stakeholders. These changes include the plan to spin off the company's Renal Care and Acute Therapies global business units (GBUs) into an independent, publicly traded company; a simplified commercial and manufacturing footprint to enhance underlying business performance; and further portfolio actions to improve Baxter's capital structure, including a review of strategic alternatives for the BioPharma Solutions (BPS) business.

In May 2022, Medtronic plc and DaVita Inc. has announced the intent to form a new, independent kidney care-focused medical device company ("NewCo" or "the Company") to enhance the patient treatment experience and improve overall outcomes. By bringing together Medtronic's capabilities as a healthcare technology leader and DaVita's deep expertise as a comprehensive kidney care provider, NewCo will be uniquely positioned to advance the development of differentiated therapies for patients with kidney failure.

Recent Merger in the Hemodialysis Industry

In March 2022, Fresenius Medical Care, the provider of products and services for individuals with kidney diseases, announced that it has entered into a binding agreement to create an independent new company that combines Fresenius Health Partners, the value-based care division of Fresenius Medical Care North America, with InterWell Health, the physician organization of kidney care, and Cricket Health, a U.S. provider of value-based kidney care with a leading patient engagement and data platform. The merger brings together Fresenius Health Partners’ expertise in kidney care, InterWell Health’s clinical care models and strong network of 1,600 nephrologists and Cricket Health’s tech-enabled care model that utilizes its proprietary informatics, StageSmart and patient engagement platforms to create an innovative, stand-alone entity poised to transform kidney care.

Recent Partnership in the Hemodialysis Market

In April 2022, Rockwell Medical, Inc. announced an expanded partnership withDaVita Inc., a leading kidney care provider.Rockwell Medicalhas been working to revise certain terms of its supply contracts with customers in an effort to stabilize its concentrates business. These two agreements with DaVita are designed to help ensure thatRockwell Medicalis on a more stable financial footing to supply its partners so they can serve patients undergoing dialysis in their centers.

In April 2021, Physidia and Baxter France SAS announced a co-promotion agreement to support homecare for dialysis patients in France. The objective of this agreement is to offer patients leaving peritoneal dialysis the opportunity to stay at home by receiving frequent hemodialysis using Physidia’s S3 system.

In April 2020, Baxter International Inc., a global innovator in renal care, and Ayogo Health Inc., a behavioral science-based digital health company, announced the expansion of their partnership to support the needs of patients with kidney disease through digital health solutions. Ayogo is combining LifePlan with Baxter’s expertise in renal care to build mobile apps and digital solutions that bring personalized, relevant and timely support to patients with kidney failure.

Recent Product Approval in the Hemodialysis Industry

In January 2022, Rockwell Medical, Inc., announced regulatory approval of Triferic (dialysate) and Triferic AVNU in South Korea.

Recent Product Launch in the Hemodialysis Market

In May 2023, Diaverum Holding AB Diaverum Romania has launched its all-new nephrology and dialysis medical Centre in Media?, the latest investment in a series of ambitious projects, following the opening of the Nephrology Medical Centre of Excellence in Bucharest in November 2022. The new centre offers patients a broad portfolio of medical services, ranging from preventive care, haemodialysis, peritoneal dialysis to integrated management of chronic kidney disease and its complications.

In March 2022, Nipro Medical Corporation (Nipro), a manufacturer and supplier of renal, and medical-surgical products, announced the commercial launch of SURDIAL DX Hemodialysis System to the U.S. SURDIAL DX is a state-of-the-art hemodialysis system designed to create an optimal dialysis treatment experience for patients and clinicians. Manufactured in Japan, it draws from over 35 years of expertise in renal device innovation at Nipro's parent company, Nipro Corporation.

In November 2021, Industries, Inc., announced that it has developed FILTRYZER HDF, Japan’s first polymethyl methacrylate (PMMA) hollow fiber membrane-based hemodiafiltration device.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hemodialysis market analysis from 2022 to 2032 to identify the prevailing hemodialysis market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hemodialysis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hemodialysis market trends, key players, market segments, application areas, and market growth strategies.

Hemodialysis Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 111.8 billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 390 |

| By Type |

|

| By Dialysis Site |

|

| By Product and Service |

|

| By Region |

|

| Key Market Players | Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Asahi Kasei Corporation., Nikkiso Co., Ltd, Diaverum Holding AB, Nipro Corporation, B. Braun Melsungen AG, TORAY INDUSTRIES, INC., Rockwell Medical Technologies Inc., DaVita Inc. |

Analyst Review

According to the insights of the CXOs, the hemodialysis market is poised to grow at a notable pace due to rise in prevalence of chronic renal diseases and kidney failures, which further boosts the demand for hemodialysis drugs and equipment.

As per the perspectives of CXOs, factors that fuel the growth of the global hemodialysis market include the technological advancements in hemodialysis equipment and increase in awareness about healthcare. Furthermore, hemodialysis is the most popular and preferred form of treatment for chronic renal diseases and kidney failures as compared to kidney transplantation. However, factors such as non-eligibility of patients suffering from heart or liver diseases for kidney transplantation are expected to boost the growth of market.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to high adoption of hemodialysis equipment, availability of robust healthcare infrastructure, and strong presence of key players. However, Asia-Pacific is anticipated to witness notable growth owing to rise in healthcare expenditure, high unmet medical demands, surge in prevalence of renal diseases, and increase in public–private investments in the healthcare sector.

The base year is 2022 in Hemodialysis Market report

The hemodialysis market was valued at $76.9 billion in 2022

The increase in geriatric population, and rise in incidence of renal diseases, especially end stage renal disease (ESRD), rise in incidence of diabetes and hypertension, and shortage of kidneys for transplantation are the upcoming trends of Hemodialysis Market in the world.

The forecast period for Hemodialysis Market is 2023 to 2032.

The hemodialysis market is estimated to reach $111.8 billion by 2032

The services segment is the leading segment of Hemodialysis Market

North America is the largest regional market for Hemodialysis.

The Baxter International Inc., DaVita Inc., Fresenius Medical Care AG & Co. KGaA are the top companies to hold the market share in Hemodialysis.

Yes, competitive analysis included in Hemodialysis Market report.

Loading Table Of Content...

Loading Research Methodology...