High Performance Composites Market Research, 2032

The global high performance composites market was valued at $33 billion in 2022, and is projected to reach $59.4 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global high performance composites market includes the market numbers in terms of value ($Million) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of resin type, fiber type, and end-use industry. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter‐™s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including TORAY INDUSTRIES, INC., TPI Composites, Inc., Solvay, Hexcel Corporation, Owens Corning, TEIJIN LIMITED, Arkema, BASF SE, hold a large proportion of the high performance composites market.

- This report makes it easier for existing market players and new entrants to the high performance composites business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

High performance composites are advanced materials engineered by combining two or more constituent materials with distinct properties to create a composite material that outperforms its individual components. These composites are characterized by exceptional mechanical, thermal, and electrical properties, making them ideal for demanding applications in aerospace, automotive, sporting goods, and more.

High performance composites typically consist of a reinforcing phase, such as carbon fibers or glass fibers, embedded in a matrix, often composed of polymers, metals, or ceramics. The properties of these composites are determined by the type and arrangement of these materials. They exhibit high strength-to-weight ratios, excellent stiffness, corrosion resistance, and durability, making them well-suited for environments with extreme conditions. In addition, high performance composites can be tailored for specific applications, offering designers flexibility in optimizing material properties to meet performance requirements, which is a key advantage of these versatile materials.

The flourishing growth of the building and construction sector is poised to drive significant expansion in the high performance composites market.

High performance composites find extensive applicability in the building and construction industry, including but not limited to cultured marble and concrete. Their superior qualities, including high tensile strength, weight reduction, and durability, account for this. Due to growth factors including escalating residential housing plans, expanding infrastructure development, and urbanization, the construction industry is expanding at a rapid rate.

The National Investment Promotion & Facilitation Agency projects that the construction sector in India will attain a valuation of $1.4 trillion by 2025. As per the findings of Oxford Economics, the global construction industry generated $10.7 trillion in output in 2020. From 2020 to 2030, this figure is anticipated to increase by 42%, culminating in USD 15.2 trillion. The rising prevalence of building and construction activities has led to a greater utilization of high performance composites in cement structures, concrete, and other applications. This is due to the lightweight and cost-effective nature of these materials, which is subsequently stimulating demand and propelling the high performance composites market.

The growth of the wind energy sector is poised to be a significant driver for the high performance composites market.

Wind turbine blades, a critical component of wind power generation, rely heavily on composite materials for their construction. High performance composites, with their exceptional strength, durability, and lightweight properties, enable the production of longer and more efficient wind turbine blades. As the demand for renewable energy sources continues to surge globally, wind power is experiencing substantial expansion.

The need for larger and more efficient wind turbines, combined with the push for reduced environmental impact and increased energy efficiency, positions high performance composites as a key enabler of this growth. The high performance composites market is set to benefit from ongoing innovations in materials and manufacturing processes, further driving its prominence in the wind energy sector and contributing to the transition to cleaner and more sustainable energy sources.

Conventional materials used in the production of automobiles, such as aluminum and steel, are regarded as less functional than high performance composites. In addition, the market for high performance composites is influenced by the growth of the automotive sector and the increasing prominence of the aviation industry. As a result of the high costs of basic materials, production, and assembly, however, the market for high performance composites could not expand further.

Fiber composites have been utilized in aerospace and aviation applications for a very long time. On the other hand, it is expected that the extensive integration of carbon fiber into commercial aircraft of the next generation will result in fuel savings of approximately 20%, in addition to providing benefits that elevate passenger comfort. The utilization of high performance composites enables an estimated 40% reduction in costs, thereby contributing to the product's competitive pricing.

The growing demand for composites from emerging markets presents lucrative opportunities for the high performance composites market. Emerging economies, such as those in Asia, Latin America, and Africa, are experiencing rapid industrialization, urbanization, and infrastructure development, creating a heightened need for advanced materials. High performance composites are increasingly sought after in these regions due to their superior properties, including strength, lightweight characteristics, and resistance to corrosion.

These composites find applications in a wide range of industries, from construction to automotive to renewable energy. As emerging markets expand and modernize their infrastructure, there is a significant potential for the high performance composites market to thrive. Moreover, as these regions prioritize sustainability and energy efficiency, composites that offer lightweighting and improved performance will be in high demand, making this trend a promising opportunity for manufacturers and suppliers in the industry.

The high performance composites market is segmented on the basis of resin type, fiber type, end-use industry, and region. By resin type, the market is divided into thermoset and thermoplastic. On the basis of the fiber type, it is categorized into carbon fiber composites, s-glass composites, aramid fiber composites and others. On the basis of the end-use industry, it is categorized into aerospace and defense, automotive, construction, energy, medical and others. region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

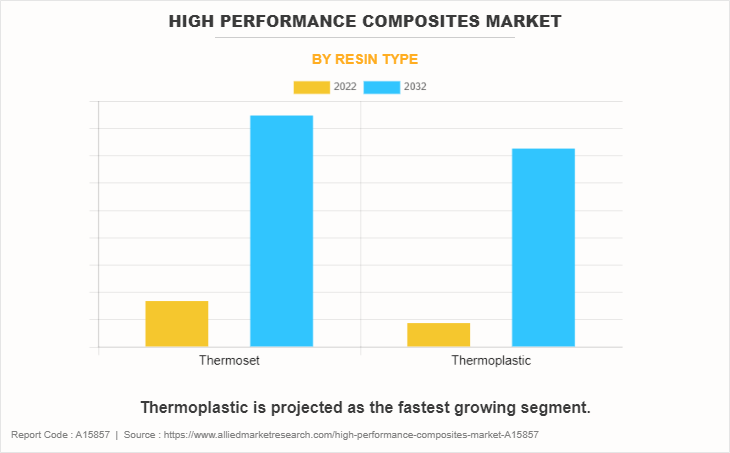

The thermoset segment accounted for the largest share in 2022 accounting for nearly half of the global high performance composites market revenue. The increasing demand for thermosets in high-performance composites can be attributed to their exceptional strength, durability, and resistance to high temperatures, making them ideal for applications in aerospace, automotive, and energy industries. Their superior mechanical properties drive the growing preference for thermoset-based composites, fostering a surge in market demand.

Thermoplastic is expected to register the highest CAGR of 6.2%. The demand for thermoplastics in high-performance composites is propelled by their superior mechanical properties, lightweight nature, recyclability, and ease of processing. Industries seeking efficient, durable, and environmentally friendly materials drive the increasing adoption of thermoplastics in advanced composite applications.

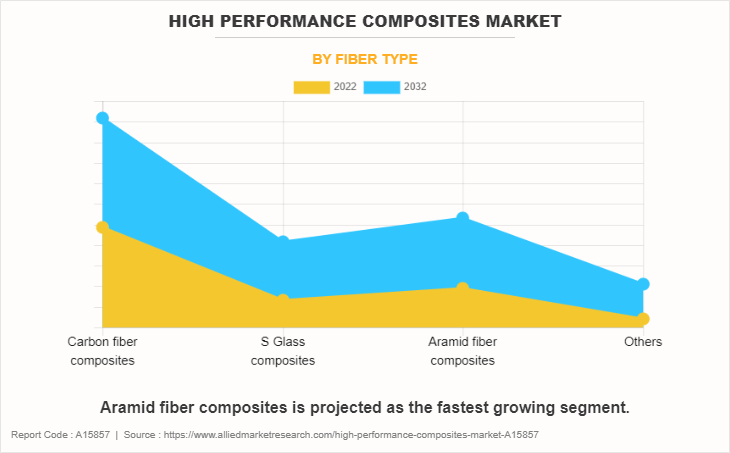

The carbon fiber composites segment accounted for the largest share in 2022 accounting for more than two-fifths of the global high performance composites market. The demand for carbon fiber composites in high-performance composites is driven by their exceptional strength-to-weight ratio, corrosion resistance, and versatility in industries such as aerospace, automotive, and sports equipment. Their ability to enhance fuel efficiency, reduce emissions, and improve overall performance makes them crucial in the pursuit of lightweight and high-strength materials for advanced applications.

Aramid fiber composites is expected to register the highest CAGR of 6.6%. The increasing demand for lightweight and high-strength materials in industries such as aerospace, automotive, and defense is driving the demand for aramid fiber composites in high-performance composites. Aramid fibers, known for their exceptional strength-to-weight ratio and resistance to heat and chemicals, make them a preferred choice for enhancing the performance of composite materials in various advanced engineering applications.

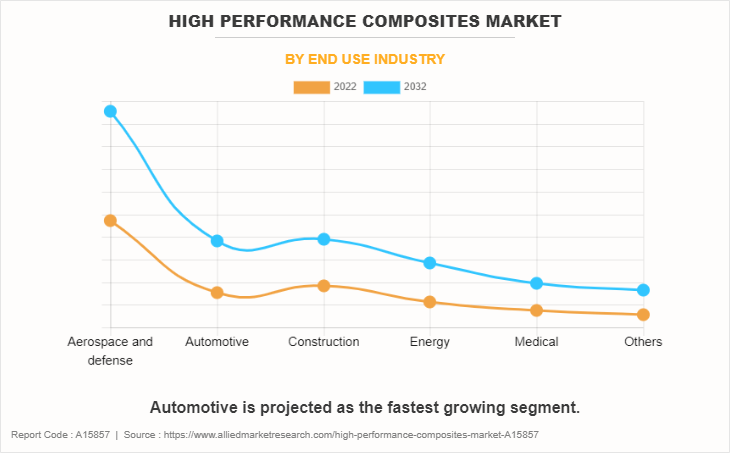

The aerospace and defense segment accounted for the largest share in 2022 accounting for more than one-third of the global high performance composites market revenue. The demand for high-performance composites in the aerospace and defense industry is driven by the pursuit of lightweight materials to enhance fuel efficiency and increase payload capacity. These advanced composites offer superior strength-to-weight ratios, corrosion resistance, and durability, crucial for aircraft and military applications, thereby fueling industry growth.

Automotive is expected to register the highest CAGR of 6.7%. The demand for high-performance composites in the automotive industry is propelled by the pursuit of lightweight materials for enhanced fuel efficiency and reduced emissions. In addition, increasing consumer preference for advanced, durable, and aesthetically appealing vehicles, coupled with stringent regulatory standards promoting sustainability, further drives the adoption of high-performance composites in automotive manufacturing.

Asia-Pacific garnered the largest share in 2022 accounting for more than two-fifths of the global high performance composites market revenue. The high-performance composites market in the Asia-Pacific region is experiencing robust growth due to increasing demand across various industries such as aerospace, automotive, and construction. Rapid industrialization, technological advancements, and a growing emphasis on lightweight and durable materials are driving the market. Key players are focusing on strategic collaborations and innovations to capitalize on the region's expanding market opportunities.

The major players operating in the global high performance composites market are SGL Carbon, TORAY INDUSTRIES, INC., TPI Composites, Inc., Solvay, Hexcel Corporation, Owens Corning, TEIJIN LIMITED, Arkema, BASF SE, and Crawford Composites, LLC.

Other players include Hexcel Corporation, Mitsubishi Chemical Corporation, Cytec Solvay Group, Axiom Materials, Tencate Advanced Composites, Park Aerospace Technologies Corp, Huntsman Advanced Materials and 3M.

Strategic developments undertaken by key players

On September 2021, Solvay announced the installation completion of its new thermoplastic composites (TPC) manufacturing facility at its Greenville, South Carolina site. The new product line will have the ability to manufacture unidirectional composite tape from a range of high-performance polymers including PVDF, PPS, and PEEK. This expansion will boost the growth of the high-performance composites market.

On April 2023, Solvay and GKN Aerospace signed an extension to their 2017 collaboration agreement. Under the terms of the agreement, both companies are working together to target future key high-rate programs and are developing a collaborative thermoplastic composites (TPC) roadmap to investigate new materials and manufacturing techniques for aircraft structures. This agreement will increase the demand for high-performance composites leading to the expansion of the market.

On December 2021, Hexcel Corporation and METYX, a manufacturer of high-performance NCF, partnered to produce high-performance carbon pultruded profiles for the wind energy market using PU resin and unidirectional carbon fiber. The two companies have partnered to develop technology that uses Hexcel's capabilities in providing wind energy customers with high-performance composites and expanding into other sectors for composite applications, in addition to its experience in polyurethanes for the ski industry. This partnership will increase the demand for high-performance composites leading to market growth.

On February 2021, BASF SE expanded its polyphthalamide (PPA) portfolio of Ultramid Advanced with carbon-fiber reinforced grades with fillings of 20, 30 and 40%. These new materials have the ability to safely replace aluminum and magnesium without reducing strength or stiffness, and they also make for extremely lightweight parts that are electrically conductive. The new grades are unique from other carbon-fiber reinforced PPAs on the market as they have high dimensional stability because of low water absorption, excellent chemical and hydrolysis resistance, high strength, and high modulus. These characteristics are combined with the benefits of Ultramid Advanced N (PA9T). This expansion will boost the demand for high-performance composites market.

On March 2023, SGL Carbon introduced a new carbon fiber called SIGRAFIL C T50-4.9/235, which has a high elongation capacity and will meet the high strength specifications for standard pressure vessel designs. It also enables further applications in market segments that require high strength and elongation. This product launch will strengthen the product portfolio of the high-performance composites market.

On June 2023, Arkema acquired a controlling stake in PI Advanced Materials to broaden its range of high-performance polymers. The portfolio and performance of Arkema's advanced materials segment will be strengthened by this acquisition, which will increase the company's range of polymers with ultra-high performance and modern technology.

Public Policies

Federal Aviation Administration (FAA) Regulations (U.S.): The FAA has specific regulations and guidelines for the use of composite materials in the aerospace industry. These regulations ensure the safety and reliability of composite structures in aircraft.

National Highway Traffic Safety Administration (NHTSA) Regulations (U.S): The NHTSA sets safety and performance standards for composite materials used in the automotive industry, especially in vehicle structures. These standards are designed to ensure vehicle safety and crashworthiness.

Environmental Protection Agency (EPA) Regulations (U.S): The EPA may regulate the use and disposal of composite materials, especially if they contain hazardous substances or if there are environmental concerns related to their production or disposal.

Occupational Safety and Health Administration (OSHA) Regulations (U.S): OSHA sets workplace safety standards that may apply to the manufacturing and handling of composite materials, with a focus on worker safety and exposure to hazardous materials.

Building Codes (varies by jurisdiction): Building codes in North America may have guidelines for using composites in construction, such as for structural applications. These codes are enforced at the local and state levels.

Import and Export Regulations (North America): Depending on the nature of the composite materials and their intended use, there may be import and export regulations, including customs and trade compliance requirements.

Trade Agreements (e.g., USMCA): Trade agreements such as the U.S -Mexico-Canada Agreement (USMCA) may impact the import and export of composite materials between North American countries.

Industry-Specific Regulations: Various industries have specific regulations or standards related to the use of high performance composites. For example, the American Society for Testing and Materials (ASTM) develops standards for composite materials used in various applications.

European Union Regulations: The European Union (EU) has several regulations that can apply to high performance composites, depending on their intended use. For instance, composites used in aerospace applications may need to adhere to regulations set by the European Aviation Safety Agency (EASA). In the automotive industry, composites may need to comply with vehicle safety and environmental regulations.

REACH: The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation is an EU regulation that applies to chemicals, including those used in the production of composites. Manufacturers and importers of chemicals and composite materials must comply with REACH requirements.

CE Marking: Products that are sold within the European Economic Area (EEA) often require CE marking to indicate compliance with relevant EU directives. While this is not specific to composites, it can apply depending on the end-use of the composite materials.

Eco-design Directive: The EU has eco-design directives that set minimum energy efficiency and environmental performance standards for certain products. While this is more focused on the energy efficiency of products, it can indirectly affect the design and materials used, including composites.

R&D Funding: European countries and the EU often provide R&D funding for projects related to advanced materials and composites. Companies and organizations working with high performance composites can benefit from these programs.

Industry Standards and Regulations: Many countries in the Asia-Pacific region follow international industry standards and regulations when it comes to high performance composites. Organizations like ISO (International Organization for Standardization) and ASTM International provide standards for testing, quality control, and safety of composite materials.

Impact Of Russia Ukraine War On the High Performance Composites Market

The Russia-Ukraine war can have various impacts on the high performance composites industry. High performance composites are advanced materials that are engineered for their exceptional strength, durability, and lightweight properties. These materials find applications in a wide range of industries, including aerospace, automotive, defense, and more.

War can disrupt the supply chain of critical raw materials and components used in the production of high performance composites. Ukraine, in particular, is known for its production of raw materials like titanium, which is essential for aerospace and defense applications. Any interruptions in the supply chain can lead to delays in manufacturing and increased costs.

Instability in the region can lead to price fluctuations for raw materials and energy sources used in the composites industry. Fluctuating prices can affect the cost of manufacturing high performance composites, which may, in turn, impact the pricing of end products.

Geopolitical tensions and sanctions can impact international trade and cooperation in the high performance composites industry. Companies may face restrictions or limitations on exporting or importing these materials and products.

High performance composites are extensively used in the defense sector for applications like aircraft, vehicles, and armor. The war may lead to increased demand for these materials in military applications, potentially straining the supply for other industries.

Changes in geopolitical alliances can affect the flow of technology and knowledge exchange between countries, impacting the development and innovation in the high performance composites sector.

Collaboration and research efforts between countries involved in the conflict may be hampered, affecting the development of new high performance composite materials and manufacturing processes.

Governments may impose export restrictions on high performance composite materials and technologies, especially those with potential military applications, which can impact global trade and technological development.

In response to potential supply chain disruptions or geopolitical risks, industries reliant on high performance composites may explore alternative materials or sources, leading to changes in the competitive landscape.

The war can lead to damage to infrastructure, including manufacturing facilities and transportation networks in the region, which can disrupt production and distribution of high performance composites.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high performance composites market analysis from 2022 to 2032 to identify the prevailing high performance composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high performance composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high performance composites market trends, key players, market segments, application areas, and market growth strategies.

High Performance Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.4 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Resin Type |

|

| By Fiber Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Crawford Composites, LLC, SGL Carbon, Owens Corning, Hexcel Corporation, Arkema, TEIJIN LIMITED, TPI Composites, Inc., TORAY INDUSTRIES, INC., BASF SE, Solvay |

Analyst Review

According to the insights of the CXOs of leading companies, the exceptional strength-to-weight ratio, corrosion resistance, and versatility in design of high performance composite makes them a preferred choice for applications such as aerospace, automotive, and sports equipment. Moreover, the increasing emphasis on fuel efficiency and environmental sustainability fuels the demand for lightweight composites, reducing the carbon footprint in transportation and promoting greener manufacturing processes.

However, the high cost of raw materials, particularly carbon and aramid fibers, limits their adoption in price-sensitive markets. Complex manufacturing processes and stringent quality control requirements further add to the cost. Moreover, composites' brittle nature can lead to challenges in damage detection and repair, especially in safety-critical applications.

The CXOs further added that the development of advanced matrix materials, such as thermoplastic composites, and the integration of nanotechnology for enhanced properties offer lucrative opportunities for growth. As industries strive for lightweight structures and enhanced performance, high performance composites are poised to play an increasingly vital role in addressing these challenges. Moreover, the expansion of emerging markets, such as wind energy and electric vehicles, presents significant growth potential for these materials.

The high performance composites market attained $33.0 billion in 2022 and is projected to reach $59.4 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

The High Performance Composites Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for High Performance Composites.

Growing demand for lightweight and strong materials and Bolstering growth of wind energy sector.

Rising awareness about the advantages of the high performance composites as compared to their substitutes is the upcoming trend of High Performance Composites Market in the world.

SGL Carbon, TORAY INDUSTRIES, INC., TPI Composites, Inc., Solvay, Hexcel Corporation, Owens Corning, TEIJIN LIMITED, Arkema, BASF SE, and Crawford Composites, LLC are the top companies to hold the market share in High Performance Composites.

Automotive is the leading end-use industry of High Performance Composites Market.

Loading Table Of Content...

Loading Research Methodology...