High Speed Motors Market Research, 2032

The global high speed motors market was valued at $12.6 billion in 2022, and is projected to reach $21.7 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Key Report Highlights:

- The high speed motors has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

A high speed motor is an electric motor designed to operate at significantly higher speeds than standard motors. These motors are engineered for applications where rapid rotation or high RPM (revolutions per minute) is required.

High speed motors are designed to operate at RPMs well above the typical range of standard motors. They reach speeds of tens of thousands of RPM or more. These motors are often manufactured with tight tolerances and precision components to ensure smooth and stable operation at high speeds. High speed motors are often more compact and lightweight compared to motors of similar power output, making them suitable for applications with space constraints. They use specialized materials for components such as rotors and stator laminations to reduce eddy current losses at high speeds. Many high speed motors incorporate advanced cooling systems, such as liquid cooling or forced air cooling, to manage the heat generated at high speeds.

High speed spindles in CNC machines, milling machines, and precision grinders are just a few industrial machinery applications that make use of high speed motors. They are used in aircraft systems such auxiliary power units (APUs), jet engine starters, and aviation instruments. In electric and hybrid vehicles, high-speed motors are used to power cooling fans, turbochargers, and electric compressors. They are used in medical equipment such as dental handpieces, centrifuges, and laboratory instruments requiring high speed rotation. Some power tools, such as high speed drills and rotary tools, use high speed motors to achieve fast and efficient cutting or drilling. High speed motors are integral to automated electronics manufacturing processes, including pick-and-place machines and soldering equipment. They power various laboratory equipment, such as centrifuges for sample separation and analytical instruments. They are utilized in wind turbines and other renewable energy systems to drive generators at high rotational speeds.

High speed motors offer improved efficiency in certain applications due to reduced losses and higher power-to-weight ratios. They provide precise control over rotational speed and position, making them suitable for applications requiring accuracy and consistency. Their compact size allows integration into smaller and space-constrained devices and systems. However, high speed motors generate more heat, which must be effectively managed to prevent overheating and ensure reliability. Bearings and lubrication systems must be designed to withstand the demands of high speed operation. Achieving precise rotor balance is crucial at high speed to minimize vibration and maintain smooth operation.

Market Dynamics

Drivers

Stringent energy efficiency regulations and environmental concerns have pushed industries to adopt high speed motors, which often offer better energy efficiency and reduced emissions compared to traditional motors. The expansion of renewable energy sources such as wind and solar power relies on high speed motors for efficient energy conversion. This sector's growth is driven by the demand for high speed motors used in wind turbines and solar tracking systems.

The increase in adoption of automation and robotics in industries such as manufacturing, automotive, and electronics requires high speed motors to drive various components, such as robot arms and automated machinery. The development of emerging technologies such as 3D printing, electric propulsion systems for drones, and automated electronics manufacturing relies on high speed motors, creating new market opportunities. Ongoing advancements in manufacturing processes and materials help to reduce the cost of producing high speed motors, making them more accessible for a broader range of applications.

Restraints

High speed motors often come with a higher initial purchase price compared to standard motors. This cost is a barrier to entry for some businesses, especially small and medium-sized enterprises. Maintaining high speed motors is complex and costly, requiring specialized knowledge and equipment. This deters some companies from adopting these motors.

High speed motors generate more heat due to their rapid rotation, necessitating efficient cooling systems and heat management. Addressing this heat adds to the overall cost and complexity. High speed operation places significant demands on bearings and lubrication systems. These components require precise design and maintenance, adding to the operational challenges and costs. Maintaining precise rotor balance at high speeds is crucial to minimize vibration. Balancing is a complex and time-consuming process, adding to the cost of operation.

Opportunities

The trend toward increased industrial automation, including the adoption of robotics and automated machinery, drives the demand for high speed motors. These motors are used in robot arms, conveyor systems, and other automated equipment. High speed motors play a crucial role in aircraft systems, including jet engine starters, auxiliary power units (APUs), and aviation instrumentation. As air travel continues to grow, so does the market for high speed motors in this sector. The medical equipment industry relies on high speed motors for devices such as dental handpieces, centrifuges, and laboratory instruments. Advancements in medical technology and the aging population contribute to the expansion of this market. The growing market for consumer electronics, including smartphones and gaming consoles, requires compact and efficient high speed motors for various applications such as vibration reduction and lens focusing. High speed motors are used in telecommunications and data center equipment for tasks such as moving optical components. With increasing global connectivity, this market segment is expected to expand.

The high speed motors market size is studied on the basis of product, power range, application, and region.

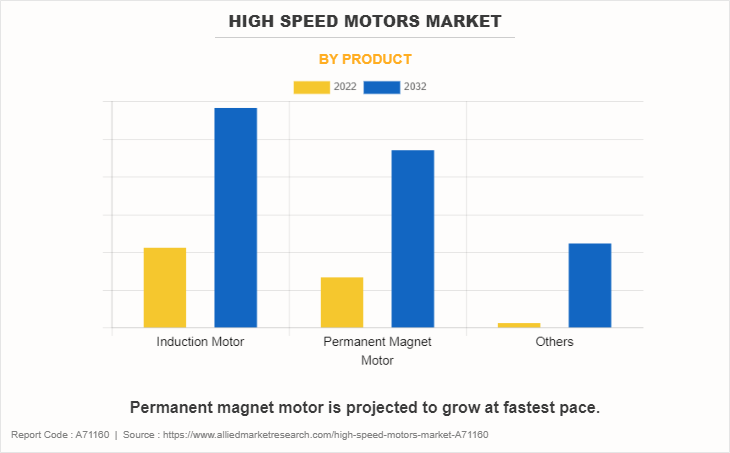

By product, the high speed motors market is divided into induction motor, permanent magnet motor, and others. Induction motors dominated the high speed motors market share in 2022. It is projected to grow at a CAGR of 5.7% during the high speed motors market forecast period. However, permanent magnet motor is projected to dominate the market growth in the near future growing at a higher CAGR of 6.0%. This can be attributed to them being commonly used in electric vehicles (EVs) for their high power density and efficiency, driving the wheels directly or in hybrid systems. High speed permanent magnet motors also find applications in aircraft systems, including electric propulsion systems and auxiliary power units.

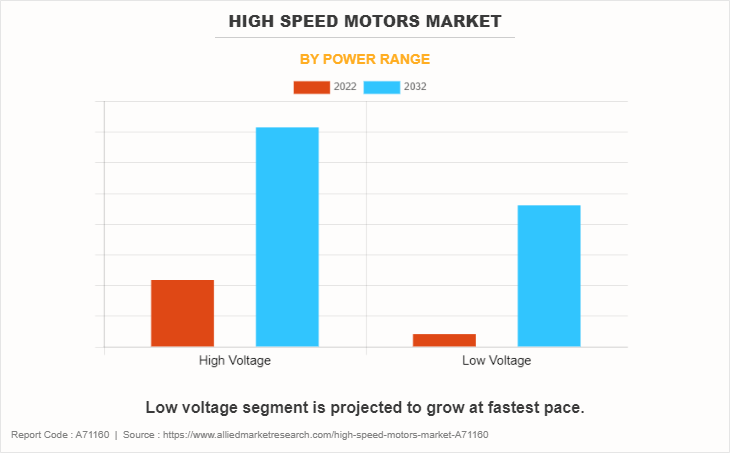

By power range, the market is bifurcated into high voltage and low voltage. High voltage segment garnered the largest share of high speed motors market in 2022 in terms of revenue. High-voltage high speed motors are expensive to manufacture and maintain. Specialized knowledge and equipment are often required for maintenance, making it complex and costly. However, the low voltage segment is projected to grow at a higher CAGR of 6.0% during the projection period. The increasing use of low voltage high speed motors in consumer electronics presents growth opportunities. The growth of medical technology and precision instruments drives the demand for low voltage high speed motors.

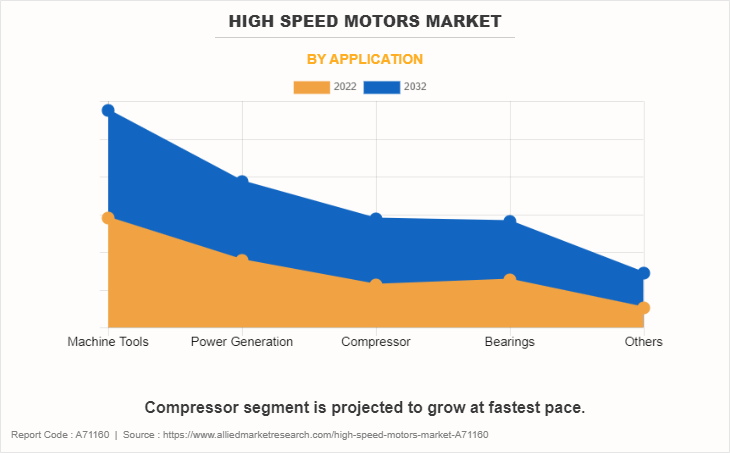

By application, the market is categorized into machine tools, power generation, compressor, bearings, and others. Machine tools dominated the market in terms of revenue for 2022. These motors are used in grinding machines that require high speed rotations for achieving fine surface finishes. High speed motors power laser cutting and welding machines, ensuring accurate and swift material processing. However, the compressor segment is expected to dominate the high speed motors market growth during projection years. The continued growth of industrial automation and pneumatic systems presents opportunities for high speed air compressors. As the automotive industry focuses on engine efficiency, high speed turbochargers gain significance.

By region, the high speed motors market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific dominated the market growth in 2022 by contributing largely in terms of revenue. Asia-Pacific region has experienced significant growth in the high speed motors market due to its thriving manufacturing sector, industrial automation, and the increasing adoption of renewable energy sources. However, Norh America is projected to dominate the high speed motors market growth during the forecast period. The adoption of automation in various industries drives the demand for high speed motors to power robots, conveyor systems, and other automated equipment.

The major players operating in the high speed motors industry are ABB Ltd., Emerson, GE Company, Meidensha Corporation, Mitsubishi Electric Corporation, Nidec Industrial Solutions, Siemens AG, Hitachi Ltd., Toshiba Corporation, and Turbo Power Systems (TPS). The companies adopted key strategies such as collaboration to increase their market share.

Policies across globe

High-speed motors, such as many other electrical and mechanical devices, are subject to various standards and regulations to ensure their safety, performance, and compliance with international quality benchmarks. These standards are essential for manufacturers, users, and regulatory bodies to establish a common understanding of design, testing, and operational requirements.

- IEC 60034 Series (International Electrotechnical Commission):

- IEC 60034-1: Specifies the general requirements and testing methods for rotating electrical machines, including high-speed motors.

- IEC 60034-2: Focuses on methods of cooling and the temperature rise limits for electric motors.

- IEC 60034-3: Covers construction, mounting, and terminal boxes for electric motors.

- IEC 60034-17: Provides guidance on tolerances and fits for high-speed rotating electrical machines.

- ISO 9001 (International Organization for Standardization):

- While ISO 9001 is not specific to high-speed motors, it's a globally recognized standard for quality management systems. Manufacturers often seek ISO 9001 certification to ensure consistent quality in their products.

- ISO 14001 (Environmental Management System):

- ISO 14001 focuses on environmental management systems. Companies involved in high-speed motor manufacturing adopt this standard to address environmental concerns related to their processes and products.

- UL 1004-1 (Underwriters Laboratories):

- UL 1004-1 is a safety standard for rotating electrical machinery, including high-speed motors, and covers construction, marking, and performance requirements.

- CSA C22.2 No. 100 (Canadian Standards Association):

- This standard outlines the requirements for electric motors, including safety and performance criteria.

- CE Marking (Conformité Européene):

- High-speed motors intended for sale in the European Union must comply with CE marking requirements, which demonstrate conformity with relevant EU directives, including safety standards.

- NEC (National Electrical Code):

- In the U.S., the NEC provides electrical installation requirements and safety guidelines for electrical equipment, including high-speed motors.

- IEEE 112 (Institute of Electrical and Electronics Engineers):

- IEEE 112 provides guidelines for the testing and performance of electrical rotating machinery, which includes high-speed motors.

- ANSI (American National Standards Institute):

- ANSI standards, such as ANSI C50.41, cover the testing and performance of rotating electrical machinery.

- ATEX Directive (ATEX 2014/34/EU):

- In Europe, the ATEX directive addresses the safety requirements for equipment used in potentially explosive atmospheres, including high-speed motors installed in such environments.

- NEMA (National Electrical Manufacturers Association):

- NEMA publishes standards that cover a wide range of electrical equipment, including motors. NEMA MG 1 is relevant to motors and generators.

- OSHA (Occupational Safety and Health Administration):

- In the U.S., OSHA sets safety and health standards that may be applicable to workplaces using high-speed motors.

- ANSI/RIA R15.06 (Robotics Industry Association):

- If high-speed motors are used in robotic systems, compliance with ANSI/RIA R15.06 may be necessary to ensure safety in robotic applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high speed motors market analysis from 2022 to 2032 to identify the prevailing high speed motors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high speed motors market scope assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high speed motors market trends, key players, market segments, application areas, and market growth strategies.

High Speed Motors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21.7 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 273 |

| By Product |

|

| By Power Range |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nidec, Siemens AG, Hitachi Ltd., TOSHIBA CORPORATION, ABB Ltd., Mitsubishi Electric, General Electric, Meidensha Corporation, Emerson Electric, Turbo Power Systems Limited |

Analyst Review

According to the insights from the CXO’s, the high speed motors market has gained momentum owing to energy transition goals and renewable energy integration across the globe. Moreover, technological advancements in the field and several cost benefits that serve long-term purpose drive the growth of high speed motors market. Furthermore, the growing market for electric vehicles and the requirement of machinery for precision cutting & manufacturing employ high speed motors.

Above-mentioned factors led to an increase in the high speed motors market growth. The market faces challenges from high upfront costs for installation and maintenance that limit widespread adoption. Meeting regulatory standards and safety requirements is challenging, particularly in industries such as aviation and healthcare, where high speed motors are used. However, the trend toward increased industrial automation, including the adoption of robotics and automated machinery, drives the demand for high speed motors. Emerging technologies such as 3D printing, electric propulsion for drones, and automated electronics manufacturing gain traction due to which the demand for high speed motors in these applications is expected to increase. This offers lucrative opportunities for high speed motors industry growth.

Machine tools is the leading application of High Speed Motors Market.

Renewable energy integration and energy transition goals, technological advancements and cost benefits, and growing market for electric vehicle, automation in aviation, and precision manufacturing are the recent trends of the high speed motors market in the world.

Asia-Pacific is the largest regional market for High Speed Motors.

$21.7 billion is the estimated industry size of High Speed Motors by 2032.

ABB Ltd., Emerson, GE Company, Meidensha Corporation, Mitsubishi Electric Corporation, Nidec Industrial Solutions, Siemens AG, Hitachi Ltd., Toshiba Corporation, and Turbo Power Systems (TPS) are the top companies to hold the market share in High Speed Motors.

Loading Table Of Content...

Loading Research Methodology...