Home Banking Market Research, 2033

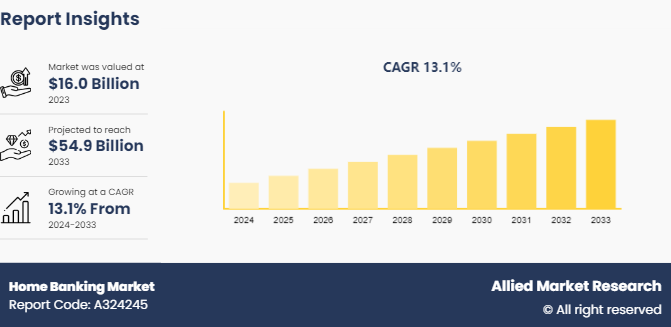

The global home banking market size was valued at $16.0 billion in 2023, and is projected to reach $54.9 billion by 2033, growing at a CAGR of 13.1% from 2024 to 2033. Home banking refers to managing financial transactions and services remotely, usually through digital platforms like mobile apps or websites, allowing users to perform banking tasks from home.

Market Introduction and Definition

Home banking is a financial service that enables customers to conduct a wide range of banking activities through digital platforms, typically from the convenience of their home or any location with internet access. The home banking market includes using web-based and mobile applications to perform conventional banking functions such as checking account balances, transferring funds, paying bills, and managing investments. It includes services offered by traditional brick-and-mortar banks and digital-only banks, also known as neobanks, which operate exclusively online without physical branches.

The home banking market leverages advanced technologies, such as secure encryption protocols, artificial intelligence, blockchain, and biometric authentication to ensure the efficiency and safety of transactions. It caters to various customer segments, including individual retail customers, small and medium-sized enterprises (SMEs) , and large corporations, offering tailored solutions to meet diverse financial needs. Furthermore, home banking services allow customers greater convenience to access their bank accounts and conduct transactions at anytime from anywhere with an internet connection, thereby eliminating the need to visit a physical branch. In addition, it reduces the need for paper statements and physical infrastructure, leading to cost savings for both banks and customers. Some banks also offer lower fees for online bill payment transactions.

Key Takeaways

The home banking market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2033.

More than 1, 500 product literature, industry releases, annual reports, and other documents of major payroll card industry participants, along with authentic industry journals, trade associations' releases, and government websites, have been reviewed to generate high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The home banking market is witnessing growth due to several factors, such as the growing proliferation of smartphones and mobile applications, increasing integration with financial ecosystems, and the rising efforts of banks to personalize and enhance user experience through remote account access options continue to drive the market growth. However, the data security & privacy concerns, along with the lack of digital literacy among people restrain the development of the home banking market. In addition, the rising collaborations among fintech companies and banks, along with the growing adoption and promotion of sustainable practices, such as paperless statements and digital documentation, in emerging markets are expected to provide ample opportunities for industry development during the forecast period. Furthermore, the improved convenience of 24/7 access to banking services, coupled with the surging demand for improved customer experiences boosts the acceptance of home banking services, thereby expanding home banking market growth.

Moreover, governments and regulatory bodies in many regions have supported the shift towards digital banking by offering clear guidelines and frameworks that ensure the safety and security of online transactions. This regulatory support has boosted consumer confidence in home banking offerings and services, which plays a significant role in shaping the landscape of the home banking industry. In addition, home banking options presents a considerable opportunity to promote financial inclusion, particularly in rural and underserved areas. By providing low-cost, easily accessible banking services through digital platforms, banks can reach a broader audience, including those who previously had restricted access to traditional banking, which is expected to drive demand for the home banking market globally.

Regulatory Framework: Global Home Banking Market

The global home banking market operates under a complex regulatory framework designed to ensure security, protect consumer rights, and maintain financial stability. This framework varies by region but generally includes regulations related to data protection, cybersecurity, anti-money laundering (AML) , and consumer protection. Some key regulatory frameworks and guidelines that impact the home banking market globally

General Data Protection Regulation (GDPR) - European Union: It is one of the most stringent data protection regulations globally, affecting any company that processes the personal data of EU citizens. Banks must ensure they have robust data protection measures in place, obtain explicit consent from customers for data processing, and provide transparency about data usage.

Bank Secrecy Act (BSA) – U.S.: The BSA requires financial institutions to assist in detecting and preventing money laundering. Banks must implement AML programs, conduct customer due diligence (CDD) , and report suspicious activities through Suspicious Activity Reports (SARs) .

Financial Conduct Authority (FCA) Regulations - UK: The FCA regulates financial services firms and financial markets in the UK. Banks must adhere to conduct rules, ensure the fair treatment of customers, and comply with reporting requirements. The FCA also sets standards for cybersecurity and operational resilience.

The regulatory landscape for home banking is dynamic and varies significantly across different regions. Financial institutions must stay abreast of regulatory changes and ensure compliance to maintain trust, protect consumer data, and avoid legal penalties.

Market Segmentation

The home banking market is segmented into service type, platform type, end-user, and region. By service type, the home banking market is divided into retail banking services and business banking services. By platform type, the home banking market is categorized into web-based banking, mobile banking, telephone banking, and others. By end-user, the home banking market is divided into individual and business. Region-wise, the home banking market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Home Banking Market Outlook

North America has been one of the leading countries in the home banking market, primarily due to the robust growth of financial infrastructure in the region, driven by the presence of major financial technology companies and startups. Furthermore, the region has been at the forefront of adopting and implementing cutting-edge technologies, including digital banking platforms, mobile banking apps, and AI-driven financial services, which drives the home banking market growth in this region. In addition, the regulatory environment in North America is generally supportive of digital banking innovations. Regulations such as the Dodd-Frank Act and the Consumer Financial Protection Bureau (CFPB) in the U.S., as well as Canada's financial regulations, promote transparency, security, and innovation in financial services. This factor is expected to drive the demand for the home banking market.

However, Asia-Pacific is expected to register a significant market share during the home banking market forecast period, due to the growing government efforts to promote financial inclusion through digital financial services, along with the technological innovations such as AI, machine learning, and blockchain are transforming home banking. Furthermore, the expansion of internet and mobile connectivity is a significant driver for home banking in Asia-Pacific. As more people gain access to the internet and smartphones, the demand for digital banking services grows. This is particularly notable in emerging markets, such as China and India, where mobile banking is often the primary means of accessing financial services. Moreover, the growing demand for seamless, 24/7 access to banking services is driving the adoption of home banking solutions. Consumers prefer the flexibility and ease of managing their finances from anywhere, which home banking provides, which is positively impacting the market growth during the forecast period.

Industry Trends

In January 2024, ICICI Bank Canada, a subsidiary of ICICI Bank Limited, unveiled its new mobile banking app, ‘Money2India (Canada) ’. This user-friendly platform allows customers of Canadian banks to perform instant, 24/7 money transfers to any bank in India. The app supports transactions of around $22, 000 per transfer, providing significant flexibility. This innovation simplifies cross-border transactions, offering enhanced convenience without requiring an account with ICICI Bank Canada.

In September 2023, Government of India owned public sector ‘Indian Bank’ has launched its 'IB SAATHI' initiative that aims to offer an integrated financial ecosystem for all stakeholders in the financial sector through the business correspondent route. Under the 'IB SAATHI' initiative, Indian Bank aims to offer essential banking services at all centers for a minimum of four hours each day. Additionally, business correspondents will deliver services directly to customers' doorsteps, further enhancing accessibility and convenience.

In July 2023, the U.S. Federal Reserve declared its new long-awaited FedNow Service for instant payments, which will aim to modernize the country's payment system. This system allows banks and credit unions of all sizes to provide their customers with instant money transfers, available 24/7, year-round. The FedNow Service has been developed by the Federal Reserve to improve the speed and convenience of everyday payments in the coming years.

Competitive Landscape

The major players operating in the home banking market include Backbase, Capital Banking Solutions, EdgeVerve Systems Limited, Finastra, Fiserv, Inc., Jack Henry & Associates, Inc., Microsoft Corporation, NCR Corporation, Oracle Corporation, Q2 Holdings, Inc., and Temenos Headquarters SA. Other players in the home banking market include ACI Worldwide, FIS Global, SAP SE, and so on.

Recent Key Strategies and Developments in Home Banking Industry

In February 2024, Finastra, a leading global provider of financial software applications and marketplaces, and Tesselate, a renowned global digital transformation consultancy and integrator, unveiled a comprehensive pre-packaged service designed to accelerate and simplify the digitalization of trade finance. Tegula Trade Finance as a Service, powered by Finastra Trade Innovation and Corporate Channels, allows the U.S. banks to automate manual processes and swiftly adapt to evolving demands, offering faster time to market and enhanced value.

In January 2024, Temenos introduced Temenos Enterprise Services on the Temenos Banking Cloud, allowing banks to deploy comprehensive software solutions within just 24 hours and drastically cut modernization costs. This new offering features over 120 pre-packaged banking products, predefined customer journeys, and more than 700 pre-configured APIs. By providing a complete end-to-end system, Temenos enables banks to swiftly launch new business lines or progressively update their legacy systems. Temenos Enterprise Services deliver faster time-to-market, drive growth, and quickly unlock value for banks.

In April 2022, FIS introduced its Banking-as-a-Service Hub, empowering banks, credit unions, and FinTech's to create tailored digital banking and payments ecosystems. This hub offers a comprehensive suite of banking and payments capabilities for institutions of all sizes, facilitating the development of embedded finance solutions that improve customer experiences. The FIS Banking-as-a-Service Hub is intended to enable rapid configuration of new financial services, providing banks, FinTech's, and businesses across various industries with the tools needed to innovate and expand their financial offerings

In July 2021, Fiserv, Inc., a global leader in payments and financial services technology, unveiled its enhanced Fiserv Digital suite, designed to elevate digital banking and card management. This advanced, mobile-first solution enables financial institutions to deliver an exceptional digital banking experience, tailored to modern customer expectations. It addresses the increasing demand for a cohesive and seamless experience across both mobile and online platforms.

Key Sources Referred

American Bankers Association (ABA)

National Automated Clearing House Association (NACHA)

Electronic Transactions Association (ETA)

Financial Services Information Sharing and Analysis Center (FS-ISAC)

Institute of International Finance (IIF)

International Banking Federation (IBFed)

European Payments Council (EPC)

Global Digital Finance (GDF)

Open Banking Implementation Entity (OBIE)

Bank Administration Institute (BAI)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the home bankingmarket segments, current trends, estimations, and dynamics of the home banking market analysis from 2024 to 2033 to identify the prevailing home banking market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the home banking market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global home banking market trends, key players, market segments, application areas, and market growth strategies.

Home Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 54.9 Billion |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Service Type |

|

| By Platform Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, Temenos Headquarters SA, Capital Banking Solutions, Fiserv, Inc., Oracle Corporation, EdgeVerve Systems Limited, FIS Global, Backbase, ACI Worldwide, NCR Corporation, SAP SE, Finastra, Q2 Holdings, Inc., Jack Henry & Associates, Inc. |

Home banking allows users to manage their bank accounts and perform financial transactions online or via mobile apps from home.

The forecast period for the home banking market is 2024 to 2033.

The base year is 2023 in the home banking market.

The total market value of the home banking market was $16.0 billion in 2023.

The market value of the home banking market is projected to reach $54.9 billion by 2033.

Loading Table Of Content...