Home Surveillance Market Research, 2032

The global home surveillance market size was valued at $49 billion in 2022, and is projected to reach $116.6 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032. The growth of the home surveillance market is driven by rise in concerns about security and safety, advancements in camera technology, increased affordability of surveillance systems, and the convenience of remote monitoring through mobile devices. Moreover, growth in awareness of the importance of home security drives the adoption of surveillance solutions.

Home surveillance market refers to the industry which provides electronic security systems and devices which are designed for residential properties. It encompasses a wide range of products and services which monitor and safeguard homes against unauthorized access, theft, damage, and other potential threats. Home surveillance includes security cameras, smart doorbells, motion detectors, and integrated monitoring systems which are accessible through mobile applications or dedicated control panels.

Key Takeaways of Home Surveillance Market Report

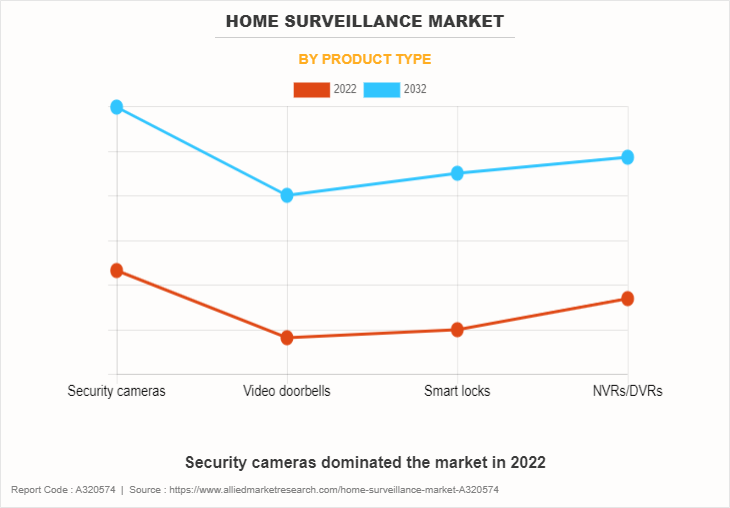

- By type, the security cameras segment was the highest revenue contributor to the home surveillance market in 2022 owing to the increase in awareness of the home security from burglaries, break-ins, and other property crimes.

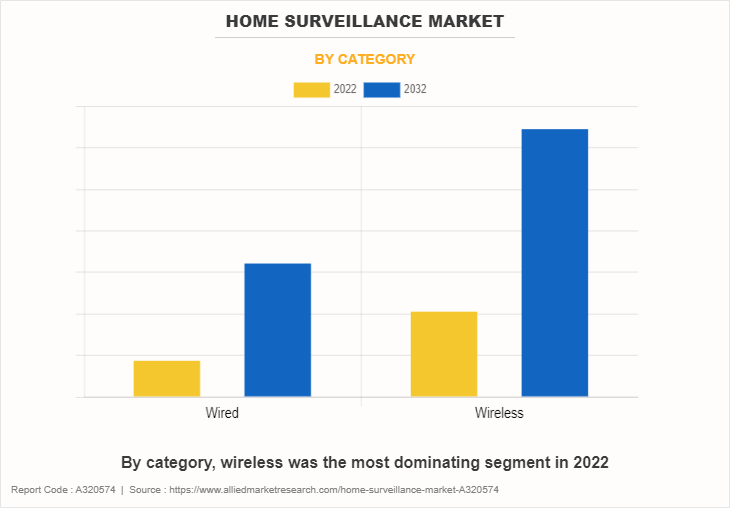

- As category, the wireless segment was the largest segment in the global home surveillance market during the forecast period.

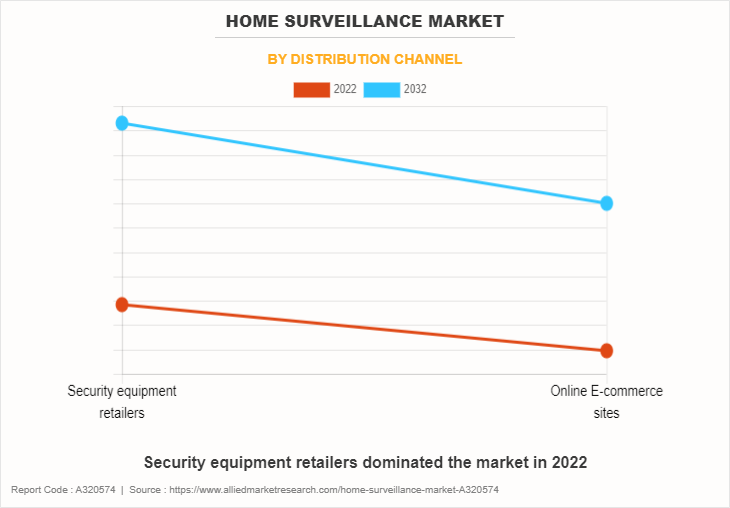

- Depending on distribution channel, security equipment retailers' segment was the largest segment in 2022.

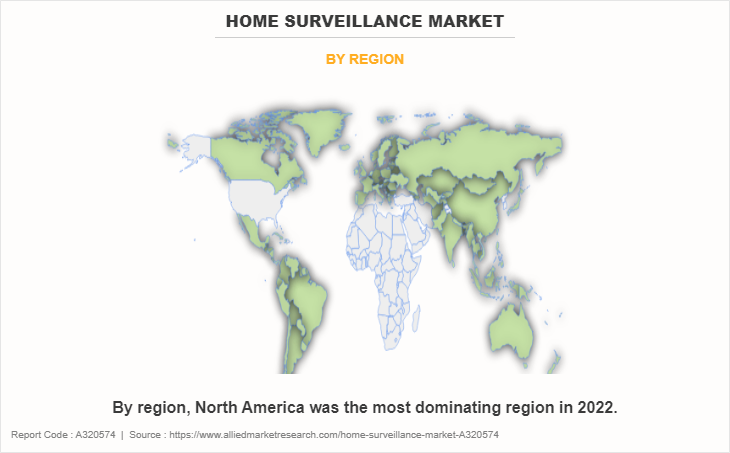

- Region-wise, North America was the highest revenue contributor in 2022 owing to greater spending on security solutions and the prevalence of smart home adoption.

MARKET DYNAMICS

Increase in concerns for home security

The increasing concerns for home security significantly contributes to the surge of demand for the home surveillance market. Homeowners are growing more aware of their homes' security such as burglaries, break-ins, and other property crimes are reported more frequently and have created a sense of insecurity in the minds of consumers. The growing awareness drives the demand for advanced home surveillance systems which prevent probable attackers and provide homeowners a way to track and safeguard their properties. Moreover, the home security systems have become increasingly popular among the U.S. homeowners, with at least 72% of home decision-makers opting for some form of home security. These factors thus contribute to the growth of the home surveillance market share.

According to U.S. News & World Report (multifaceted digital media company), the home security camera usage is 38% to monitor delivery workers, 32% to monitor their neighborhood, 29% to monitor the kids & pets, and 15% to monitor domestic workers. Advanced technologies such as high-definition cameras, smart sensors, and real-time monitoring capabilities address these concerns by allowing homeowners to take proactive measures to protect their families and assets. The demand is growing for continuously innovating and offering integrated, user-friendly solutions which provide to the specific security needs of homeowners. Furthermore, the rising concerns for home security drive the growth of home surveillance industry as individuals increasingly prioritize the safeguarding of their living spaces.

Integration of smart home surveillance systems

Integration of home surveillance systems with smart home ecosystems acts as a significant driver which surges the demand for home surveillance market. As smart home technologies become more prevalent, homeowners seek seamless and interconnected solutions which enhance overall home security. The integration of surveillance systems with smart home ecosystems allows users to manage and monitor their security seamlessly through centralized platforms or mobile applications. In addition, the level of integration provides convenience to the consumers and contributes to a more comprehensive and responsive security infrastructure, where surveillance cameras, motion detectors, and other devices work in harmony to ensure a strong defense against potential threats and help the market to boost.

Moreover, smart home ecosystems further increase the demand for home surveillance systems as users may receive real-time alerts, view live camera feeds, and even control surveillance devices remotely through their smart home hubs or smartphones. This integration aligns with the modern lifestyle, where individuals increasingly rely on technology for convenience and efficiency. Furthermore, the ability to integrate surveillance systems with other smart devices, such as door locks, lighting, and thermostats enhances the overall security ecosystem which makes it a more attractive and complete solution for homeowners. Thus, all these factors contribute to the growth of the home surveillance market demand.

High-Initial Investment

High-initial investment is required for high-quality surveillance equipment, including cameras, sensors, and monitoring systems which acts a restraint for home surveillance market. Homeowners observe these costs as a significant financial burden which discourages them from adopting comprehensive surveillance solutions especially for individuals with limited budgets or those who prioritize other household expenses over security enhancements. The cost of hiring professional installers makes it even more difficult for people to afford the services. In addition, setting up advanced surveillance systems which are complex in nature, prompts homeowners to opt for more affordable alternatives. Homeowners consider home security as a luxury or optional expense instead of primary need especially among price conscious customers. Thus, all these factors limit the growth of the home surveillance market.

Cybersecurity risks

Cybersecurity risks act as a restraint on the demand for home surveillance systems as surveillance systems have become more interconnected and reliant on internet connectivity. Concerns about unauthorized access to surveillance cameras, data breaches, or hacking incidents lessen the consumer confidence in the security of these technologies and result in the decline of widespread adoption of home surveillance systems. The increasing prevalence of cyberattacks on smart devices, including home surveillance systems, raises awareness about the weaknesses in these technologies. Moreover, the instances of hacking incidents, where unauthorized individuals gain access to live camera feeds or manipulate system settings led to a loss of trust in the reliability and safety of home surveillance solutions. Consumers may be hesitant to invest in these home surveillance systems due to being afraid of the potential consequences of cyber-attacks and restrict the growth of home surveillance market.

Development of smart surveillance technologies

The continuous development of surveillance technologies, such as high-resolution cameras, artificial intelligence (AI), and edge computing, enhances the capabilities of home surveillance systems. High-resolution cameras provide clearer and more detailed footage, while AI enables advanced features like facial recognition, object detection, and behavior analysis. These advancements improve the accuracy and effectiveness of home surveillance and contribute to a more proactive and intelligent security infrastructure. In addition, the integration of smart technologies and the Internet of Things (IoT) such as cloud-based storage solutions provide convenient access to recorded footage from anywhere, addressing the need for flexibility & accessibility and presents new opportunities for the home surveillance market.

SEGMENTAL OVERVIEW

The home surveillance market is segmented into Product Type, Category, Distribution Channel, and Region.

By Type

By type, the security cameras segment dominated the global home surveillance market in 2022 and is anticipated to maintain its dominance during the forecast period. Security cameras provide real-time video footage, minimize potential threats and serve as a valuable tool for investigations. The rise of smart home technology has further fueled their dominance, allowing users to remotely access and control cameras through mobile devices. Moreover, features such as motion detection, night vision, and two-way audio contribute to its versatility. The increasing awareness of the importance of home security and the affordability of advanced camera systems have propelled their widespread adoption across the globe.

By Category

By category, the wireless segment dominated the global home surveillance market in 2022 and is anticipated to maintain its dominance during the forecast period. Wireless cameras have gained prominence due to their unparalleled convenience, flexibility, and ease of installation. Wireless cameras eliminate the need for complex cable installations and allow users to set up their surveillance network effortlessly. The emergence of advanced wireless technologies, such as Wi-Fi and Bluetooth, ensures seamless connectivity and remote access via smartphones and other devices. Moreover, it provides user-friendly setup, integrated with the absence of physical cables and makes wireless cameras more demanding to a broader consumer base.

By Distribution Channel

By distribution channel, the security equipment retailers segment dominated the global home surveillance market in 2022. Security equipment retailers offer a diverse range of surveillance solutions to consumers. Security equipment retailers provide a one-stop-shop for individuals who seek comprehensive security solutions which includes surveillance cameras, alarms, and monitoring systems. They often offer expert advice and ensure the customers make informed decisions based on their specific requirements. Security equipment retailers provide convenience of physically examining and purchasing products to the consumers and offer potential bundled deals and after-sales services.

By Region

Region-wise, North America is anticipated to dominate the market with the largest share during the home surveillance market Forecast period. North America has a high awareness of security and safety concerns which drives the demand for advanced home surveillance systems. The affluence of the population in North America enables greater spending on security solutions and the prevalence of smart home adoption and the integration of home surveillance into comprehensive security ecosystems contribute to the region's dominance. Technological advancements and innovations in surveillance systems are often first introduced and widely adopted in North America. Furthermore, government initiatives prompt home security and the presence of a tech-savvy population further contribute in the home surveillance market growth.

COMPETITIVE ANALYSIS

Key players include Honeywell International, Inc., Panasonic Corporation, Bosch Security Systems GmbH, Zhejiang Dahua Technology Co., Ltd, Canon Inc., Eagle Eye Networks, Inc., Verkada Inc., Teledyne FLIR LLC, Brinks Home, and Frontpoint Security Solutions, LLC.

Several well-known and upcoming brands are vying for market dominance in the expanding home surveillance industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Large conglomerates, however, control most of the market and often buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies. Brands that change the preferences of their target market and align with their ethical & environmental values have an advantage over rivals.

Recent Developments in Home Surveillance Market

- In January 2022, Panasonic Corporation announced the development of technology for the mass production of far-infrared aspherical lenses suitable for improving the performance of cameras and sensors. These lenses are made of chalcogenide glass having excellent transmission characteristics in the far infrared.

- In May 2022, Panasonic Corporation and Leica Camera AG announced an agreement for a new comprehensive and expanded business alliance. Both companies collaborated to develop new technologies and solutions under the name of "L2 Technology" (L squared Technology).

- In August 2022, Teledyne FLIR announced the release of the Neutrino LC CZ 15-300, Neutrino IS series model of mid-wavelength infrared (MWIR) camera modules with integrated continuous zoom (CZ) lenses. Designed for integrated solutions requiring crisp, long-range, SD or HD MWIR imaging, the ITAR-free Neutrino IS series offers size, weight, power, and cost benefits to original equipment manufacturers (OEM) and system integrators for airborne, unmanned, C-UAS, security, ISR, and targeting applications.

- In May 2022, Teledyne FLIR Defense launched SeaFLIR 240 and TacFLIR 240, the additions to its line of high-definition, multi-spectral surveillance systems developed for a variety of maritime and land-based operations.

- In April 2022, Teledyne FLIR launched Hadron 640R combined radiometric thermal and visible dual camera module. The Hadron 640R design is optimized for integration into unmanned aircraft systems (UAS), unmanned ground vehicles (UGV), robotic platforms, and emerging AI-ready applications where battery life and run-time are mission-critical.

- In April 2020, Dahua Technology launched a professional retail epidemic safety protection solution to help retailers maintain safe operations and improve business efficiency during the pandemic, as well as providing upgraded plans to increase ROI after business resumption.

- In March 2022, Eagle Eye Networks launched Eagle Eye LPR (license plate recognition), which uses artificial intelligence (AI) in a true cloud-based system for high accuracy in all kinds of challenging conditions. Eagle Eye LPR operates on readily available security cameras making it affordable and practical for today's business owners.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the home surveillance market analysis from 2022 to 2032 to identify the prevailing home surveillance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the home surveillance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global home surveillance market trends, key players, market segments, application areas, and market growth strategies.

Home Surveillance Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 296 |

| By Product Type |

|

| By Distribution Channel |

|

| By Category |

|

| By Region |

|

| Key Market Players | Panasonic Corporation, Brinks Home, Canon Inc., Verkada Inc., Honeywell International, Inc., Eagle Eye Networks, Inc., Zhejiang Dahua Technology Co., Ltd, Bosch Security Systems Gmbh, Frontpoint Security Solutions, LLC, Teledyne FLIR LLC |

Analyst Review

According to CXOs of leading companies, the global home surveillance market is growing at a considerable pace owing to several factors such as increasing demand for new and home security applications. Individuals in developed nations monitor their homes, properties and make consistent efforts in purchasing different types of home surveillance systems. The integration of surveillance systems with smart home ecosystems allows consumers to manage and monitor their security seamlessly through centralized platforms or mobile applications. All these factors fuel the increase in sales of the home surveillance market.

Furthermore, significant changes in home automation technologies, such as smart doorbells, integrated lighting systems, and intelligent thermostats, create an environment where surveillance seamlessly integrates with broader smart home ecosystems. This integration aligns with the modern lifestyle, where individuals increasingly rely on technology for convenience and efficiency. As a result of growing crime rates, the demand for home surveillance solutions has significantly increased. Moreover, the desire for enhanced safety and the need for reliable tools to stop rising crime contribute to the growing demand for home surveillance market.

The global home surveillance market was valued at $ 48978.7 million in 2022, and is projected to reach $ 116564.1 million by 2032, registering a CAGR of 9.2%.

The forecast period in the home surveillance market report is 2023 to 2032.

The base year calculated in the home surveillance market report is 2022.

The top companies analyzed for global home surveillance market report are Honeywell International, Inc., Panasonic Corporation, Bosch Security Systems GmbH, Zhejiang Dahua Technology Co., Ltd, Canon Inc., Eagle Eye Networks, Inc., Verkada Inc., Teledyne FLIR LLC, Brinks Home, and Frontpoint Security Solutions, LLC.

The security cameras segment is the most influential segment in the home surveillance market report.

North America holds the maximum market share of the home surveillance market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the home surveillance market in 2022 was $ 48978.7 million.

Loading Table Of Content...

Loading Research Methodology...