Image Sensor Market Research, 2032

The global image sensor market was valued at $26.3 billion in 2022, and is projected to reach $87.5 billion by 2032, growing at a CAGR of 12.9% from 2023 to 2032.An image sensor is a semiconductor device that converts light into electronic signals, forming the basis of digital imaging in devices such as cameras and camcorders, enabling the capture and processing of visual information. It consists of an array of pixels that detect light intensity and create digital representations of images or videos.

There are various advantages to having an image sensor such as high-quality imaging with accurate color and detail, rapid capture speed for real-time applications, effective performance in low-light conditions, compact size for integration into portable devices, versatility across various fields, digital signal generation for seamless processing, energy efficiency, real-time feedback capabilities, customizability for specific needs, and broad compatibility with diverse electronic systems, collectively transforming how we capture, process, and utilize visual data in modern technology.

Segment Overview

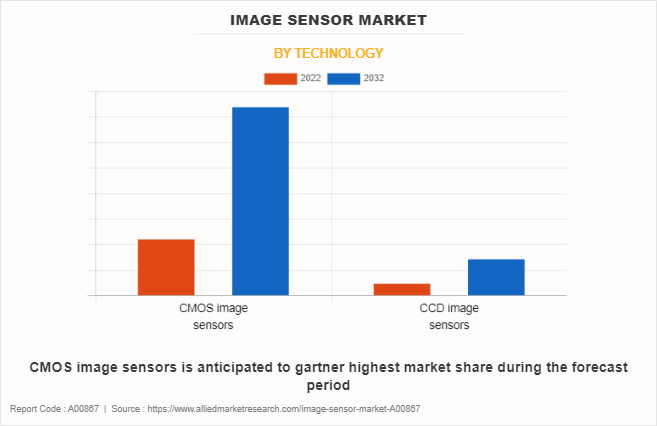

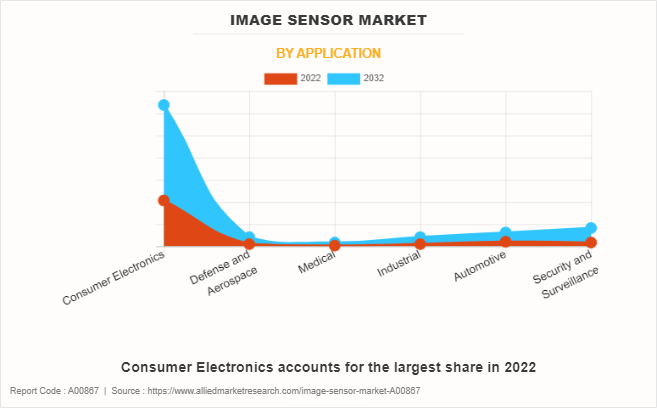

The image sensor market is segmented into Technology and Application.By technology, the market is segmented into CMOS image sensor and CCD image sensor. By application, the market is bifurcated into consumer electronics, defense & aerospace, medical, industrial, automotive, and security & surveillance.

on the basis of technology, the image sensor market outlook is segmented into CMOS image sensor and CCD image sensor. In 2022, the CMOS image sensor segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

On the basis of application, the image sensor market forecast is bifurcated into consumer electronics, defense & aerospace, medical, industrial, automotive, and security & surveillance. In 2022, the Consumer Electronics segment dominate the market in terms of revenue.

Region-wise, the Image sensor industry are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, Taiwan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).The Asia-Pacific Image sensor market industry is expected to grow at the highest CAGR during the forecast period.

One of the important drivers of the image sensor market is the rise in demand for multiple cameras in mobile phones as many consumer’s preferences shift toward enhanced photography and diverse imaging capabilities. This trend compels smartphone manufacturers to integrate a variety of specialized image sensors, such as wide-angle, telephoto, and depth sensors, fostering innovation and competition within the image sensor industry. The pursuit of advanced imaging effects such as portrait mode and low-light performance further accentuates the need for sophisticated image sensor technologies, thereby propelling research, development, and investment in the image sensor market.

For instance, Apple launched the iPhone 13 Pro and iPhone 13 Pro Max in September 2021. These flagship smartphones feature a sophisticated camera system that includes multiple specialized image sensors, including ultra-wide, wide, and telephoto lenses. Enhancing photography capabilities, such as improved low-light performance and the introduction of photographic styles for customized image processing highlight the emphasis on diverse imaging functionalities. As a result, demand for image detector is projected to increase as the need for smarter, more intuitive consumer devices across end user verticals are anticipated to grow during the forecast period, which in turn is predicted to boost the market growth.

Furthermore, the growing popularity of ADAS system in automotive drives the growth of the image sensor market by establishing a smooth driving experience. ADAS relies heavily on image sensors to provide crucial data for functions such as lane departure warnings, adaptive cruise control, and automated emergency braking. As consumer demand for safer and more automated driving experiences grows, automotive manufacturers are incorporating a range of image sensors, such as cameras and LiDAR, to enhance vehicle perception and decision-making capabilities.

However, high installation and maintenance costs hinder the growth of the photodetector market. The cost of manufacturing image sensors is quite high, and the additional costs of installation and maintenance can further increase the overall cost of image sensors, making it difficult for manufacturers to offer components at competitive prices. Thus, limiting the adoption of image sensors and restraining the revenue growth of the market. These high costs can be a roadblock, especially for small businesses and organizations with limited budgets, and hinder the adoption and use of image sensor technology.

On the other hand, advancements in image sensor technology present a compelling opportunity for the image sensor market. With continued innovations, such as higher pixel densities, improved dynamic range, enhanced low-light performance, and the integration of artificial intelligence, image sensors deliver increasingly sophisticated and precise visual data. These technological strides cater to the demand for higher-quality imaging in consumer electronics, automotive safety, medical diagnostics, and industrial automation as well as open doors to novel applications such as 3D imaging, multispectral sensing, and advanced image processing techniques. Thereby creating an opportunity for market growth.

Top Impacting Factors

The market for image sensor market is anticipated to expand significantly during the forecast period, owing to the surge in the use of image sensors for biomedical applications. In addition, increase in the adoption of ADAS systems in automobiles and the growing demand for multiple cameras in mobile devices fuel the market growth. Moreover, the image sensor market is anticipated to benefit from surge in investments in security and surveillance and advancements in image sensor technology, thus expected to present enormous opportunities for the market during the forecast period. However, the high cost of manufacturing image sensors is anticipated to restrain the market growth during the forecast period.

Competitive Analysis

The key players profiled in the report include Canon Inc., Samsung Electronics Co. Ltd., ON Semiconductor Corporation, Sony Group, STMicroelectronics NV, OMNIVISION, GalaxyCore Shanghai Limited Corporation, SK hynix Inc., PixArt Imaging Inc., and Panasonic Holding Corporation. These key players have adopted strategies, such as product portfolio investments, expansion, and product launch to enhance their position in the image sensor market share.

Historical Data & Information

The image sensor market growth is highly competitive, owing to the strong presence of existing vendors. Vendors in the image sensor market size with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/ Strategies

Canon Inc., Samsung Electronics Co. Ltd., ON Semiconductor Corporation, Sony Group, STMicroelectronics NV, OMNIVISION, GalaxyCore Shanghai Limited Corporation, SK hynix Inc., PixArt Imaging Inc., and Panasonic Holding Corporation are the top companies holding a prime share in the global image sensor market. Top market players have adopted various strategies, such as expansion and investment to expand their foothold in the image senor market.

- In April 2022, STMicroelectronics NV. launched a second-generation automotive global-shutter image sensor named VB56G4A that simplifies driver monitoring system (DMS) design, leveraging investment in advanced 3D-chip technology.

- In May 2022, OMNIVISION collaborated with Leopard Imaging Inc. to launch artificial intelligence (AI) camera solutions for autonomous machines, supporting the OA8000 and OAX8000 camera video processors The two companies are expected to collaborate closely to incorporate these powerful OMNIVISION processors with high-performance image sensors into a variety of Al systems, including autonomous driving, robotics, loT, drones, and other self-driving applications.

- In March 2022, OMNIVISION launched the new OS03B10 CMOS image sensor, which delivers high-quality digital pictures and high-definition (HD) video to security surveillance, IP, and HD analog cameras in a 3-MP 1/2.7-inch optical size.

- In December 2021, SK Hynix, Inc. announced that it has received merger clearance from the Chinese antitrust authority, State Administration for Market Regulation (SAMR), for its acquisition of Intel NAND and SSD business. SK Hynix will enhance its competitiveness of NAND Flash and SSD business by continuing the remaining post-merger integration process.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the image sensor market analysis from 2022 to 2032 to identify the prevailing image sensor market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the image sensor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global image sensor market trends, key players, market segments, application areas, and market growth strategies.

Image Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 87.5 billion |

| Growth Rate | CAGR of 12.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 253 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | OMNIVISION, Sony Group Corporation, Canon Inc., PixArt Imaging Inc., SK HYNIX INC., Samsung Electronics Co. Ltd, STMicroelectronics NV., GalaxyCore Shanghai Limited Corporation, Panasonic Corporation, ON Semiconductor Corporation |

Analyst Review

The global image sensor market holds high potential for the semiconductor industry. The business scenario witnesses increase in the demand for image sensor devices, particularly in developing regions, such as China, Japan, India, U.S., UK, Germany, and others. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

The growing demand for multiple cameras in mobile devices, and surge in use of image sensors for biomedical applications drive the growth of the image sensor market. However, the high cost of manufacturing image sensors impedes market growth. Further, advancements in image sensor technology and increasing investments in security and surveillance are expected to create lucrative opportunities for the key players operating in the market.??

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. For instance, in March 2022, OMNIVISION launched the new OS03B10 CMOS image sensor, which delivers high-quality digital pictures and high-definition (HD) video to security surveillance, IP, and HD analog cameras in a 3-MP 1/2.7-inch optical size.

CMOS image sensors is the upcoming trends of image sensor market in the world.

Consumer Electronics is the leading application of image sensor market.

Asia-Pacific is the largest regional market for image sensor market.

$26.30 Billion is the estimated industry size of image sensor.

Canon Inc., Samsung Electronics Co. Ltd., ON Semiconductor Corporation, Sony Group, STMicroelectronics NV, OMNIVISION, GalaxyCore Shanghai Limited Corporation, SK hynix Inc., PixArt Imaging Inc., and Panasonic Holding Corporation are the top companies to hold the market share in image sensor.

Loading Table Of Content...

Loading Research Methodology...