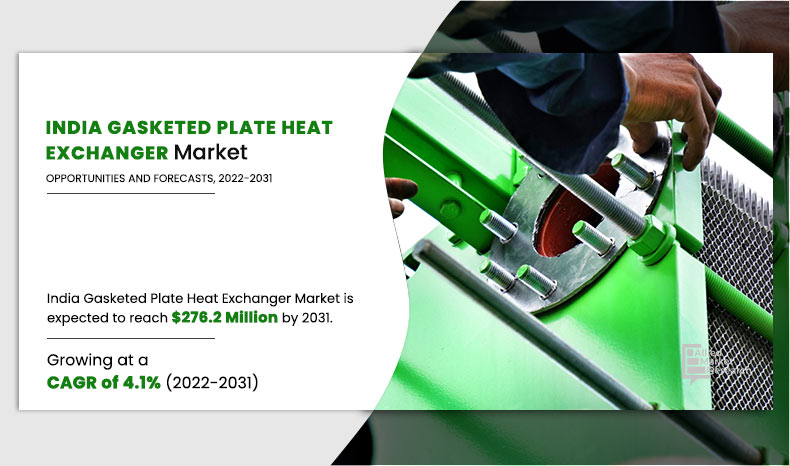

India Gasketed Plate Heat Exchanger Market Growth - 2031

The India gasketed plate heat exchanger market size was valued at $184.7 million in 2021, and projected to reach $276.2 million by 2031, with a CAGR of 4.1% from 2022 to 2031. Gasketed plate heat exchanger is an effective heat exchange device constructed by a series of corrugated thin metal sheets and gaskets. Sealing gaskets keep the hot and cold fluids apart between the plates so they can flow independently in the flow channels on either side. The heat transfer coefficient of GPHE is 3-5 times higher than that of the shell and tube heat exchanger. Gasketed plate heat exchanger possesses various properties, such as high heat exchange efficiency, compact design, temperature control, convenient maintenance, anti-corrosive properties, and low manufacturing cost, due to which it is used in chemical, oil & gas, HVAC & refrigeration, food & beverages, and other industries.

A crucial factor in the growth of the gasketed plate heat exchanger market is rise in environmental consciousness and rise in demand for more energy. Further, rise in industrialization, urbanization, rise in disposable income, and increase in demand from end users, such as chemical, HVACR, petrochemical, and oil & gas industries are the key factors expected to drive the growth of the India gasketed plate heat exchanger market during the forecast period.

Increase in industrial and construction activities has resulted in heavy metal contamination in various states. In addition, presence of strict environmental regulations in regards with testing is another factor driving the growth of the market. On the other hand, need for high-cost investment, fluctuating raw material prices, and lack of skilled workforce & equipment are factors that hamper the growth of the market.

Outbreak of novel coronavirus across the nation has negatively impacted the growth of the market. This is attributed to significant disruptions experienced by their respective manufacturing and supply-chain operations as a result of various precautionary lockdowns as well as other restrictions that were enforced by governing authorities across the nation. Manufacturers of heat exchangers are facing unexpected difficulties as a result of the crisis, including delayed production due to lockdown limitations, reduced worker availability, nationwide lockdowns, and fluctuations in the price of raw materials.

The India gasketed plate heat exchanger market forecast is segmented on the basis of type, material, and end use. On the basis of type, it is classified into industrial GPHE, semi-welded GPHE, and widegap GPHE. Depending on material, it is fragmented into stainless steel, titanium, and tungsten. By end use, it is divided into chemical, oil & gas, HVAC & refrigeration, food & beverage, and others.

The major companies profiled in India Gasketed Plate Heat exchanger market analysis include, Alfa Laval, Danfoss, Delta Cooling Towers P. Ltd., Heatex Industries Ltd., HRS Process Systems Ltd., HYDAC International GmbH, Kelvion Holding GmbH, Majestic Marine & Engineering Services, Process Engineers and Associates, Ved Engineering, Transcon Engineers Pvt. Ltd., Techtrans Engineers, Tranter, and Xylem.

Additional growth strategies, such as expansion of production capacities, acquisition, and partnership in the development of the innovative products from manufacturers have helped to attain key developments in the India gasketed plate heat exchanger market trends.

India gasketed plate heat exchanger market, by type

By type, the industrial GPHE segment dominated the India gasketed plate heat exchanger market in 2021, and is anticipated to grow at a CAGR of 4.3% during forecast period. The industrial GPHE segment is anticipated to grow as a result of rise in use of these devices in the petrochemical, food and beverage, and hydrocarbon processing industries. Moreover, industrial gasketed plate heat exchanger possesses various properties such as improve operational efficiency, cutting maintenance costs, and limiting equipment failure due to overheating which give rise to industrial gasketed plate heat exchanger market.

By Type

Industrial GPHE is the most lucrative segment

India gasketed plate heat exchanger market, by material

In 2021, the stainless steel segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.2% during the forecast period. The primary drivers fueling the increase in product demand include, rise in steel production, rise in R&D efforts, and expanding building sector. In addition, stainless steel is eco-friendly, anticorrosive, long-lasting, neutral alloy, and infinitely recyclable owing to such properties market expansion for stainless steel gasketed plate heat exchanger is anticipated to grow in upcoming year.

By Material

Stainless Steel would exhibit highest CAGR of 4.2% during 2021-2030.

India gasketed plate heat exchanger market, by end-use

By end use, the food & beverage segment dominated the India market in 2021, and is anticipated to grow at a CAGR of 4.5% during forecast period. The growth in the food & beverages sector is being fueled by a number of factors, including rapid urbanization, changing eating and lifestyle habits of consumers, and rise in household consumption rates. Meanwhile, the industry has developed and widened its scope with newly emerging trends in consumer preferences and the development in technologies adapted to meet those preferences. To offer new items such ready-to-eat foods, drinks, processed fruits & vegetables, processed marine and meat products, etc., competitors are now focusing on implementing new projects which include the establishment of cold storage facilities, food parks, packaging centers, irradiation centers, and modernized processing plants.

By End Use

Food & Beverage end-use is projected as the fastest growing segment

Key Benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current India gasketed plate heat exchanger market trends and future estimations from 2021 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The study provides India gasketed plate heat exchanger opportunities, drivers, restraints, and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The India Gasketed Plate Heat Exchanger Market

- COVID-19 is an infectious disease that originated in the Hubei province of the Wuhan city in China in late December 2019. This highly contagious disease is caused by a virus, namely, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans. The disease has spread to almost 213 countries around the globe since the outbreak in December 2019 with the World Health Organization declaring it a pandemic on March 11, 2020.

- The COVID-19 pandemic affected the growth of various industries. Several industries were forced to cease operations as a result of the strict lockdowns that were enforced in many nations. Activities related to infrastructure were stopped because of the nationwide lockdowns. The impact of the outbreak is varied, as few industries registered a drop in demand, whereas numerous other industries remained unscathed and exhibited promising growth opportunities. The COVID-19 outbreak along with the decline in price of crude oil in first quarter wreaked havoc on the economic landscape. Manufacturers of gasketed plate heat exchangers are facing unexpected difficulties as a result of the crisis, including delayed production due to lockdown limitations, reduced worker availability, supply chain delays, nationwide lockdowns, and fluctuations in the price of raw materials. However, stimulus packages from various governments globally have assisted the nations in supporting their lagging economies. These programmes are also anticipated to benefit a number of end-use industries and promote economic recovery period the COVID-19 crisis.

India Gasketed Plate Heat Exchanger Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By End Use |

|

| By Key Market Players |

|

Analyst Review

According to CXOs of leading companies, the India gasketed plate heat exchanger market is expected to exhibit high growth potential during the forecast period, owing to surge in heavy metal contamination and growth in industrialization, urbanization, and stringent government regulation for environmental protection.

Depending on type, the industrial GPHE segment is the dominating segment in the India gasketed plate heat exchanger market, owing to stringent government regulation imposed over the pollution maintenance and heavy metal contamination, which, in turn, limits the increase in investments by the various manufacturing industries. Furthermore, factors that can influence the industrial gasketed plate heat exchanger market involve growing energy generation costs, strict government regulations on CO2 emissions, high priority on improving operational efficiency, cutting maintenance costs, and limiting equipment failure due to overheating.

Gasketed plate heat exchanger is used in chemical, industrial, food & beverage, and oil & gas sectors. The major factor for the growth of the market includes, increase in awareness of environmental degradation along with surge in industrial activities and initiatives for sustainable development. Growth in instances of health issues, such as COVID-19 caused by organic contamination resulted in favorable polices for environment and human health protection, which are projected to fuel the market growth.

Additional growth strategies, such as expansion of production capacities, acquisition, and partnership in the development of the innovative products from manufacturers have helped to attain key developments in the India gasketed plate heat exchanger market trends.

Rise in industrialization, Urbanization, Rise in disposable income, and increase in demand from end users, such as chemical, HVACR, petrochemical, and oil & gas industries.

The major companies profiled in this report include, Alfa Laval, Danfoss, Delta Cooling Towers P. Ltd., Heatex Industries Ltd., HRS Process Systems Ltd., HYDAC International GmbH, Kelvion Holding GmbH, Majestic Marine & Engineering Services, Process Engineers and Associates, Ved Engineering, Transcon Engineers Pvt. Ltd., Techtrans Engineers, Tranter, and Xylem.

Growing pharmaceuticals and textile industry escalating the demand from pasteurization, heating cleaning fluids that remove residues from systems components are the emerging trends in the gasketed plate heat exchanger market.

Loading Table Of Content...