India Nano Gold Market Outlook - 2020–2027

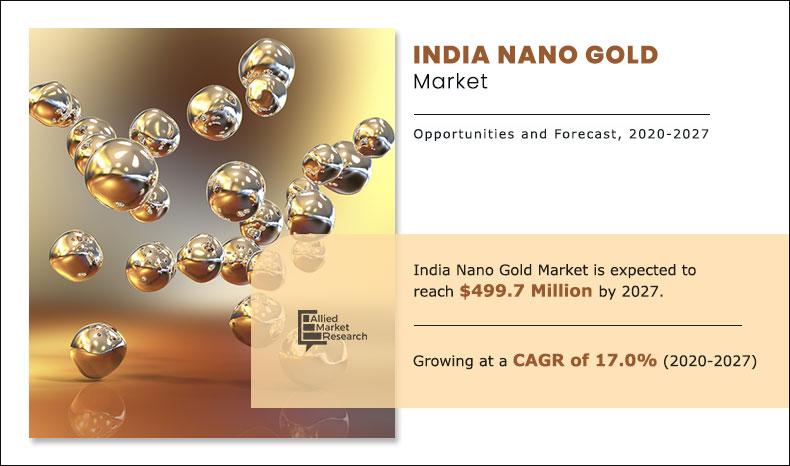

The India nano gold market size was valued at $201.4 million in 2019, and is projected to reach $499.7 million by 2027, growing at a CAGR of 17.0% from 2020 to 2027.

Nano gold is one of the most commonly used nanomaterials due to its superior electrical-chemical properties, optical properties, and anti-microbial properties. The gold nanoparticles are easy to manufacture as compare to other types of nanoparticles or materials, owing to high chemical stability. It is used in various applications including probes, sensors, and optical applications due to its high conductivity. It is also used in the applications including imaging, targeted drug delivery, in vitro diagnostics, catalysis, and others.

The growth of the India nano gold market is driven by factors such as rise in demand for nano gold from electronics & healthcare industry and properties & advantages associated with gold nanoparticles in the country. However, government regulations toward environmental pollution and variation in prices of raw materials are expected to restrain the market growth in the upcoming years. On the contrary, rise in awareness & trend toward biological synthesis method along with R&D toward the use of nano gold in healthcare and electronics applications is anticipated to create lucrative opportunity for the key players in the India nano gold market.

The India nano gold market is segmented on the basis of type, diameter size, application, and end user. The study highlights various types of nano gold available in the market such as water soluble, oil soluble, and others. Depending on diameter size, the market is segmented into less than 40 NM, 40 to 100 NM, 101 to 400 NM, and others. On the basis of application, the market is fragmented into imaging, targeted drug delivery, sensors, in vitro diagnostics, probes, catalysis, and others. The end users covered in the study include electronics, healthcare, chemicals, and others.

The key players operating in the India nano gold market are Aritech Chemazone Pvt Ltd, Nanocomposix, Blacktrace Holdings Ltd, Mincometsal, Indian Platinum Private Limited, Merck KGaA, Nano Labs, Nanoshel LLC, Techinstro, and Thermo Fisher Scientific.

Other players operating in the value chain of the India nano gold market are Nano Research Lab, Nano Research Elements, Nanorex, Nanopartz, Inc., and others.

The India nano gold market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2020–2027. The report includes the study of the India nano gold market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

The India nano gold market, by type

By type, the water-soluble segment held the largest market share in 2019. This is attributed to increase in use of water-soluble gold nano particles in the applications including spin coating, self-assembly, and monolayer formation.

By Type

Water Soluble is projected as the most lucrative segment.

The India nano gold market, by diameter size

By diameter size, the less than 40 nm segment held the largest market share in 2019. This is attributed to rise in demand for gold nano particles with diameter size less than 40 nm from applications such as drug delivery, energy related devices, surface-enhanced Raman labels, sensing/detection, biological targeting, plasmonic, and electronics applications in the country.

By Diameter Size

Less than 40 nm holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

The India nano gold market, by application

On the basis of application, the in vitro diagnostics segment dominated the India nano gold market in 2019, in terms of share, owing to rise in demand for in vitro diagnostics (IVD) instruments from applications including bedside diagnostic tests, in-home tests, and bio emergency response. In addition, increase in use of IVD instruments in clinical labs or by isolated village health service providers is anticipated to fuel the demand for nano gold in the upcoming years.

By Application

In Vitro Diagnostics holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

The India nano gold market, by end user

By end user, the healthcare segment dominated the highest share in the India nano gold market in 2019, and is expected to maintain the same during the forecast period. This is attributed to rise in demand for gold nano particles from healthcare applications such as therapeutics, diagnostics, antibiotics, and antigens in India during the forecast period. In addition, improvements in medical imaging and nano medicines are fueling the demand for nano gold, which in turn is projected to propel the market growth in the coming years.

By End User

Healthcare is projected as the most lucrative segment.

COVID-19 impact on the market

Lockdown imposed due to the outbreak of the COVID-19 pandemic has resulted in temporary ban on the import and export; thereby, disrupting the supply chain and hampering the nano gold market growth in the second, third, and fourth quarter of 2020. However, the market is expected to recover in the late year or by the first quarter of 2021 as the production activities in the country begins.

Key Benefits For Stakeholders

- The report includes in-depth analysis of different segments and provides India nano gold market estimations between 2020 and 2027.

- A comprehensive analysis of the factors that drive and restrict the growth of the India nano gold market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecast are based on factors impacting the India nano gold market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current India nano gold market trends and future estimations from 2020 to 2027, which helps identify the prevailing market opportunities.

Key Market Segments

By Type

- Water Soluble

- Oil Soluble

- Others

By Diameter Size

- Less than 40 nm

- 40 to 100 nm

- 101 to 400 nm

- Others

By Application

- Imaging

- Targeted Drug Delivery

- Sensors

- In Vitro Diagnostics

- Probes

- Catalysis

- Others

By End User

- Electronics

- Healthcare

- Chemicals

- Other

India Nano Gold Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Diameter Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | INDIAN PLATINUM PRIVATE LIMITED, TECHINSTRO, Thermo Fisher Scientific Inc., NANO LABS, NANOSHEL LLC, ARITECH CHEMAZONE PVT LTD, BLACKTRACE HOLDINGS LTD., MINCOMETSAL, MERCK KGAA, NANOCOMPOSIX |

Analyst Review

According to the perspective of the CXOs of companies in the market, the factors that drive the market are rise in demand for nano gold particles or materials from electronics, pharmaceutical, chemicals, and healthcare industry. In addition, increase in demand for nano gold from various research areas in electronics and medical field is anticipated to fuel the growth of the market during the analyzed time frame. Moreover, R&D toward efficient use of nano gold in the electronics and healthcare applications is projected to create lucrative opportunity for key players in the India nano gold market.

However, factors such as stringent environmental regulations toward environmental pollution are expected to hamper the market growth during the forecast period. Currently, the electronics, healthcare, chemicals, and others segments are the major end user markets for gold nanoparticles. The healthcare segment accounted for the largest market share of around 48.3% in the India nano gold market followed by electronics and chemicals, and is expected to maintain its dominance in this market during the forecast period.

Key factors boosting the India nano gold market are rapid growth of electronics, healthcare, and chemical industries in the country and rise in demand for consumer electronics products in the region is expected to fuel the demand for electronic chips, sensors, and others used in manufacturing of electronics products.

The market value of the India nano gold was valued at $201.4 million in 2019 and is expected to reach $499.7 million by 2027 at a CAGR of 17.0%.

The most established players of the India nano gold market are Aritech Chemazone Pvt Ltd, Nanocomposix, Blacktrace Holdings Ltd, Mincometsal, Indian Platinum Private Limited, MERCK KGaA, Nano Labs, Nanoshel LLC, Techinstro, and Thermo Fisher Scientific.

Healthcare is projected to increase the demand for the nano gold in the Indian market.

The India nano gold market is anlayzed on the basis of type, diameter size, application and end user.

The main driver of the India nano gold market is rise in demand for nano gold from electronics and healthcare industries

Applications including imaging, targeted drug delivery, sensors, in vitro diagnostics, probes, catalysis, and others are expected to drive the adoption of the nano gold products in India.

Lockdown imposed due to the outbreak of the COVID-19 pandemic has resulted in temporary ban on the import and export; thereby, disrupting the supply chain and hampering the nano gold market growth in the second, third, and fourth quarter of 2020. However, the market is expected to recover in the late year or by the first quarter of 2021 as the production, supply and trade activities in the country begins.

Loading Table Of Content...