Industrial Automation Market Research, 2031

The global industrial automation market size was valued at $196.4 billion in 2021, and is projected to reach $443.5 billion by 2031, growing at a CAGR of 8.7% from 2022 to 2031.

Emergence of connected enterprises and requirement of mass manufacturing of products and increasing adoption of digital techniques and AR technologies in manufacturing is driving the growth of market. Moreover, growing demand for Industrial IoT are boosting the industrial automation market size. However, significant initial capital investments and re-investments and lack of technical proficiency and lack of awareness for maintenance. are hampering the industrial automation market growth. On the contrary, increased demand for safety compliance automation solutions and industrial automation solutions are expected to offer remunerative opportunities for expansion of market during the forecast period.

Industrial automation is the process of applying intelligent technology to industrial processes to replace manual, tedious, repetitive tasks with highly efficient and automated workflows. Furthermore, automation helps in reduction of manufacturing costs, increases productivity, enhances quality, and industrial safety. Moreover, it improves process control and significantly reduce lead times compared to outsourcing or going overseas.

Segment Review

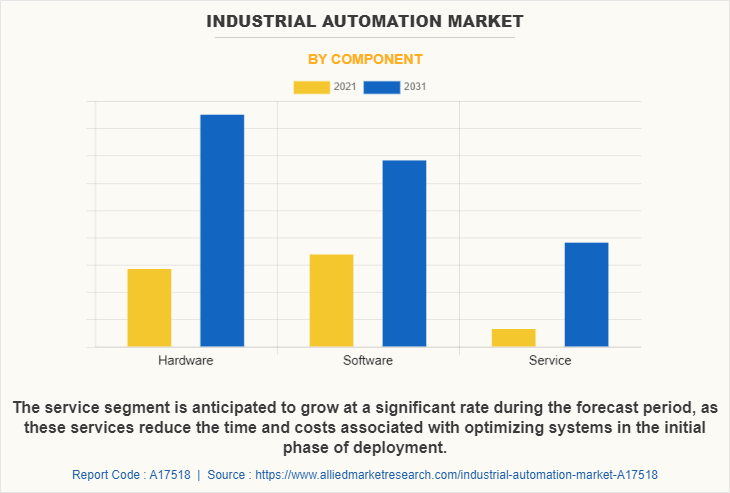

The industrial automation market is segmented on the basis of component, hardware, software type, industrial vertical and region. On the basis of component, the market is categorized into hardware, software and service. On the basis of hardware, the market is bifurcated into industrial sensors, machine vision systems, field instruments, industrial robots, human machine interface, industrial pcs, and others. On the basis of software type, the market is classified into supervisory control and data acquisition, programmable logic controller, distributed control system, manufacturing execution system, industrial safety, and plant asset management. On the basis of industrial vertical, it is classified into oil & gas, manufacturing, automotive, healthcare, food & beverages, chemicals, energy & power, metal & mining, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the industrial automation industry are Adisra, ABB Ltd, Dwyer Instruments LLC., Endress + Hauser, Emerson Electric Co, Fizyr, Fanuc Corporation, Generic Electric Co, Honeywell, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation Inc, Siemens AG, Stratasys, Schneider Electric SE, WIKA USA, and Yocogawa Electric Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

In terms of component, the software segment holds the largest industrial automation market share owing to, high level of cost savings on the total cost of ownership, increased delivery speed & quality, and growth in standardized & configurable fixed operator services. However, the service segment is expected to grow at the highest rate during the forecast period owing to increasing demand for industrial automation and need for professional services to train the employees to safely operate these machines.

Region wise, the industrial automation market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in industrial automation solutionssuch as AI, IoT technologies and robotic automation offers lucrative opportunity for the market. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to presence of robotics and factory automation products and manufacturing companies.

Top Impacting Factors

Emergence of connected enterprises and requirement of mass manufacturing of products

The emergence of the concept of connected enterprises is fueling the growth of the industrial automation market globally. In addition, efficient information flow across different units in industries is an important factor for enhanced production activities to enables manufacturers to understand the process of converting raw materials into finished goods in an improved manner with the help of IoT and IP networks. Furthermore, IoT-enabled systems can be used to track the location of field instruments, ensure proper flow of raw materials, keep a record of the status of inventories, and report products going through the supply chain.

Moreover, connected enterprises also have easy access to the flow of information throughout the entire supply chain, thereby making it easy to respond to the changing market conditions. However, real-time information helps manufacturing industries in reducing inventory costs, identifying issues related to cyber theft, and achieving production according to the market requirements. Increased requirement for enhanced productivity, along with the manufacturing of quality products, is driving the demand for advanced tools and software systems. This demand can be addressed by the deployment of advanced production systems and methods offered by industrial automation.

Growing demand for Industrial IoT

Industrial Internet of Things (IIOT) plays a crucial role in automation technology as it helps to create and streamline effective, affordable, and responsive systems architectures. In addition, it helps to connect industrial assets, create transparency quickly and easily and increase productivity. Furthermore, IoT and edge computing solutions helps to simplify device management and software across the entire business operations.

Moreover, Organizations deploy IIOT solutions to automate the manufacturing process and to provide better customer service experience. For instance, in June 2022, Siemens partnered NVIDIA Omniverse to enable the industrial metaverse and increase use of AI-driven digital twin technology that will help bring industrial automation to a new level. Therefore, such growing expansion of industrial IoT across industries likely to drive the industrial automation market growth.

Regional Insights -

The industrial automation industry is experiencing significant growth globally, driven by technological advancements and increasing demand for operational efficiency.

North America is a key market, characterized by a high adoption rate of advanced automation technologies in industries such as automotive, aerospace, and manufacturing. The U.S. and Canada lead in integrating robotics, AI, and IoT into industrial processes, enhancing productivity and precision.

In Europe, the industrial automation market is expanding steadily, with strong growth in Western Europe, including Germany, the UK, and France. European industries are investing heavily in automation to comply with stringent regulations and improve manufacturing efficiency. The region also focuses on Industry 4.0 initiatives, which drive the adoption of smart factories and digitalization.

Asia-Pacific is witnessing rapid growth, fueled by industrial expansion in countries like China, India, and Japan. The region's market is driven by the increasing adoption of robotics, sensors, and automated control systems in manufacturing and logistics, supported by rapid urbanization and economic development.

Latin America shows gradual growth, with Brazil and Mexico leading the adoption of automation technologies to modernize industrial operations and enhance productivity.

In the Middle East & Africa, the market is emerging, with investments in automation driven by industrial development projects and the need for improved efficiency in sectors like oil and gas, mining, and manufacturing. Such factors drive the growth of the industrial automation market.

COVID-19 Impact Analysis

The industrial automation industry has recorded continuous investments for its developments and has become a massive contributor to the economic growth. However, the COVID-19 pandemic has substantially impacted the value chain of the market. In addition, resulting in decreased shipments of component and solution of industrial automation and the revenues generated from them. Furthermore, COVID-19 pandemic has impacted almost all the industries globally including industrial automation and machinery. Moreover, as a result, a drop was witnessed in the growth trend of the market during the first half of 2020. This is expected to discontinue in the latter half of the year as the demand is expected to increase due to the growing concern for smart automation, energy, and resource efficiency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial automation market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial automation market trends, key players, market segments, application areas, and market growth strategies.

Industrial Automation Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Hardware |

|

| By Software Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Schneider Electric SE, Honeywell International Inc., Omron Corpporation, Adisra, WIKA USA, Yocogawa Electric Corporation, Fanuc Corporation, Stratasys, ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, General Electric,, Fizyr, Siemens AG, Dwyer Instruments, LLC, Endress+Hauser group services AG, Rockwell Automation Inc. |

Analyst Review

Industrial automation uses to control industrial processes and machinery by removing as much labor intervention as possible and replacing dangerous assembly operations with automated ones. Industrial automation is closely linked to control engineering. In addition, control systems are an essential part of an automation system. The various types of closed-loop control techniques ensure the process variables to follow the set points. Furthermore, with this basic function, the automation system employs different functions such as computing set points for control systems, plant startup, monitoring system performance, equipment scheduling, etc. The control systems combined with the operating environment in the industry to allow flexible, efficient, and reliable production system.

Industrial automation enables businesses to obtain gross profit margin, working capital, and return on equity. Moreover, the increasing demand for advance technology and industrial operations is driving the growth of the industrial automation market. With growth in requirement for manufacturing services, various companies have established alliance to increase their capabilities. For instance, in June 2022, MG Motor has partnered with Siemens. To focus on industrial digitalization and intelligent manufacturing. It will strengthen commitment to lowering carbon footprints, increasing production efficiency, and providing significant energy and cost-saving solutions

In addition, with further growth in investment across the world, the rise in demand for financial consulting software, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2022, Rockwell Automation and Schlumberger, is the leading automation specialist in oil and gas production, transportation and processing has launched Avalon automation and digitalization platform. It helps to save time, money and hassle compared to building a custom digital platform by selecting and integrating technologies from multiple vendors.

Moreover, with increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, September 2021, Honeywell acquired privately held Performix Inc. The acquisition is expected to deliver critical solutions to pharmaceutical and biotech manufacturers as they digitally transform their operations.

Emergence of connected enterprises and requirement of mass manufacturing of products and increasing adoption of digital techniques and AR technologies in manufacturing is driving the growth of industrial automation market. Moreover, growing demand for Industrial IoT are boosting the industrial automation market size.

Region wise, the industrial automation market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions such as AI, IoT technologies and robotic automation offers lucrative opportunity for the market.

The global industrial automation market was valued at $196.36 billion in 2021, and is projected to reach $443.49 billion by 2031, registering a CAGR of 8.7% from 2022 to 2031.

The key players that operate in the industrial automation industry are Adisra, ABB Ltd, Dwyer Instruments LLC., Endress + Hauser, Emerson Electric Co, Fizyr, Fanuc Corporation, Generic Electric Co, Honeywell, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation Inc, Siemens AG, Stratasys, Schneider Electric SE, WIKA USA, and Yocogawa Electric Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...