Industrial Food And Beverages Filtration System Market Research, 2031

The global industrial food and beverages filtration system market size was valued at $1.1 billion in 2021 and is projected to reach $1.9 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

The process of filtering is crucial in foods & beverages industries. Foods & beverages filters such as string wrapped filters are used to purify foods & beverages products in manufacturing process. Filtration systems keeps food and its ingredients fresh, extends shelf life of snacks, prevents beverages from getting waste too quickly, and improves taste and color of vegetables.

Increase in awareness regarding the need to prevent diseases and health issues such as heart problems, obesity, diabetes, and cholesterol boosts foods & beverages industries to implement filtration systems in their manufacturing facility. Moreover, expansion of modern techniques of farming, which involves use of pesticides and fertilizers with an increase in trend of organic farming is expected to raise concerns over hygiene and safety of foods & ingredients, which creates demand for efficient filtration systems for foods & beverages. Furthermore, expansion of the industrial food and beverages filtration system market is aided by increase of food-borne diseases brought on by consumption of tainted food items produced in unclean settings without the use of adequate filtering systems. Market share is probably driven by rise in customer desire for eating packaged, healthier food items. Acceptance of the product might be accelerated by rising consumer knowledge of benefits of organic fruit juices and non-alcoholic drinks. Such strategic moves are expected to boost the global industrial food and beverages filtration system market growth.

Furthermore, various government rules and laws, especially assigned for foods & beverages manufacturing such as Food Safety and Standards Authority of India (FSSAI), Food and Drug Administration (FDA), and General Food Law Regulation force companies to manufacture filtration systems for the foods & beverages sector. For instance, in October 2020, Donaldson Company, Inc introduced Donaldson Torit Rugged Pleat (RP) baghouse, an industrial dust collector which is designed to capture heavy and abrasive dust inherent to woodworking, mining, grain processing, and other industries. As a result, increase in number of increase investments in the manufacturing industry to control harmful particulate emissions and rise in stringent air pollution control norms projects is expected to provide profitable prospects for industry participants.

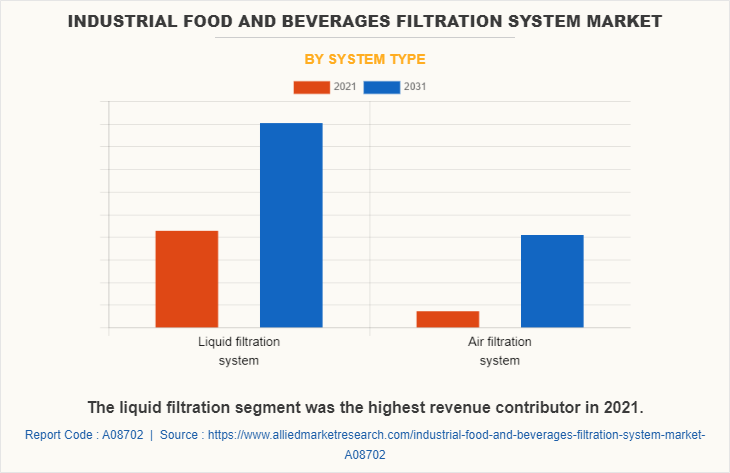

On the basis of system type, the liquid filtration segment is generated largest revenue in 2021, owing to advancements in technology related to filtration and rapid industrial development around the globe are anticipated to accelerate growth of the liquid filtration.

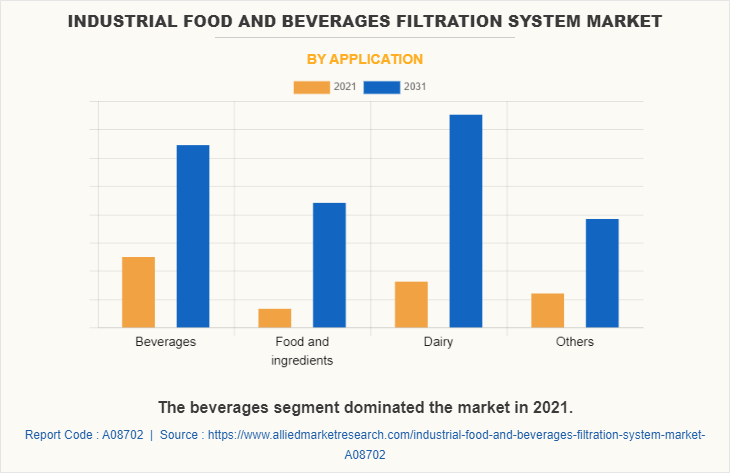

On the basis of application, the beverage segment accounted for highest revenue in the global industrial food and beverages filtration system market in 2021, owing to the rise in popularity of refreshment drinks and increase in in demand for packaged foods.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the industrial food and beverages filtration system market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with introduction of vaccines for COVID-19 in the market. This has led to reopening of indoor flooring companies at their full-scale capacities. This is expected to help the market recover by the mid of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

The industrial food and beverages filtration system market is segmented into system type, products types and application. On the basis of system type, the market is divided into liquid filtration system air filtration system. On the basis of product type, it is divided into dust collector, cartridge collector, baghouse filter, basket centrifuges, and others. On the basis of application, it is divided into beverages, foods & ingredients, dairy, and others. Region wise, the industrial food and beverages filtration system market share analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

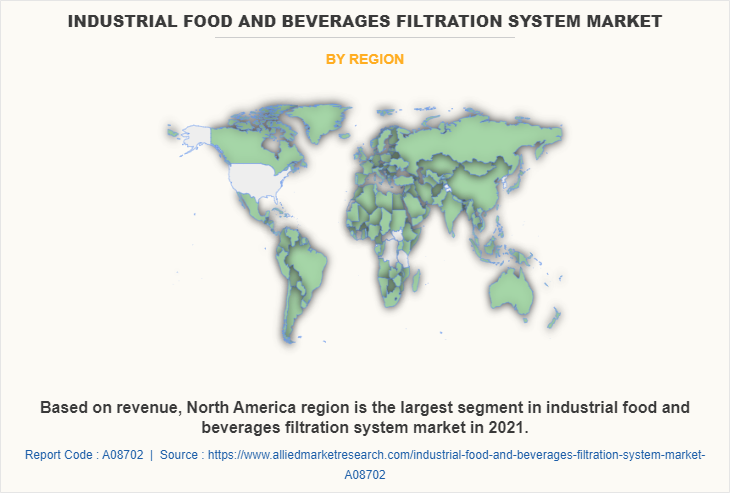

On the basis of region, North America registered highest revenue in 2021, owing to rise in investments and increase in consumer awareness regarding clean label food products in foods & beverages. Furthermore, the majority of countries in the region are spending on the foods & beverages manufacturing sector for growth of their economies.

Competition Analysis

The key players that operating in the industrial food and beverages filtration system industry are 3M Co., Alfa Laval AB, American Air Filter Co. Inc., Critical Process filtration inc., Eaton Corporation plc, Filter Concept Pvt. Ltd., GEA Group AG, Graver Technologies LLC, KRONES AG, Parker Hannifin Corp., Pall Corporation, Mott Corporation, Aqseptence Group, Universal Filtration, and Donaldson Company, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial food and beverages filtration system market analysis from 2021 to 2031 to identify the prevailing industrial food and beverages filtration system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- The industrial food and beverages filtration system market of the segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global industrial food and beverages filtration system market trends, key players, market segments, application areas, and market growth strategies.

- The global industrial food and beverages filtration system market forecast analysis from 2022 to 2031 is included in the report

Industrial Food and Beverages Filtration System Market Report Highlights

| Aspects | Details |

| By System Type |

|

| By Products Types |

|

| By Application |

|

| By Region |

|

| Key Market Players | Dorstener Wire Tech, 3M Co., GEA Group AG, Mott Corporation, Aqseptence Group, pall corporation, Alfa Laval AB, Krones A, Parker Hannifin Corp., Donaldson Company, Inc., Universal Filtration, Critical Process Filtration Inc., Filter Concept Pvt. Ltd., Eaton Corp. Plc., Graver Technologies LLC |

Analyst Review

The industrial food and beverages filtration system market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to register significant growth in the future, owing to expansion of the foods & beverages sectors and rise in population. Moreover, increase in awareness regarding nutritious and organic foods also propels market. Companies are focusing on providing enhanced quality food products that adhere to government regulations on food safety. The liquid filtration system segment accounted for the majority of the market share in 2021, owing to rise in health concerns and enactment of stringent government regulations on food safety.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand its business and strengthen its market position. For instance, In January 2020, Parker-Hannifin Corporation began the construction of Parker Filtration Innovation Center, a new filter membrane application research and development center in Columbia, Tennesse. This capacity expansion would enable the company to conduct extensive research to improve filtration systems in the foods & beverages industry. As a result, such strategic moves are expected to provide lucrative growth in the global industrial food and beverages filtration system market.

The Industrial Food and Beverages Filtration System market size was valued at $1,098.1 million in 2021.

The Industrial Food And Beverages Filtration System Market is projected to reach $1,911.5 million by 2031.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Technical issue in filtration process is the Industrial Food and Beverages Filtration System Market effecting factors.

Based on system type, the liquid filtration segment holds the maximum market share of the Industrial Food and Beverages Filtration System Market.

North America is the largest regional market for Industrial Food and Beverages Filtration System market.

The beverages segment is the leading application of Industrial Food and Beverages Filtration System Market.

Stringent regulatory norms by governments to maintain the quality of food & beverage products and the expansion of foods & beverages manufacturing facilities are the upcoming trends of the Industrial Food and Beverages Filtration System Market in the world.

Loading Table Of Content...