Industrial Refrigeration Service Market Research, 2032

The Global Industrial Refrigeration Service Market size was valued at $3.8 billion in 2020, and is projected to reach $7.1 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. Industrial refrigeration services refer to all the services pertaining to industrial refrigeration systems. These services include designing of refrigeration system, its installation, and maintenance & repair which includes renovation, rehabilitation, remote maintenance, and other relevant services.

Market Dynamics

Industrial refrigeration services are vital systems in many industries, as they are used for keeping various temperature-sensitive goods from food and beverages, pharmaceuticals, chemicals, and other industries. In the past few decades, the growth witnessed by these industries has been immense. For example, between 2011 and 2021, the total production sale of chemicals in the European Union increased from $746.7 billion in terms of value, reaching a peak of $909 billion in 2021. Medical-related chemicals accounted for the highest share.

Moreover, according to the Germany Trade & Invest (GTAI), the food and beverage industry generated a production value of around $230 billion in 2022. In addition, various industries such as petrochemicals, chemicals, pharmaceuticals, and other industries use refrigeration systems to extract heat from their process machinery to prevent them from overheating. In recent times, the demand for petrochemicals such as oil and gas has increased substantially. For instance, according to the International Energy Agency, global oil demand is expected to rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day. This will have a positive impact on the petrochemical industry, which is expected to eventually benefit the industrial refrigeration services market.

Both, original equipment manufacturers (OEMs) and consumers, profit from third-party services for industrial refrigeration systems. Third-party service providers offer extensive knowledge and experience in design, installation, maintenance, and repair of refrigeration systems. Customers benefit from the expertise of professionals who are familiar with the complexity of refrigeration technology. However, OEMs may focus their own resources on essential business operations and strategic objectives by outsourcing refrigeration services. This results in increased operational efficiency and the capacity to direct resources toward areas that promote development and innovation.

However, the fluctuating cost of raw materials used for manufacturing industrial refrigeration equipment is expected to restrain the market growth. Even if the manufacturer does not increase the price, it is expected to affect the profitability of the company involved in making industrial refrigeration equipment and their components. In addition, the services pertaining to industrial refrigeration are expensive as the technicians hold extensive expertise, which comes with a lot of money and time. Thus, expensive services are expected to restrain the industrial refrigeration service market growth.

Furthermore, the World Trade Organisation estimated that the overall value of global goods trade, including food, drinks, and agricultural products, would be $25.3 trillion in 2022, rising by 1.7% in 2023 and 3.2% in 2024. Furthermore, according to PwC 2021 research, expenditure on food goods is predicted to increase by 2030. This will generate demand for a better and larger cold chain sector globally. Developing countries especially, are witnessing increased growth in the cold-chain industry. For instance, in October 2022, the Guangzhou Nansha International Logistics Center began its operation of cold chain import business. Guangzhou Nansha International Logistics Center is the largest single cold storage in China. Moreover, in December 2022, a 5,000 metric ton capacity cold-storage facility began its operation in the Assam state of India.

The industrial refrigeration services market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for industrial refrigeration services from various sectors such as food and beverages, pharmaceuticals, petrochemicals, and others. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Also, rise in global inflation is a new major factor hampering the entire industry. The inflation is a result of the war between Ukraine and Russia and a few long-term impacts of the coronavirus pandemic.

This has introduced unpredictability in the prices of raw materials used for manufacturing industrial refrigeration equipment. In addition, the cost of oil & gas has also increased substantially, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience severe negative impacts on industrial production of food and beverages, pharmaceuticals, and other industries, including the production of industrial refrigeration equipment. However, India and China are performing relatively well, and the production of industrial produce is witnessing rise unlike other countries; prompting increase in demand for industrial refrigeration equipment and services and positively affecting the industrial refrigeration service market outlook in these countries for ner future.

Segmental Overview

The industrial refrigeration services market is segmented on the basis of services, end-user industry, and region. By service, the market is divided into design, installation, and maintenance and repair. By end-user industry, the market is categorized into fresh fruits and vegetables, meat, poultry, and fish, dairy and ice cream, beverages, chemical and pharmaceutical, petrochemicals, and others. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, Netherlands, Belgium, Poland, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Services:

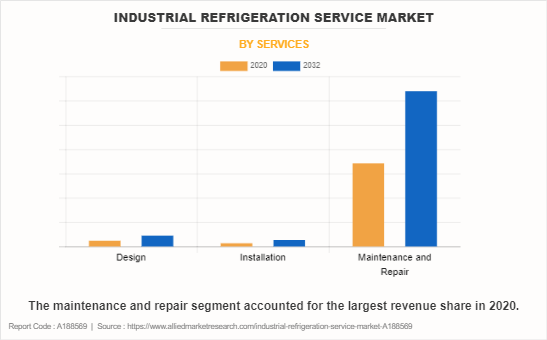

The industrial refrigeration services market is divided into design, installation, and maintenance and repair. In 2022, the maintenance and repair segment dominated the industrial refrigeration service market share in terms of revenue, and the design segment is expected to grow with a higher CAGR during the forecast period. The designing of the industrial refrigeration system is the first step towards commissioning an industrial refrigeration system. In this phase, the services provider analyses the requirements of the customer and the placement of other industrial equipment.

The layout of the refrigeration system is an indistinguishable part of this phase. The service providers also offer consultation on what type of equipment needs to be installed during this phase. The other major service pertaining to industrial refrigeration is its installation. The installation of a refrigeration system that strictly follows the stipulated layout is a must for the efficient operation of the refrigeration system throughout its lifetime. Moreover, maintenance and repair services are vital to keeping the refrigeration system working to its highest efficiency.

By End-User Industry:

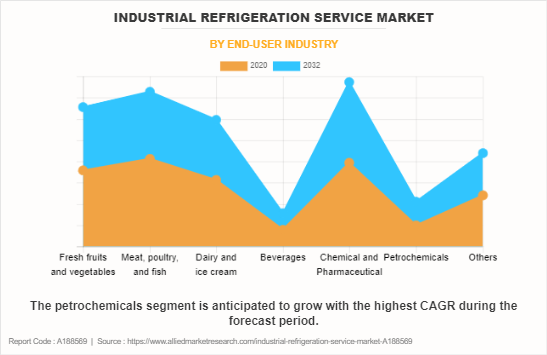

The industrial refrigeration service market is divided into fresh fruits and vegetables, meat, poultry, and fish, dairy and ice cream, beverages, chemical and pharmaceutical, petrochemicals, and others. In 2022, the meat, poultry, and fish segment dominated the industrial refrigeration services market, in terms of revenue, and the petrochemical segment is expected to witness growth at a higher CAGR during the forecast period.

Rapid rise in global population and the rising trend of online grocery and fruit shopping, especially in developing nations have a positive influence on the demand for industrial refrigeration systems. This eventually drives the growth of the industrial refrigeration services market. However, meat, poultry, and fish products are generally kept below freezing temperatures to prevent the growth of harmful bacteria and pathogens. Thus, refrigeration systems meant for facilities handling these products are designed with robust and durable components, equipment, and accessories.

Furthermore, the dairy and ice cream refrigeration system is intended to maintain particular temperature and humidity levels that are excellent for preserving these sorts of goods. Milk, cheese, yogurt, and ice cream require temperatures slightly above freezing to avoid spoiling and retain freshness. Furthermore, chemical processes often require precise temperature control for reactions, crystallization, or separation. The refrigeration system in these industries may need to achieve and maintain specific temperature ranges to ensure the desired chemical reactions occur.

By region:

Asia-Pacific accounted for the highest market share in 2022 and LAMEA is expected to dominate the industrial refrigeration service market forecast by growing with the highest CAGR during the forecast period. The industrial refrigeration services market is rapidly growing in Asia-Pacific. Increase in demand for food & beverages, growth in the pharmaceutical industry, and rise in the number of refrigerated warehouses in the region fuel the growth of the industrial refrigeration services market. For instance, according to Invest India, the Indian food processing industry is among the largest in India and is estimated to reach $535 billion by 2025. Moreover, the Chinese food and beverages industry is also growing substantially.

According to the International Trade Administration, China’s food and beverage sector reached approximately $595 billion in 2019, with a 7.8% increase over 2018. Furthermore, there has been rise in the consumption of frozen food, majorly meat, in Australia in the last few years. Utilizing this opportunity, in November 2020, Proform Foods started production of meat products in its plant located in Sydney. This led to the installation of refrigeration systems for maintaining the products in inventory and for transportation under controlled temperature. The LAMEA industrial refrigeration services market is witnessing growth with the rise in demand for food and beverages. Further, increase in the export of perishable products to the U.S. and the other parts of the world has supplemented the growth of the industrial refrigeration services market in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the industrial refrigeration services market are provided in the report. Major companies in the report include ACE Services, Carrier Corporation, Coolsys, Daikin Industries, Ltd., Emerson Electric Co., Newman Refrigeration Ltd, Nimlas Group, Seward Refrigeration Limited, Star Refrigeration, and Stellar.

Major players to remain competitive adopt development strategies such as business expansion, acquisitions, partnerships, and mergers. For instance, in July 2023, CAREL Industries S.p.A., a provider of control technology and humidification for air conditioning and refrigeration, acquired an 82.4% stake in Kiona Holding AS, a major Software as a Service (SaaS) provider in Norway. Kiona offers tech solutions to optimize energy consumption and digitize buildings in various sectors, including industrial refrigeration, retail, public, commercial, and multi-residential facilities. Similarly, in June 2021, Blue Pearl Energy, a major provider of design, installation, and maintenance services for industrial refrigeration systems acquired REFRECO. REFRECO is one of Belgium’s leaders in industrial, commercial, and HVAC refrigeration services from design to realization.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging industrial refrigeration service market trends, and historic data.

- In-depth industrial refrigeration service market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the industrial refrigeration services market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The industrial refrigeration services market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the industrial refrigeration services market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the industrial refrigeration service industry.

Industrial Refrigeration Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.1 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2020 - 2032 |

| Report Pages | 150 |

| By Services |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | KG Refrigeration and Air Conditioning, Newman Refrigeration Ltd., Daikin Industries, Ltd., CoolSys, Nimlas Group, ACE Service, Star Refrigeration, Superchill, Stellar, Seward Refrigeration Limited |

Analyst Review

The industrial refrigeration services market has witnessed significant growth in the past few years, owing to increase in the number of food and beverages processing facilities, pharmaceutical manufacturing facilities, chemical and petrochemical facilities, and others.

The industrial refrigeration services market is a very dynamic market. In the past few decades, various guidelines pertaining to what kind of refrigerants can be used in a refrigeration system have been unveiled by many countries. For example, the U.S. government has also planned to ban the use of high GWP refrigerants including R134a, R410A, and R407C, from use in new chillers in the U.S. from January 1, 2024. This is expected to create new growth opportunities for the repair, maintenance, and refrigeration systems rehabilitation services providers. Similarly, European countries have also enforced a few guidelines related to refrigerants. In March 2023, The European Parliament revised its F-gas Regulation, and approved ban on HFCs and HFOs [HFC-125, HFC-134a, HFC-143a, HFO-1234yf, HFO-1234ze(E), HFO–1336mzz(Z) and HFO-1336mzz(E)] in various applications, primarily form heat pumps and stationary refrigeration, along with others. The new regulations also plan to phase out of HFCs by 2050 taking the phase down of 80% to 85% between 2036 and 2047. These amendments will further boost the adoption of natural refrigerants. These factors indicate an upcoming demand for various services related to industrial refrigeration.

The global industrial refrigeration services market is a mix of consolidated as well as fragmented manufacturing. Large companies often provide advanced services such as remote monitoring and maintenance. However, small-scale companies provide generic maintenance and repair services often for less critical systems.

The importance of refrigeration in the food & beverage industry, the necessity of periodic maintenance of refrigeration systems, and the advantages of third-party industrial refrigeration services drive the growth of the global industrial refrigeration service market.

The latest version of the global industrial refrigeration service market report can be obtained on demand from the website.

The global tire recycling market size was valued at $3.7 billion in 2020.

The global industrial refrigeration service market size is estimated to reach $7.1 billion by 2032, exhibiting a CAGR of 4.9% from 2023 to 2032.

The forecast period considered for the global industrial refrigeration service market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. In addition, the historical period from 2020-2021 is also analyzed.

Asia-Pacific is the largest regional market for industrial refrigeration service market.

Key companies profiled in the tire recycling market report include ACE Services, Carrier Corporation, COOLSYS, Daikin Industries, Ltd., Emerson Electric Co., Newman Refrigeration Ltd., Nimlas Group, Seward Refrigeration Limited, Star Refrigeration, and Stellar.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...