Insect Feed Market Research, 2031

The global Insect Feed Market Size was valued at $261.5 million in 2021, and is projected to reach $2.2 billion by 2031, growing at a CAGR of 24.5% from 2022 to 2031. Insect feeds are meals that have been enhanced with a lot of protein and are made from a variety of additives and raw ingredients. These mixtures are created specifically for use as aqua feed, taking into account the needs of the target animal. Feed compounders produce them as meal varieties, pellets, or crumbles. Only insect feed has been taken into consideration for the purposes of this report. The market segments and variables influencing the growth of the commercial insect feed industry are extensively studied in the report.

It is currently unmanageable to boost food production to a level that can satisfy the demands of the constantly expanding human and animal population while limiting the availability of new agricultural land. Currently, 30% of the world's land area is used for agriculture, of which 70% is used to make animal feed. One of the major forces influencing the biosphere is intensive livestock farming, which has a negative impact on biological diversity, soil degradation, air and water pollution, greenhouse gas emissions, and global warming. Despite the aforementioned, animal breeding and farming is one of the agricultural industries that is growing the fastest, and the demand for animal-based products is rising. Alternative protein sources are able to help address these global problems, and these dynamic processes will also raise the need for cattle feeds. Thus, is likely to foster the demand for alternative sources of protein in animal feed and will propel the demand for insect feed in the process.

However, due to regulatory compliances, the industry still faces certain operational challenges. In spite of the fact that 80% of the world's nations have a tradition of eating insects, western nations nevertheless regarded them as unique foods. The Novel Food Act of 1997 in the EU became a barrier in nations that claimed insects were novel foods (not all countries made the same interpretation). It was difficult (and occasionally illegal) to commercialize edible insects due to the legal uncertainties, and it was even more difficult to get investors to invest.

The global food & beverage industry has witnessed robust growth in the last few years driven by innovation in the food system, improved logistics, increase in affordability, development of global trade, and increase in consumer spending. Furthermore, the food & beverage industry has been evolving continuously according to consumer requirements. In addition, the expansion of the food processing industry is expected to boost the demand for fast food, which, in turn, is likely to positively impact the demand for animal meat all around the world. In addition, according to FAO In 2017, the global demand for meat was estimated at 323 million tons (Mt) and is expected to increase by 15% in 2027 Thus, all these factors collectively drive the growth of the global feed market which includes insect feed.

Moreover, the increasing use of antibiotics among farmed animals will uplift the growth of the insect feed market as growers are liking more sustainable options to protect the environment. According to the Natural Resources Defence Council, an international environmental non-profit organization, around 65% of antibiotics sold in the US are used in farmed animals. Antibiotics are used to keep the animals healthy and to keep the farm yield high. Although, antibiotics can kill good bacteria that are essential to function the animals’ bodies properly. The antibiotics can also lead to wiping out healthy and protective natural microbial life and also potentially provide a blank and fertile slate for harmful bacteria to colonize completely. Thus, the use of naturally occurring antibiotics through the animal feed can keep them healthy and increases their productivity for the long run.

Segmental Overview

The insect feed market is segmented into Product Type, End Use and End User. Product type includes the study of meal worms, fly larvae, silkworm, cicadas and other. Mealworms are defined as the larval forms of the yellow mealworm beetle, Tenebrio Molitor. They contain lots of protein and amino acids and thus are very healthy for consumption. On the basis of end use the market is classified as pet food, aquaculture and livestock. On the basis of end user the market is bifurcated into commercial and residential. The commercial segment includes the study of all the animal shelters where animals are raised for a good quality of meat or for as a raw material. The residential segment comprises of pets. On the basis of sales channel the market is bifurcated into online and offline. Online segment includes the study of sales generated via e-commerce and all the online stores selling insect feed. For the offline segment our scope includes the study of hypermarkets/supermarkets, specialty stores, and other retail outlets. On the basis of region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA.

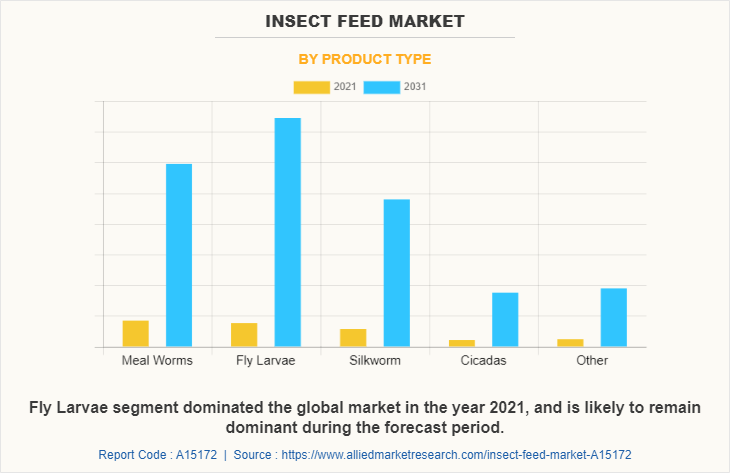

By Product Type

On the basis of product type, the meal worms segment garners the largest Insect Feed Market Share in 2021 with the Insect Feed Market Size of $6.9 million. However, fly larvae segment is projected to grow at a fastest CAGR during the projected period. Growing concerns over fishmeal's environmental impact have made room for more sustainable and affordable alternatives like insect feed. The protein and calcium content in fly larvae makes it a best choice for insect feed. Owing to this, they are becoming popular among poultry farmers. The consumption of fly larvae can be helpful during weather changes and in times of stress. The fat content present in the larvae provides essential energy to poultry animals. It helps boost the amount of nutrition absorbed from supplementary feed ingredients present at the same time of digestion. The fiber content comes from their shell, made of chitin (a great source of fiber), which helps maintain a healthy digestive system and boosts gut health.

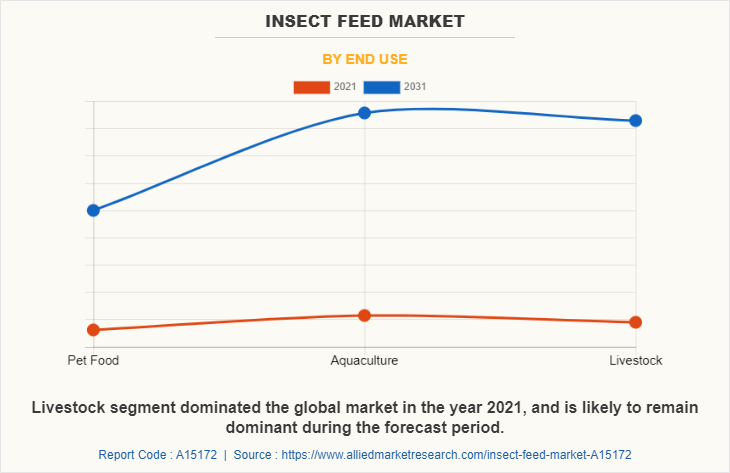

By End Use

On the basis of end use the market is classified as pet food, aquaculture and livestock. The aquaculture segment dominated the market in 2021 with a Insect Feed Market Share of more than 43% for the same year. The Insect Feed Market Growth is attributed to the increasing consumption of aquatic animals. Apart from that the year around availability with wide available options such as fish, shellfish, and aquatic plants. Moreover, the increasing demand for insect feed for residential use will also drive the demand. Also, high awareness and acceptance regarding the use of insect-based feeds in farmed fish diets among aquaculture growers will likely to propel the market demand. Increasing aquaculture production to meet the increasing demand will also uplift the market. This is mainly driven by the expectations for the decline in fishing pressure on wild fish stocks, the reduction of the ecological footprint and the enhancement of the sustainability of the aquaculture sector.

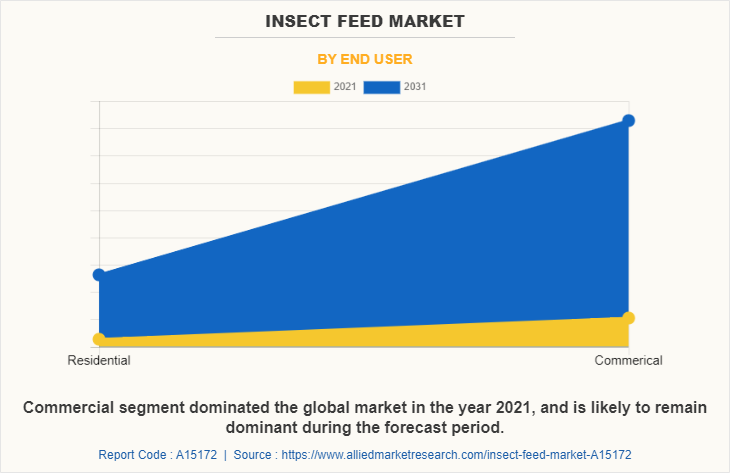

By End User

On the basis of end-user, the market is bifurcated into commercial and residential. The commercial segment dominated the global market in 2021. The insect feeds are getting adopted by poultry and swine farmers owing to the high availability of protein content. The protein and amino acid present inside the insect feed help to regulate gut health among commercially developed animals. Insects have great potential as a sustainable protein source to feed animals, with lower greenhouse gas emissions, land use, and water requirements than traditional livestock feed ingredients. Owing to these factors the segment is likely to dominate the segment throughout the Insect Feed Market Forecast period as well.

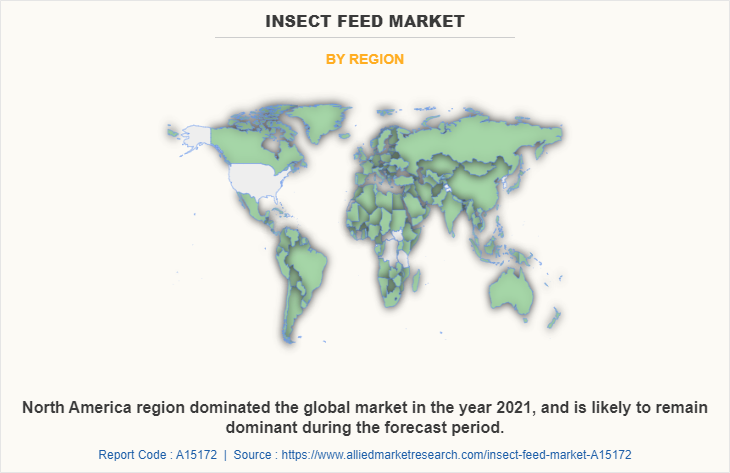

By Region

Region wise, North America was a highest revenue contributor and is estimated to reach $ 704.8 million by 2031, with a CAGR of 22.3%. However, LATAM is likely to be the fastest-growing region during the forecast period. Asia-Pacific is likely to grow at a moderate pace during the estimated period. The presence of major manufacturers such as Nutritio Technologies, JR Unique Foods Ltd., Endofood Sdn Bhd, Protenga, among others will flourish the regional Insect Feed Market Demand during the projected period. Moreover, high population and increasing demand for basic necessities such as food are some of the factors that will affect the growth for insect feed market. Apart from that, investment opportunities and favorable government policies to set up insect feed production facilities will likely to create an Insect Feed Market Opportunity for market players.

Competitive Analysis

The key players operating in the global insect feed market include AgriProtein Holdings Ltd, Buhler AG, Protix, Enterra Feed, entofood, enviroflight, Nasekomo, InnovaFEED, Hexafly, Coppens, DeliBugs, Kreca Ento-Feed BV, Ynsect, Nusect, Protenga, Beta Hatch, and Entobel.

Key players are investing in R&D to expand its product offering and launch innovative products to stay ahead in the competition. For instance, in July 2020, Protenga has raised USD 1.6 million with the help of the UK agritech company Roslin Technologies. This development has helped to find new, highly productive genetic strains of the black soldier fly for aquaculture, livestock, and pet food applications. Also, in June 2022, Nutrition technologies announced that they are developing bacteriophages to replace antibiotics in black soldier fly protein. Apart from that, key players are collaborating with other manufacturers to incorporate their products. For instance, in May 2022, Nutrition technologies and SPCA Selangor collaborated with Pet World Nutrition Technologies to introduce the first sustainable commercial dog food in Malaysia that contains black soldier fly larvae (BSFL) protein. Also, in June 2020, Protix has collaborated with Agrifirm to launch of several new initiatives using Protix's insect-based ingredients. This development helped the company to create a sustainable and circular food system. Moreover, in March 2022, Evonik and Nutrition Technologies collaborated to conduct R&D in insect feed. Under this collaboration, the companies will focus on the amino acid requirements of Black Soldier Flies (BSF) in Southeast Asia. This aims to optimize BSF diets to maximize sustainability results in livestock production while continuing to provide safe and healthy meat. Such initiatives undertaken by different manufacturers will uplift the product visibility among the growers and eventually, the use of insect feed will increase.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the Insect Feed Industry segments, current trends, estimations, and dynamics of the insect feed market analysis from 2021 to 2031 to identify the prevailing insect feed market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insect feed market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global insect feed market trends, key players, market segments, application areas, and market growth strategies.

Insect Feed Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.2 billion |

| Growth Rate | CAGR of 24.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 231 |

| By Product Type |

|

| By End Use |

|

| By End User |

|

| By Region |

|

| Key Market Players | Endofood Sdn Bhd, senterra corporation, Entobel, Beta Hatch, innovafeed, Nusect, Alltech Coppens, JR Unique Foods Ltd., Hexafly, Protenga, EnviroFlight, DeliBugs, Nasekomo, YNSECT, Nutrition Technologies, protix, Kreca Ento-Feed BV |

Analyst Review

The demand for insect feed among livestock growers is on the rise, industry participants are focusing on investments to develop high quality products. For instance, in August 2021, Nasekomo launched a 433 714 EUR monoproject to automate insect multiplication and bioconversion to enable the production of sustainable products at a large scale. Also, some manufacturers are involved in the acquisition to strengthen its business offerings. For instance, in April 2021, Ynsect acquired French nutrition company to offers its mealworm protein-based YnMeal product into the sports nutrition market. This development aids in product offering across the globe.

The increasing adoption of sustainable and environment friendly animal farming among growers resulting in new and innovative product search. In addition, the increasing demand for organic products with visibility for nutritional content is expected to support the demand for insect feed. Furthermore, increasing egg and meat consumption is contributing to the market growth.

As income increases, meat consumption tends to increase. High expenditure elasticity in poultry indicates its dominance in the diet both in the developed and the developing countries. There is generally a positive relationship between per capita consumption of poultry products and per capita incomes. This positive relationship supports the general economic theory which suggests that as incomes increase, particularly in developing countries, people will increase their consumption of high income-elastic food.

Technology change in the poultry industry, led by advances in breeding that improved animal size, fecundity, growth rate and uniformity, has enabled farmers to increase output per unit of feed, produce more birds per year, improve animal disease control and decrease mortality. These factors will enhance the market for insect feed.

Pet humanization has become a common practice as majority of the pet owners tend to treat pets like a family member. This trend has led to a corresponding increase in the amount of money that people are willing to spend on their pets, as well as the number of products and services available in the market to meet the demands of pet owners. The increase in pet humanization has led to the rise in demand of pet food which include insect feed. Pets are increasingly being seen as members of the family, and as such, pet owners are willing to invest in pet’s diet and nutrition. According to American Pet Products Association (APPA), in the year 2021, $123.6 billion was spent on pet out of $50 billion was spent only on pet food and treats in U.S alone. This trend is expected to continue, as the bond between humans and their pets continues to grow.

The global insect feed market was valued at $261.5 million in 2021, and is projected to reach $2,182.0 million by 2031, registering a CAGR of 24.5% from 2022 to 2031.

From 2022-2031 would be forecast period in the market report

$261.5 million is the market value of insect feed market in 2021.

2021 is base year calculated in the insect feed market report

The key players analyzed in the report AgriProtein Holdings Ltd, Buhler AG, Protix, Enterra Feed, entofood, enviroflight, Nasekomo, InnovaFEED, Hexafly, Coppens. are the top companies hold the market share in insect feed market.

Loading Table Of Content...