Insurance Advertising Market Research, 2032

The global insurance advertising market was valued at $10.8 billion in 2022, and is projected to reach $30.2 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

Insurance advertising refers to the promotional efforts undertaken by insurance companies to communicate information about their insurance products and services to potential customers. Through various channels such as television, radio, print media, online platforms, and social media, these advertisements aim to educate consumers about the benefits of different insurance policies, coverage options, and the overall financial security they can provide. The advertisements often highlight real-life scenarios, examples, and testimonials to showcase how insurance can protect individuals, families, and businesses from unexpected events such as accidents, illnesses, or property damage. By emphasizing the peace of mind and protection that insurance offers, these advertisements encourage individuals to consider and purchase insurance plans that align with their needs and circumstances.

The dynamics of the insurance advertising market size are influenced by several compelling driving factors. The rising penetration of insurance within emerging markets serves as a catalyst, as a larger number of individuals and businesses are becoming familiar to the advantages of safeguarding their financial well-being. This trend is further propelled by the increasing prominence of online comparison platforms. These digital tools empower consumers by offering them a simplified means to assess various insurance offerings, fostering a climate of informed decision-making.

Moreover, the market is positively impacted by the growing desire for innovative policy solutions. As lifestyles and risk profiles evolve, there is a growing demand for insurance products that cater to specific and evolving needs, driving insurers to develop imaginative policies that resonate with diverse segments of the population.

However, there exist restraining factors that can potentially hamper the growth trajectory of the insurance advertising market share. The complicated regulatory frameworks across different jurisdictions introduce complexity and challenges for insurers looking to effectively market their products. This regulatory landscape necessitates precise adaptation and compliance efforts to ensure that advertisements align with each region's distinct requirements. In addition, the insurance industry faces negative public perceptions that have been cultivated by historical mistrust, complex policies, and limited transparency. Thus, overcoming these perceptions is a substantial hurdle, requiring insurers to proactively address misconceptions and rebuild trust through transparent and consumer-centric communication strategies. On the contrary, the insurance advertising market presents notable opportunities for expansion.

One of these opportunities lies in the strategic utilization of social media platforms and influencer partnerships. In an era dominated by digital interaction, insurers can tap into the immense reach of social media to engage with potential customers. Collaborating with influencers can lend credibility and relatability to their advertising efforts, bridging the gap between complex insurance concepts and the everyday lives of consumers. This approach can significantly amplify the reach and impact of insurance advertising, ultimately fostering a deeper understanding and appreciation for the role insurance plays in safeguarding financial futures.

The report focuses on growth prospects, restraints, and trends of the insurance advertising market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the insurance advertising industry.

Segment Review

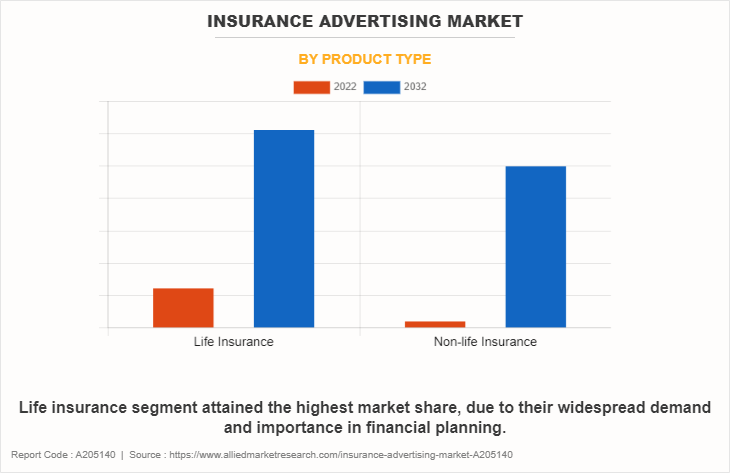

The insurance advertising market is segmented on the basis of product type, advertising channels, application and region. On the basis of product type, the market is bifurcated into life insurance, and non-life insurance. Based on advertising channel, the market is segmented into television, Email, sales calls, and others. By application, it is bifurcated into direct marketing, network marketing, mobile marketing, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product type, the life insurance segment held the highest market. This is due to its intrinsic connection to long-term financial planning and security. Life insurance provides a safety net for loved ones in the event of unexpected loss, making it an integral part of estate planning and ensuring family well-being. On the other hand, the non-life insurance segment is forecasted to be the fastest-growing segment. This was attributed to the tangible and immediate benefits that non-life insurance offers, such as coverage for property, vehicles, and health-related expenses. These types of insurance are often mandatory or deemed necessary for daily life, compelling consumers to seek comprehensive coverage.

Based on region, North America attained the highest market share in the insurance advertising market. This can be attributed to several factors, including the region's robust insurance industry, a mature market with high insurance penetration, and a culture of risk mitigation. The presence of well-established insurance companies, coupled with the awareness of the importance of insurance among North American consumers, has fueled a consistent demand for insurance products.

On the other hand, the Asia-Pacific region is forecasted to be the fastest-growing segment in the insurance advertising market. This growth can be attributed to factors such as rising disposable incomes, expanding middle-class populations, and increasing awareness about the need for insurance. As these economies experience rapid urbanization and lifestyle changes, there's a heightened recognition of the role insurance plays in safeguarding against uncertainties. Moreover, the adoption of digital technologies and the growing accessibility of insurance products through online platforms have further accelerated the market's expansion in Asia-Pacific, making it a pivotal region to watch in the coming years.

The report analyzes the profiles of key players operating in the insurance advertising market such as Allianz SE, Allstate Insurance Company, American International Group, Inc., AXA, Chubb, MetLife Services and Solutions, LLC., Ping An Insurance (Group) Company of China, Ltd., Progressive Casualty Insurance Company, Prudential, and Zurich Insuarance. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance advertising market.

Market Landscape and Trends

The insurance advertising market growth is experiencing notable trends and changes. With the growth of digital platforms, insurance companies are shifting their focus towards online advertising to reach a broader audience. Personalization has become crucial, as companies use data analytics to tailor advertisements to individual customer needs. In addition, there's an increased emphasis on conveying trust and reliability to potential customers, given the competitive nature of the market. Social media and influencers are also playing a role in shaping the way insurance products are promoted. Overall, the market is adapting to new technologies and strategies to effectively engage with consumers in this digital age.

Top Impacting Factors

Growing Insurance Penetration in Emerging Markets

Growing insurance penetration in emerging markets is fueling the expansion of the insurance advertising market. As more individuals in these regions recognize the importance of insurance coverage, insurance companies are leveraging advertising to tap into this burgeoning customer base. Insurance penetration, which refers to the percentage of the population with insurance policies, is on the rise due to increasing awareness about financial security and risk management. Insurance providers are focusing their advertising efforts on educating potential customers about the benefits of insurance, such as protection against unforeseen events and financial stability. These campaigns often emphasize relatable scenarios and success stories, resonating with the target audience's needs and aspirations. Moreover, the digital transformation in these markets has opened up new avenues for advertising, enabling insurers to reach a wider audience through social media, online platforms, and mobile apps. This shift allows for more targeted and personalized campaigns, optimizing the impact of advertising efforts. In conclusion, the growth of insurance penetration in emerging markets creates a ripe environment for insurers to invest in advertising. By effectively conveying the value of insurance, companies can attract a larger customer base, leading to increased revenue and market expansion.

Rise of Online Comparison Platforms

The rise of online comparison platforms has significantly impacted the insurance advertising market by altering consumer behavior and competition dynamics. These platforms offer users a streamlined way to compare insurance options, fostering an environment of transparency and convenience. As consumers increasingly turn to these platforms to find the best deals, insurance companies are compelled to enhance their advertising strategies to stand out. Insurance providers now invest more in digital advertising to secure prominent positions on these platforms and showcase their offerings effectively. The heightened competition has driven companies to create more compelling and targeted advertisements to capture users' attention. Moreover, the online nature of these platforms allows for more accurate tracking of advertising performance, enabling insurers to refine their strategies based on real-time data. The convenience of online comparison platforms has also led to an expanded customer base seeking insurance, further propelling advertising efforts. In response, insurers have embraced innovative tactics like personalized ads, retargeting, and partnerships with these platforms to maximize their reach. In summary, the rise of online comparison platforms has reshaped the insurance advertising landscape by necessitating increased digital ad investments, prompting heightened creativity, and fueling competition among insurance providers to effectively reach and engage with a growing online consumer base.

Demand for Innovative Policy Offerings

The demand for innovative policy offerings is playing a significant role in driving the insurance advertising market. As consumers' needs and preferences evolve, insurance companies are compelled to develop creative and tailored insurance products that cater to these changing demands. This shift has led to an increased emphasis on advertising to effectively communicate the unique benefits and features of these novel policies. Innovative policies often provide coverage for emerging risks or offer customizable options that resonate with a tech-savvy and diverse customer base. To capture attention and market share, insurance providers are investing in advertising campaigns that highlight the innovative aspects of their offerings. This includes employing digital marketing strategies, social media engagement, and visually appealing content to effectively convey the value proposition of these policies. Insurance companies are competing to stand out in a crowded market, and the demand for innovative policies drives the need for compelling advertising that not only educates consumers but also establishes a strong brand presence. As a result, the convergence of creative policy design and strategic advertising is reshaping the insurance landscape and shaping the way insurers connect with their target audience

Complex and Varying Regulatory eEnvironments

The insurance advertising market demand is hindered by intricate and diverse regulatory frameworks that vary across different regions and countries. These regulations govern how insurance products can be marketed, communicated, and sold to consumers. Navigating these complexities poses significant challenges for insurers and advertisers alike. Insurance is a highly regulated industry due to its financial and consumer protection implications. Regulations often dictate the language, disclosures, and transparency required in insurance advertisements to ensure consumers are well-informed and not misled. The variations in rules and requirements across jurisdictions result in a fragmented landscape, making it difficult for insurers to create consistent and effective advertising campaigns.

Compliance costs, administrative burdens, and the need for legal reviews add further constraints to insurers' advertising efforts. Additionally, the potential for non-compliance can lead to hefty fines and damage to a company's reputation. These hurdles collectively deter innovation and creativity in insurance advertising. As a result, the insurance advertising market struggles to adapt quickly to evolving consumer preferences and technological advancements, limiting its growth potential. Harmonizing regulations and streamlining compliance processes could alleviate these barriers and allow for a more dynamic and competitive insurance advertising landscape.

Negative Public Perception of the Insurance Industry

The negative public perception of the insurance industry is significantly hampering the growth of the insurance advertising market. People often associate insurance companies with complex policies, hidden clauses, and denied claims, leading to a lack of trust. This skepticism creates a challenging environment for insurance companies to effectively advertise their services. Consumers are more likely to be wary of promotional messages, fearing they might be misleading or manipulative.

The negative perception also stems from high-profile cases of insurance fraud, scandals, and instances of companies prioritizing profits over customers. This erodes the credibility of the industry as a whole. Consequently, potential customers are less inclined to engage in insurance advertisements or consider purchasing policies, as they are concerned about being taken advantage of. Insurance companies face an uphill battle in their marketing efforts, needing to address and overcome these deeply ingrained negative perceptions. Strategies may involve transparency initiatives, clearer communication about policies, and a focus on customer satisfaction. Until these issues are effectively addressed, the insurance advertising market is likely to continue facing challenges in gaining public trust and driving consumer engagement.

Leveraging Social Media and Influencer Partnerships

Leveraging social media and influencer partnerships has created a significant opportunity for the insurance advertising market. Social media platforms serve as vast, highly targeted spaces to engage potential customers. By collaborating with influencers, insurance companies tap into their established credibility and wide reach, enhancing brand visibility. Influencers' ability to craft relatable content fosters genuine connections with audiences, making insurance offerings more approachable. Through informative posts, videos, or personal anecdotes, influencers can effectively educate their followers about the importance of insurance coverage.

This approach addresses the challenge of making insurance relevant and appealing, especially to younger demographics accustomed to digital interactions. As influencers tailor messages to their followers' interests, insurance becomes a less daunting topic, generating interest and potential leads. The dynamic nature of social media encourages interactive campaigns, quizzes, and challenges, increasing user engagement and fostering brand loyalty. Furthermore, analytics tools enable precise tracking of campaign effectiveness, ensuring targeted investments. In essence, the synergy between social media's expansive reach and influencers' relatability opens up new avenues for insurance advertising, capturing previously untapped markets and establishing a modern brand presence.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance advertising market forecast from 2022 to 2032 to identify the prevailing insurance advertising market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the insurance advertising market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global insurance advertising market trends, key players, market segments, application areas, and market growth strategies.

Insurance Advertising Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.2 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 428 |

| By Product Type |

|

| By Advertising Channels |

|

| By Application |

|

| By Region |

|

| Key Market Players | AXA, MetLife Services and Solutions, LLC., Ping An Insurance (Group) Company of China, Ltd., American International Group, Inc., Progressive Casualty Insurance Company, Zurich Insurance, Prudential, Chubb, Allstate Insurance Company, Allianz SE |

Analyst Review

The insurance advertising market is undergoing a transformative phase marked by several key factors. Rapid technological advancements have driven a shift toward digital platforms, allowing insurers to leverage data analytics and AI for more targeted campaigns. Personalized messaging has become crucial as consumers seek tailored solutions. With the rise of remote work and online interactions, insurers have seized the opportunity to strengthen their online presence and engage customers virtually. Recent news highlights a focus on sustainable and ethical practices in advertising, reflecting evolving consumer values. Thus, the insurance advertising landscape is defined by innovation, customization, and a growing emphasis on responsible communication.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in order to tighten the regulatory framework on issuing advertisements by insurance companies to curb mis-selling in the sector, regulator IRDAI has proposed to amend the extant guidelines on advertisements and disclosure in line with the principle based approach. The regulator has issued draft amendments and a draft circular to amend the Insurance Regulatory and Development Authority of India (Insurance Advertisements and Disclosure) Regulations, 2021, with an objective to assign higher responsibility on the senior management of insurance companies while designing and approving the advertisements for the consumption of the customers. IRDAI has proposed to modify the existing procedure of filing of advertisements, thereby enabling the Product Management Committee (PMC) responsible for the approval of advertisements. Insurance advertisements are considered to be the integral part of product filing procedure. Therefore, these strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Allianz SE, Allstate Insurance Company, American International Group, Inc., AXA, Chubb, MetLife Services and Solutions, LLC., Ping An Insurance (Group) Company of China, Ltd., Progressive Casualty Insurance Company, Prudential, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the insurance advertising market.

The insurance advertising market is experiencing notable trends and changes. With the growth of digital platforms, insurance companies are shifting their focus towards online advertising to reach a broader audience. Personalization has become crucial, as companies use data analytics to tailor advertisements to individual customer needs. In addition, there's an increased emphasis on conveying trust and reliability to potential customers, given the competitive nature of the market.

North America is the largest regional market for Insurance Advertising

The global insurance advertising market was valued at $10,782.34 million in 2022 and is projected to reach $30,198.46 million by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

Allianz SE, Allstate Insurance Company, American International Group, Inc., AXA, Chubb, MetLife Services and Solutions, LLC., Ping An Insurance (Group) Company of China, Ltd., Progressive Casualty Insurance Company, Prudential, and Zurich Insurance

Loading Table Of Content...

Loading Research Methodology...