Integrated Pest Management (IPM) Market Research, 2031

The global integrated pest management market was valued at $17.8 billion in 2021, and is projected to reach $34.0 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Report Key Highlighters:

- The research combines high-quality data, expert opinions and analysis, and important independent perspectives. The research technique is meant to present a fair view of global markets and to help stakeholders to make informed decisions in order to accomplish their most ambitious growth plans.

- The integrated pest management market study covers 20 countries. The research includes various segment level analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2021-2031.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The integrated pest management market is highly fragmented, with several players including ADAMA Ltd., AgBiTech, AgrichemBio, BASF SE, Bayer CropScience Ltd, FMC Corporation, Hercon Environmental Corporation, Oxitec, Rentokil Initial Group, and Sumitomo Chemical Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in integrated pest management market.

Rising demand from the agricultural sector is predicted to propel integrated pest management market growth during the forecast period.

Integrated pest management is mostly used in agriculture as crop protection, it helps farmers to grow more food on less land by protecting crops from pests, diseases and weeds as well as raising productivity per hectare. Advancements in new and innovative technologies improve the yield as well as lifespan of crops in agriculture. Genetic transformation and modification are carried out in order to boost agricultural yield and lifetime. Adoption of new and innovative laboratory-prepared crop species is increasing crop productivity.

According to the Royal Society of Chemicals, about 800 chemically active substances have been registered for use as crop protection treatments across the world. These substances are classified generically as herbicides, fungicides, and insecticides. In the cereals and grains sector, the most common crops treated with pesticides are corn, rice, and wheat. As grains are grown in practically every country, there is a large global need for pesticides in agriculture. With the increase in grain output and consumption, it has become increasingly vital for growers to focus more on yield and quality by utilizing effective pesticides. However, higher prices associated with integrated pest management is predicted to hinder the market growth of integrated pest management industry.

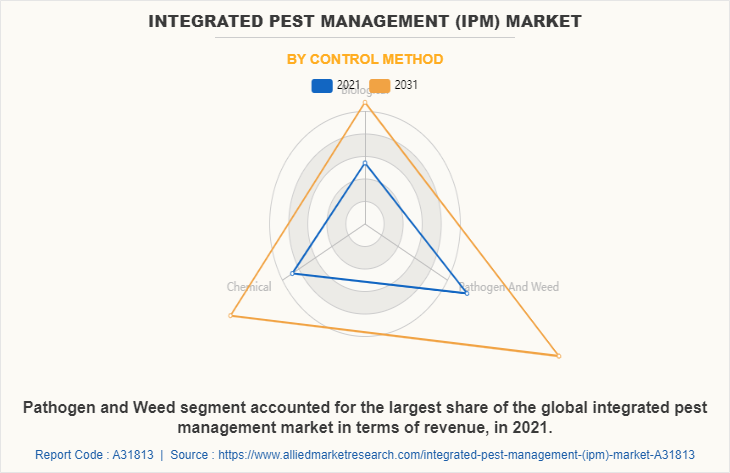

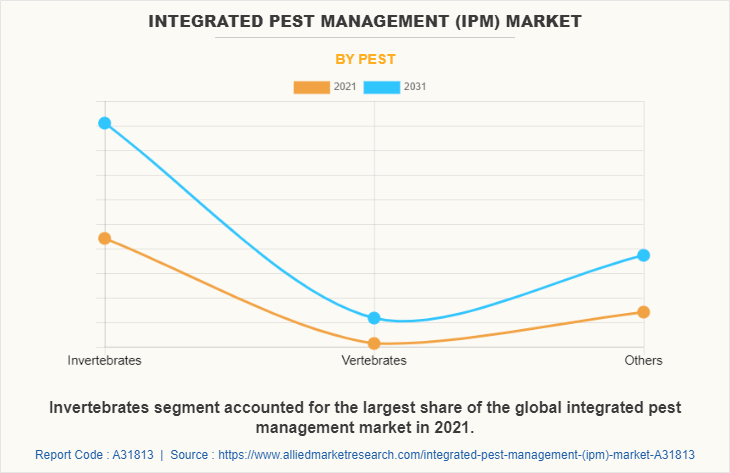

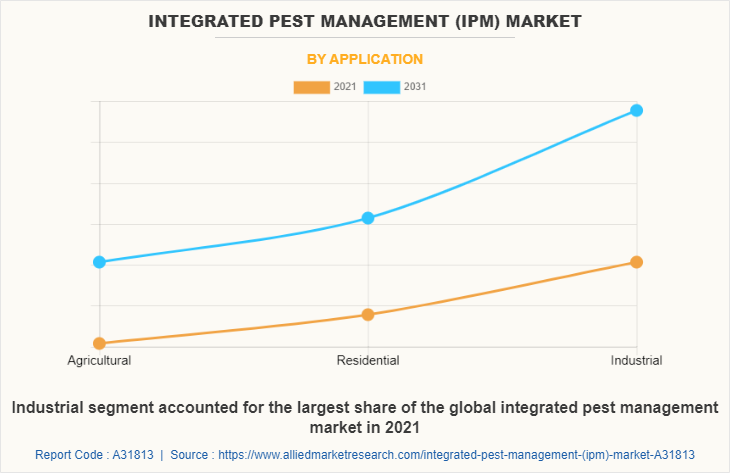

The integrated pest management market is segmented into control method, pest, application, and region. By control method, it is categorized into biological, chemical and pathogen & weed. On the basis of pest, the market is categorized into invertebrates, vertebrates and others. On the basis of application, it is categorized into agricultural, residential and industrial. Region wise, the integrated pest management market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

The pathogen and weed segment accounted for the largest share of the global integrated pest management market in terms of revenue, in 2021. Pathogen and weed pest control method of integrated pest management includes mechanical & physical and cultural. Mechanical pest control is the management and control of pests by the use of physical barriers like fences, barriers, or electrical lines. Weeding and temperature adjustments are also used to battle pests. Many farms are presently working to create ecologically friendly insect control methods. Destruction of the pest using mechanical techniques such as burning, trapping, protective screens and barriers, or management of temperature and humidity is frequently effective as part of integrated pest control. Cultural management solutions can range from simple ideas like changing planting dates to prevent insect infestations to more complicated farm scaping techniques like shifting an agroecosystem's spatial and temporal architecture.

The invertebrates segment accounted for the largest share of the global integrated pest management market in terms of revenue, in 2021. Integrated pest management methods seek to prevent pests from becoming a danger as invertebrates pests by managing the crop, yard, or interior area. In an agricultural crop, this may entail utilizing cultural approaches such as crop rotation, pest-resistant variety selection, and pest-free rootstock planting. These techniques of control can be highly successful and cost-effective, with little or no harm to humans or the environment. Invertebrate insect hormones are utilized as insecticides to control the number of dangerous insect pests, and when combined with other pesticides, they kill adult insects. It interferes with the mounting process of insects, preventing them from maturing.

Industrial application of integrated pest management includes industrial pest. Pest control is used in the industrial buildings of walls, ceilings, and common areas commercial property. It is used to control various pests and disease carriers, such as mosquitoes, ticks, rats and mice in industrial areas.

North America is projected to register a robust growth during the forecast period. In North America, integrated pest management is mostly used for bug prevention and control in agricultural, commercial buildings, and the industrial sector. It is also utilized as an emulsifier in pesticides and herbicides, which are widely used in agricultural, public health, and industrial applications, as well as to control roaches and termites in the home. To suppress weeds, North America utilizes mulch agricultural films, as well as barriers to keep insects and birds out and steam sterilization of the soil to combat disease. Other devices used in integrated pest management in North America include traps, screens, fences, nets, and obstacles. According to the People Forestry, U.S. pesticides are used on 900,000 farms and in 70 million households.

Key Players and Strategies:

The major players operating in the global Integrated pest management market include ADAMA Ltd., AgBiTech, AgrichemBio, BASF SE, Bayer CropScience Ltd, FMC Corporation, Hercon Environmental Corporation, Oxitec, Rentokil Initial Group, and Sumitomo Chemical Ltd. These players have been adopting various strategies to gain higher share or to retain leading positions in the market. For instance, FMC Corporation worked with Novozymes in 2021, which is a global leader in biological solutions, to investigate, co-develop, and market biological enzyme-based crop protection solutions for growers worldwide. Under a multi-year worldwide partnership, the two firms will focus on enzyme-based biocontrol technologies for the global fungicide and pesticide sectors. In the year 2020 Sumitomo Chemical Co., Ltd. took out all Nufarm's South American businesses in Brazil, Argentina, Chile, and Colombia. Sumitomo Chemical's crop protection revenue in South America will now exceed its sales in North America, consequently expanding the integrated pest control industry. It also introduced KANAME Flowable, which contains a novel fungicide.

Historical Trends:

Integrated pest management was originally utilized in agriculture in the 1970s in response to growing awareness about the harmful side effects of pesticide usage. The strategy stressed the convergence of pest biology and cultural techniques in crop pest management.

From 1948 through 1988, chlordane was used as a pesticide on agricultural crops, lawns, gardens, and residences in the U.S. Due to concerns about environmental and human health risks, the EPA (Environmental Protection Agency) prohibited all applications of chlordane except for termite control in 1983.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the integrated pest management market share, current trends, estimations, and dynamics of the integrated pest management market analysis from 2021 to 2031 to identify the prevailing integrated pest management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the integrated pest management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global integrated pest management market trends, key players, market segments, application areas, and market growth strategies.

Integrated Pest Management (IPM) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 34 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 243 |

| By Control Method |

|

| By Pest |

|

| By Application |

|

| By Region |

|

| Key Market Players | AgBiTech, Bayer Crop Science AG, Sumitomo Chemical Co., Ltd., AgrichemBio , Oxitec , Rentokil Initial plc, ADAMA Ltd., BASF SE, FMC Corporation, Hercon Environmental |

Analyst Review

According to the perspective of the CXOs of leading companies, the integrated pest management market is anticipated to grow in the future, owing to its extensive use in applications such as agricultural, residential and others. Rising adoption of biological control method is projected to drive market expansion throughout the projected period.

The biological control approach is used to reduce pest populations by employing biological control agents such as bacterial, microorganisms, and entomopathogenic worms. However, the high price associated with integrated pest management is expected to restrain industry expansion whereas, Price increases in these generic agrochemicals will mostly effect paddy and cotton producers. The North America region is projected to register a robust growth during the forecast period.

The global integrated pest management market was valued at $17.8 billion in 2021, and is projected to reach $34.0 billion by 2031, registering a CAGR of 6.7% from 2022 to 2031.

Key factors driving the growth of the global integrated pest management market is majorly attributable to its wide applications in various industries such as agricultural, residential and others. In addition, rising adoption of biological control methods propel the market growth.

Based on pest, invertebrates segment dominated the Integrated Pest Management Market in 2021.

North America is the largest regional market for Integrated Pest Management.

Top companies to hold the market share in Integrated Pest Management include ADAMA Ltd., AgBiTech, AgrichemBio, BASF SE, Bayer CropScience Ltd, FMC Corporation, Hercon Environmental Corporation, Oxitec, Rentokil Initial Group, and Sumitomo Chemical Ltd.

Loading Table Of Content...