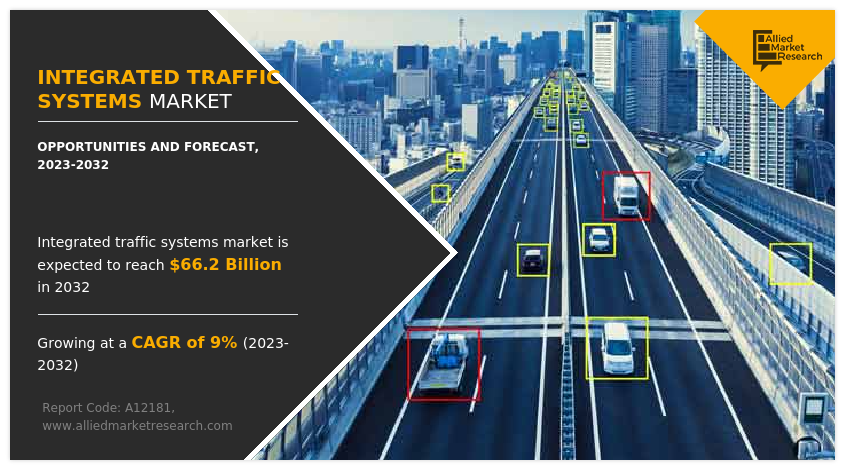

The global integrated traffic systems market size was valued at $28,054.2 million in 2022, and is projected to reach $66,146.6 million by 2032, registering a CAGR of 9.03% from 2023 to 2032.

Report Key Highlighters:

- The market study covers 14+ countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The Integrated traffic systems market share is highly fragmented into several players, including Kapsch TrafficCom AG, Siemens AG, Cubic Transportation Systems, Inc., Swarco, Teledyne Flir LLC, Jenoptik, Sumitomo Electric Industries, Ltd., Cisco Systems, Inc., Iteris Inc and ST Engineering. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Integrated traffic systems market are diverse and interconnect systems that are optimally designed to control the flow of traffic. In addition, it improves passenger safety and enhances the competence of the overall transportation industry. ITS utilizes various hardware and software to gather the data and then analyze it to optimally manage the traffic flow and control the traffic. Furthermore, the system improves productivity by effectively scheduling routes, delivering traffic updates, and forecasting the time of arrival and departure. Thus, benefitting the environment by helping to reduce carbon emissions from vehicles, reducing congestion, and reducing accidents.

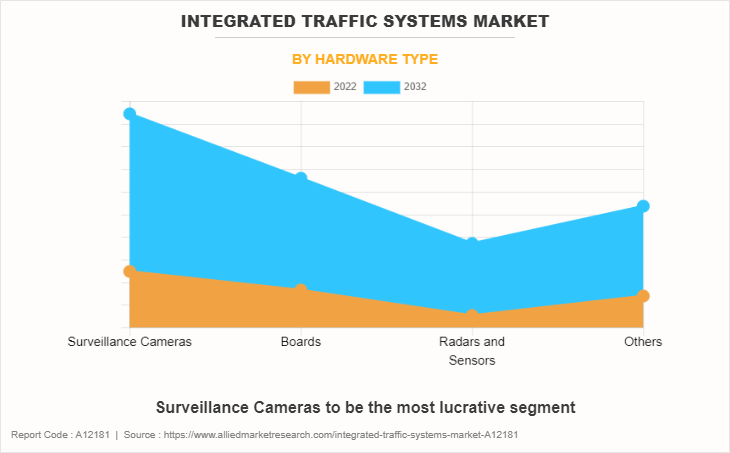

Integrated traffic systems are comprehensive surveillance and control system that are equipped with hardware such as CCTV, radars, display boards, traffic signals, and others. This system works collectively and enables live monitoring and control of traffic. In addition, ITS is useful in case of emergency response by providing optimal routes for emergency vehicles.

The growth of the global Integrated traffic systems market is driven by are a rise in global traffic congestion and traffic jams, growing public-private partnerships for the development of the integrated traffic system technology, and an increase in government focus on reducing CO2 emission from vehicles. However, factors such as high technology cost restrain the market growth. On the contrary, the growth of autonomous and connected vehicles and the improvement of high-speed internet and communications technologies are expected to provide lucrative growth opportunities for the market growth.

In addition, stringent regulations pertaining to reduce road accidents is positively impacting the market. For instance, the U.S. Department of Transportation (USDOT) actively promotes the adoption of the technology. In addition, USDOT introduced the Intelligent Transportation Systems Joint Program Office (ITS JPO). This program majorly focuses on R&D of intelligent transportation systems (ITS) and promotes integrated traffic system technology implementation throughout the country.

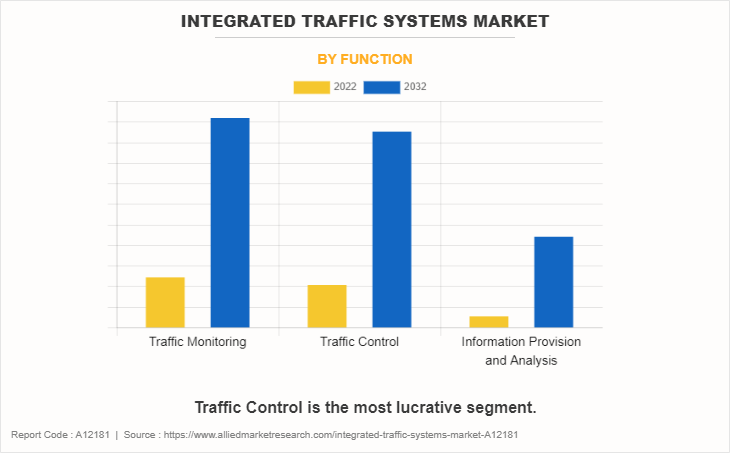

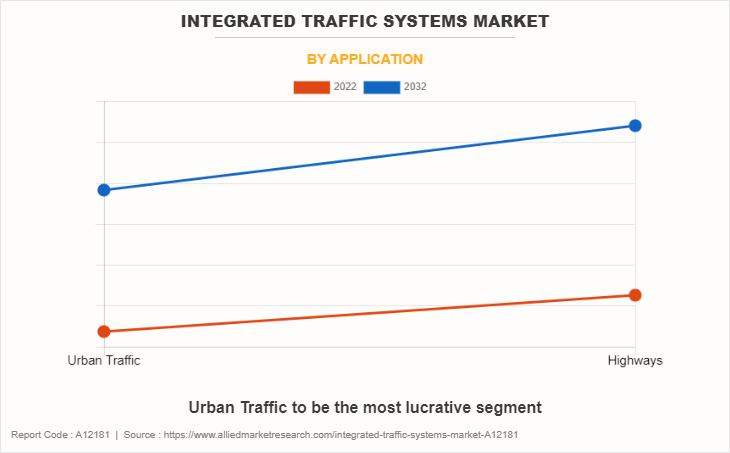

The global market has been segmented into by function, hardware, and application. Based on function the integrated traffic systems market has been bifurcated into traffic monitoring, traffic control and information provision & analysis. On the basis of hardware, the market has been segmented into surveillance cameras, boards, radars and sensors and others. Based on application, the market has been analyzed across urban traffic and highways. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Integrated traffic systems market demand in Asian countries has witnessed significant growth and is poised to offer compelling opportunities in the coming years. Major cities in Asia-Pacific are witnessing migration of people from its rural areas to urban area due to strong economic growth in the region. Increase in the population growth in the cities lead to chaotic traffic jams and longer commute times. To address the issue, the government in the region is optimally utilizing vehicle and infrastructure date to improve transportation and make transportation more sustainable.In addition, countries in the region are collaboratively working for the development of the technology. For instance, ITS Asia-Pacific, a cooperative collaboration between Asia-Pacific countries, aims to support economic growth by providing solutions for modern transportation problems. The members of the cooperative collaboration include China, Thailand, Malaysia, Singapore, Indonesia, Japan, South Korea, Chinese-Taipei, Hong Kong SAR, Australia, and New Zealand.

Key Developments in Integrated Traffic Systems Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On 19 October 2023, ST Engineering received a contract from Abu Dhabi first multimodal intelligent transportation central platform. The contract is applicable till 2027 for 3 and half year, and will include the design and building of ITCP and system integration and overall project management. The ITCP will integrate various subsystems and data sources into a centralized platform, enabling the Abu Dhabi ITC to implement effective multimodal transport strategies through automated response plans. The ITCP will leverage AI capabilities to enable real-time road traffic monitoring and incident detection, automated traffic information dissemination, as well as traffic congestion prediction capabilities, enabling shortened incident response time and improved traffic flow. Beginning with road transport management, the ITCP is designed to connect to other transport modes including rail networks and others over time.

- On 27 July 2022, Jenoptik announced the expansion of its road safety project in Uzbekistan. The contract which started in 2018, Jenoptik delivered a mixture of more than 200 mobile and stationary speed enforcement systems to the Uzbekistan Ministry of Interior along with accompanying project consultation and a full range of trainings to improve service and maintenance efficiencies. Following the success of the earlier project, the Uzbekistan government extended the contract and new contract will be extended and will include smart city components, covering new types of violations such as illegal turns and lane changes.

- On 1 July 2021, Siemens AG launched a new brand Yunex Traffic, which will operate as a separate brand from Siemens AG and will offer smart, and comprehensive mobility solutions for roads and cities. Currently Yunex Traffic operates in over 40 countries worldwide and its intelligent mobility solutions are currently being used in major cities across the world, including Dubai, London, Berlin, Bogota, and Miami. Yunex Traffic is the only supplier who can offer all major regional standards in Europe, UK, Asia, and America.

Rise in global traffic congestion

Rapid industrialization and expanding global trade activities lead to increase in wealth among major countries across the world. The increased influx of wealth has resulted in spending more on enhancing their roadways and infrastructural development in the country. In addition, due to upsurge in commerce activities, there was huge migration of people from rural areas to urban areas especially in developing countries of Asia-Pacific and Latin America region. The rise in population in cities resulted in increase in transit time and traffic congestions leading to surge in strain on the existing infrastructure.

According to Asia Business Councils most recent survey in upcoming years, over half of Asia-Pacific's inhabitants are projected to settle in urban areas, In China alone, there are already 236 cities, each with a population exceeding half a million people. The World Bank reports that developing regions' economic growth will rely on cities for over 80% of its output. Furthermore, Hong Kong, Singapore, Mumbai, Tokyo, Seoul, and Bangalore are among several other metropolises in the Asia-Pacific region grappling with rapid population increases. The overpopulation in cities have resulted in long traffic jams and longer commute times thus, creating an increase in the demand for integrated traffic systems during the forecast period.

Growing public-private partnership

As traffic congestion is becoming more and more severe, companies are collaborating with government institutions to develop advanced vehicle technologies. For instance, the U.S. Department of Transportation (USDOT) is supporting the project of advancement of connected vehicle technology. USDOT collaborated with NYC Department of Transportation (DOT) for the New York City Pilot project, which aimed to improve the safety of travelers and pedestrians in the city through the deployment of V2V and V2I-connected vehicle technologies. This objective directly aligns with New York city's Vision Zero initiative. The program seeks to combine connected vehicle and mobile device technologies in innovative and cost-effective ways to improve traveler mobility and system productivity while reducing environmental impacts and enhancing safety. Major other countries around the world are supporting public-private partnerships for the development of efficient traffic management technologies. Thus, the growing public-private partnership is anticipated to positively impact the integrated traffic systems market during the forecast period.

High technology cost

Integrated traffic system works on real-time data sharing, also the technology demands sophisticated hardware and optimal collaboration with software to perform. In addition, integrated traffic system requires huge initial investment to deploy the technology and a synergy between system developers, optimal collaboration between system integrators, and regulatory bodies. Owing to this, these factors collaboratively become a challenge for companies operating in the market. Moreover, the high cost associated with the development technology restricts the entry of new players in the market.

In addition, integrated traffic system requires sophisticated hardware such as sensors, communication devices, high-speed internet hardware, CCTV cameras, toll booth infrastructure requirement, fleet management systems, radars, control centers, data processing and storage centers, optimal power grid infrastructure, and different other types of infrastructure and technology investment. Thus, the high cost required for the technology is expected to hinder the market growth during the forecast period.

Growth of autonomous and connected vehicles

The increase in focus toward the development of autonomous and connected vehicles and surge in investment for the development of the technology is expected to create lucrative growth opportunities for companies operating in the integrated traffic systems market and will provide the demand for security & surveillance on highways and urban city areas.

According to a recent statistic by the World Economic Forum autonomous vehicle technology are tested on public roads through private-public and government partnership, and by 2050, the industry has the potential to reach $7 Trillion. If autonomous vehicle technology is harnessed properly, it has a strong growth potential to increase road safety, reduce traffic jams, and enhance the air quality in cities.

In addition, major countries have put in place authoritative bodies or committees for foreseeing and development of this technology. For instance, UK has introduced a Centre for Connected and Autonomous Vehicles (CCAV), Singapore has launched a Committee on Autonomous Road Transport for Singapore (CARTS), similarly Australia has Office of Future Transport Technology. Thus, increased penetration of autonomous driving and connected cars is expected to create lucrative growth opportunities during the forecast period.

Russia-Ukraine War Impact Analysis

The conflict has disrupted supply chains, especially for components and materials sourced from Ukraine and Russia. This can result in delays and increased costs for Integrated traffic system manufacturers, as they may struggle to obtain critical parts or materials required for production. Economic uncertainty, trade disruptions, and geopolitical tensions can lead to reduced economic growth in the affected regions and beyond, this can result in a decreased demand for new Integrated traffic systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the integrated traffic systems market analysis from 2022 to 2032 to identify the prevailing integrated traffic systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Integrated Traffic Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 66.2 billion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 448 |

| By Function |

|

| By Hardware Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ST Engineering, Cisco Systems, Inc., Iteris Inc., Sumitomo Electric Industries, Ltd., JENOPTIK, Kapsch TrafficCom AG, Teledyne FLIR LLC, Swarco AG., Cubic Transportation Systems, Inc. , Siemens AG |

Integration of AI and ML in integrated traffic system is the upcoming trend in the market.

Highway is the leading application of the integrated traffic system market.

Asia-Pacific is the largest region for integrated traffic system market.

The global integrated traffic system market was value at $28.05 Billion in 2022.

Teledyne Flir LLC, Kapsch TrafficCom AG, and Cisco Systems, Inc. are the top companies in the global integrated traffic system market.

Loading Table Of Content...

Loading Research Methodology...