Intelligent Virtual Assistant (IVA) Based Banking Market Research, 2031

The global intelligent virtual assistant (iva) based banking market was valued at $1.3 billion in 2021, and is projected to reach $11.2 billion by 2031, growing at a CAGR of 24.5% from 2022 to 2031.

An intelligent virtual assistant (IVA) or intelligent virtual agent is a software program that recognizes natural language voice commands and performs activities for the user. To create full-fledged virtual identities that talk with users, this technology includes features of interactive voice response and other recent artificial intelligence technologies. In the customer service department, the virtual assistants ai is utilized to engage clients by delivering product-related information, bills and payments, and directing on transfer ease of navigation.

Increase in automation uses across many industries, such as BFSI, retail, residential, and others, has propelled the intelligent virtual assistance (IVA) based banking market adoption. In addition, the market is witnessing growth due to rise in demand for customer service automation in the banking industry. However, increase in costs for server systems hamper growth of the intelligent virtual assistance (IVA) based banking market. On the contrary, developing economies offer significant opportunities for intelligent virtual assistant (IVA) based banking companies to expand their offerings, owing to growth in digital banking platforms. Moreover, growth in developments toward digital AI chatbots is anticipated to provide a potential growth opportunity for the intelligent virtual assistant (IVA) based banking market growth.

The report focuses on growth prospects, restraints, and trends of the intelligent virtual assistant (IVA) based banking market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the intelligent virtual assistant (IVA) based banking market outlook.

The intelligent virtual assistant (iva) based banking market is segmented into Product and User Interface.

Segment review

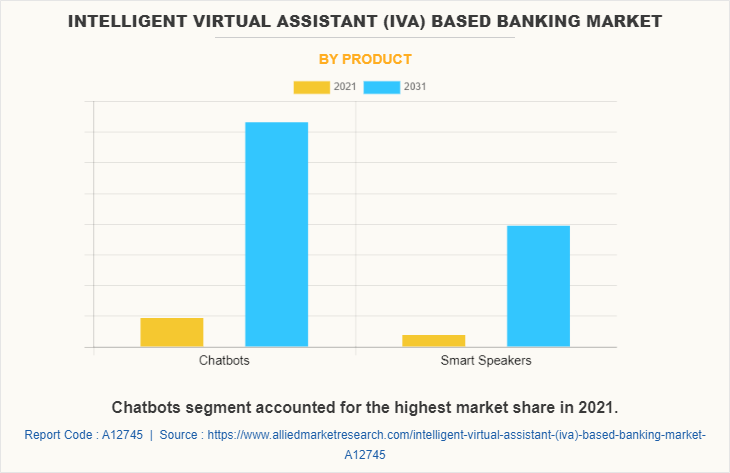

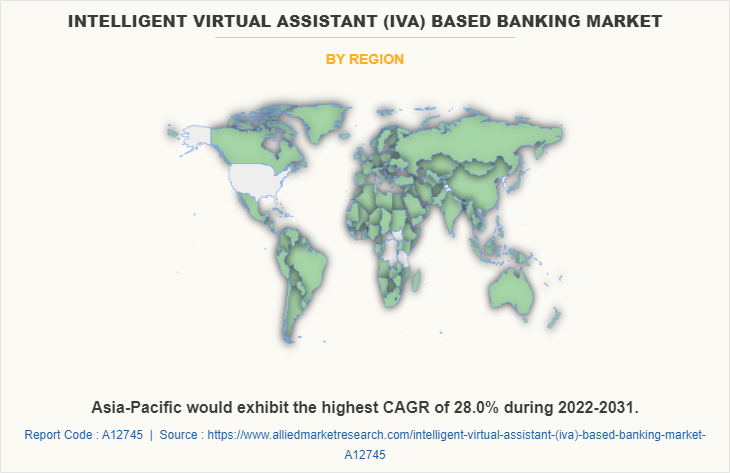

The intelligent virtual assistant (IVA) based banking market is segmented into product, user interface, and region. By product, the market is differentiated into chatbots and smart speakers. Depending on user interface, it is fragmented into text-to-text, text-to-speech and automatic speech recognition. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product, the chatbots segment attained the highest growth of intelligent virtual assistant (IVA) based banking market size during 2021. This is attributed to its wide acceptance in different sectors such as BFSI, retail and others. Moreover, chatbots provide a number of advantages, including reduced wait times, increased customer satisfaction, and the ability to provide quick assistance to customers without the need of human participation. The smart speakers segment is predicted to grow at a healthy CAGR in the coming years, owing to rise in acceptance of intelligent speakers by the general public for managing home services.

Region-wise, North America acquired the highest intelligent virtual assistant (IVA) based banking market share in 2021. This was attributed it being home to prominent players in the market. Significant investment by the large companies to promote the new technology is favoring the market growth in North America.

The intelligent virtual assistant (IVA) based banking market analysis includes top companies operating in the market such as Alphabet Inc., Amazon.com Inc., Artificial Solutions, IBM, Nuance Communications Inc., CSS Corp., eGain Corporation, Oracle, True Image Interactive, Inc. and Verint Systems Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the intelligent virtual assistant-based banking industry.

COVID-19 impact analysis

COVID-19 pandemic has a significant impact on the intelligent virtual assistant (IVA) based banking industry, owing to increase in usage and adoption of online & digitalized banking methods among consumers globally. Intelligent virtual assistant (IVA) based banking market technology is experiencing massive growth as consumers are getting familiar with the chatbots and AI assistants in the market. Moreover, banks and fintech industries are increasingly developing AI chatbots to provide precise information to the customers. This, has become one of the major growth factors for the intelligent virtual assistant (IVA) based banking industry during the global health crisis.

Top Impacting Factors

Rise in adoption of intelligent virtual assistant in banking market

The market is expected to develop due to rise in deployment of cloud-based conversational bots by banking organizations and rise in focus on increasing customer alignment. In addition, growing need for continuous customer assistance at lower operational costs is propelling the industry forward. Moreover, increased use of cloud-based products such as Skype and MS Office Online has significantly benefitted the growth of the market. An increasing number of individuals are working remotely and relying heavily on virtual assistants to complete their jobs owing to the widespread use of cloud-based applications. Furthermore, several financial institutions have incorporated virtual assistants that employ artificial intelligence (AI) and predictive analytics to allow consumers to converse through voice and text. They assist users in making payments, saving money, transferring funds, and checking account balances, all of which improve the quality of services supplied to clients. Thus, rise in adoption of intelligent virtual assistant (IVA) in banking boosting the growth of the market.

Better quality of customer service owing to adoption of IVA in banking market

The growth of virtual assistants is due to improvements in AI technologies such as deep neural networks, machine learning, and other AI technologies. A virtual assistant can help develop brand loyalty through the deployment of a persona. Moreover, banks and financial institutions are focusing more on delivering their core skills, with minimal emphasis dedicated to addressing client queries and guiding them to the relevant items online. By providing an additional mode of contact, the virtual assistant aids the company in serving consumers. Furthermore, customers can also seek help from virtual assistants on any topic relevant to a certain organization. As a result, the boost in demand for better customer alignment is propelling the expansion of the intelligent virtual assistant (IVA)-based banking industry. Thus, better quality of customer service owing to adoption of the intelligent virtual assistant (IVA) based banking is driving the growth of the market.

Decrease in operating costs owing to use of intelligent virtual assistant in banking market

The assistant can help with email management, business correspondence management, scheduling and arranging appointments, and bookkeeping and invoicing. By simplifying corporate processes, a virtual assistant reduces operational costs and eliminates the costs of advertising, interviewing, and training new personnel for the jobs. Moreover, they can also function as a virtual call center, handling and following up on calls as required. In addition, the virtual assistant can take care of marketing efforts such as email, blog, and social media advertising. By allowing for the advantage of time, this enhances flexibility and work-life balance of the organization. As a result, entrepreneurs are increasingly outsourcing their services. As a result, these factors are expected to boost the growth of the market in future. Thus, decrease in operating costs owing to the use of intelligent virtual assistant (IVA) based banking market is fueling the growth of the market.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile security market analysis from 2021 to 2031 to identify the prevailing intelligent virtual assistant (IVA) based banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intelligent virtual assistant (IVA) based banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intelligent virtual assistant (IVA) based banking market trends, key players, market segments, application areas, and market growth strategies.

Intelligent Virtual Assistant (IVA) Based Banking Market Report Highlights

| Aspects | Details |

| By Product |

|

| By User Interface |

|

| By Region |

|

| Key Market Players | Alphabet Inc., Artificial Solutions, CSS Corp., Verint Systems Inc., IBM, Amazon.com Inc., eGain Corporation, Nuance Communications Inc., True Image Interactive, Inc., Oracle |

Analyst Review

Virtual assistants in banking can be used to blend previous conversation history with current client data to deliver customized advice, support offers, or any other information. AI-powered banking virtual assistants allow more complicated interactions than a standard digital banking app, as they can mimic human-to-human discussions. Moreover, consumers continue to prefer digital banking as it is a convenient way to perform banking operations. Benefits associated with intelligent virtual assistant-based banking such as increase in convenience & reduced operational costs drives the market growth. In addition, several key players are enhancing & providing advanced intelligent virtual assistant-based banking products in order to leverage technology and provide advanced products.

The COVID-19 outbreak has a significant impact on the intelligent virtual assistant-based banking market, and has accelerated the adoption of cloud computing owing to the trend of digital banking. Moreover, during this global health crisis, the adoption of intelligent virtual assistant-based banking technology increased among all the banks and financial institutions. This, as a result promoted the demand for intelligent virtual assistant-based banking, thereby accelerating revenue growth.

The intelligent virtual assistant-based banking market is fragmented with the presence of global vendors such as Alphabet Inc., Amazon.com Inc., Artificial Solutions, IBM, Nuance Communications Inc., CSS Corp., eGain Corporation, Oracle, True Image Interactive, Inc. and Verint Systems Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership, to reduce supply and demand gap. With increase in awareness & demand for intelligent virtual assistant-based banking across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Intelligent Virtual Assistant (IVA) Based Banking Market is estimated to grow at a CAGR of 24.5% from 2022 to 2031.

The Intelligent Virtual Assistant (IVA) Based Banking Market is projected to reach $11.2 billion by 2031.

Rise in use of digital and intelligent speaker-based technologies in the banking industry is primarily responsible for the rise of the intelligent virtual assistant market.

The intelligent virtual assistant-based banking market analysis includes top companies operating in the market such as Alphabet Inc., Amazon.com Inc., Artificial Solutions, IBM, Nuance Communications Inc., CSS Corp., eGain Corporation, Oracle, True Image Interactive, Inc. and Verint Systems Inc.

The key growth strategies of Intelligent Virtual Assistant (IVA) Based Banking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...