Intraoral Scanners Market Research, 2035

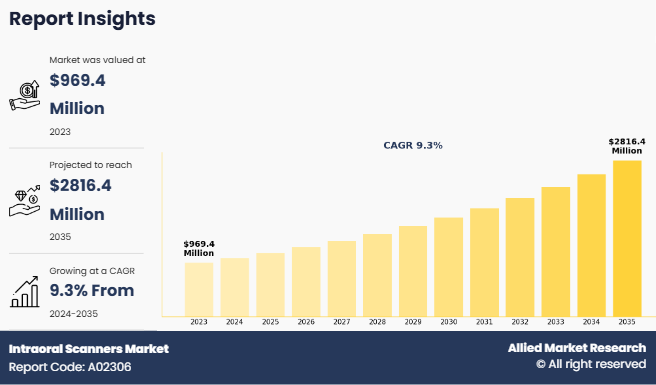

The global intraoral scanners market size was valued at $969.4 million in 2023, and is projected to reach $2,816.4 million by 2035, growing at a CAGR of 9.3% from 2024 to 2035. The intraoral scanners market growth is driven by advancements in digital dentistry, rise in awareness about oral health, coupled with increase in its adoption in orthodontics, prosthodontics, and restorative dentistry. For instance, according to the World Health Organization (WHO) report, oral diseases affected nearly 3.5 billion people in 2023. In addition, 2 billion people suffer from caries of permanent teeth and 514 million children suffer from caries of primary teeth. Thus, rise in oral health problems led to a surge in the need for intraoral scanners thereby propels the market growth.

Intraoral scanners (IOS) are digital devices used in dentistry to capture high-resolution, 3D images of a patient’s teeth, gums, and oral structure. They use optical or laser technology to create precise digital impressions, which are then used for various dental procedures, including orthodontic, restorative, and implant treatments. Intraoral scanners eliminate the need for traditional molds, enhancing patient comfort and reducing errors associated with manual impressions. These scanners contribute to faster workflows, improved patient outcomes, and enhanced accuracy in diagnosis, planning, and fabrication of custom dental appliances.

Key Takeaways

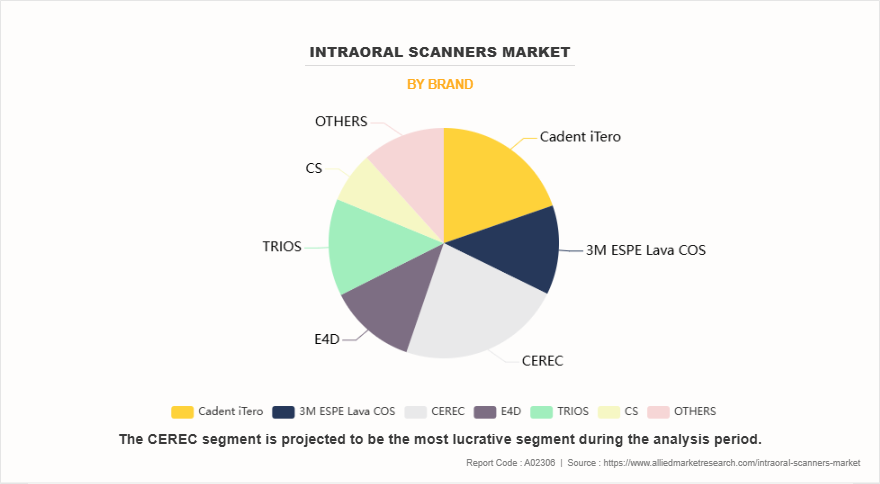

- On the basis of brand, the CEREC segment dominated the market in terms of revenue in 2023.‐¯However, the CS segment is anticipated to grow at the fastest CAGR during the forecast period.

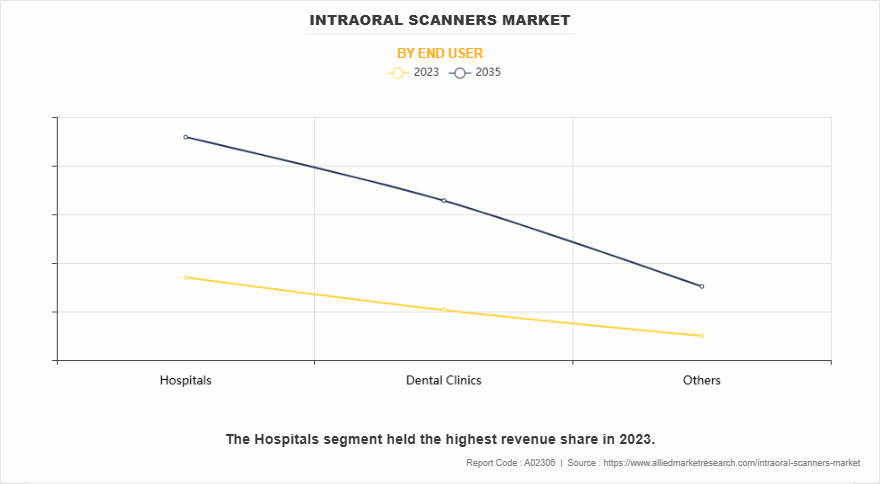

- On the basis of end user, the hospitals segment held the largest market share in 2023. However, the dental clinics segment is anticipated to grow at the fastest CAGR during the forecast period.

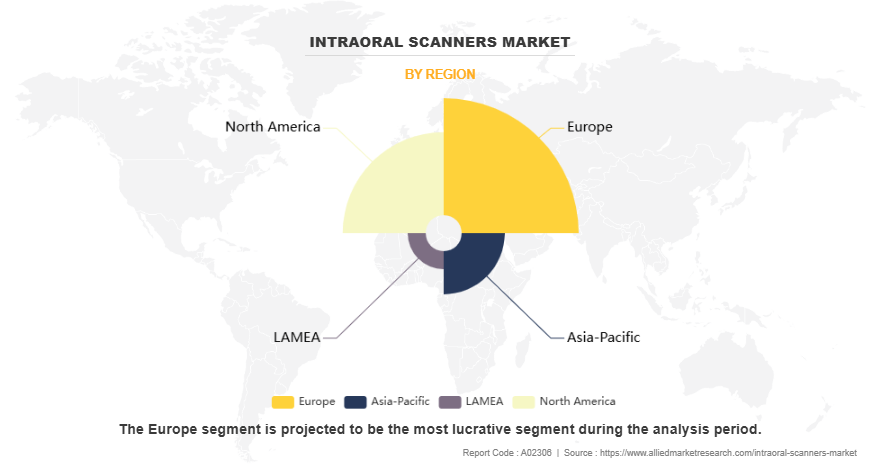

- Region wise, Europe generated the highest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The intraoral scanners market growth is driven by the growing demand for digital dental solutions that enhance patient comfort and streamline clinical workflows. Traditional impression techniques can be uncomfortable, prone to error, and time-consuming, whereas intraoral scanners offer a highly accurate and patient-friendly alternative. By capturing precise 3D images of the oral cavity, IOS enables faster diagnosis, treatment planning, and fabrication of dental appliances, making them a preferred choice in orthodontics, restorative dentistry, and prosthodontics.

In addition, rise in technological advancements plays a significant role in market growth. Innovations in imaging, artificial intelligence, and software integration have improved the functionality and user experience of intraoral scanners. Modern devices can now deliver color images, recognize soft tissues, and provide real-time feedback, contributing to more accurate, customizable, and efficient workflows. These innovations attract dental practitioners seeking to upgrade their technology and offer better patient outcomes. Furthermore, the integration of IOS with computer-aided design and manufacturing (CAD/CAM) systems allows for immediate in-house production of crowns, bridges, and aligners, reducing the dependency on dental labs and enhancing the practice’s operational efficiency.

Moreover, the rise in global awareness of oral health, along with the increasing prevalence of dental disorders such as malocclusion, tooth decay, and gum disease, which drive the need for accurate diagnostic tools such as intraoral scanners. Intraoral scanners play a critical role in early detection and effective management of these conditions. In addition, supportive government initiatives and investments in dental health infrastructure—particularly in developing regions are driving the adoption of intraoral scanners.

However, the high initial cost of acquiring and implementing intraoral scanner devices, which can be prohibitive for smaller dental practices and clinics, particularly in developing regions which limits the adoption of intraoral scanners and restricts the market growth. These costs extend beyond the scanner itself, often including expenses for compatible software, digital storage, and maintenance, making it challenging for some practitioners to justify the investment. In addition, while intraoral scanners promise enhanced efficiency and accuracy, they require specific training and a learning curve for effective use. Many dental professionals are adapted to traditional methods, and adapting to digital workflows can be time-consuming, especially in settings with limited resources for training which further negatively impacted the market growth.

On the other hand, the growing preference for minimally invasive procedures presents a strong opportunity for intraoral scanners. By eliminating the need for traditional molds, these scanners provide a non-invasive, convenient option for patients, especially those who are anxious about dental procedures. This trend aligns with the broader shift toward patient-centered care, where comfort and satisfaction are prioritized. In addition, the increase in demand for clear aligners, dental implants, and cosmetic dentistry procedures also creates intraoral scanners market opportunity.

Segmental Overview

The intraoral scanners industry is segmented into brand, end user, and region. On the basis of the brand, it is classified into Cadent iTero, 3M ESPE Lava COS, CEREC, E4D, TRIOS, CS, and others. On the basis of end user, the market is categorized into hospitals, dental clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Brand

On the basis of brand, the CEREC segment was the largest revenue contributor to the intraoral scanners market share in 2023. This was attributed to its high accuracy, speed, and ease of use that made it a popular choice among dental professionals seeking to enhance patient experience and streamline workflows. Its strong brand presence and ongoing product innovations further solidified its position as a leading option in digital dentistry. However, the CS segment is expected to register the fastest growth during the forecast period. This is attributed to its user-friendly design, high imaging precision, and seamless software integration. This segment benefits from rapid technological advancements that enhance diagnostic accuracy and streamline treatment planning. In addition, the CS brand’s affordability and versatility appeal to a wide range of dental practices, supporting its rapid adoption across various regions.

By End User

By end user, the hospitals segment was the largest revenue contributor to the intraoral scanners market size in 2023 owing to the increase in adoption of advanced digital technologies in hospital-based dental departments. Hospitals typically have a higher volume of patients, driving the need for efficient, high-accuracy diagnostic tools like intraoral scanners. The ability to streamline workflows, reduce patient discomfort, and improve treatment outcomes has made intraoral scanners an essential tool in hospital settings, further boosting their demand and contributing to the segment growth.

However, the dental clinics segment is expected to register the fastest growth during the forecast period owing to a surge in preference for digital dentistry among smaller, independent practices. Dental clinics are adopting intraoral scanners to improve patient satisfaction by offering quicker, more accurate diagnoses and treatments. Affordability, and ability to provide same-day restorations are key factors driving the adoption of intraoral scanners in dental clinics. In addition, the growing trend of preventive and cosmetic dentistry further fuels the demand for advanced scanning technology in these settings.

By Region

Region wise, Europe was the largest shareholder in the intraoral scanners market share in 2023, owing to the high adoption of advanced dental technologies and the presence of well-established healthcare infrastructure. European countries have been early adopters of digital dentistry, driven by strong regulatory support, significant healthcare investments, and a growing emphasis on patient-centered care. In addition, the rise in demand for cosmetic and orthodontic procedures, along with favorable reimbursement policies in several European nations, contributed to Europe's dominant position in the market.

However, Asia-Pacific is anticipated to register the highest CAGR during the intraoral scanners market forecast period owing to the rapid expansion of dental healthcare infrastructure, increasing disposable incomes, and a rising awareness of oral health. The region is witnessing a surge in the adoption of advanced dental technologies, including intraoral scanners, driven by growing urbanization and a rising demand for cosmetic dentistry and orthodontic treatments. In addition, government initiatives and investments in healthcare, coupled with the increasing number of dental professionals seeking to upgrade their practices, further fuel the growth of the intraoral scanners market in Asia-Pacific.

Competition Analysis

Key players such as Envista Holdings Corporation, Dentsply Sirona, and 3Shape A/S have adopted acquisition, investment, product launch as key developmental strategies to improve the product portfolio of the intraoral scanners market. For instance, in September 2022, 3Shape introduced TRIOS 5 Wireless, a completely new, state-of-the-art intraoral scanner designed to make it easier than ever for dentists to go digital with their dentistry. A breakthrough in intraoral scanners, TRIOS 5 Wireless makes scanning smoother and faster with its all-new ScanAssist intelligent alignment technology that comes housed in a redesigned compact and hygienically optimized scanner to deliver the highest standard in imaging performance and infection control.

Recent Developments in Intraoral Scanners Industry

- In September 2024, Dentsply Sirona announced the introduction of a new, versatile, and innovative intraoral scanner: Primescan 2. Powered by the DS Core cloud platform.

- In September 2023, Dentsply Sirona, the largest global manufacturer of dental products, and 3Shape, a leader in digital dental solutions, enhanced their workflow integrations. The integration of DS Core, Primemill, and Primeprint with the 3Shape TRIOS intraoral scanner, powered by 3Shape Unite, streamlines digital dentistry processes. This collaboration provides dentists and technicians with secure, connected technology solutions, fostering effective collaboration and enabling improved dental care.

- In September 2023, The Straumann Group signed an agreement to acquire AlliedStar, an intraoral scanner (IOS) manufacturer in China. It will enable the Group to offer customers in China a competitive intraoral scanner solution and to address additional price-sensitive markets and customer segments in the future. As part of the Straumann Group, AlliedStar is expected to continue to serve existing channels.

- In March 2023, Launca Medical launched its latest innovation, the Launca DL-300 Series Intraoral Scanner (Wireless & Wired version both available). The new series intraoral scanner features our latest AI technology, allowing for effortless and cleaner scanning with speed while ensuring high accuracy. Launca DL-300 is the most lightweighted, intelligent, and powerful intraoral scanner ever launched.‐¯

- In February 2022, 3Shape introduced its brand-new model maker app, Dental practice management software integrations, and 3Shape automate innovation at LAB DAY 2022. Model maker enables both 3Shape TRIOS intraoral scanner and 3Shape Studio apps users to instantly convert digital impressions into dental models.

- In December 2021, Dentsply Sirona and 3Shape enhanced their partnership by integrating Dentsply Sirona’s Connect Case Center with 3Shape’s Dental System software. This integration allows dentists using Primescan or Omnicam intraoral scanners to securely share data with dental labs via the Connect Case Center Portal. The new interface is accessible to dental laboratories using 3Shape’s Dental System that has upgraded to Version 2021.2, facilitating closer collaboration between dental practices and technicians.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the intraoral scanners market analysis from 2023 to 2035 to identify the prevailing intraoral scanners market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the intraoral scanners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global intraoral scanners market trends, key players, market segments, application areas, and market growth strategies.

Intraoral Scanners Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 2.8 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 290 |

| By Brand |

|

| By End User |

|

| By Region |

|

| Key Market Players | Planmeca Oy, Institut Straumann AG, Align Technology, Inc., Midmark Corporation, Envista Holdings Corporation, Dentsply Sirona Inc., Guangdong Launca Medical Device Technology Co. Ltd, densys3D, 3Shape A/S, Condor Technologies NV |

Analyst Review

This section provides various opinions of in the intraoral scanners market. The intraoral scanners market expansion is driven by technological advancements that enhance the accuracy and efficiency of dental procedures. In addition, the surge in focus on patient-centric care pushes practitioners to integrate digital solutions that provide immediate feedback and transparency in treatment planning, further supporting market growth.

In addition, the rise in prevalence of dental disorders, along with an aging population that seeks advanced dental care, further fuels the demand for intraoral scanners, positioning the market for substantial growth. Furthermore, rise in number of strategies adopted by key players further boosts market growth.

Europe generated the highest revenue in 2023, owing to its advanced healthcare infrastructure and high adoption rates of advanced intraoral scanners. In addition, strong healthcare expenditure and the presence of key market players also contribute to its leading position. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to expansion in healthcare infrastructure, increase in awareness of dental health, and rise in number of oral health issues. Rapid economic growth and improved access to advanced medical technologies in the region contribute to the accelerated market growth.

The total market value of intraoral scanners market was $969.4 million in 2023.

The forecast period for intraoral scanners market is 2024 to 2035.

The market value of intraoral scanners market is projected to reach $2,816.4 million by 2035.

The base year is 2023 in intraoral scanners market .

The CEREC segment holds the largest market share in the intraoral scanners market. This dominance was attributed to its widespread adoption in dental clinics and laboratories for chairside restorations. CEREC systems, known for their precision, user-friendly interface, and integration with CAD/CAM technology, making them a preferred choice among dental professionals.

The growth of the intraoral scanners market is driven by increasie in adoption of digital dentistry, advancements in 3D imaging technology, and rising demand for precise and efficient dental care solutions.

Intraoral scanners (IOS) are advanced dental devices used to capture detailed digital impressions of a patient’s oral cavity, including teeth, gums, and soft tissues. These scanners utilize optical and laser technology to create high-resolution 3D images that can be used for diagnostic, restorative, and orthodontic applications.

Loading Table Of Content...

Loading Research Methodology...