Invoice Factoring Market Research, 2031

The global invoice factoring market was valued at $1946.5 billion in 2021, and is projected to reach $4618.9 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Invoice factoring provides financial flexibility in terms of maintaining cash flow for a short period. Therefore, business owners do not have to apply for loans. When a business applies for a loan or line of credit, bank requires businesses to have collateral such as equipment, vehicles, buildings, inventory, or even intellectual property. This way, invoices do not have to be paid in full before there is money in the business account, hence providing financial flexibility.

Invoice factoring helps to increase revenue for a company by notifying loan servicers about outstanding payments or approaching due dates and facilitates follow ups, online payments, and offline collections. In addition, it helps in ensuring accuracy in calculating repayment, interest, and the principal amount. Moreover, invoice factoring reduces turnaround time. Therefore, these are some of the factors propelling the invoice factoring market growth. However, lack of a stringent regulatory framework for debt recovery mechanisms is a major factor limiting growth of the invoice factoring market forecast period. On the contrary, advances in technology and adoption of artificial intelligence and machine learning in the lending industry is expected to provide lucrative growth opportunities for the invoice factoring market size in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the invoice factoring market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the invoice factoring industry.

Segment Review

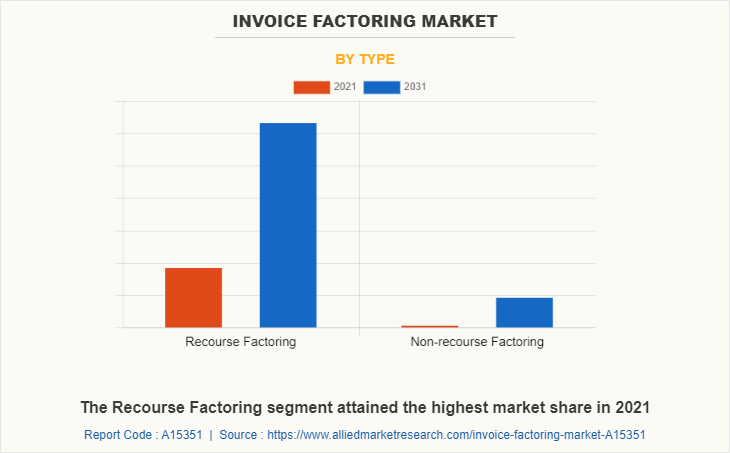

The invoice factoring market share is segmented on the basis of type, enterprise size, provider, and industry vertical. By type, it is segmented into recourse factoring and non-recourse factoring. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises (SMEs). By provider, it is segregated into banks and NBFCs. On the basis of application, it is segmented into domestic and international. On the basis of industry vertical, the invoice factoring market is bifurcated into construction, manufacturing, healthcare, transportation & logistics, energy & utilities, IT & telecom, staffing, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the recourse factoring segment attained highest growth in 2021. This is attributed to fact that recourse invoice factoring is less expensive than non-resourcing invoice factoring. Recourse factors can offer higher advances and lower factor fees while purchasing invoices under recourse factoring facilities. Moreover, recourse factoring requires personal guarantee of management or owners as owners must maintain liquidity to purchase back any non-performing accounts receivable taken as collateral by the factor.

Region wise, Europe attained the highest growth in 2021. This is attributed to significant growth of the invoice factoring market in these countries can be further explained from an historic perspective. Moreover, since many of these formerly socialist nations have quickly embraced capitalist practices over the past three decades, with a huge increase in entrepreneurial endeavors and SMEs, it stands to reason that such businesses, frequently with little to no financial history or assets, are frequently the best candidates for invoice financing.

The report analyzes the profiles of key players operating in the invoice factoring market such as Adobe, American Express Company, Barclays Bank UK PLC, ICBC, Intuit Inc., Lloyds Bank, Porter Capital, Sonovate, Waddle, and Velotrade. These players have adopted various strategies to increase their market penetration and strengthen their position in the invoice factoring industry.

COVID-19 Impact Analysis

The COVID-19 pandemic impacted the overall economy along with the financial markets. But, pandemic had positively impacted the invoice factoring market as more business were opting for factoring to fulfill short-term cash requirements. Moreover, the primary factor driving the market growth was increasing demand for alternative sources of financing for MSMEs, increase in various factoring businesses delivering a combination of financing options, raised liquidity for efficient working capital management, and enhanced inventory management. In addition, the increased awareness and understanding of supply chain financing benefits contribute to market expansion, like business invoice factoring. Furthermore, the rising advancements and unique identification for fast funding, complete transactional security, and innovative contract capabilities. Therefore, the COVID-19 had a positive impact on the invoice factoring market.

Top Impacting Factors

Rise in Open Account Trading Opportunities

Increasing implementation of open account in small and medium enterprises (SMEs), is that propel growth of the market owing to the expansion of the manufacturing industry in Asian countries and the growing need among startups and SMEs for an alternate source of finance are further driving the market growth. In addition, BFSI companies are adopting and developing machine learning techniques to analyze large volume of data and to deliver valuable insights to customers. Moreover, increase in investments in AI and advanced machine learning by fintech & banks to enhance the automation process and to offer more streamlined and personalized customer experience propels the growth of the market. Therefore, this is one of the major driving factor of the invoice factoring market.

Foreign Currency Restrictions and Stamp Duties

Invoice factoring are expected to gain high traction in enterprises, however, practices and adoption remain stagnant. In addition, stamp duty exemption allow companies to get their bills discounted easily by banks or other entities, which provide invoice factoring services and buy accounts receivables at a discount. Moreover, several factors are expected to impede the demand for invoice factoring in emerging markets, including archaic regulations hindering growth of receivables purchase programs, such as continued use of stamp duty tax, laws limiting rights of assignment, and foreign currency restrictions. Therefore, this is one of the major factors that hampers the growth of invoice factoring market.

Technological Advancements such as Automated Invoices

Increasing implementation of open account in small and medium enterprises (SMEs), is that propel growth of the market owing to the expansion of the manufacturing industry in Asian countries and the growing need among startups and SMEs for an alternate source of finance are further driving the market growth. In addition, BFSI companies are adopting and developing machine learning techniques to analyze large volume of data and to deliver valuable insights to customers. Moreover, increase in investments in AI and advanced machine learning by fintech & banks to enhance the automation process and to offer more streamlined and personalized customer experience propels the growth of the market. Therefore, this is one of the major driving factor of the invoice factoring market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the invoice factoring market outlook from 2021 to 2031 to identify the prevailing invoice factoring market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the invoice factoring market segmentation assists to determine the prevailing market invoice factoring market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global invoice factoring market trends, key players, market segments, application areas, and market growth strategies.

Invoice Factoring Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4618.9 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 342 |

| By Type |

|

| By Application |

|

| By Enterprise Size |

|

| By Provider |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Adobe, Velotrade, American Express Company, ICBC, Porter Capital, Intuit Inc., Sonovate, Lloyds Bank, Barclays Bank UK PLC, Waddle |

Analyst Review

Invoice factoring reduce credit risk by completing responsibility of debt collection. In addition, new technologies help invoice factoring companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts. Thus, it provides benefits such as cost-effectiveness, powerful insights & reporting, and credit evaluation, which are expected to increase demand for factoring services. Moreover, with further growth in investments across the globe and rise in demand for invoice factoring service, various companies have expanded their current product portfolio with increased diversification among customers.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on August 2022, M1xchange, one of the invoice discounting and factoring service providers on India’s TReDS platform, announced a partnership with YES bank and RBL bank. Digital credit assessment of MSMEs through the latter’s cash flows. It analyzes authentic, non-repudiable data of MSMEs from multiple digital sources to generate insights into a business’s credit profile. The cash flow-based approach alleviates traditional concerns around the authenticity of MSMEs’ business financials, a key data source in the traditional balance sheet-based credit assessment model, the company noted.

Some of the key players profiled in the report include Adobe, American Express Company, Barclays Bank UK PLC, ICBC, Intuit Inc., Lloyds Bank, Porter Capital, Sonovate, Waddle and Velotrade. These players have adopted various strategies to increase their market penetration and strengthen their position in the invoice factoring market.

Invoice factoring helps to increase revenue for a company by notifying loan servicers about outstanding payments or approaching due dates and facilitates follow ups, online payments, and offline collections. In addition, it helps in ensuring accuracy in calculating repayment, interest, and the principal amount. Moreover, invoice factoring reduces turnaround time. Therefore, these are some of the factors propelling the growth of invoice factoring.

On the basis of application, it is segmented into domestic and international.

Region wise, Europe attained the highest growth in 2021.

The estimated industry size of Invoice Factoring Market is projected to reach $4,618.89 billion by 2031

Adobe, American Express Company, Barclays Bank UK PLC, ICBC, Intuit Inc., Lloyds Bank, Porter Capital, Sonovate, Waddle, and Velotrade

Loading Table Of Content...