The Japan insurance chatbot market has experienced substantial growth during the projection period. The rapid evolution of consumer demand for fast and effective insurance solutions is a crucial factor to consider. In a time where efficiency is increased, chatbots offer a way to accelerate customer service, claims processing, and sales. This increase in demand for immediate satisfaction drives the expansion of the chatbot market, acting as a guiding light for insurers aiming to meet customer expectations. Moreover, pursuit of cost-efficiency by the insurance industry shapes the market dynamics. The incorporation of chatbots, specifically in the areas of claims processing and underwriting, has the potential to substantially diminish operational expenses. This economic advantage serves as a compelling catalyst, compelling insurance companies to adopt automation and chatbot technology.

On the other hand, the Japan insurance chatbot market is not devoid of restraints. Market restraints act as intangible barriers that aim to limit the expansion of the chatbot market. One particular restraint revolves around concerns regarding data security and privacy. Insurance involves handling sensitive and personal information, and the potential for data breaches poses a significant and tangible threat. The task of ensuring the security of chatbot interactions remains an ongoing challenge for insurance companies.

Furthermore, importance of human interaction in the insurance industry is not underestimated. Despite the efficiency of chatbots, some customers still prefer the personal touch when dealing with complex insurance matters. This resistance to complete automation presents a restraint that insurers carefully navigate to uphold customer satisfaction. However, the Japan insurance chatbot market presents a wealth of opportunities despite the challenges it faces. Integrating chatbots with advanced technologies such as artificial intelligence and machine learning is a significant opportunity that revolutionizes insurance processes, and improves accuracy and efficiency. Moreover, the expansion of the role of chatbots to serve as informational guides and advisors creates new revenue streams for insurers by providing consumers with valuable information about insurance products, enabling them to make informed decisions.

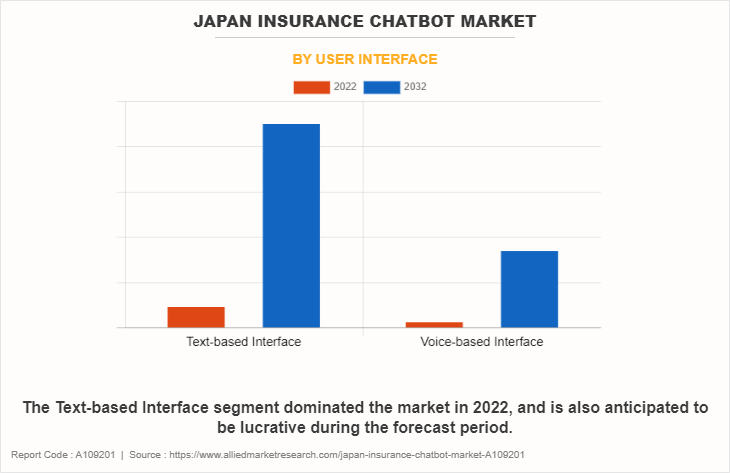

The Japan insurance chatbot market's future is uncertain as it navigates uncharted territory. As technology advances, chatbots' role in insurance evolves, influenced by broader tech trends and customer expectations. A significant trend to monitor is integration of voice-based interfaces into chatbots, which are gaining popularity over text-based chatbots. This shift is motivated by the desire for a more natural and human-like interaction with chatbots, potentially revolutionizing customer service in insurance and providing a more seamless experience. In addition, the future of chatbots is significantly influenced by regulations in the insurance sector. As the government implements policies concerning data security and insurance practices, chatbots adjust and adhere to these regulations. It is imperative for insurers and chatbot developers to stay proactive in anticipating and complying with regulatory changes.

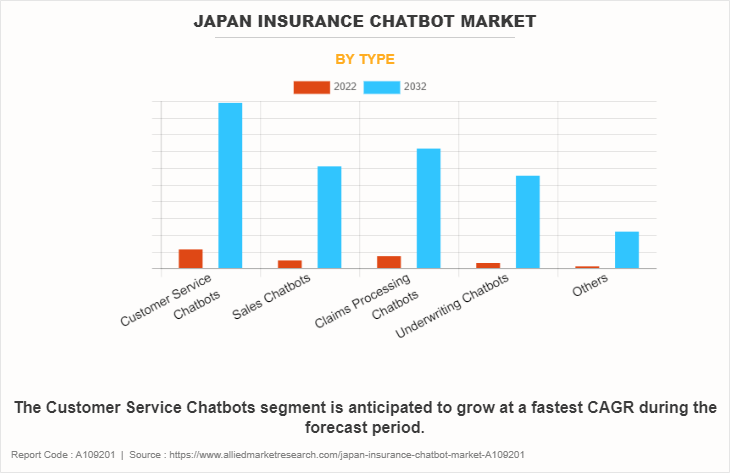

The Japan insurance chatbot market is segmented into type, and user interface. Depending on type, the market is classified into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. On the basis of user interface, it is bifurcated into text-based interface and voice-based interface. In the chatbot market, innovation is perpetual. Developers and insurance companies strive to create smarter and more intuitive chatbots that handle a wider range of insurance-related tasks. This drive for innovation is fueled by need to stay ahead of competitors and meet the demands of consumers for more advanced chatbot solutions. In addition, ongoing R&D is crucial to the chatbot market's vitality. The evolution of chatbot technology relies on continuous R&D efforts to enhance capabilities, improve data security, and address the changing needs of the insurance industry.

Moreover, the market's success heavily relies on how consumers and end users perceive it. Chatbots' adoption rate is influenced by positive or negative perceptions. Insurers prioritize providing value and a positive user experience to ensure chatbots' success. Pricing strategies play a crucial role in the chatbot market, as insurers balance cost savings and consumer value. Finding the right pricing strategy is an ongoing challenge that requires a deep understanding of market dynamics and consumer expectations.

The Porter’s five forces analysis analyzes the competitive scenario of the Japan insurance chatbot market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry. The threat of new entrants in this market is moderate. Although the obstacles to entry are not insurmountable, achieving a dominant position in the insurance chatbot industry necessitates substantial investments in technology and adherence to insurance regulations. In this context, suppliers are the developers and technology providers responsible for chatbots. The bargaining power of suppliers is moderate as they are the driving force behind creative solutions. Nevertheless, as the market expands, more suppliers are entering the market, providing insurers with a wider range of options.

The bargaining power of buyers, including insurance companies, is substantial in this market. Customers have the option to select from a diverse range of chatbot solutions and engage in negotiations for favorable pricing and terms. This ability is strengthened by continuous need for economical automation. The threat of substitutes is minimal. Chatbots present an exclusive resolution to enhance the efficiency of insurance procedures. Although certain manual processes still persist, chatbots persist as the optimal choice. The market experiences a high degree of competitive rivalry. Insurance companies and technology providers compete for a larger market share, consistently striving to surpass their competitors. This competitive intensity is fueled by dynamic nature of the market.

A roadmap through the internal and external landscape of the Japan insurance chatbot market, a SWOT analysis identifies the strengths, weaknesses, opportunities, and threats. Strengths encompass efficiency and cost-effectiveness, with the potential for innovation through AI and machine learning. In addition, ability to cater to customer demand for quick service is a notable strength. Weaknesses include concerns over data security and privacy, and resistance to complete automation in complex insurance matters. Furthermore, there is a risk of depersonalization in customer interactions. Opportunities arise from the integration of voice-based interfaces and the growth of sales chatbots. Moreover, compliance with evolving regulations and expansion of chatbots as informational guides present opportunities. Threats to the Japan insurance chatbot market include regulatory challenges, negative consumer perceptions, and intense competition in the market.

Key players operating in the market are IBM Corporation, Microsoft Corporation, Oracle Corporation, Google LLC, SAP SE, Amazon Web Services, Inc., Nuance Communications, Inc., Kore.ai, Inc., Pegasystems Inc., and Inbenta Technologies Inc.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Japan insurance chatbot market.

- Assess and rank the top factors that are expected to affect the growth of japan insurance chatbot market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Japan insurance chatbot market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Japan Insurance Chatbot Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 84 |

| By Type |

|

| By User Interface |

|

| Key Market Players | Oracle Corporation, Kore.ai, Inc., Google LLC, Inbenta Technologies Inc., Nuance Communications, Inc., SAP SE, IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., Pegasystems Inc. |

The Japan Insurance Chatbot Market is estimated to reach $308.9 million by 2032

IBM Corporation, Microsoft Corporation, Oracle Corporation, Google LLC, SAP SE, Amazon Web Services, Inc., Nuance Communications, Inc., Kore.ai, Inc., Pegasystems Inc., Inbenta Technologies Inc. are the leading players in Japan Insurance Chatbot Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in japan insurance chatbot market.

3. Assess and rank the top factors that are expected to affect the growth of japan insurance chatbot market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the japan insurance chatbot market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Japan Insurance Chatbot Market is classified as by type, by user interface

Loading Table Of Content...

Loading Research Methodology...