The global jet engines marketsize was valued at $66.9 billion in 2022, and is projected to reach $140 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

A jet engine is a kind of internal combustion engine that uses high-speed exhaust gases created by the engine's fuel burning to push itself and other vehicles ahead. In addition to powering airplanes and helicopters, jet engines are frequently utilized in land-based and maritime applications in aviation.

Report Key Highlighters:

The jet engine market studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The jet engine market share is marginally fragmented, with GE Honda; Safran Group; Roll Royce; Honeywell Corporation; Kawasaki; Williams International; MTU Aeroengines; PBS Group; PRATT & WHITNEY. Major strategies such as contractcontracts, partnerships, product launches, and other strategies of players operating in the market are tracked and monitored.

Variable cycle engines have become more popular due to their potential efficiency increases. These engines adjust to varied flight phases.

Technological Advancements in Turbofan

The drive toward quieter and more eco-friendly aviation is another notable trend in turbofan engines. Stringent noise regulations and a growing focus on community and environmental concerns have spurred innovations in engine design to reduce noise emissions. Quieter engines not only contribute to a more pleasant flying experience for passengers but also address concerns related to airport noise pollution. Manufacturers are investing in research and development to design turbofan engines with lower noise profiles without compromising performance.

The jet engine market holds a great potential over the coming years backed by rise in inflight passengers across the globe, aircraft modernization contracts on commercial as well as military verticals, development of infrastructure related to aviation industry, and R&D practiced by global players to improve fuel efficiency of aircraft engines and reduce overall carbon footprint. Surge in travel enthusiasm and a return to normalcy have revitalized the aviation industry. Turbofan jet engines, pivotal in aviation propulsion, are undergoing transformative trends, influencing their evolution in the aerospace sector.

Surge in need for civil aviation will create lucrative growth oppurtunites for jet engine

The trend of extended range capabilities in turbofan engines. Aircraft equipped with these engines can cover longer distances without the need for frequent refueling stops. This trend is particularly relevant for airlines operating international routes, where non-stop flights become more economically and operationally viable. Turbofan engines with increased range contribute to the globalization of air travel and create new possibilities for direct long-haul routes. Increasing regulatory requirements and community concerns regarding aircraft noise present opportunities for the development of turbofan engines with advanced noise reduction technologies. Quieter engines can enhance the passenger experience and address environmental and regulatory challenges.

Geopolitical factors are restricting the market growth

Several geopolitical factors are affecting jet engines such as turbofan and turbojet. The market is experiencing growth in supply chains, influencing the number of suppliers. Firms are adjusting their manufacturing as well as advancement and enhancement to initiate with geopolitical factors as well as make sure a steady supply of turbofan engines to fulfill global demand.The combination of electronic modern technologies, information analytics as well as components in turbofan engines uses technology for real-time surveillance, anticipating as well as boosted functional performance. Makers can take advantage of innovations in electronic to offer cutting-edge remedies for airline companies looking for boosted engine efficiency.

Turbofan jet engines are undertaking substantial improvements driven by the requirement for gas performance, ecological sustainability, minimized sound discharges, electronic combination expanded array abilities together with geopolitical factors to consider. These trends will create lucrative growth oppurtunities for the aeronautics propulsion systems, adding to an extra reliable, lasting and also attached aeronautics industry.

These players are actively looking for new raw material suppliers from Africa, Asia-Pacific, or North America regions in an effort to reduce their dependency on Europe. The jet engine market outlook is segmented into Type and Application.

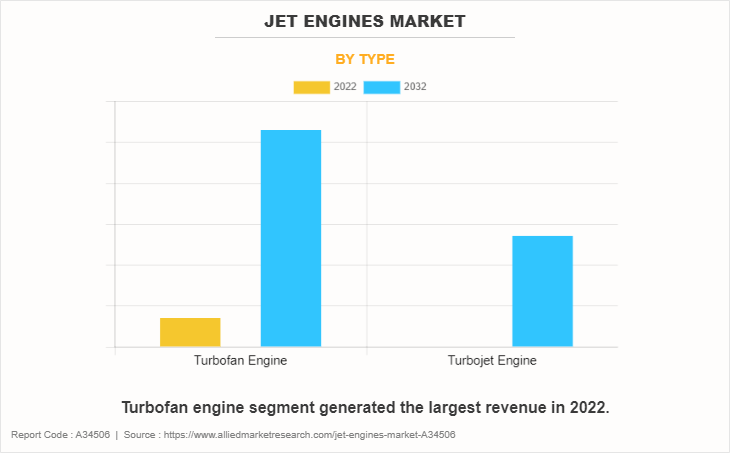

On the basis of type, the market is bifurcated into turbofan and turbojet. Turbofan jet engine segment generated largest jet engine market share in 2022.Sustainable aviation fuels (SAFs) are among the alternative fuels being investigated by the industry to reduce the carbon footprint of turbofan engines. In addition, interest in electric and hybrid-electric power systems has increased to further cut emissions, particularly for smaller regional aircraft.

The rise in need for engine performance along with ecological sustainability. Airlines as well as airplane makers are focusing on the growth of turbofan engines with improved gas performance to lower functional prices and also lessen ecological influence. This trend straightens with the wider sector objective of accomplishing even more lasting aeronautics techniques. Makers are incorporating sophisticated products, boosted wind resistant as well as cutting-edge innovations to enhance the efficiency of turbofan engines making them extra environmentally friendly.

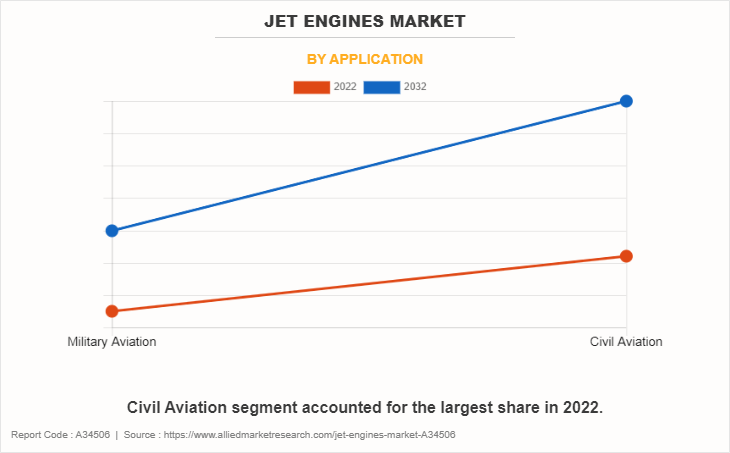

On the basis of application, the market is divided into civil aviation and military aviation. The civil aviation segment accounted for the largest share in 2022.Convergence of commercial demands, environmental requirements, and technical progress. The ongoing quest for lower emissions and greater fuel economy is a noteworthy trend. To maximize engine performance, manufacturers make investments in cutting-edge cooling technology, aerodynamics, and new materials.

Growing focus on gas performance as well as ecological sustainability produces possibilities for producers to establish as well as market turbofan engines with improved gas performance. Developments in products, wind resistant, as well as propulsion modern technologies can add to even more eco-friendly with economical engines.

By region, the jet engine industry is analyzed in North America, Europe, Asia Pacific, and LAMEA. Region wise, the jet engine market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).On the basis of region, the Asia-Pacific is expected to be the largest market shareholder due to the country’s constantly increasing military expenditure to integrate advance technologies across all its commercial aircraft platforms.

Impact of Russia-Ukraine war on Jet Engine Industry

Geopolitical tensions and conflict between Russia and Ukraine are expected to cause economic uncertainty in the impacted regions. Budgets and plans for implementing automation solutions may be impacted by economic instability, which may also have an impact on the choices made by airports, airlines, and technology suppliers about investments. Furthermore, projects pertaining to the expansion and upgrading of airports, among other infrastructure development initiatives, may be postponed or delayed in areas where there is a conflict between Russia and Ukraine. This may affect how new jet engine technologies are implemented. Moreover, the airport automation market depends on an international supply chain for a range of parts and technology.

Due to the Russia-Ukraine war, delaying the production and delivery of automation equipment which in turn may disrupt the supply chain. In addition, the Russia and Ukraine together reduced business and tourist traffic to the impacted regions may be the outcome of conflict and geopolitical concerns. The urgency and priority of airport automation initiatives may be impacted by decrease in passenger volume. Moreover, airports automation may emphasize security measures in reaction to geopolitical concerns resulting from the Russia-Ukraine war, which could lead to greater investments in technologies linked to surveillance, access control, and threat detection. This may have an indirect effect on how other automation projects are prioritized.

Competitive Analysis

Competitive analysis and profiles of the major global jet engine market manufacturers that have been provided in the report include GE Honda; Safran Group; Roll Royce; Honeywell Corporation; Kawasaki; Williams International; MTU Aeroengines; PBS Group; PRATT & WHITNEY. The key strategies adopted by the major players of the global jet engine industry are product launch and mergers & acquisitions.

Top Impacting Factors

The global jet engine market is expected to witness notable growth owing to integration of AI & ML in jet manufacturing to optimize manufacturing processes, technological innovation to improve the efficiency of engine operations and improve operational revenues, customer centric approach, goal to achieve carbon net neutrality, the rise in the number of jet engine vendors across the globe, impact of COVID-19, increase in jet engine lease and rent opportunities, increase in air traffic passengers, inclination of end user toward human-machine interface, supporting automation, threat of cybersecurity, and data breach.

Historical Data & Information

The global jet engine market is highly competitive, owing to the strong presence of existing vendors. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.Advancements in digital technologies and connectivity are also influencing turbofan engine trends. The integration of digital systems and sensors allows for real-time monitoring and data analysis, leading to more efficient engine performance. Predictive maintenance, enabled by data analytics, helps airlines identify and address potential issues before they result in operational disruptions. Connectivity features in turbofan engines facilitate communication between the aircraft and ground control, enabling more efficient flight operations and maintenance planning.

Key Developments/ Strategies in Jet Engine Industry

- In July 2021, GE Aviation and NASA entered an agreement to works on net-zero-emissions for engine.GE is working on hybrid electric system including motor, generator, and power convertors for aircraft engine.

- In Feb 2022, Honeywell signed a contract with Lockheed Martine Skokie-Boeing to power DEFIANT X helicopter in the U.S Army. The new HTS7500 turboshaft engine provides power-to-weight-ratio and total value for military helicopter turboshaft engine.

- In March 2020, IHI Corporation developed the first aircraft jet engine with high power density and heat resistance which help to reduce the CO2 emission for energy management.

- In February 2022, Embraer, Widerøe, and Rolls-Royce entered into a research partnership agreement to conduct a 12-month study and research innovative sustainable technologies for regional planes, focusing on developing a conceptual zero-emission aircraft.

- In February 2022, Safran Helicopter Engines signed a Memorandum of Understanding (MoU) with ST Engineering to conduct a study on the use of Sustainable Aviation Fuel (SAF) in helicopter engines. The study aims to assist helicopter operators in switching from conventional fossil fuels to SAF.

KEY BENEFITS FOR STAKEHOLDERS

- This study comprises analytical depiction of the global jet engine market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the jet engine.

- The report includes the market share of key vendors and the global market.

Jet Engines Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 140 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 321 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | GE Honda Aero Engines, PBS Group, IHI Corporation, Williams International, Safran Group, MTU Aeroengines, Roll Royce, Kawasaki, Honeywell Corporation, PRATT & WHITNEY |

Analyst Review

The jet engine market is poised to capitalize on significant potential, particularly in the realm of turbine technology and advanced materials during the forecast period. The surge is attributed to the advent of next-generation aviation technologies, including supersonic travel, and the increasing demand driven by the expansion of commercial aviation and military applications. Key regions driving this growth include North America, Europe, and Asia-Pacific.

North America, with its robust aerospace industry and continuous technological innovation, is anticipated to play a pivotal role in the market's expansion. Europe, home to major aircraft manufacturers and a growing focus on sustainable aviation, is expected to contribute significantly. Meanwhile, Asia-Pacific is set to emerge as a dominant force, fueled by increasing air travel demand, rapid economic growth, and rising defense budgets.

Government initiatives and collaborations are becoming instrumental in driving the Asia-Pacific jet engine market forward. In India and China, strategic emphasis on aerospace development and defense modernization programs is poised to accelerate market growth. The International Finance Corporation's initiatives in North America and European countries are also anticipated to stimulate market dynamics.

As the jet engine market continues to evolve, companies are strategically focusing on innovation to meet the demands of modern aviation. With a surge in air travel and the constant need for more efficient engines, key players are investing in research and development, forming collaborations, and enhancing their product portfolios. Notable market leaders shaping the industry landscape include General Electric, Rolls-Royce Holdings, Pratt & Whitney, Safran Aircraft Engines, and CFM International.

The global jet engine market was valued at $67.0 billion in 2022.

The upcoming trends of jet engines market include integration of AI & ML in jet manufacturing to optimize manufacturing processes.

The civil aviation is the leading application of jet engines market.

Asia-Pacific is the largest regional market for jet engines.

GE Honda, Safran Group, Roll Royce, Honeywell Corporation, Kawasaki are the top companies to hold the market share in Jet Engines.

Loading Table Of Content...

Loading Research Methodology...