Kids Toys Market Research, 2031

The global kids toys market size was valued at $65.8 billion in 2021, and is projected to reach $89.5 billion by 2031, growing at a CAGR of 3% from 2022 to 2031.Kids toys market includes toys for the age group of 0-10 years. Exploratory and outdoor toys are introduced in this age group; however, plush toys and dolls also constitute a significant share in this age group. In addition, construction sets, board games, and action figures are also widely played by this age group. As a result, educational toys focusing on STEM are now being introduced globally. Furthermore, increase in STEM jobs globally has resulted in parents creating interest in their children in STEM educational toys. These toys teach kids to focus on the 4 subjects, Science, Technology, Engineering, and Math. A plethora of different STEM toys focusing on multifaceted disciplines, including but not limited to coding, engineering, chemistry, and mechanical toys are now being introduced to target this age group segment.

Digital progression in kids toys is leading to increase in the application of Artificial Intelligence, particularly in STEM toys. Kids toys has limited manufacturing competence in battery-operated, electronic, and technology-based toys but there is scope to scale this up in a medium to long-term period. Labor-intensive sub-segments instituting about 50 to 60% of the kids toys market can scale up instantly, considering an indigenization push to these segments which could, consequently, offer a huge impetus to job generation.

The pandemic has had a significant impact on consumer behavior, with over 76% of end-users shifting to e-commerce. Taking note of this consumer purchasing sentiment, toymakers are now hoping to make a comeback this time by going online. Furthermore, the hybrid business model is expected to increase online-led exports in the coming years. The brick-and-mortar model is still alive and well, but the answer to optimum retailing for offline retailers is to embrace the click-and-mortar business approach and pave their way forward. The hybrid business model is sustainable for the future, while there are some signs of recovery.

Most companies are developing innovative ways to highlight sustainability, because it is certain that plastic will be eliminated from toy products. Ethical practices is expected to enable the development of new products, though it may not solve the harmful effects of plastic. Furthermore, toys that renovate themselves when exposed to water, revealing a hidden message, color, or character, are gaining popularity. Craft toys like water ink, DIY magic water toys, splash and spray beach ball sprinkler, and backpack water shooter that use water to create designs are also popular among this age group. Educational toys that teach children about underwater life are popular, and bath and outdoor water toys are still popular.

The manufacturing kids toys industry has always come up with something that is both fun and educational for children. Many businesses create products that are innovative, and enjoyable, and keep children occupied indoors.

However, there are certain products that have been avoided by parents. For instance, when it comes to playing dough as a product for children, parents are more selective in buying the best for their children, because it has various consequences such as choking hazards. Playing dough comprises chemicals and may cause severe illness, as kids try to consume every product they touch.

China is the major exporter of toys across the world. Exports of toys of China have tripled in the last decade with about $30 billion of exports in the global market. The U.S. and EU accounts for about 58% of the market share, with the former constituting about 31% of the toys export. Various governments are taking steps toward local production of toys to end monopoly of China and boost indigenous production of toys. The government of India increased the import duty on toys by 200% in February 2020 and made toy quality certification mandatory to revive the indigenous industry. Production-Linked Incentive (PLI), Phased Manufacturing Program (PMP) schemes, labor reforms, and corporate tax rates that are the lowest among peer nations are expected to boost the local manufacturing of toys in the Indian subcontinent. Similarly, the U.S. government has increased tariffs on $200 billion of Chinese goods to 25% from 10% under the trade war conflicts. They account for roughly 50% of all Chinese exports to the U.S., including toys, smartphones, shoes, video game consoles, and other intermediate & capital goods. These increased tariffs on Chinese goods are expected to hike prices for consumers and negatively impact the market. It is pertinent to note that tariff hikes might negatively impact the market for a short duration; however, with the increase in local production, the negative impact is anticipated to diminish.

Toys based on movie characters generated a 19% increase in revenue in early 2021, according to data from early 2021. Non-movie toys have only increased by a single digit. Disney+ has already tapped into this trend. The service has more than 150 million users. The company released "Soul" directly to streaming in 2020. Every big box retailer sells a set of toys to go with it. Another major Disney release, "Raya and the Last Dragon," is set to debut on Disney+ this spring. Toys based on the film were in high demand beginning in early January 2021.

Businesses emphasize offering a variety of gaming accessories so that youngsters will be surprised when they open the boxed goods. Kids may become interested in playing with these goods as a result, which will boost the expansion of the toy sector. For instance, as a gift for its LEGO VIP members in August 2021, Lego System A/S debuted a sailboat adventure kit. The rate of product consumption will also be fueled by recent trends in gift-giving among the world's population.

Furthermore, because these play kits give youngsters a calming scent to smell, scented products have become more and more popular. The popularity of educational board games and brain training cubes among children is expected to drive industry expansion in the near future.

The need for dolls created sustainably is anticipated to decrease as eco-friendly gaming accessories made of bamboo, clay, cork, and other sustainable materials become more common. To accommodate this demand, businesses are concentrating more and more on creating video games utilizing recycled plastic, which will likely accelerate market expansion. For instance, Barbie Loves the Ocean, a line of Barbie dolls constructed from recycled plastic, was unveiled by Mattel Inc. in June 2021.

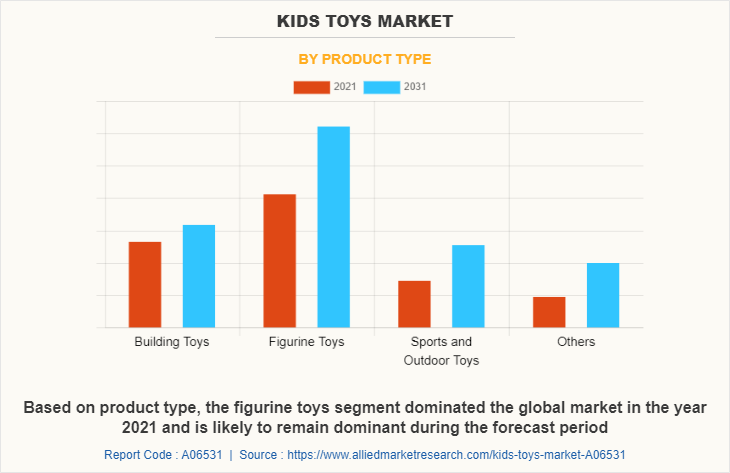

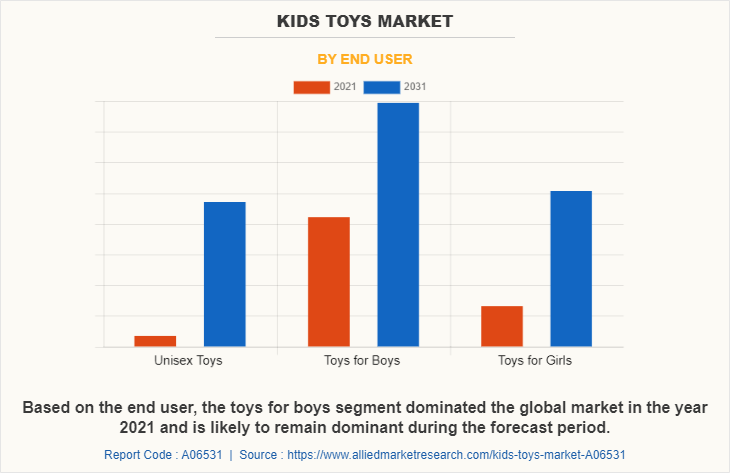

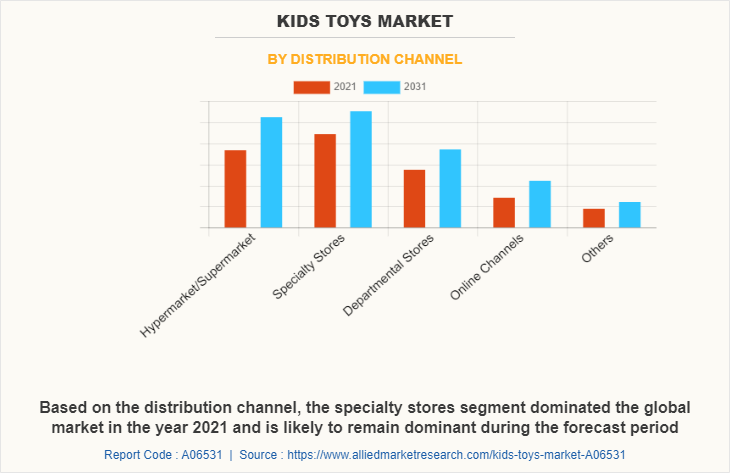

The kids toys market is segmented on the basis of product type, end-user, distribution channel, and region. On the basis of product type the market is categorized into building toys, figurine toys, sports and outdoor toys, and others. On the basis of end users, the market is segmented into unisex toys, toys for boys, and toys for girls. On the basis of distribution channel, the market is categorized into hypermarkets/supermarkets, specialty stores, departmental stores, online channels, and others. On the basis of region, the market is classified into North America (U.S., Canada, and Mexico) Europe (UK, Germany, France, Italy, Sweden, Spain, Russia, the Netherlands, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Thailand, Australia, New Zealand, and Rest of Asia-Pacific, and LAMEA (Brazil, Argentina, UAE, Saudi Arabia, South Africa, Egypt, and Rest of LAMEA).

On the basis of product type, the figurine toys segment was the highest revenue contributor to the market, with $25,589.3 million in 2021. Key players in the industry are introducing new product lines in the action figure toys segment. For instance, 'Heroes of Goo Jit Zu' is an innovative new series of action figure toys from Moose Toys. The new product line tells the story of a group of zoo animals that transformed into mutant hero fighters and broke out of the zoo to fight bad guys. Furthermore, action figures from Marvel and DC franchises remain quite popular among kids across the world.

On the basis of end users, the toys for boys segment was the highest revenue contributor to the market, with $26,455.6 million in 2021. Action figures of well-known characters and toy cars are favorites among young boys. Their need for and preference for toys change as they become older. Action figures from Star Wars or the Avengers, remote-controlled cars, and games with lego-style building blocks are some of the most popular toys for boys. These toys can keep kids entertained and help them improve their cognitive skills. Since there are so many options available to meet the increasing kids toys market demand, e-commerce has emerged as a preferred platform for buying kids toys.

On the basis of distribution channel, the specialty stores segment had the dominating kids toys market size, in 2021. Specialty stores provide high-quality service and detailed product specifications & expert guidance to customers. Moreover, these stores promote the sales of international as well as private-label brands. The continuously evolving retail industry, changes in consumer behavior, and improvements in overall lifestyle across the world have led to the introduction of new retail formats.

On the basis of region, Asia-Pacific was the highest revenue contributor in 2021and is likely to remain dominant during the kids toys market forecast period. The toys and games market in the Asia-Pacific region is highly fragmented, with leading companies in most countries having a single-digitkids toys market share. Branded toys remained an urban phenomenon in countries with large rural populations, such as China and India. Increase in urbanization, participation of women in the workforce, and growing disposable income provide lucrative kids toys market opportunity for engaged stakeholders in the region.

The players operating in the global market have adopted various developmental strategies including but not limited to product launches, geographical expansion, and acquisitions to increase their market share, gain profitability, and remain competitive in the market. The key players included in the market analysis are - Atlas Games, Clementoni S.P.A., Famosa Toys, Goliath Games, Guangdong Hayidai Toys Co., Ltd., Hasbro, Inc., Mattel, Inc., Ravensburger AG, Reliance Industries Limited, Schuco Model., Simba Dickie Group., Thames & Kosmos, The LEGO Group, Tomy Company, Ltd and Vtech Holdings

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current kids toys market trends, estimations, and dynamics of the kids toys market analysis from 2021 to 2031 to identify the prevailing kids toys market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the kids toys market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global kids toys market trends, key players, market segments, application areas, and kids toys market growth strategies.

Kids Toys Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 89.5 billion |

| Growth Rate | CAGR of 3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By End User |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Ravensburger, Bella Luna Toys, GuangDong Hayidai toys Co.,Ltd., Goliath Games, LLC, Simba Dickie Group GmbH, VTech Holdings Limited, KIRKBI A/S, Giochi Preziosi SpA, Thames & Kosmos, LLC., TOMY Company, Ltd., Atlas Games, Clementoni S.p.A., Reliance Industries Limited, Hasbro, Inc., Mattel, Inc. |

Analyst Review

The global kids toys market is growing rapidly, with the Asia-Pacific region leading in the market growth. The market is driven by innovation in toys, expansion of retail channels, and rise in disposable income. However, the emergence of smartphones poses a major challenge for engaged stakeholders. Moreover, the market also provides lucrative opportunities for the key players of the market with the emergence of educational, interactive, and multi-functional toys.

Growth in concern about the negative impact of plastic on the environment have resulted in leading players in the industry taking steps in this direction. Players now make environment-conscious decisions by ensuring the incorporation of natural raw materials and minimizing the usage of plastic. Such environment-friendly practices are gaining recognition among consumers who are now willing to pay premium prices for such products. This trend is anticipated to gain more popularity during the forecast period, which may result in small players to also make environment-friendly decisions regarding their product offerings.

Operating players in the market are strengthening their retail presence across the region. Amazon, Walmart, and Target have increased their toy assortments and ramped up their marketing in 2019. Walmart, which coined itself as “Best Toy Shop of America,” introduced a digital playground and relaunched its interactive toy lab while Amazon released its second annual paper toy catalog for holiday 2019. In October, Walmart also rolled back prices on more than 200 toys in stores and online ahead of the holiday season. In 2019, Target partnered with Disney to open 25 shop-in-shops for Disney-branded toys, and in October 2019, it partnered with TRU Kids Brands, which owns the intellectual property of Toys “R” Us. The expansion of retail channels drives the market growth.

The global kids toys market was valued at $65,762.2 million in 2021 and is projected to reach $89,478.2 million by 2031, registering a CAGR of 3.0% from 2022 to 2031.

Kids toys market is segment on the basis of product type, end user, distribution channel and region. 2022-2031 would be the forecast period in the market report.

Based on product type, the figurine toys segment dominated the global market in the year 2021. $878.5 million is the market value of the Kids toys market in 2021.

Kids toys market is analyzed across North America, Europe, Asia-Pacific and LAMEA. 2021 is base year calculated in the Kids toys market report

The top companies hold the market share in Kids toys market are Atlas Games, Clementoni S.P.A., Famosa Toys, Goliath Games, Guangdong Hayidai Toys Co., Ltd., Hasbro, Inc., Mattel, Inc., Ravensburger AG, Reliance Industries Limited, Schuco Model., and Simba Dickie Group.

Loading Table Of Content...