Lab Grown Diamonds Market Research, 2032

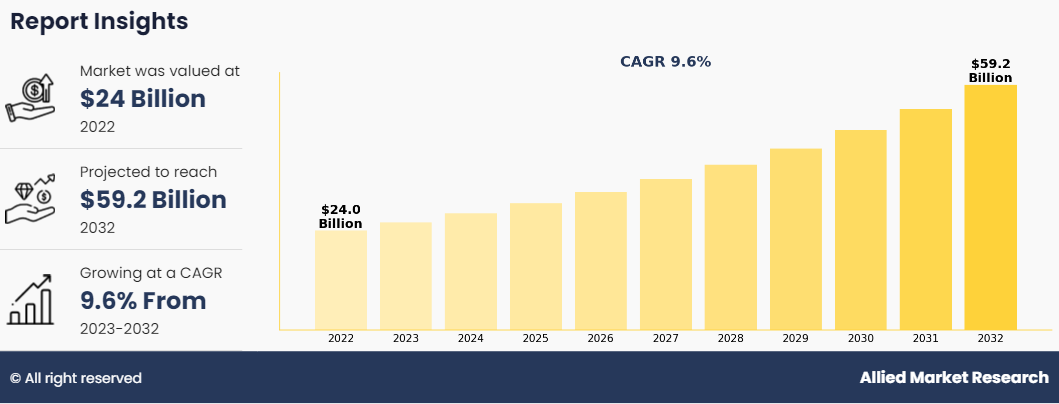

The global lab grown diamonds market size was valued at $24.0 billion in 2022, and is projected to reach $59.2 billion by 2032, growing at a CAGR of 9.6% from 2023 to 2032. Lab grown diamonds are made in laboratories and factories. They are identical to natural diamonds in their composition and appearance. Lab grown diamonds are manufactured using techniques such as HPHT, which stands for high pressure and high temperature and CVD, which stands for chemical vapor deposition. Diamonds made in labs are generally of better quality than natural diamonds as they are made in controlled environments with constant monitoring and quality control.

An increase in disposable incomes and improving standards of living of consumers in developing countries along with an increase in the adoption of luxury goods in developed countries propel their adoption, especially in diamond jewelry.

According to the Gem & Jewellery Export Promotion Council (GJEPC) China is the top producer of lab-grown diamonds (LGDs), making 3 million carats, while Singapore and the USA share the third spot with 1 million carats each. India's exports of polished LGDs are growing by about 55% yearly, making up roughly 6.2% of natural polished diamond exports. India mainly uses the carbon vapor deposition (CVD) method for LGD production, followed by high pressure high temperature (HPHT). China primarily relies on the HPHT method. Research from India's GJEPC suggests there are around 1,500 to 1,800 LGD reactors in India.

Market Dynamics

The surge in demand for lab grown diamonds industry is fueled due to their cost-effectiveness, which is appealing to consumers seeking high-quality gems at a more affordable price. As lab-grown diamonds offer a competitive alternative to natural diamonds, the lower production costs contribute to a broader demographic being able to afford these gems. This affordability factor, combined with growing awareness of ethical and environmental considerations, has significantly boosted the popularity of lab-grown diamonds in the market.

The use of lab grown diamonds in creation of jewelry has increased significantly, many companies are including lab grown diamond jewelry as a cost-effective alternative to naturally mined diamond jewelry. Lab grown diamonds are available in many shapes and sizes, providing multiple avenues to use them effectively. Many companies such as Pandora, which is a well-renowned jewelry company across the globe, have completely transitioned over to lab grown diamonds from natural diamonds such factors surge the lab grown diamonds market share.

Creative innovations and customizable options are boosting the popularity of lab-grown diamonds, as they enable intricate and customizable designs, attracting consumers seeking unique jewelry pieces. Jewelers and consumers can explore creative and intricate designs that are challenging with natural diamonds. This flexibility in design attracts consumers seeking distinctive and personalized jewelry.

Moreover, the increase in the adoption of lab grown diamonds in the fashion and jewelry sector, along with the increase in application of these diamonds in the industrial sector have spurred the lab grown diamonds market demand across myriad industry verticals.

The growing preference for lab-grown diamonds in the fashion and jewelry industry is driving a significant increase in market demand. With consumers increasingly valuing ethical and sustainable choices, lab-grown diamonds offer a responsible alternative. This shift in consumer behavior has led to a surge in demand for these diamonds, prompting manufacturers and retailers to cater to the rising interest in eco-friendly and high-quality options. As a result, the lab-grown diamond market is experiencing substantial growth within the fashion and jewelry sector shows lab grown diamonds market.

Growing ethical and environmental concerns surrounding traditional diamond mining propel the market demand for lab grown diamonds. Consumers, increasingly mindful of the social and ecological impact of mining, opt for lab-grown diamonds as a responsible alternative. The lab-grown diamond industry, positioned as conflict-free and eco-friendly, aligns with these values, driving the shift towards ethically sourced jewelry. This heightened awareness contributes to the rising popularity of the lab grown diamonds market.

Segment Overview

The lab grown diamonds market is segmented on the basis of manufacturing method, size, nature, application, and region. By manufacturing method, the global market is bifurcated into HPHT and CVD. By size, it is segmented into below 2 carats, 2–4 carats, and above 4 carats. By nature, it is bifurcated into colorless and colored. On the basis of application, it is studied across fashion and industrial. Region wise, the lab grown diamonds market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Manufacturing Method

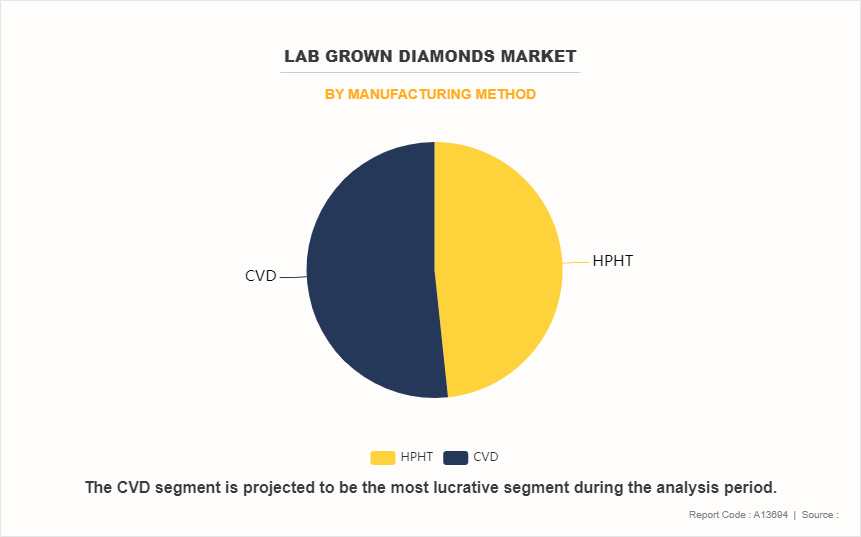

On the basis of the manufacturing method, the market is segmented into HPHT and CVD. HPHT was the first method used for creation of lab grown diamonds, while CVD is a relatively new technique. CVD segment held the major share of the market in 2022, owing to low costs associated with CVD production of diamonds and low space consumption of CVD setup. These diamonds are made by mimicking formation of diamonds in the interstellar gas clouds of outer space. This technique is the most widely used technique for making lab grown diamonds as it is more cost effective and enables diamond production in smaller spaces, results in lab grown diamonds market growth.

By Size

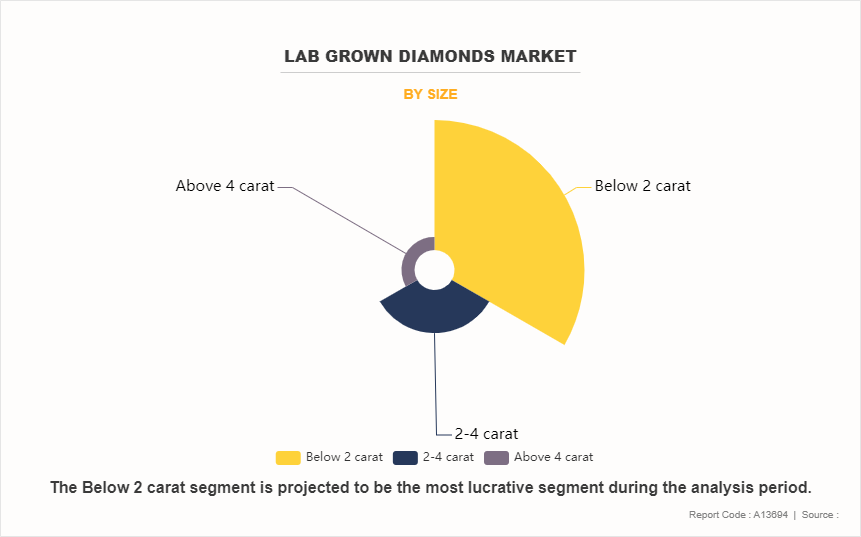

By capacity, the below 2 carats segment held the highest market share in 2022, accounting for more than two-thirds of the global lab grown diamonds market revenue and is expected to grow with a highest CAGR of 9.9% during the forecast period. Most of the lab grown diamonds that are available in the market for jewelry production and industrial tools production are below 2 carats. 1 to 2 carat diamonds are highly popular for making engagement and wedding rings and are expected to gain popularity in the future.

By Nature

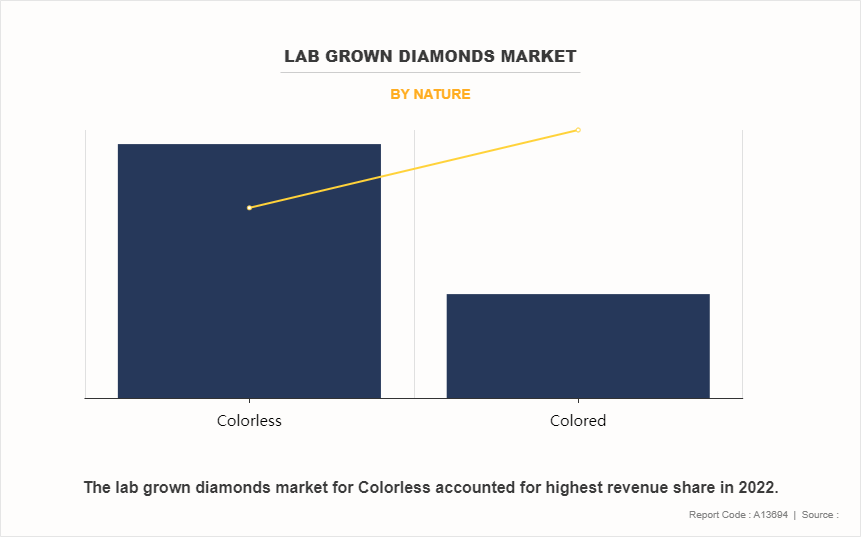

Depending on the nature of the diamonds, the lab grown diamonds are divided into colorless and colored. Colorless diamonds are completely transparent and shiny diamonds that are used for jewelry and rough diamonds used for industrial purposes. Colored diamonds are slowly emerging as a new option for fashionable diamond jewelry. The colorless segment held the major share of the market in 2022, however colored segment is expected to grow with a highest CAGR during the forecast period.

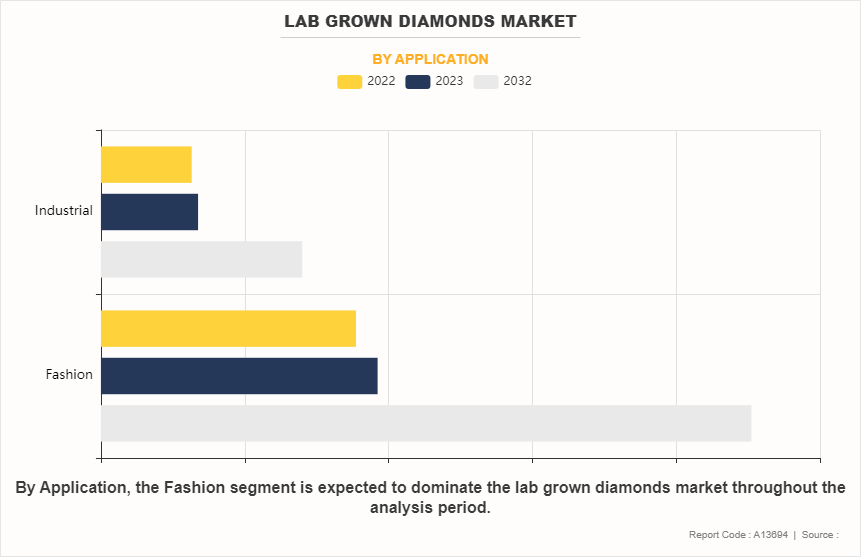

By Application

On the basis of applications, the lab grown diamonds are divided into fashion and industrial. Most of the bigger and better-quality lab grown diamonds are used for manufacturing different types of jewelry pieces. Diamonds for industrial use are high in volume but the total cost associated with industrial use diamonds is very less compared to fashion diamonds. The fashion segment held the major share of the market in 2022 and is expected to grow at the highest CAGR during the forecast period.

By Region

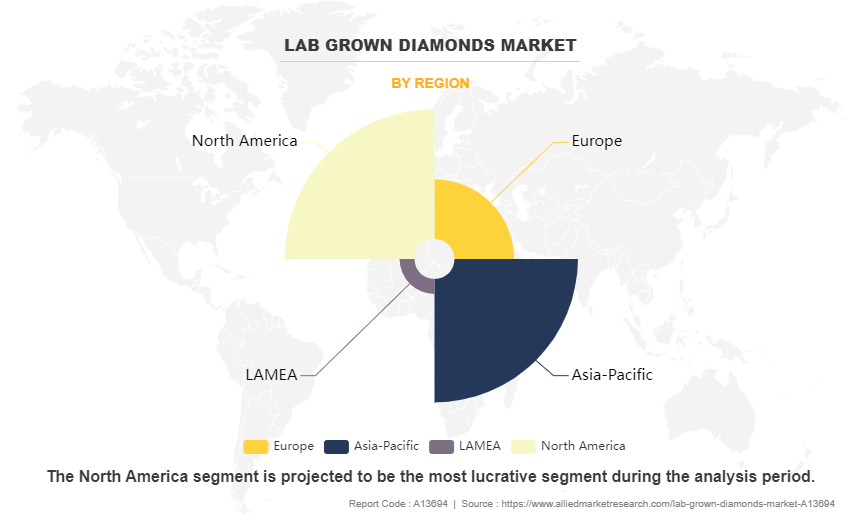

By region, the lab grown diamonds market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is the largest consumer of lab grown diamond while Asian countries such as China and India are the biggest manufacturers and exporters of lab grown diamonds.

Asia-Pacific is expected to gain dominance in the upcoming years. China is the top country in terms of lab grown diamond production and export, while India is set to become a major hub of lab grown diamonds in the globe.

Competitive Analysis

Some of the major players profiled in the lab grown diamonds market analysis include WD Lab Grown Diamonds, Mittal Diamonds, ABD Diamonds, De Beers Group, Diam Concept, Diamond Foundry Inc., Henan Huanghe Whirlwind Co., Ltd, New Diamond Technology LLC, Element Six UK Ltd, Bhanderi Prime Lab Grown CVD Diamonds.

Major players such as De Beers Group and Swarovski AG adopted product launch and agreement as key developmental strategies. In 2021, De Beers Group through its subsidiary namely, Element Six has launched a new diamond DNV-B14. With this launch, it will expand its product offering of advanced materials for quantum applications. In 2021, Swarovski AG formed an agreement with Duraflex Group Australia to make it the distributor of the companies' diamonds in Australia.

Key Takeaways

- By manufacturing method, the chemical vapor deposition (CVD) segment led in terms of market share in 2022 and is projected to grow with the highest CAGR during the forecast period.

- Depending on the size, the below 2 carats segment held the major share of the market in 2022.

- By nature, the colorless segment led in terms of market share in 2022, however, the colored segment is expected to gain high popularity during the forecast period.

- By application, the fashion industry held the major share of the market in 2022.

- By region, North America dominated in terms of market share in 2022, however, Asia-Pacific is projected to grow at the highest CAGR during the forecast period.

Recent Development in Lab Grown Diamonds Market

- In 2022, WD Advanced Materials, LLC partnered with JC Jewels Pty Ltd. which is a retail company engaged in jewelry, for the distribution of its products. With this partnership, it will expand its presence in Australia and New Zealand markets and will offer its lab-grown diamonds in these new markets.

- In 2022, De Beers Group through its subsidiary namely, Element Six announced collaboration with Thorlabs which is a designing and manufacturing company engaged in photonics equipment. With this collaboration, it will offer a wide range of CVD products including optical diamond-enabled solutions.

- In 2021, WD Advanced Materials, LLC launched a new brand called Latitude in order to expand its portfolio. Latitude offers fully traceable lab-grown stones.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lab grown diamonds market forecast from 2022 to 2032 to identify the prevailing lab grown diamonds market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lab grown diamonds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- lab grown diamonds market players positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lab grown diamonds market trends, key players, market segments, application areas, and market growth strategies.

Lab Grown Diamonds Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.2 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Manufacturing Method |

|

| By Nature |

|

| By Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bhanderi Lab Grown Diamonds, Diam Concept, Mittal Diamonds, ABD Diamonds, Diamond Foundry, New Diamond Technology LLC, WD Advanced Materials, LLC, Henan Huanghe Whirlwind CO., Ltd., Swarovski AG, De Beers Group |

Analyst Review

According to CXOs, the last few years have seen a tremendous increase in sales and adoption of lab grown diamonds. An increase in disposable incomes and improving standards of living of consumers in developing countries along with an increase in the adoption of luxury goods in developed countries propel their adoption, especially in diamond jewelry. The use of different shapes, sizes, and colors of lab grown diamonds in jewelry with unique designs has augmented sales of lab grown diamonds.

The most used method for making lab grown diamonds is the chemical vapor disposition method, also known as the CVD method, which was invented in the 1980s. This method has become increasingly popular due to the lower costs of production and reduction in space required to house such machines. The high-pressure high temperature or HPHT method, which was invented in the 1950s is still used to produce lab grown diamonds, however, is now being slowly overtaken by chemical vapor deposition (CVD). These methods of diamond production are much more environmentally friendly compared to mining of natural diamonds. In addition, companies are using renewable sources of energy for diamond manufacturing, further resulting in decreased carbon footprint. This transformation is expected to resonate with environment-conscious millennials and Generation Z.

Technological innovations and an increase in expenditure on research and development across industries have resulted in high demand for industrial diamonds. Increasing demand for industrial diamonds in optics, electronics, radiation, thermal, and quantum applications is driven by transformative industries and substantial research spending. Lab-grown diamonds are vital for meeting this demand sustainably and economically.

Increase in use of lab grown diamonds in fashion jewelry are the upcoming trends of Lab Grown Diamonds Market in the world

Fashion is the leading application of Lab Grown Diamonds Market

North America is the largest regional market for Lab Grown Diamonds

The global lab grown diamonds market was valued at $24,031.5 million in 2022, and is projected to reach $59,194.2 million by 2032, registering a CAGR of 9.6% from 2023 to 2032.

Some of the major players profiled in the lab grown diamonds market analysis include WD Lab Grown Diamonds, Mittal Diamonds, ABD Diamonds, De Beers Group, Diam Concept, Diamond Foundry Inc., Henan Huanghe Whirlwind Co., Ltd, New Diamond Technology LLC, Element Six UK Ltd, Bhanderi Prime Lab Grown CVD Diamonds.

Loading Table Of Content...

Loading Research Methodology...