Laboratory Equipment Services Market Research, 2033

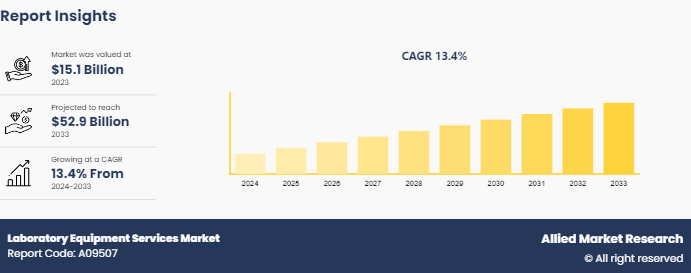

The global laboratory equipment services market was valued at $15.1 billion in 2023, and is projected to reach $52.9 billion by 2033, growing at a CAGR of 13.4% from 2024 to 2033. The growth of the laboratory equipment services market is primarily driven by the increasing demand for preventive maintenance and calibration services. As laboratories rely heavily on precise and accurate equipment, regular servicing is essential to maintain optimal performance, reduce downtime, and comply with regulatory standards. Additionally, the rising number of diagnostic labs and research institutions, especially in the fields of biotechnology and pharmaceuticals, has increased the need for professional equipment services. Technological advancements in laboratory devices have also contributed to the demand for specialized services to ensure these sophisticated instruments function properly. Furthermore, the growing focus on reducing operational costs by outsourcing equipment maintenance and repair is another factor propelling the market forward

Market Introduction and Definition

Laboratory equipment services encompass a range of offerings aimed at ensuring the optimal performance and maintenance of laboratory instruments. These services include calibration, maintenance, validation, repair, and installation, which are critical for maintaining accuracy, efficiency, and compliance with regulatory standards. The demand for these services is driven by the increasing complexity of modern lab equipment, the need for precise and reliable results, and stringent quality control requirements in industries such as pharmaceuticals, biotechnology, and clinical diagnostics. Additionally, the growing emphasis on research and development (R&D) , particularly in life sciences and healthcare, has fueled the adoption of laboratory equipment services to minimize downtime and extend the lifespan of high-cost instruments.

Key Takeaways

- The laboratory equipment services market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major laboratory equipment services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to laboratory equipment services market forecast analysis the key factors driving the growth of the market are increasing demand for analytical and diagnostic labs and growing trend towards outsourcing of laboratory services and growing prevalence of chronic diseases and infectious diseases. The increasing demand for analytical and diagnostic laboratories is a key driver for the growth of the laboratory equipment services market. As industries such as pharmaceuticals, biotechnology, and healthcare expand, the need for accurate and timely diagnostics has risen. National Institute of Health invested more than $48 billion in medical research in 2023. Analytical and diagnostic labs are crucial for research and development, clinical diagnostics, and quality control processes, all of which require high-functioning, calibrated laboratory equipment. This demand is further driven by the growing prevalence of chronic diseases, personalized medicine, and advancements in molecular diagnostics, which necessitate sophisticated lab equipment for precise testing. To maintain operational efficiency and regulatory compliance, these labs rely heavily on maintenance, calibration, and validation services, boosting the laboratory equipment services market.

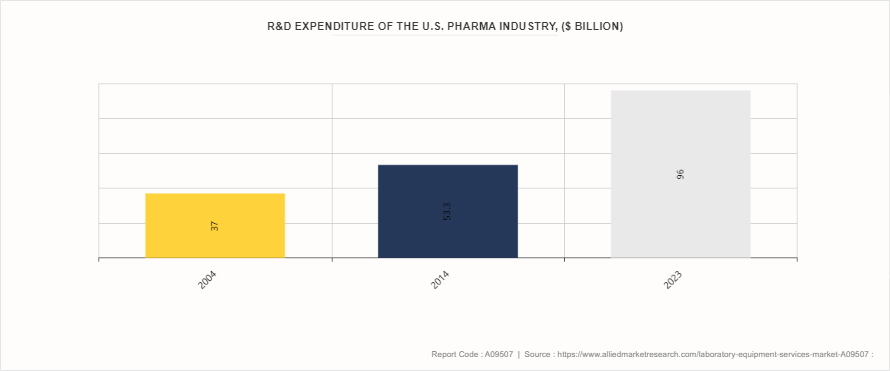

Growing Research and Development

The growing research and development (R&D) expenses across industries like pharmaceuticals, biotechnology, and healthcare have a significant impact on the laboratory equipment services market. As companies and research institutions allocate more funds to R&D, there is an increased demand for advanced laboratory equipment to support innovation, drug discovery, clinical trials, and product development. This surge in R&D activity drives the need for high-performance lab instruments that are well-maintained and calibrated for accurate results. To ensure the reliability, efficiency, and compliance of this equipment with industry standards, regular servicing becomes essential. As a result, the laboratory equipment services market benefits from increased demand for repair, maintenance, calibration, and validation services. Moreover, as R&D activities become more complex and technology-driven, specialized services to maintain sophisticated equipment are in high demand, further propelling the growth of the laboratory equipment services market.

Market Segmentation

The laboratory equipment services market is segmented on the basis of equipment, service type, end user, and region. By equipment, the market is classified into analytical equipment, general equipment, specialty equipment and support equipment. As per service type, the market is divided into repair, maintenance, calibration, validation and other. By end user, the market is divided into research laboratories, diagnostic laboratories and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the laboratory equipment services market share in 2023 owing to advanced healthcare infrastructure, significant investment in research and development, and a strong presence of leading pharmaceutical and biotechnology companies. The region benefits from a high demand for laboratory services driven by the growing focus on precision medicine, diagnostics, and innovative therapies, which requires reliable and well-maintained laboratory equipment. Additionally, stringent regulatory standards and the need for compliance with safety protocols further boost the demand for equipment maintenance and support services. In the Asia-Pacific region, rapid market expansion is anticipated due to rapid economic growth, increasing healthcare expenditure, and expanding research capabilities. Countries like China and India are witnessing a surge in the establishment of research laboratories and clinical testing facilities, which drives the demand for laboratory equipment services. Furthermore, the rise in public-private partnerships and government initiatives aimed at enhancing healthcare infrastructure contribute to the growth of this market in Asia-Pacific, positioning it for significant expansion in the coming years.

- According to Orphanet Journal of Rare Diseases (2024 edition) , it is estimated that about 70 million people are affected with rare genetic diseases in India.

- There were about 198 accredited labs in 555 govt medical colleges in India in 2022.

- According to 2023 article by National Institute of Health (NIH) , approximately 11% of the NIH's budget supports projects conducted by nearly 6, 000 scientists in its own laboratories.

Competitive Landscape

Laboratory Equipment Services market report summarizes top key players overview as Thermo Fisher Scientific Inc, Agilent Technologies, Inc, Waters Corporation, PerkinElmer, Inc, Bio-Rad Laboratories, Inc, Bruker Corporation, Merck KGaA, Eppendorf AG, Sartorius AG, and F. Hoffmann-La Roche Ltd. Other players in the Laboratory Equipment Services market are Qiagen N.V., Shimadzu Corporation, Hitachi High-Tech Corporation, and PerkinElmer Ltd.

Industry Trends

- According to 2022 report by Center of Disease Control and Prevention, 70% of medical decisions depend on 14 billion laboratory tests conducted annually.

- According to 2022 article by National Library of Medicine, chronic diseases are the leading causes of disability and premature death among the elderly population in India. Chronic conditions such as diabetes, cardiovascular diseases, and respiratory issues require regular monitoring and testing, increasing the use of laboratory equipment.

- According to American Clinical Laboratory Association, more than 7 billion clinical lab tests are performed in the U.S. each year.

- According to 2024 U.S. Blood Donation Statistics, there are 53 community blood centers and 90 hospital-based blood centers in the U.S

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the laboratory equipment services market analysis from 2024 to 2033 to identify the prevailing laboratory equipment services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the laboratory equipment services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global laboratory equipment services market trends, key players, market segments, application areas, and market growth strategies.

Laboratory Equipment Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 52.9 Billion |

| Growth Rate | CAGR of 13.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Equipment |

|

| By Service Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Eppendorf AG, Sartorius AG, F. Hoffmann-La Roche Ltd., PerkinElmer, Inc., Bio-Rad Laboratories, Inc. , Merck KGaA, Agilent Technologies, Inc., Waters Corporation, Bruker Corporation, Thermo Fisher Scientific Inc. |

The global laboratory equipment services market was valued at $15.1 billion in 2023

The market value of Laboratory Equipment Services Market in 2033 is $2.1 billion.

The forecast period for Laboratory Equipment Services Market is 2024-2033.

The base year is 2023 in Laboratory Equipment Services Market

Major key players that operate in the Laboratory Equipment Services Market are Thermo Fisher Scientific Inc, Agilent Technologies, Inc, Waters Corporation, PerkinElmer, Inc, Bio-Rad Laboratories, Inc

Loading Table Of Content...