Laminated Timber Market Research, 2031

The global laminated timber market was valued at $1.6 billion in 2021, and is projected to reach $3.5 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031. Advancements in technology have played a crucial role in enhancing the laminated timber market. Advances in computer numerical control (CNC) machinery and automated cutting tools have enabled more precise and efficient production of laminated timber components. This improves accuracy in dimensions and enhances the overall quality of the finished product

Report Key Highlighters:

- The laminated timber market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2021-2031.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The laminated timber market is highly fragmented, with several players including Binderholz GmbH, DRJ Wood Innovations, Eugen Decker & WebMan, HASSLACHER Holding GmbH, KLH Massivholz GmbH, Mayr-Melnhof Holz Holding AG, NORDIC STRUCTURES, SmartLam, Stora Enso, and Structurlam Mass Timber Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in laminated timber market.

Introduction

Laminated timber, also known as engineered wood, is a composite material made from layers of wood veneers or boards that are glued together to form a single, sturdy structure. The wood layers, or laminates, are bonded using durable adhesives under high pressure, allowing the timber to achieve remarkable strength, versatility, and stability compared to traditional solid wood. The direction of the wood grains in each laminate layer can be adjusted to improve the material's mechanical properties, such as load-bearing capacity and resistance to bending or warping. Common types of laminated timber include glue-laminated timber (glulam), cross-laminated timber (CLT), and laminated veneer lumber (LVL), each having specific uses and structural advantages.

Laminated timber is a popular choice for designers and architects as it can be curved and shaped to produce distinctive architectural characteristics. It is also utilized as a sustainable building material as it is composed of renewable resources and has a lower carbon footprint than other building materials such as steel and concrete. Laminated lumber is fire resistant as it burns on the surface while retaining structural integrity, making it a safer choice for building construction.

Furthermore, laminated timber is far lighter than steel and concrete, making it easier to transport and install on-site. This can lead to decreased shipping costs and a fast construction procedure. Laminated timber is a low-carbon building material that outperforms standard building materials such as steel and concrete. Laminated timber is produced from renewable resources and may be recycled or repurposed when its life cycle is complete. Glulam has natural insulating properties, which can help to reduce energy costs and improve the energy efficiency of a building. It can help to regulate indoor humidity levels, creating a more comfortable living or working environment.

Market Dynamics

Rise in demand for green building materials is expected to drive the laminated timber market growth. The rising demand for green building materials has significantly boosted the adoption of laminated timber, also known as engineered wood or glulam, in construction projects worldwide. This trend is driven by a growing recognition of the environmental impact of traditional building materials such as concrete and steel. Laminated timber offers a compelling eco-friendly alternative due to its biodegradability and significantly lower embodied energy compared to conventional materials. This makes it an attractive choice for developers and architects seeking sustainable construction solutions that align with environmental goals. In March 2023, BlocPower, a startup specializing in green building technology, successfully raised close to $25 million in equity funding and secured $130 million in debt financing. This substantial financial boost is expected to enable the company to upgrade energy efficiency in numerous homes and other buildings through retrofitting advanced, eco-friendly appliances.

Furthermore, according to the U.S. Census Bureau, construction spending in January 2023 accounted $1,825.7 billion, a 0.1 % (0.7%) increase from 2022. Private construction spending was $1,442.6 billion per year, essentially unchanged from the revised December estimate of $1,442.0 billion (0.5%). In January, annual pace of residential building was $847.4 billion, a 0.6% increase from the previous month.

However, high cost associated with cross-laminated timber is predicted to hinder the growth of the laminated timber market. It is more expensive than other building materials. CLT is a relatively new and specialized building material with fewer suppliers and producers than more typical building materials such as steel and concrete.

CLT is a highly sustainable and ecologically friendly building material, making it an appealing alternative for developers and builders who value sustainability and environmentally responsible construction techniques. The Concrete Reinforcing Steel Institute projected that the CLT alternative would cost $48 to $56 per gross square foot, excluding charges for acoustic dampening and fire prevention.

The cost of acoustics and fire safety is projected to be between $2 and $6 per square foot. The structural frame of the cast-in-place reinforced concrete alternative is expected to cost between $42 and $46 per gross square foot. Acoustic dampening may be necessary at an additional expense, which is estimated to be between $1 and $2 per square foot.

The laminated timber market is segmented into type, end-use industry, and region. On the basis of type, the market is categorized into cross-laminated timber (CLT), glue laminated timber (Gulam), laminated veneer lumbar (LVL), and others. On the basis of end-use industry, it is classified into residential and non-residential. Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Laminated Timber Market By Segment

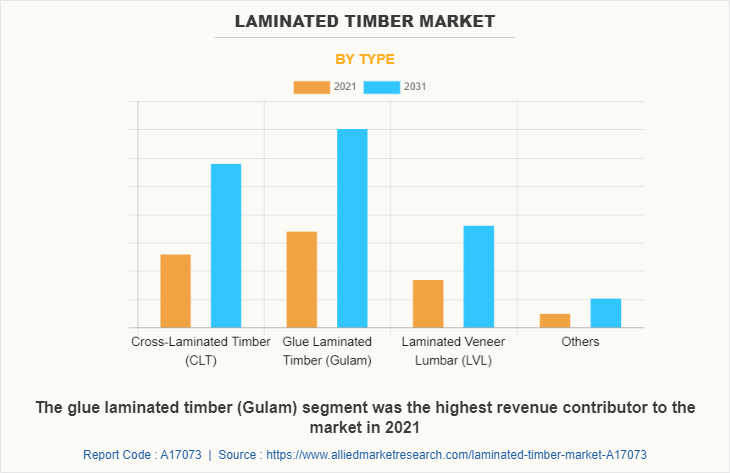

The glue laminated timber (Gulam) segment accounted for the largest share of the global laminated timber market in terms of revenue, in 2021. Glulam beams and columns are often used as load-bearing members in commercial and residential buildings. They can span long distances and support heavy loads, making them ideal for large open spaces like arenas, schools, and churches

On the basis of type, the glue laminated timber (gulam) segment dominated laminated timber market, accounting for more than one-third of the market share in 2021 and is expected to witness a CAGR of 7.7% during the forecast period. Glulam is often used in the construction of prefabricated buildings, such as schools, offices, and homes. The prefabricated components can be quickly and easily assembled onsite, saving time and labor costs. Glulam is also used in the construction of agricultural buildings, such as barns and sheds. Its strength and durability make it ideal for supporting heavy equipment and withstanding harsh weather conditions.

Laminated Timber Market By End- Useindustry

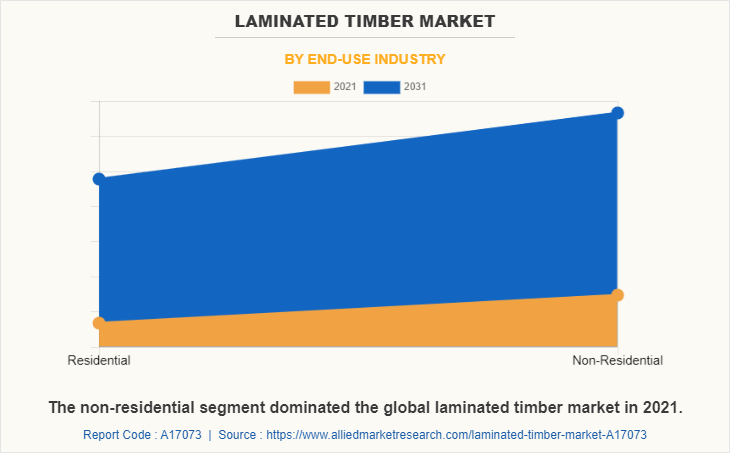

On the basis of end-use industry, the non-residential segment was the highest revenue contributor in 2021 and is expected to witness a CAGR of 8.0% in the laminated timber market during the forecast period. Laminated timber is utilized in non-residential construction to provide strength, sustainability, and aesthetic appeal. It is used in commercial structures, educational structures, cultural and recreational structures, and bridges. Laminated lumber is used in the construction of museums, galleries, and sports stadiums because it has the aesthetic appeal and durability that these institutions require.

As it is made from renewable resources and can be recycled at the end of its life, laminated timber is used as a sustainable building material. It retains carbon dioxide and needs less energy to manufacture, it has a lower carbon footprint than many other building materials. Laminated timber can be used for the construction of warehouses, factories, and other industrial facilities due to its strength, durability, and fire-resistant properties. It can also be used for the construction of cranes, hoists, and other heavy equipment.

Laminated Timber Market Region

On the basis of region, the Europe segment dominated the global laminated timber market in 2021. In Europe, laminated timber is used to build prefabricated dwellings that are built off-site and then assembled on-site. This involves the use of cross-laminated timber (CLT) for prefabricated home walls, roofs, and floors. Roof structures such as trusses, purlins, and rafters are made from laminated timber.

In Europe, these structures support the roof and help to distribute weight evenly throughout the building. Furthermore, laminated timber is used in institutional buildings such as schools, hospitals, and government buildings, where glulam and CLT are used for structural elements and interior design features.

In Germany, laminated timber is becoming popular in both residential and public building projects. The country has seen a rise in the use of this material due to its structural benefits and energy efficiency. Germany’s strict building codes and emphasis on sustainability drive the adoption of laminated timber, particularly in high-rise and large-scale constructions.

Competitive Analysis

Major players operating in the global laminated timber market includes Binderholz GmbH, DRJ Wood Innovations, Eugen Decker & WebMan, HASSLACHER Holding GmbH, KLH Massivholz GmbH, Mayr-Melnhof Holz Holding AG, NORDIC STRUCTURES, SmartLam, Stora Enso, and Structurlam Mass Timber Corporation. These players adopted several growth strategies such as expansion and acquisition to strengthen their position in the market.

Key Latest Developments:

- In February 2023, HASSLACHER Holding GmbH acquired a 40% stake in Egoin Wood Group. This acquisition is expected to enable the exchange of know-how and optimization ranging from forest management through the production of high-quality system solutions for modern timber construction to renewable energy solutions such as biomass and photovoltaic systems. The 40% stake in the Egoin Wood Group is projected to help HASSLACHER Holding GmbH to strengthen its position in Southwest Europe.

- In October 2022, Stora Enso expanded its business by establishing a new production site for cross-laminated timber (CLT) in Zdirec, the Czech Republic with a total investment of $ 84 million. With the new site, Stora Enso’s CLT production capacity is anticipated to grow substantially to meet the rise in demand for sustainable, cost-effective, and renewable building materials.

- In February 2022, Stora Enso expanded its business by investing $ 9 million in an automated CLT (cross-laminated timber) coating line at the Ybbs sawmill in Austria. The investment is expected to further strengthen Stora Enso’s position as a leading global provider of engineered wood products for low carbon and sustainable buildings. The investment enables industrially pre-applied CLT coatings on the CLT walls and floors produced at Stora Enso’s Ybbs site. The automated coating solution results in shorter construction times and higher wood protection.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the laminated timber market analysis from 2021 to 2031 to identify the prevailing laminate timber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the laminated timber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global laminated timber market trends, key players, market segments, application areas, and market growth strategies.

Laminated Timber Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.5 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | DRJ Wood Innovations, HASSLACHER Holding GmbH, NORDIC STRUCTURES, Mayr-Melnhof Holz Holding AG, KLH Massivholz GmbH, Eugen Decker & WebMan, Binderholz GmbH, Structurlam Mass Timber Corporation, SmartLam, Stora Enso |

Analyst Review

According to the opinions of various CXOs of leading companies, the laminated timber market is driven by surge in urban population. The surge in urban population has a significant impact on the laminated timber market, as more people move to cities and urban areas. This has driven the demand for construction materials such as laminated timber, which can be prefabricated off-site and assembled on-site, allowing for faster and more efficient building. This is especially important in densely populated urban areas where space and time are at a premium.

However, high cost associated with cross-laminated timber is expected to restrain industry expansion. Cross laminated timber (CLT) is highly expensive than other building materials due to its specialized nature and fewer suppliers & producers. It is, however, a highly sustainable and eco-friendly building material, making it an appealing alternative for developers and builders who prioritize sustainability and ecologically responsible construction techniques.

The Europe region is projected to register robust growth during the forecast period. In Europe, laminated timber is increasingly being used in the construction of cultural structures such as museums, theatres, and music halls. This involves the use of glulam and CLT for structural parts as well as decorative beams and columns in interior design. Laminated timber also provides strength, durability, and design flexibility, making it a popular choice for a variety of bridge and infrastructure applications, including pedestrian bridges, bike lanes, and walkways.

Binderholz GmbH, DRJ Wood Innovations, Eugen Decker & WebMan, HASSLACHER Holding GmbH, KLH Massivholz GmbH, Mayr-Melnhof Holz Holding AG, NORDIC STRUCTURES, SmartLam, Stora Enso, and Structurlam Mass Timber Corporation. are the top companies to hold the market share in Laminated Timber.

Rise in adoption of environment-friendly building materials is the upcoming trends of Laminated Timber Market in the world.

Europe is the largest region for the Laminated Timber Market.

Growing demand from the construction industry is the main driver of Laminated Timber Market.

The non-residential segment is the leading end-use industry of Laminated Timber Market.

The Laminated Timber Market is segmented into type, end-use industry, and region. Depending on type, the market is categorized into cross-laminated timber (CLT), glue laminated timber (Gulam), laminated veneer lumbar (LVL), and others. On the basis of end-use industry, it is classified into residential and non-residential.

The global Laminated Timber Market was valued at $1.6 billion in 2021, and is projected to reach $3.5 billion by 2031, registering a CAGR of 8.1% from 2022 to 2031.

Loading Table Of Content...

Loading Research Methodology...